Linear Motor Market Outlook:

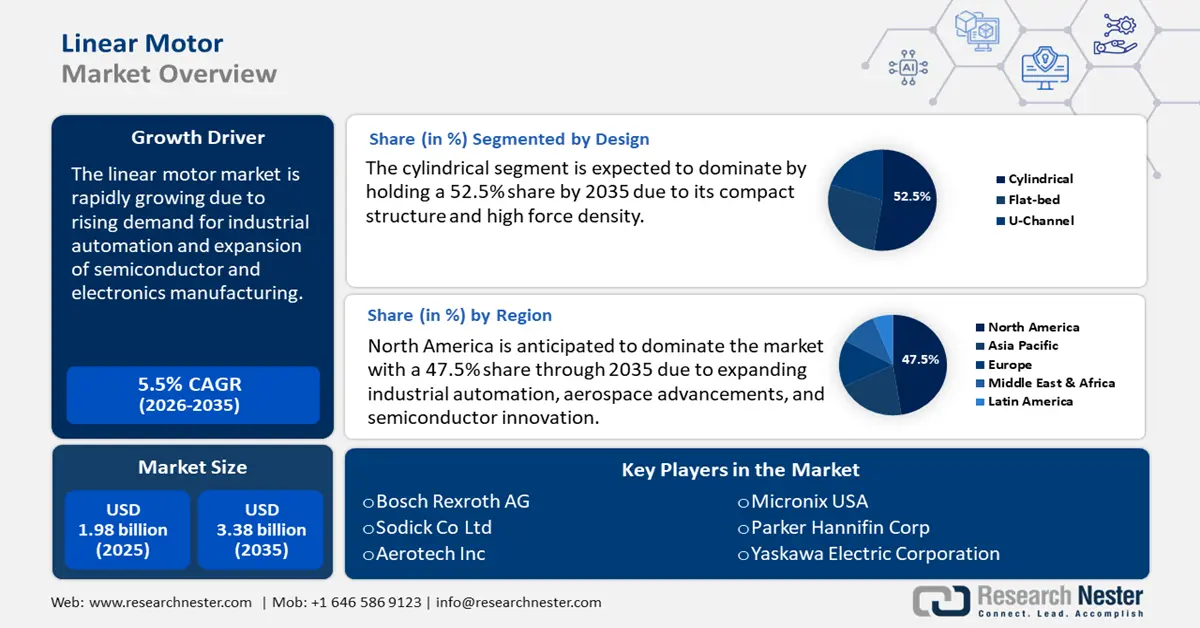

Linear Motor Market size was valued at USD 1.98 billion in 2025 and is expected to reach USD 3.38 billion by 2035, registering around 5.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of linear motor is evaluated at USD 2.08 billion.

The rising demand for industrial automation is a key driver for linear motor market growth. The accelerating push towards Industry 4.0 has significantly raised the adoption of linear motors across multiple verticals. Automated production lines in electronics, automotive, and pharmaceutical industries demand motion control systems that deliver high-speed precision, minimal mechanical complexity, and seamless integration with smart manufacturing ecosystems. For instance, Bosch Rexroth launched its linear motion technology 2024 initiative, showcasing new intelligent linear motion systems designed specifically for smart factory automation. Their new range of cyber-physical linear motors directly addresses the surge in demand for flexible, high-precision industrial automation under Industry 4.0 frameworks.

Key Linear Motor Market Insights Summary:

Regional Highlights:

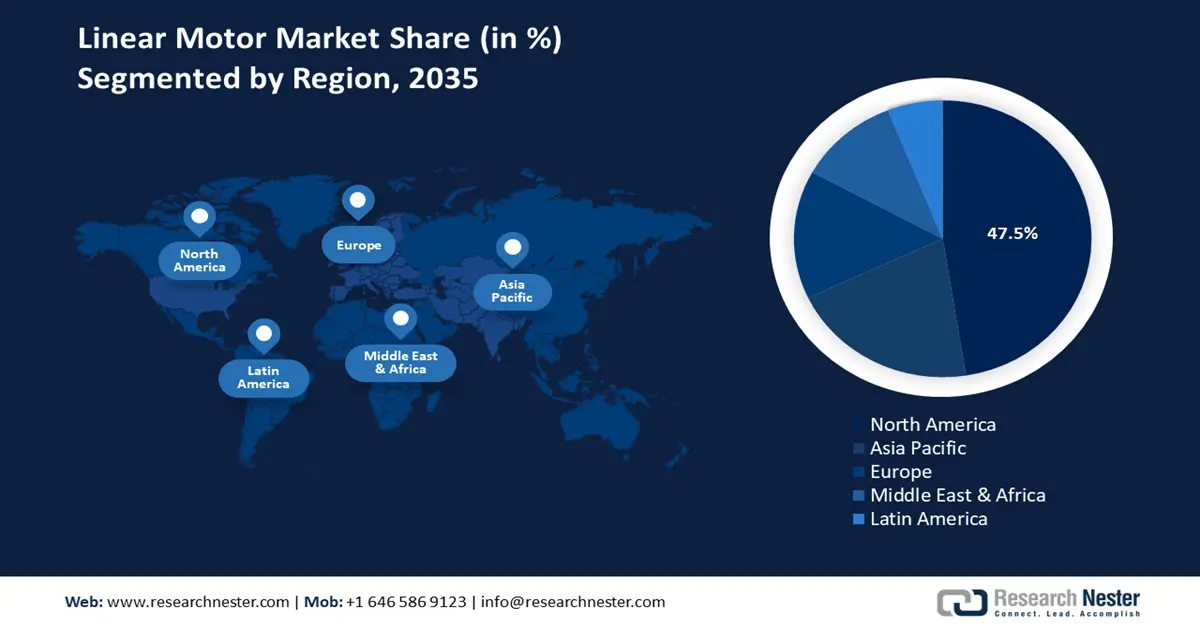

- North America leads the Linear Motor Market with a 47.5% share, propelled by expanding industrial automation, aerospace advancements, and semiconductor innovation, fostering growth through 2035.

Segment Insights:

- The Electronics and Assembly Segment is expected to capture a significant share by 2035, driven by the surge in 5G infrastructure and IoT devices.

- The Cylindrical Design segment is expected to capture a 52.50% share by 2035, fueled by rising demand for space-saving, high-precision motion systems.

Key Growth Trends:

- Expansion of semiconductor and electronics manufacturing

- Adoption of advanced transportation and logistics solutions

Major Challenges:

- High initial costs and complex integration

- Thermal management and heat dissipation issues

- Key Players: Sodick Co. Ltd, Aerotech Inc., Micronix USA, Parker Hannifin Corp, Yaskawa Electric Corporation.

Global Linear Motor Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.98 billion

- 2026 Market Size: USD 2.08 billion

- Projected Market Size: USD 3.38 billion by 2035

- Growth Forecasts: 5.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (47.5% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: Japan, Germany, United States, China, South Korea

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 12 August, 2025

Linear Motor Market Growth Drivers and Challenges:

Growth Drivers

-

Expansion of semiconductor and electronics manufacturing: The semiconductor and electronics sectors require ultra-precise positioning systems for wafer fabrication, chip assembly, and testing. Linear motors are critical enablers of sub-micron accuracy and vibration-free motion, both of which are essential in manufacturing processes that continue to push the limits of miniaturization. As global electronic demand rises, due to 5G, AI devices, and EV technologies, the linear motor market stands to benefit from sustained growth in high-precision environments.

-

Adoption of advanced transportation and logistics solutions: Modern transportation systems, particularly maglev trains and automated material handling systems, rely heavily on linear motor technology. In warehousing and logistics, the surge of e-commerce has led to an unprecedented need for automated storage and retrieval systems (AS/RS) and smart conveyor solutions, where linear motors offer speed, reliability, and maintenance-free operation. For instance, Amazon and Ocado (UK-based e-commerce tech company) have integrated linear motor-driven shuttle systems in their automated warehouses to optimize picking and material handling, particularly after the post-pandemic e-commerce boom. The trend toward magnetic levitation transport and robotized fulfillment centers proves the high reliance on linear motor systems. Innovations in urban mobility, such as hyperloop prototypes and smart intralogistics, are further encouraging investment in linear motor development.

- Technological advancements in motor design and materials: Recent innovations in motor topology, power electronics, and advanced magnetic materials are enhancing the efficiency, force output, and thermal management of linear motors. A recent example citing this is the introduction of the ORCA-3 linear motor by Iris Dynamics Ltd. in February 2025. The ORCA-3 is the smallest, fastest, and most cost-effective motor in the ORCA series, developed in response to growing demand for compact and affordable solutions. These developments have reduced system costs and expanded the range of environments where linear motors can operate reliably, including vacuum, cryogenic, and hazardous settings.

Challenges

-

High initial costs and complex integration: Despite offering superior performance, linear motors often come with higher upfront costs compared to traditional rotary-to-linear conversion systems. Additionally, integrating linear motors into existing production lines or machinery requires custom engineering, precision alignment, and specialized controllers, which can drive implementation time and cost. For industries with tight capital budgets or legacy infrastructures, the cost-to-benefit ratio can delay or limit adoption.

-

Thermal management and heat dissipation issues: Linear motors, especially high-power or high-speed versions, can face thermal buildup during operation. Without proper cooling systems, thermal expansion can reduce positioning accuracy, shorten motor lifespan, and affect system reliability. Therefore, managing heat is particularly challenging in compact, vacuum, or cleanroom environments, where traditional cooling methods are limited.

Linear Motor Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.5% |

|

Base Year Market Size (2025) |

USD 1.98 billion |

|

Forecast Year Market Size (2035) |

USD 3.38 billion |

|

Regional Scope |

|

Linear Motor Market Segmentation:

Design (Cylindrical, Flat-bed, U-Channel)

The cylindrical segment is expected to dominate the design type segment by holding a 52.5% share by 2035 due to its compact structure and high force density. It offers efficient direct drive motion ideal for confined spaces in robotics, semiconductor, and medical equipment. The growth is driven by the rising demand for space-saving, high-precision motion systems. Additionally, advancements in cooling and material technologies are making cylindrical linear motors more reliable and versatile across industries.

Application (Electronics and Assembly, Food & Beverage, Packaging & Labeling, Meteorology, Machine Tools, Printing, Robotics, Semiconductors, Non-Industrial Applications)

The electronics and assembly segment is poised to hold a significant linear motor market share through 2035, owing to rising demand for ultra-fast, high-precision manufacturing. Linear motors offer direct drive motion, minimizing mechanical wear and ensuring consistent accuracy for PCB assembly, semiconductor packaging, and microelectronics production. The growth is fueled by the global surge in 5G infrastructure, EV electronics, and IoT devices. Manufacturers increasingly prefer linear motors to achieve higher yields, faster cycle times, and greater miniaturization in electronic components.

Our in-depth analysis of the global linear motor market includes the following segments:

|

Design |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Linear Motor Market Regional Analysis:

North America Market Analysis

North America is expected to dominate the linear motor market with a 47.5% share through 2035 due to expanding industrial automation, aerospace advancements, and semiconductor innovation. Major investments in smart factories and cleanroom manufacturing facilities are driving the adoption of high-precision motion solutions. The growing need for faster, energy-efficient production systems is pushing industries to replace traditional actuators with linear motors. Additionally, the integration of AI and IoT technologies into automation systems is amplifying demand for intelligent motion control.

The U.S. linear motor market is growing rapidly due to massive semiconductor fabrication expansions and a renewed push toward domestic manufacturing. The initiatives such as the CHIPS and Science Act are boosting high precision equipment needs, where linear motors play a critical role. For instance, in January 2025, Samsung announced a USD 40 billion investment in Texas, facilitated by a USD 4.74 billion grant from the U.S. Department of Commerce under the CHIPS and Science Act. This funding will support the construction of two new semiconductor chip fabrication plants and a research and development facility in Taylor, Texas, and Austin. Moreover, sectors such as defense, aerospace, and EV manufacturing are adopting linear motor technologies to achieve greater precision and system reliability.

In Canada, the linear motor market is witnessing steady growth fueled by rising investments in advanced logistics automation and medical robotics. Warehousing giants in Canada are integrating linear motor-driven automated storage and retrieval systems to optimize distribution efficiency. In addition, government initiatives to strengthen high-tech manufacturing and sustainable innovation support the adoption of linear motor technologies across key sectors.

Asia Pacific Market Analysis

Asia Pacific is anticipated to garner a robust share from 2026 to 2035, driven by the continuously developing electronics and semiconductor industries. The market in Asia Pacific is primarily driven by top countries such as Japan, China, and South Korea, necessitating high-precision linear motion solutions. This demand is propelling the adoption of linear motors in semiconductor manufacturing equipment and electronics assembly lines.

China’s linear motor market is rising rapidly due to the government’s push for advanced manufacturing and automation technologies. Initiatives such as the Made in China 2025 are promoting the integration of linear motors in various industries, including automotive assembly lines and logistics. This strategic focus is enhancing production effeiciency and positioning China as a key player in industrial automation.

The linear motor market in South Korea is facing significant growth, particularly in the automotive and robotics sectors. This rise in trend is reflected by Hyundai Motor Group’s announcement to invest USD 16.7 billion in 2025, with a substantial portion allocated to research and development in electrification and autonomous driving. Such investments are accelerating the adoption of linear motors in next-generation vehicle production and robotics applications.

Key Linear Motor Market Players:

- Bosch Rexroth AG

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Sodick Co. Ltd

- Aerotech Inc.

- Micronix USA

- ANCA Group

- Oswald Elektromotoren GmbH

- Parker Hannifin Corp

- Yaskawa Electric Corporation

- KML Linear Motion Technology GmbH

The competitive landscape of the linear motor market is marked by intense innovation, with companies such as Parker Hannifin, HIWIN Technologies, LinMot, and ETEL leading advancements in precision and efficiency. Major players focus on expanding product portfolios, customizing solutions, and investing in Industry 4.0-ready technologies. The market is also shaped by competitive strategic collaborations and regional expansions in electronics, robotics, and transportation sectors. Here are some leading players in the linear motor market:

Recent Developments

- In March 2025, IKO announced the launch of its LT170H2 direct drive linear motor stage for high-performance uses like semiconductor fabrication that need strong thrust and long strokes. This new addition to the LT motor family can deliver 260N of regular force and up to 500N at maximum, which is more powerful than earlier models. It expands the LT series capability, especially for moving heavy objects in tight spaces. The LT170H2 uses a redesigned motor design without mechanical parts that could affect positioning accuracy, and it also features C-Lube linear bearings for smoother guidance and better performance, enabling higher thrust and faster speeds with greater precision.

- In April 2025, Kollmorgen Corporation, a leader in motion control and automation, expanded its IC Ironcore DDL motor series to now support 400/480 VAC-powered applications, along with its earlier 230 VAC models. This new direct drive linear motor from Kollmorgen delivers a continuous force of up to 8,211 N, with peak forces reaching 13,448 N. When used with higher voltages, the motor can maintain its force even at higher speeds, making it ideal for jobs that require fast and precise movement of heavy loads, like machine tools, semiconductor manufacturing, battery production, and industrial automation.

- Report ID: 7646

- Published Date: Aug 12, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Linear Motor Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.