Li-Fi Market Outlook:

Li-Fi Market size was valued at USD 992.2 million in 2025 and is projected to reach USD 43.74 billion by the end of 2035, rising at a CAGR of 52.3% during the forecast period, i.e., 2026-2035. In 2026, the industry size of Li-Fi is assessed at USD 1.5 billion.

The global light fidelity (Li-Fi) market is positively influenced by the heightened demand for high-speed, secure, and low-latency wireless communication across enterprise, industrial, and government sectors. In this regard, the Colorado Office of Economic Development and International Trade in November 2025 reported that Terra Ferma has selected Colorado Springs, Colorado, as the site for a new Li-Fi manufacturing facility, marking one of the major capital investments and expansions of the domestic Li-Fi supply chain. It also stated that the project includes a USD 1.3 million investment in capital expenditures to build out manufacturing infrastructure and related support functions such as engineering, sales, and customer service. This expansion was chosen due to Colorado Springs’ access to extremely skilled talent and proximity to Department of Defense assets, which also showcases the strategic integration of Li-Fi production with defense as well as advanced communications markets.

Furthermore, the Li-Fi market benefits from the presence of companies that are focusing on product innovation, strategic partnerships, and hybrid Li‑Fi or Wi-Fi solutions to enhance coverage, reliability, and interoperability. In this context, du and pureLiFi in June 2025 announced that they have entered into a collaboration to deploy Bridge XC, a LiFi-based solution that enables wireless data and power transfer through windows to simplify outdoor CPE deployment for broadband and private 5G networks. Besides, as the first consumer LiFi solution in the MENA region, Bridge XC delivers high-speed, low-latency connectivity without drilling or complex installations, improving reliability in environments where conventional 5G signals are constrained. Also, the solution optimizes sub-6 GHz and mmWave network capacity while ensuring secure, interference-free data transmission between outdoor and indoor networks.

Key Li-Fi Market Insights Summary:

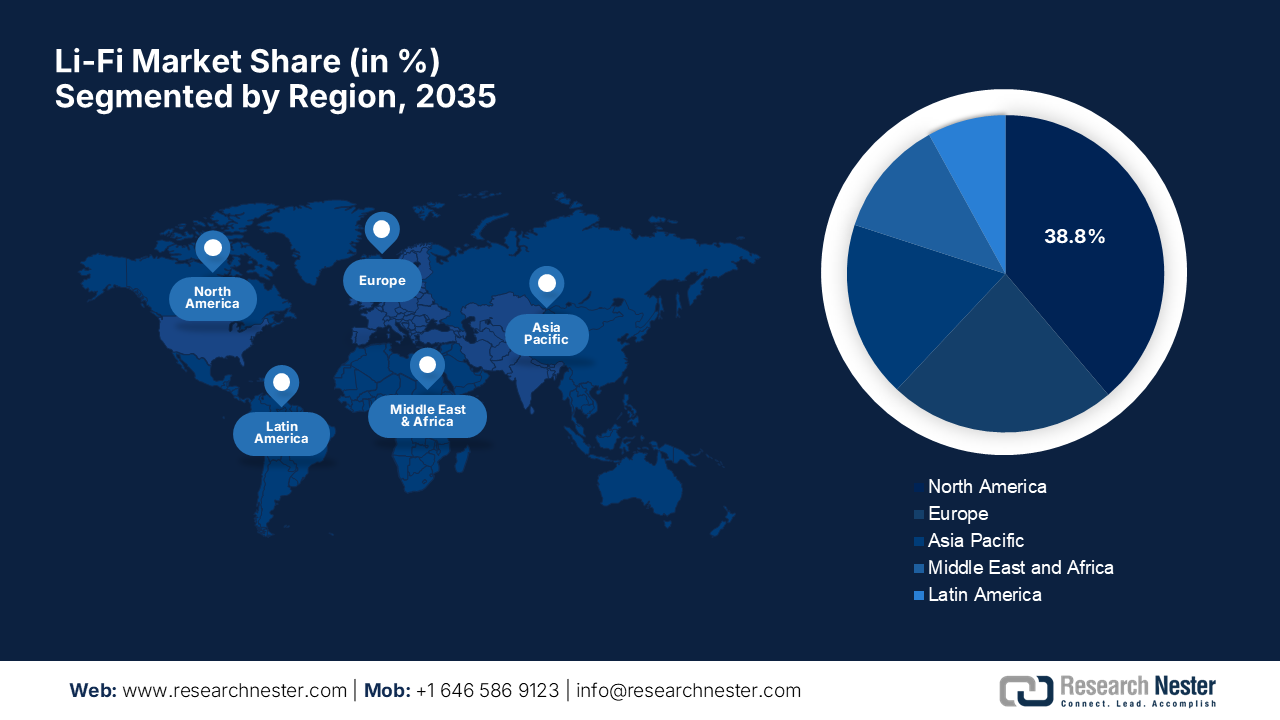

Regional Insights:

- North America is projected to secure a dominant 38.8% revenue share by 2035 in the li-fi market, as strong demand for high-bandwidth connectivity combined with continuous technological advancements strengthens regional adoption.

- Asia Pacific is anticipated to register the fastest growth by 2035, as accelerating urbanization alongside government-backed smart city and digital infrastructure initiatives amplifies demand for secure high-speed wireless communication.

Segment Insights:

- Indoor Networking Segment is expected to command a leading 55.4% share by 2035, as its ability to deliver secure and ultra-fast wireless connectivity in congested RF environments strengthens its market position.

- LED Segment is forecast to expand steadily by 2035, as its central role in visible light communication and alignment with energy-efficient smart infrastructure programs stimulates adoption.

Key Growth Trends:

- Smart cities & urban infrastructure initiatives

- Rising demand for high-speed wireless connectivity

Major Challenges:

- Limited range and line-of-sight requirement

- Standardization and interoperability issues

Key Players: pureLiFi Ltd., Oledcomm S.A.S., Signify N.V., Velmenni OÜ, Lucibel S.A., Acuity Brands Inc., Panasonic Corporation, General Electric Company, Firefly LiFi, VLNComm Inc., LightBee Corporation, Renesas Electronics Corporation, Qualcomm Technologies, Inc., Samsung Electronics Co., Ltd., Bytelight

Global Li-Fi Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 992.2 million

- 2026 Market Size: USD 1.5 billion

- Projected Market Size: UUSD 43.74 billion by 2035

- Growth Forecasts: 52.3% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (38.8% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: India, South Korea, Canada, France, Singapore

Last updated on : 6 January, 2026

Li-Fi Market - Growth Drivers and Challenges

Growth Drivers

- Smart cities & urban infrastructure initiatives: The continued expansion of smart city projects worldwide is a significant growth catalyst for the Li-Fi market. Cities across the globe are making continued investments in infrastructure that combines illumination with data connectivity, for example, Li-Fi-enabled streetlights and urban sensors. In September 2025, Velmenni and Niral Networks announced they had allied to deliver fiber-like, cable-free industrial connectivity by integrating Li-Fi wireless backhaul with private 5G networks. The collaboration has already been successfully deployed at a power plant in Odisha, proving reliable, secure connectivity in RF-restricted and hard-to-wire environments. The company also states that by combining Velmenni’s high-speed, interference-free Li-Fi technology with Niral Networks’ Private 5G platform, the partnership enables ultra-secure and resilient connectivity for mission-critical industrial operations, hence denoting a positive market outlook.

- Rising demand for high-speed wireless connectivity: Li-Fi offers considerably faster data transmission rates when compared to conventional Wi-Fi, achieving speeds that exceed 10 Gbps by leveraging visible light rather than radio frequencies. This makes it attractive for bandwidth-intensive applications and reduces network congestion in dense environments, driving business in the Li-Fi market. As per the article published by NIH in December 2024, its 2024 study in Sensors highlights the integration of Wi-Fi, Li-Fi, and broadband over power lines to create a very secure and high-speed indoor communication system. Besides, Li-Fi provides ultra-fast data transfer up to 224 Gbps that too with very minimal interference and enhanced security, by complementing Wi-Fi and BPL for broader coverage and reliability. In addition, this approach improves network efficiency and ensures connectivity for applications in smart buildings, industrial sites, and critical infrastructure.

- Enhanced security requirements: This is one of the primary growth drivers for the Li-Fi market since it utilizes light that cannot penetrate walls, limiting signal leakage outside physical spaces. This is a major influencing factor for sectors that prioritize secure communications, such as finance, healthcare, defense, and enterprise applications. In April 2024, Vibrint entered into a partnership with pureLiFi and launched the Vibrint LiFi, which is a wireless communication system especially designed for classified and national security environments. Using light waves instead of radio frequencies ensures military-grade encryption, interference-free operation, and ultra-fast connectivity, which in turn addresses the critical data as well as security needs. The solution, along with the LiFi-enabled laptops and LiFi Cube systems, provides flexible and rapidly deployable networks that efficiently enhance operational security for government as well as defense agencies.

Challenges

- Limited range and line-of-sight requirement: Li‑Fi relies mainly on visible light communication, which limits its operational range and, in turn, necessitates a clear line-of-sight between the transmitter and receiver. Simultaneously, the obstacles such as walls, furniture, or even human movement can block the light signal, causing interruptions in performance. Also, the regular Wi-Fi can penetrate objects using the radio waves, but Li-Fi cannot provide building coverage without deploying multiple access points. The existence of this restriction makes it challenging in indoor environments such as offices, hospitals, or industrial floors, where mobility is highly essential. Furthermore, to overcome this, manufacturers are focused on developing mesh networks and hybrid Li‑Fi or Wi-Fi solutions, resulting in complexity and cost, making Li-Fi market adoption slow.

- Standardization and interoperability issues: This is yet another major obstacle hindering the expansion of the light fidelity (Li-Fi) market. The IEEE 802.11bb has provided a framework for optical wireless communication, but many companies still use proprietary solutions, which can create compatibility issues across most devices and networks. Also, the absence of universally adopted protocols hinders integration with both the existing networking infrastructure and IoT ecosystems. In this context, enterprises in this market might hesitate to adopt LI-Fi owing to the aspects of vendor lock-in or difficulties in integrating with Wi-Fi, Ethernet, or cloud systems. In addition, the standardization gaps also affect regulatory compliance and global deployment, particularly in industries such as defense or healthcare, where secure communication is highly essential.

Li-Fi Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

52.3% |

|

Base Year Market Size (2025) |

USD 992.2 million |

|

Forecast Year Market Size (2035) |

USD 43.74 billion |

|

Regional Scope |

|

Li-Fi Market Segmentation:

Application Segment Analysis

In the Li-Fi market, the indoor networking segment is expected to lead with a commanding share of 55.4% during the forecast duration. Its ability to add high-speed, secure wireless links where traditional RF Wi Fi faces congestion is the key factor driving dominance of the subtype. In January 2022, Signify announced that it had deployed the Trulifi Li-Fi system in Belgian schools to provide students and teachers with high-speed, secure, and reliable indoor connectivity using light waves instead of traditional Wi‑Fi. It also mentioned that the system delivers 220 Mbps download and 160 Mbps upload speeds by supporting laptops and tablets across classrooms while also ensuring data security. These installations, following successful deployments in Italy, Germany, the U.S., and the Netherlands, demonstrate the practical application of Li-Fi for indoor networking in educational environments, addressing Wi‑Fi congestion and enhancing digital learning.

Component Segment Analysis

By the end of 2035, the LED segment is expected to grow at a progressive rate in the light fidelity (Li-Fi) market, owing to its fundamental role in Li Fi because visible light communication uses LED lighting fixtures as dual-purpose data transmitters. On the other hand, LEDs form the core of energy-efficient lighting infrastructure, i.e., streetlights, buildings, and this aligns with smart infrastructure strategies that many governments promote. In February 2025, Ameresco announced that it had launched a pilot project with the City of New Orleans to upgrade 56 streetlights to intelligent LED fixtures integrated with smart city technology, including Ubicquia UbiCell and TerraGo platforms. This project enhances energy efficiency, public safety, and city monitoring by paving the groundwork for future dual-purpose LED infrastructure, which is capable of supporting technologies such as Li‑Fi. The initiative reflects the significance of government-backed LED deployments that align with smart infrastructure strategies and the growing role of LEDs in these communication systems.

End user Segment Analysis

In terms of the end user, the retail segment is anticipated to capture a significant revenue share in the Li-Fi market during the discussed timeframe. The segment’s growth is highly attributable to the increased adoption of high-density connectivity and location services that support digital transformation. Also, the public sector interest in advanced wireless systems and industry research highlights growth in enterprise as well as retail connectivity needs. The retail segment benefits from Li‑Fi’s ability to provide high-speed indoor networking, thereby enabling real-time inventory management, targeted promotions, and enhanced customer experiences. In addition, large shopping malls and supermarkets are deploying Li‑Fi to track foot traffic and optimize store layouts. Furthermore, the segment’s growth is reinforced by government initiatives and funding for digital infrastructure in commercial spaces, supporting widespread adoption of Li‑Fi technologies.

Our in-depth analysis of the light fidelity (Li-Fi) market includes the following segments:

|

Segment |

Subsegments |

|

Application |

|

|

Component |

|

|

End user |

|

|

Transmission Type |

|

|

Form Factor |

|

|

Networking Type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Li-Fi Market - Regional Analysis

North America Market Insights

In the Li-Fi market, North America is likely to capture the largest revenue share of 38.8% over the forecasted years. The region’s progress in this field is effectively attributed to the rising demand for high-speed bandwidth and continued technological improvements. In May 2023, pureLiFi announced that it entered into an agreement with Fairbanks Morse Defense (FMD) to provide secure Li‑Fi technology to FM OnBoard maritime defense customers in the U.S. This collaboration enables technicians to communicate securely at sea by leveraging light-based data transmission for mission-critical operations. Further, this partnership marks a key step in expanding Li‑Fi applications from land-based deployments to maritime defense environments, enhancing operational reliability and cybersecurity. Hence, such instances reinforce North America’s position as a critical leader in the market over the forecasted years.

The U.S. is augmenting its leadership in the regional light fidelity (Li-Fi) market owing to the increased adoption among defense, healthcare, and corporate enterprises that are looking for a very secure and high-bandwidth communication solution. Initiatives by technology companies to integrate Li-Fi into smart office and industrial environments are complemented by pilot projects in educational institutions and research labs. In January 2025, Intelligent Waves and Signify announced that they had formed a joint venture to advance Li-Fi and optical wireless technology for the U.S. Department of Defense. This collaboration aims to provide secure, high-speed, two-way communication using light waves by efficiently reducing interference when compared to traditional radio frequency systems. Furthermore, the venture builds on existing work with the U.S. Air Force, combining Signify’s lighting innovations with Intelligent Waves’ government technology expertise to enhance defense communications.

There is a huge opportunity for Canada to capitalize on the regional Li-Fi market owing to the expanding collaborations between technology startups and universities, which are aiming to integrate visible light communication into smart buildings, museums, and healthcare facilities. Public sector interest in secure communication systems and energy-efficient lighting infrastructure is also driving adoption in the country. Simultaneously, the Canada-based firms are focused on leveraging Li-Fi’s advantages in environments where traditional wireless networks face congestion or security concerns. Also, the companies are piloting Li-Fi systems in office complexes and research institutions to test high-speed, secure connectivity solutions. In addition, collaborative programs with government agencies are supporting the deployment of Li-Fi in critical infrastructure, including hospitals and government offices, hence making it suitable for overall market growth.

APAC Market Insights

Asia Pacific is likely to grow at the fastest rate in the light fidelity (Li-Fi) market due to the ever-increasing urbanization, the rise of smart city projects, and government initiatives to enhance digital infrastructure. Countries across the region are exploring Li-Fi for applications in offices, transport hubs, and public institutions by mainly focusing on secure, high-speed connectivity. In March 2025, Jabil announced the expansion of its operations in Gujarat, India, which marks its second facility in the country, with a focus on advancing photonics capabilities. The move is supported by a new MoU with the state government and also explores the potential for a post-wafer fabrication silicon photonics facility incorporating co-packaged optics. This expansion highlights Jabil’s commitment to developing optical networking solutions for telecommunications, data communications while fostering innovation. Hence the Jabil’s expansion boosts the market by enhancing domestic manufacturing and development of photonics and optical components, which are highly essential for high-speed visible light communication.

In China, the Li-Fi market is experiencing rapid blistering growth on account of increased adoption fueled by smart city programs, IoT integration, and industrial automation efforts. The country’s push for wireless technologies in educational institutions, corporate campuses, and healthcare facilities is efficiently fueling pilots along with commercial deployments. Domestic companies are also exploring Li-Fi for large-scale infrastructure by leveraging the widespread adoption of LED lighting in both public and commercial spaces. In addition, the collaborations between China-based technology companies and research institutes are efficiently accelerating innovation in terms of Li-Fi transceivers, sensors, and connectivity solutions. Furthermore, the government-backed initiatives are efficiently promoting standards and interoperability, ensuring faster adoption across various sectors.

India is growing in the light fidelity (Li-Fi) market, backed by the government’s focus on digital education, smart infrastructure, and high-speed internet access. On the other hand, startups in the country are proactively collaborating with technology providers to develop solutions that address the challenges, such as network congestion and security in densely populated areas. In this regard, the Ministry of Electronics & IT in November 2024 reported that C-DAC Chennai has signed a transfer of technology agreement with Nav Wireless Technologies Pvt. Ltd. to commercialize its Li-Fi-enabled solutions, NLOS VICINITY for indoor positioning, and ILLUMINATE for smart indoor lighting, under the support of India’s Ministry of Electronics and Information Technology. Therefore, this collaboration enables public-private deployment of advanced visible light communication technologies for applications in smart buildings, RF-free zones, and secure environments.

Europe Market Insights

Europe is considered to be the central player in the global Li-Fi market, wherein both governments and businesses are making investments in secure, high-speed wireless communication solutions. The region’s market also benefits from administrative regulations, which promote energy efficiency and smart infrastructure, supporting the adoption of LED-based visible light communication systems. In July 2025, University of St Andrews and the University of Cambridge researchers demonstrated Li-Fi data transmission by utilizing OLEDs, thereby achieving 4 Gbps over 2 meters and 2.9 Gbps more than 10 meters. It was also mentioned by the universities that by optimizing materials, device architecture, and using the stable organic compound dinaphthylperylene, they enhanced speed and range, overcoming previous OLED limitations. Hence, such milestones highlight OLEDs’ potential for high-speed, flexible, and long-distance visible light communication in applications from homes to wearable devices, making it suitable for standard market growth.

Germany’s light fidelity market is focused mainly on integrating Li-Fi into industrial automation, research laboratories, and smart building projects. The country’s market also benefits from strong government initiatives in Industry 4.0 and digital infrastructure that have encouraged the deployment of high-speed, interference-free communication technologies. In February 2023, Germany’s Fraunhofer IPMS and KEEQuant GmbH, under the BMBF-funded QuINSiDa project, announced that they have launched a pioneering initiative combining Li-Fi and quantum key distribution to enable secure optical wireless communication. Besides, this project aims to provide quantum-safe, point-to-multipoint wireless networks for critical infrastructure, which includes hospitals, banks, and government facilities. Further, by integrating Li-Fi with advanced quantum cryptography, the initiative demonstrates the country’s push toward secure, high-speed, and interference-free wireless communication technologies.

In the U.K., Li-Fi is expanding in corporate offices, hospitals, and educational institutions that are seeking secure, high-speed alternatives to Wi-Fi. The countries' technology companies and universities are proactively conducting research and pilot deployments to demonstrate Li-Fi’s capabilities. Oledcomm in April 2023 revealed that SatelLife LiFi technology was successfully tested aboard the INSPIRE-SAT 7 nanosatellite, which marks the first-ever LiFi deployment in space. This lightweight module (83 g) replaces traditional cables by providing high-speed intra-satellite data transmission up to 3 Gbps with minimal latency and no electromagnetic interference. In addition, this milestone demonstrates LiFi’s potential for secure, efficient communication in space applications, with ongoing collaborations with ESA, NASA, and other major aerospace organizations benefiting the light fidelity market growth.

Key Li-Fi Market Players:

- pureLiFi Ltd. (U.K.)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Oledcomm S.A.S. (France)

- Signify N.V. (Netherlands)

- Velmenni OÜ (Estonia)

- Lucibel S.A. (France)

- Acuity Brands Inc. (U.S.)

- Panasonic Corporation (Japan)

- General Electric Company (U.S.)

- Firefly LiFi (U.S.)

- VLNComm Inc. (U.S.)

- LightBee Corporation (Spain)

- Renesas Electronics Corporation (Japan)

- Qualcomm Technologies, Inc. (U.S.)

- Samsung Electronics Co., Ltd. (South Korea)

- Bytelight (Osram/OSRAM subsidiary) (Germany)

- pureLiFi Ltd. is widely regarded as a market leader in Li‑Fi technology, which is developing secure, high-speed optical wireless communication systems for enterprise, defence, and industrial applications. The firm is focused on innovative Li‑Fi modules, access points, as well as integration solutions that enable wireless data delivery via visible light. In addition, pureLiFi’s product portfolio and strategic partnerships have strengthened its position in high-security and specialized use cases.

- Oledcomm S.A.S. is yet another dominant force in this field that combines smart LED lighting with ultra‑fast Li‑Fi communication solutions, by targeting smart buildings, transportation, healthcare, and industrial sectors. The company has also developed patented LiFi systems and products such as LiFiMAX that enable secure, interference-free wireless data transmission where radio waves are constrained which is positioning it as a critical leader in this light fidelity market.

- Signify N.V. leverages its global leadership in lighting and IoT to integrate Li‑Fi into its Trulifi product line, thereby offering combined illumination and data services across commercial, healthcare, and industrial settings. The company is based in the Netherlands, whereas its approach embeds Li‑Fi within existing LED infrastructures, enabling scalable deployments and partnerships with smart city initiatives.

- Velmenni OÜ specializes in terms of industrial‑grade Li‑Fi solutions, which are especially designed for factories, defense, aviation, and enterprise environments. The company is mainly focused on optical wireless mesh networks and high-performance connectivity, and it integrates Li‑Fi with existing network infrastructures and works on pilot projects that blend Li‑Fi and Wi‑Fi technologies for proper communication.

- Lucibel S.A. is the central player in this market, which focuses on aesthetic LED lighting systems embedded with Li‑Fi capabilities, serving corporate and luxury environments. Simultaneously, the company collaborates with partners to deliver Li‑Fi‑enabled lighting and communication solutions that emphasize design as well as performance, targeting commercial buildings, hospitality, and high-end enterprise installations.

Below is the list of some prominent players operating in the global light fidelity market:

The light fidelity market is highly competitive, which hosts a combination of optical communication pioneers such as pureLiFi and OLEDcomm and large multinational technology corporations such as Signify, Panasonic, and Samsung that integrate Li‑Fi into broader product ecosystems. Product innovation, partnerships for smart lighting integrations, and industry collaborations are a few strategies opted for by pioneers to strengthen their light fidelity market positions. In February 2025, LI.FI Protocol announced that it has acquired Catalyst, which is an intents protocol especially designed for resource locks and interoperability across any virtual machine. Through this, the firm aims to scale its infrastructure to support the fragmented DeFi ecosystem by combining aggregation with an intent-driven approach to create a universal, chain-agnostic liquidity marketplace, aligning with its vision of making on-chain finance more accessible and efficient.

Corporate Landscape of the Li-Fi Market:

Recent Developments

- In December 2025, LI.FI Protocol announced a USD 29 million Series A extension, which was led by Multicoin and CoinFund, bringing its total funding to USD 51.7 million. The company, which enables developers to build on-chain swaps and cross-chain bridging, has surpassed USD 60 billion in lifetime transaction volume.

- In June 2025, pureLiFi announced the launch of Kitefin XE, which is a next-generation LiFi system designed for government, defence, and enterprise sectors to provide high-speed, secure wireless connectivity.

- Report ID: 3260

- Published Date: Jan 06, 2026

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Li-Fi Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.