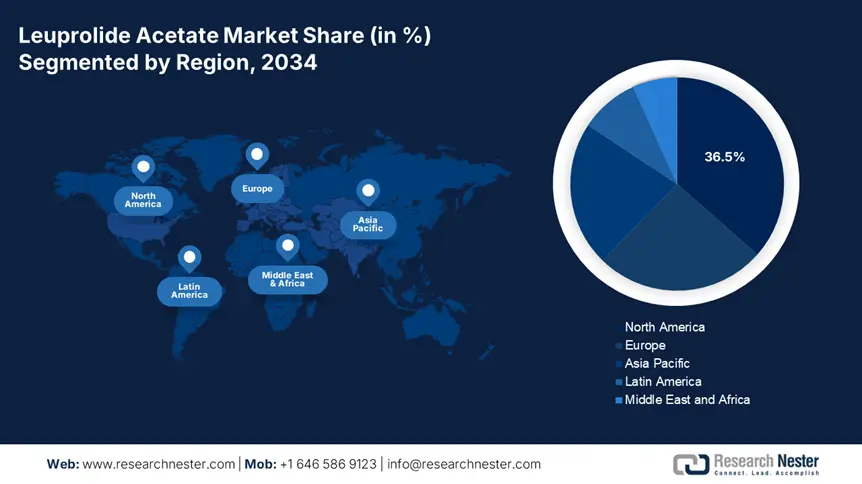

Leuprolide Acetate Market - Regional Analysis

North America Market Insights

North America is the dominant region in the leuprolide acetate market and is anticipated to hold the market share of 36.5% at a CAGR of 6.9% by 2034. The region is driven by the high disease prevalence, favorable reimbursement frameworks, and enhanced healthcare infrastructure. The growing occurrence of prostate cancer and endometriosis in the U.S. exceeds 268,010 and 6.8 million registered cases in 2023, driving a demand for GnRH agonists, including leuprolide acetate. Strong federal investment of over USD 5.5 billion is allocated to hormonal therapy with expanded Medicare insurance coverage and 15.5% rise in Medicare leuprolide-based claims over the past five years. The growth in biosimilar products, investment in depot formulations R&D, and rising outpatient infusion centers are key factors shaping the competitiveness.

The U.S. leuprolide acetate market is growing steadily and is driven by the increasing clinical applications in prostate cancer, endometriosis, and precocious puberty. CDC report states that cases of prostate cancer have increased to 268,500 in 2023, demanding the sales of LHRH agonists, including leuprolide acetate. According to the Medicare report, the expenditure of Medicare has increased by 15.4% reaching $800.5 million. On the other hand, the Medicaid policies have extended coverage and benefits additional 10.3% of patients in 2024, according to CMS report. Prices are still high despite biosimilar availability, but payer negotiations have started reducing reimbursement thresholds. Government aims toward specialty pharmaceuticals, and CMS value-based payment models continue to influence future access and pricing structures by 2034.

Canada's leuprolide acetate market is expected to witness steady growth, fueled by higher federal and provincial investment in reproductive and oncology treatment. CIHI reports that federal spending on hormonal therapy reached $3.5 billion in 2023, which is an increase of 12.6% since 2020. Health Canada has simplified LHRH therapy regulatory approvals, making it available in more urban and rural treatment facilities. PHAC highlighted an aging society and late menopause treatment as major drivers of future demand. Additionally, adoption of biosimilars in Canada is increasing, and brand loyalty and formulary preference are reducing uptake. Investment in domestic oncology drug trials and cold-chain facilities, states Innovative Medicines Canada, will increase leuprolide acetate market opportunities through 2030.

APAC Market Insights

The Asia Pacific is the fastest growing region in leuprolide acetate market and is expected to hold the market share of 22% at a CAGR of 7.5% during the forecast period 2025 to 2034. The region is driven by the growing incidence of hormone-based conditions, including uterine fibroids, prostate cancers, and endometriosis. China and Japan are leading the region with enhanced healthcare infrastructure, government co-financing of hormone treatments. China and India leuprolide acetate market is urged due to the rising diagnosis rates, government investment in specialty drug access and biosimilar adoption. Price pressures are being reduced and supply chain resilience is being improved by the extensive implementation of public insurance programs, cost reduction measures, and incentives for domestic production, such as Japan's AMED-supported clinical trials and India's Production-Linked Incentive (PLI) program.

China is expanding rapidly in the leuprolide acetate market and is poised to hold the revenue share of USD 1.8 billion by 2034. The National Medical Products Administration (NMPA) depicts that government expenditure on leuprolide acetate increased by 15.4% over the past ten years to an estimated ¥9.9 billion by the end of 2023. In China, the leuprolide acetate treatment was performed on nearly 1.9 million patients in 2023, particularly for prostate cancer and endometriosis. The leuprolide acetate market is aided by bulk procurement programs under China's centralized Volume-Based Procurement (VBP) policy, which have reduced costs and increased access. Several domestic manufacturers have been granted fast-track approvals under the NMPA's accelerated review pathway, which is supporting domestic supply.

In India, the leuprolide acetate market is anticipated to capture the revenue share of USD 908.3 million by 2034. The government expenditure on leuprolide acetate in India has increased by 18.5% over the past decade to $2.1 billion annually due to the increased treatment of prostate cancer, endometriosis, and central precocious puberty. The Indian government Ministry of Health has reported that nearly 2.8 million patients were treated in 2023, with the Jan Aushadhi scheme subsidizing treatment in more than 7950 centers. This broadened access has significantly enhanced treatment adherence and limited the out-of-pocket expenses for low-income patients in both rural and urban regions.

Country-wise Government Provinces

|

Country |

Initiative / Policy Program |

Launch Year |

Government Investment / Budget Allocation |

|

Japan |

AMED Advanced Hormone Therapy R&D Program |

2022 |

$2.9 billion allocated for hormone-based R&D |

|

South Korea |

Bio & Pharma Innovation Strategy |

2021 |

$5.1 billion over 5 years, includes hormone cancer treatments |

|

Malaysia |

National Strategic Plan for Non-Communicable Diseases |

2024 |

$450.4 million includes funding for hormone-related oncology |

|

Australia |

Pharmaceutical Benefits Scheme Expansion for Hormonal Therapies |

2025 |

AUD $1.6 billion dedicated to subsidize advanced therapies incl. leuprolide |

Sources: MHLW, AMED, MOHW, MOH, Australian Government Health

Europe Market Insights

Europe in the leuprolide acetate market is expanding rapidly and is poised to hold the market share of 25.8% at a CAGR of 6.1% by 2034. The region is driven by the growing incidence of prostate cancers, uterine fibroids, endometriosis, and the incorporation of hormonal therapies in national healthcare protocols. The European Medicines Agency (EMA) supports the increasing use of leuprolide acetate in oncology and reproductive health and has simplified regulatory processes for long-acting formulations. Further 33% of oncology drugs are approved in 2024, including leuprolide acetate. Further, in Western Europe, the National Health Systems adopted value-based purchasing agreements to minimize the costly treatments, including leuprolide acetate, to ensure wider adoption.

Germany holds the biggest leuprolide acetate market in Europe and is expected to hold the revenue share of 27% by 2034. In 2024, national expenditure on leuprolide acetate reached €4.4 billion, according to the Federal Ministry of Health (BMG), highlighting its status as a front-line treatment for advanced prostate cancer and central precocious puberty. The German Medical Association reached a 12.6% rise in the past five years, requiring hormonal therapy for Stage III prostate cancer with nationwide oncology protocol updates. Germany's DRG-based hospital reimbursement model and generous insurance coverage guarantee wide accessibility. Further, investment under the Pharmaceutical Strategy for Europe has surged localized production and clinical trial activity, broadening capacity for treatment and establishing long-term supply lines.

France's leuprolide acetate market is poised to hold a revenue share of 19.2% by 2034. In 2023, the French Ministry of Solidarity and Health allocated 7.4% of the country's pharmaceutical expenditure to leuprolide acetate treatments, from 5.8% in 2021. The increase was, according to the French National Authority for Health (HAS), fueled by revised oncology guidelines and countrywide early-access schemes for hormone analogs. In 2022, over 60,010 patients were treated with subsidized leuprolide-based therapies. France's aging population and emphasis on precision hormone therapy also lend strength to sustained demand.

Government Investments, Policies & Funding

|

Country |

Initiative/Policy |

Budget / Investment Focus |

Launch Year |

|

Italy |

National Oncology Plan (Part of PNRR - Recovery and Resilience Plan) |

€1.9 billion allocated for cancer and hormonal therapies, including GnRH agonists like leuprolide acetate |

2022 |

|

Spain |

PERTE Salud de Vanguardia (Cutting-Edge Health Strategy) |

€1.8 billion allocated for advanced therapies and digital transformation in oncology, supporting access to leuprolide acetate |

2021 |

|

Spain |

AEMPS Real-World Data Pilot |

€100.6 million for real-world efficacy and reimbursement optimization for oncology and hormone products |

2025 |

|

United Kingdom |

NHS Cancer Drugs Fund Expansion |

£340.8 million added to improve access to hormone therapies like leuprolide acetate for prostate and breast cancers |

2023 |

|

United Kingdom |

NICE Conditional Coverage + Access Scheme |

Expanded coverage for leuprolide acetate for endometriosis and precocious puberty |

2022 |

|

Italy |

AIFA Fast Track Approval for High-Demand Therapies |

Regulatory fast-tracking of leuprolide acetate generics and biosimilars to reduce treatment costs |

2024 |

Sources: AIFA, AEMPS, NHS, European Commission Health