Leukemia Therapeutics Market Outlook:

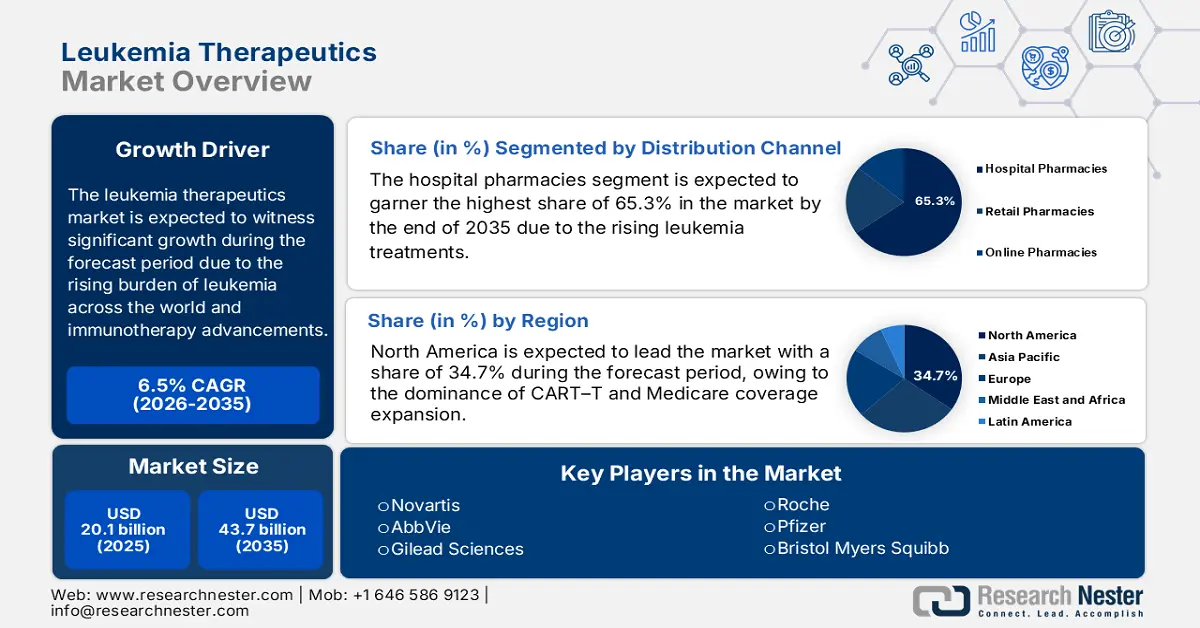

Leukemia Therapeutics Market size was valued at USD 20.1 billion in 2025 and is projected to reach USD 43.7 billion by the end of 2035, rising at a CAGR of 6.5% during the forecast period, i.e., 2026-2035. In 2026, the industry size of leukemia therapeutics is estimated at USD 21.7 billion.

The leukemia therapeutics market is growing exponentially owing to the strong demand for advanced therapeutics across all nations. In this regard SEER report states that the patient pool affected by leukemia is more than 536,245 cases in 2022, with acute lymphoblastic leukemia dominating pediatric cases and chronic lymphocytic leukemia leading adult cases. Further, factors such as genetic predispositions, aging populations, and environmental exposures are also the key drivers of the market.

Investment in research, development, and deployment is funded mainly by the public sector through institutions such as the National Institutes of Health (NIH) and private research foundations. The NIH spends USD 48 billion on medical research, some of which is allocated to various types of cancers, including leukemia, a sum that has experienced steady yearly increases. The investment drives the clinical pipeline, resulting in new drug launches and treatment modalities. From a commercial point of view, the United States is a net importer of drug products, such as therapeutics for leukemia and their lead chemicals.

Key Leukemia Therapeutics Market Insights Summary:

Regional Insights:

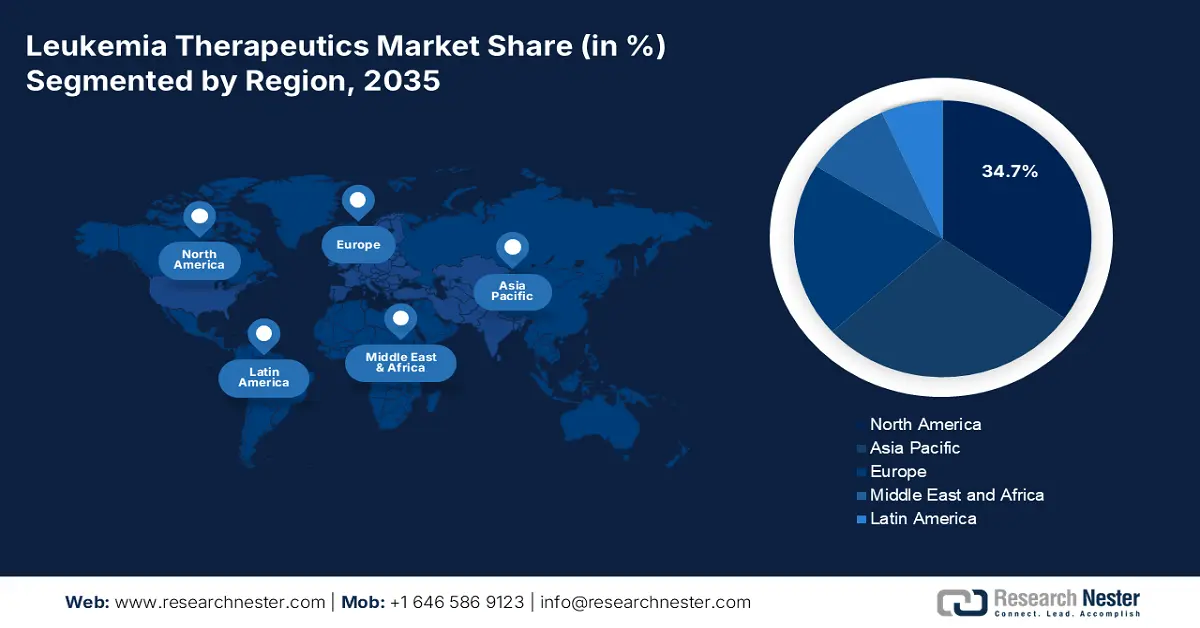

- North America is predicted to hold a 34.7% share by 2035, impelled by the widespread use of CAR-T therapies and expanded Medicare coverage.

- Asia Pacific is expected to witness the fastest growth during 2026–2035, fueled by local CAR-T production and rising adoption of NGS technologies.

Segment Insights:

- Hospital Pharmacies Segment is projected to account for 65.3% share by 2035, owing to the high volume of leukemia treatments performed in specialized care settings.

- Targeted Therapy Segment is expected to hold the highest share by 2035, driven by advancements in precision medicine and regulatory support for novel targeted drugs.

Key Growth Trends:

- Rising patient pool and disease prevalence

- Out-of-pocket expenses

Major Challenges:

- Government-imposed price controls

Key Players: Novartis AG,F. Hoffmann-La Roche Ltd.,Bristol Myers Squibb (BMS),Pfizer Inc.,Johnson & Johnson (Janssen),AbbVie Inc.,Gilead Sciences (Kite Pharma),Amgen Inc.,Merck & Co. (MSD),Sanofi,GlaxoSmithKline (GSK),Bayer AG,AstraZeneca,Eli Lilly and Company,Takeda Pharmaceutical (ex-Japan ops),Takeda Pharmaceutical,Astellas Pharma,Daiichi Sankyo,Eisai Co., Ltd.,Otsuka Holdings

Global Leukemia Therapeutics Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 258.2 million

- 2026 Market Size:USD 271.4 million

- Projected Market Size: USD 426.9 million by 2035

- Growth Forecasts: 5.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (34.7% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, Japan, France, Canada

- Emerging Countries: China, India, South Korea, Brazil, Australia

Last updated on : 9 September, 2025

Leukemia Therapeutics Market - Growth Drivers and Challenges

Growth Drivers

- Rising patient pool and disease prevalence: The rising patient pool in North America and Europe is driving demand. The National Cancer Institute (NCI) report in July 2025 states that about 62,770 new leukemia patients were registered in the U.S. in 2024. Europe's rising aging population accelerates chronic disease development, expands the addressable patient base. As prevalence continues rising, long-term therapeutic needs will continue to be robust, particularly for advanced biologics and customized treatments aimed at various leukemia subtypes.

- Out-of-pocket expenses: Patient affordability continues to be a significant access and market driver. In the U.S., Medicare Part D patients with leukemia spent an average $10,980 out-of-pocket expenses in 2023 for specialty cancer medicines, based on the ASCO article in 2025. These expenditures restrict access to lower-income individuals, creating opportunities for biosimilars and generics. Universal healthcare nations like the UK and France are negotiating pricing models to lower treatment prices.

- Emerging role of precision medicine: According to the NLM report, precision and personalized medicine can decrease the risk and cost of cancer drug development and discovery. Additionally, the report has mentioned that almost 11 % of drugs have entered FDA-approved phase I clinical trials. Further, these precision and personalized medicines aid in targeting the cancer cells and inhibiting their growth, which leads to enhanced therapeutic responses. Therefore, it is the most efficient and tailor-made treatment in contrast to the conventional therapies, leading to designing the future of cancer therapy tailored to patient-specificity.

Drugs List for Targeted Therapy (2025)

|

Combination |

Combined Drugs |

Indication |

Patient Number |

Treatment Outcome |

|

Tyrosine kinase inhibitors |

Imatinib |

Ph+ALL, CML |

1106 |

10-year OS rate 83.3% |

|

|

Dasatinib |

|

149 |

5-year OS rate 96%, treatment failure-free survival rate 95%. |

|

|

Ponatinib |

|

51 |

10-year OS rate 90%, 2-year EFS 97% |

|

FLT3 Inhibitors |

Midostaurin |

AML |

22 |

overall response rate was 55.5%, OS 3.7 months. |

|

|

Gilteritinib |

|

247 |

26 patients survived for 2 years or longer without recurrence |

|

B-Cell Signaling Pathway Inhibitors |

Ibrutinib |

CLL |

269 |

ORR 92%, |

|

|

Acalabrutinib |

|

134 |

45 months PFS 62% |

|

|

Idelalisib |

|

54 |

81.5% of patients achieved lymph node response during treatment |

|

Anti-apoptotic Inhibitors |

Venetoclax |

CLL and AML |

- |

- |

|

Immunotherapy Drugs |

Rituximab |

ALL, CLL, HCL |

209 |

2-year EFS 65% |

|

|

Obinutuzumab |

|

33 |

OS rate 62%, best overall response rate 62% |

|

|

Blinatumomab |

|

405 |

Median OS 7.7 months, CR rate was 34%. |

|

Differentiation Inducers |

ATRA |

APL |

- |

- |

|

up coming targeted therapies under trial |

Ziftomenib |

AML |

83 |

25% achieved complete remission or complete remission with partial hematologic recovery |

|

|

Nemtabrutinib |

CLL |

48 |

OS rate in patients with CLL was 75%. |

Source: NLM

Challenges

- Government-imposed price controls: One of the major factors negatively influencing growth in the leukemia therapeutics market is price caps imposed by governments across all nations. It is reported that the AMNOG law in Germany mandates price reductions for new cancer drugs, making it challenging for domestic players to opt for leukemia therapeutics. These price caps imposed resulted in reimbursement delays of drugs in Europe further hindering the domestic market expansion.

Leukemia Therapeutics Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

8.1% |

|

Base Year Market Size (2025) |

USD 20.1 billion |

|

Forecast Year Market Size (2035) |

USD 43.7 billion |

|

Regional Scope |

|

Leukemia Therapeutics Market Segmentation:

Distribution Channel Segment Analysis

Based on the distribution channel, the hospital pharmacies segment is anticipated to hold a significant share of 65.3% in the leukemia therapeutics market. The growth in the segment is subject to a high volume of leukemia treatments being performed in these specialized care settings. In this regard, the World Health Organization reports that there has been a surge in hospitalization rates for certain types of aggressive leukemia. Therefore, this version of increased adoption towards hospitalization is set to capture maximum growth in the market.

Therapy Type Segment Analysis

Based on therapy type, the targeted therapy segment is expected to garner the highest share in the leukemia therapeutics market by the end of 2035. The dominance of the segment is attributed to the preceding advancements in precision medicine and the extended support offered by the U.S. FDA with approvals for novel drugs such as FLT3 and tyrosine kinase inhibitors, which are the single-agent use of target drugs, stated in the NLM report in July 2025. Besides, the National Cancer Institute states that targeted therapy demonstrates higher efficacy in reducing relapse rates, further highlighting the segment’s upliftment during the forecast timeline.

Drug Class Segment Analysis

TKIs generate the greatest revenue due to their established position as a CML treatment and their widening use in ALL and AML. They tend to be used as long-term, chronic therapies, providing steady revenue streams. According to the ASCO article published in April 2025, patients with chronic myelogenous leukemia (CML) who received treatment with TKIs, like imatinib, approximately 30% of patients became eligible for treatment-free remission (TFR) after 10 years of treatment based on the ENESTnd trial results reported by the National Cancer Institute (NCI).

Our in-depth analysis of the leukemia therapeutics market includes the following segments:

|

Segment |

Subsegments |

|

Therapy Type |

|

|

Drug Class |

|

|

Disease Type |

|

|

Distribution Channel |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Leukemia Therapeutics Market - Regional Analysis

North America Market Insights

North America is a key player in the leukemia therapeutics market, projected to register a significant share of 34.7% in 2035. Rising at a CAGR of 6.5%, the industry is witnessing such growth fueled by the dominance of CART–T of worldwide usage and Medicare coverage expansion. In this regard, it is reported in NLM report in April 2022 states that North America ranked first globally in leukemia health burden, with an age-standardized death rate (ASDR) of 5.65 per 100,000 persons indicating both high disease incidence and substantial need for therapeutics in the region.

There is a huge opportunity for the leukemia therapeutics market in Canada, with exceptional support offered by federal and provincial healthcare reforms. For instance, as per an article published by CIHI, it is found that the country’s public system covers leukemia drugs. Besides, NIH report in 2022 notes that 36% of patients are now receiving BTK inhibitors through provincial systems. Canada has introduced more than 40 new drugs over the past ten years, including leukemia and the cost for oncology treatment ranges from $10,000 per year $5,000 per 28-day cycle. Furthermore, the reduced diagnostic delays coupled with improved medical access further contribute to the market growth in Canada.

Leukemia Cancer Stats Facts (2024-2025)

|

Country |

No. of Cases |

Deaths |

Year |

|

U.S. |

187,740 |

57,260 |

2024 |

|

Canada |

6,600 |

3200 |

2024 |

Source: Canadian Cancer Society, Blood Cancer United

APAC Market Insights

The Asia Pacific leukemia therapeutics market is anticipated to grow at the fastest rate during the forecast period. The market is mainly driven by the local production of CAR-T and the growing adoption of NGS. Besides, the business in this sector is supported by the increasing occurrence of cancer and government healthcare expansions. Japan is a key player in the Asia Pacific market with universal CART coverage under its national insurance scheme. Furthermore, the presence of emerging countries and their expansion strategies facilitates a wider market adoption of leukemia therapeutics.

The leukemia therapeutics market in China is poised for growth due to its extensive patient population and the growing investments in this sector. For instance, in 2024, according to an article published by frontiers in August 2024, nearly 105,667 people in the country were affected by leukemia, undertaking targeted therapies. The age-standardized incidence rate of leukemia in China has remained largely stable, while the age-standardized death rate continues to decline across recent years.

Europe Market Insights

Europe’s leukemia therapeutics market growth to 2035 is driven by increasing incidence and aging populations, rapid uptake of targeted and cell therapies, structured health-technology assessment (HTA) and centralized value assessment processes that influence national reimbursement timing, and stronger public R&D funding and cross-country clinical networks accelerating adoption. Major markets combine large public payer coverage and advanced hospital infrastructure required for infusion and cell therapies; this accelerates uptake of high-cost biologics.

The leukemia therapeutics market in Germany is showing steady growth driven by advances in personalized medicine and novel drug development. As per the NLM report in March 2024, the incidence and prevalence of CML in Germany of 1.8 and 14.9 per 100,000 inhabitants. Most patients in received imatinib (42%), followed by dasatinib (10%) and nilotinib (35%). This growth is supported by increasing incidence rates, innovative therapies, and strong healthcare infrastructure.

Key Leukemia Therapeutics Market Players:

- Novartis AG

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- F. Hoffmann-La Roche Ltd.

- Bristol Myers Squibb (BMS)

- Pfizer Inc.

- Johnson & Johnson (Janssen)

- AbbVie Inc.

- Gilead Sciences (Kite Pharma)

- Amgen Inc.

- Merck & Co. (MSD)

- Sanofi

- GlaxoSmithKline (GSK)

- Bayer AG

- AstraZeneca

- Eli Lilly and Company

- Takeda Pharmaceutical (ex-Japan ops)

- Takeda Pharmaceutical

- Astellas Pharma

- Daiichi Sankyo

- Eisai Co., Ltd.

- Otsuka Holdings

The global leukemia therapeutics market is highly consolidated, with the presence of several key players competing to enhance their international presence. The major firms, such as Novartis, AbbVie, and Gilead, hold a maximum share. Key strategies opted by the companies include geographical expansion through the establishment of manufacturing hubs, such as Novartis invested in Japan and EU facilities to reduce production time. Furthermore, product enhancement, precision medicine innovations are also creating a positive market expansion across the world.

Below is the list of some prominent players in the industry:

Recent Developments

- In July 2025, AbbVie announced the submission of a supplemental New Drug Application (sNDA) to the U.S. FDA for oral combination regimen of VENCLEXTA (venetoclax) and acalabrutinib in previously untreated patients with CLL.

- In October 2024, Novartis announced the accelerated approval by the US Food and Drug Administration (FDA) for Scemblix (asciminib) which is used for adult patients with newly diagnosed Philadelphia chromosome-positive chronic myeloid leukemia in chronic phase (Ph+ CML-CP).

- Report ID: 2698

- Published Date: Sep 09, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Leukemia Therapeutics Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.