Lead Acid Battery Market Outlook:

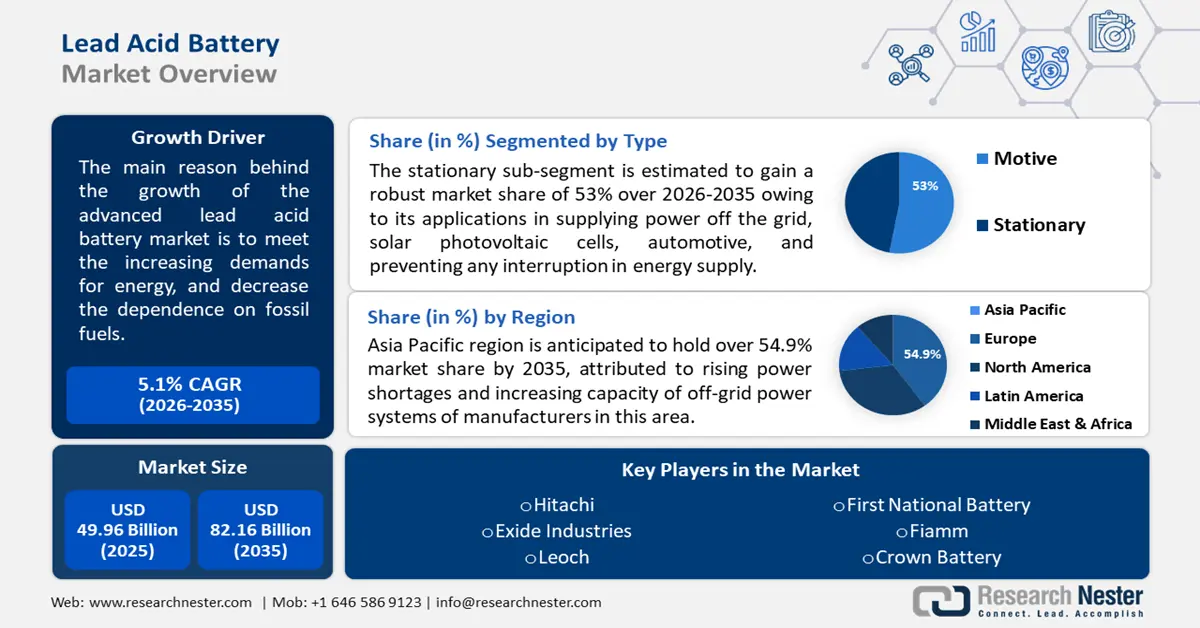

Lead Acid Battery Market size was over USD 49.96 billion in 2025 and is poised to exceed USD 82.16 billion by 2035, witnessing over 5.1% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of lead acid battery is estimated at USD 52.25 billion.

The growth of the market can be attributed to the rising demand for batteries for various applications, including telecommunication, automobiles, construction, and others. Furthermore, they are mainly used for emergency power supply systems, and it is expected to rise the growth of the market. India's EV battery consumption is anticipated to reach around 15 GWh by 2025 and nearly 60 GWh by 2030. By 2030, investments in the cell manufacturing industry are anticipated to surpass USD 9 billion.

In addition to these, factors that are believed to fuel the market growth of lead-acid batteries include the rising demand for lead-acid batteries for power backup at the time of power outages. There will undoubtedly be a higher need for power backups because electrical networks are aging and cannot meet the world's energy needs. In the United States, almost 70% of transmission and distribution lines have already outlived their expected lifespans by more than 50 years. Both the residential and industrial sectors are affected by the shortage of power all across the world.

Key Lead Acid Battery Market Insights Summary:

Regional Highlights:

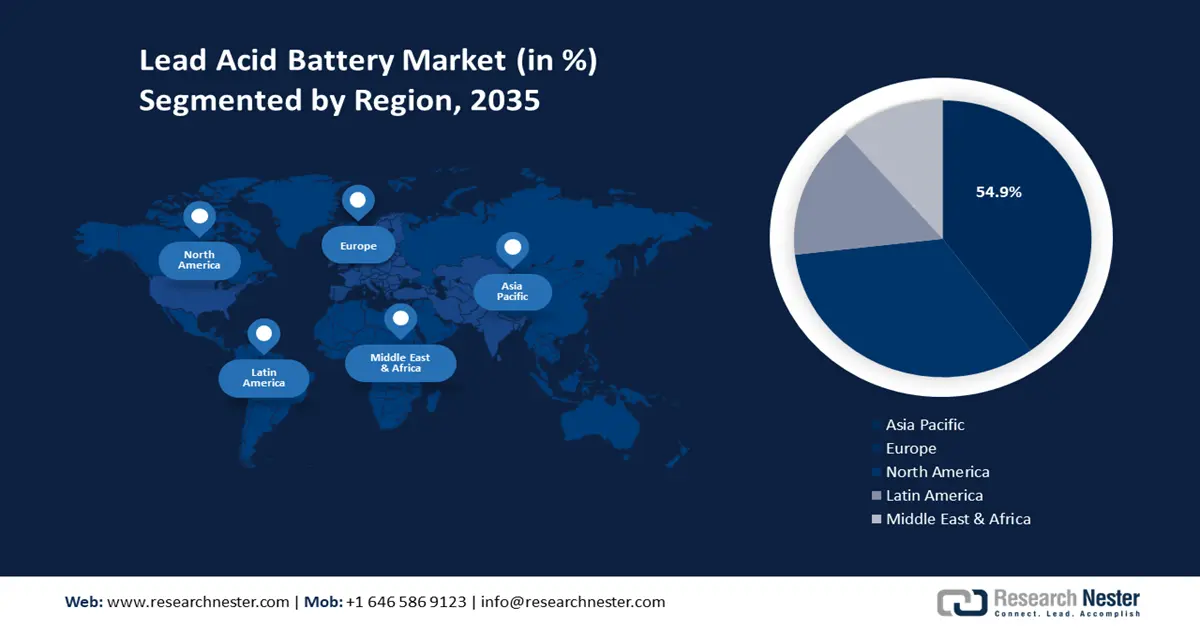

- Asia Pacific lead acid battery market is predicted to capture 54.9% share by 2035, attributed to rising power shortages and increasing capacity of off-grid power systems.

- North America market will secure the second largest share by 2035, driven by the rising use of lead-acid batteries for backup during power outages.

Segment Insights:

- The telecommunications segment in the lead acid battery market is anticipated to achieve the largest share by 2035, attributed to rising mobile phone adoption and rapid internet penetration worldwide.

- The portable lead acid batteries segment in the lead acid battery market is anticipated to achieve a significant share by 2035, driven by increased sales of electric vehicles using portable batteries.

Key Growth Trends:

- Growing Network of Off-Grid & Stand-Alone Power Systems

- Higher Instances of Power Outages

Major Challenges:

- Growing Network of Off-Grid & Stand-Alone Power Systems

- Higher Instances of Power Outages

Key Players: East Penn Manufacturing Company, Leoch International Technology Ltd., Yokohama Group of Companies, Enersys, Exide Industries Ltd., GS Yuasa Corporation, Hoppecke Batterien GmbH & Co. KG., Crown Battery, C&D Technologies, NorthStar.

Global Lead Acid Battery Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 49.96 billion

- 2026 Market Size: USD 52.25 billion

- Projected Market Size: USD 82.16 billion by 2035

- Growth Forecasts: 5.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (54.9% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Japan, Germany, India

- Emerging Countries: China, India, Brazil, Mexico, Thailand

Last updated on : 10 September, 2025

Lead Acid Battery Market Growth Drivers and Challenges:

Growth Drivers

-

Growing Network of Off-Grid & Stand-Alone Power Systems - In off-grid applications, lead-acid batteries have been most frequently employed. Moreover, they are also used for off-grid solar storage. By 2030, it is predicted that stand-alone and mini-grid systems would power over 60% of additional electrical access, and renewable energy sources will power approximately half of that access across the globe.

-

Higher Instances of Power Outages - In the event of a power outage, emergency lighting and pumping stations are both powered by lead-acid batteries. On the account of new power supply issues that have emerged on top of existing ones, more than 4% of the global population, or at least 350 million people, endured catastrophic power outages in 2021.

-

Expanding Infrastructure of Data Center - In most data centers, the uninterrupted power supply (UPS) or power failure is powered by a VRLA or valve-regulated lead-acid cell battery. As of January 2021, there were over 8,000 data centers located in 110 distinct countries. The United States, which represents 33% of all data centers, the United Kingdom, which accounts for 5.7%, and China, which accounts for 5.2%, comprise these six countries.

-

Growing Demand for Electronic Items and Battery - Given that consumer electronics were used widely in 2030, it is predicted that by 2030, the demand for batteries would have increased from 185 GWh to more than 2,000 GWh.

-

Rising Production of Lead - Following around 8% decline in CY 2020 owing to the pandemic, the output of lead-mined metal (metal in concentrate) increased by nearly 6% in CY 2021 to reach around 5 Mt. Furthermore, the manufacturing of lead-acid batteries, which are mostly used in motorized vehicles, the storage of energy produced by solar cells and wind turbines, and the creation of backup power supplies account for around 86% of the world's total lead consumption.

Challenges

- Availability of Cheaper Alternative – lead acid batteries are a cost-effective technology, however the presence of lithium-ion batteries and aluminum air batteries, that makes them an even cheaper alternative. Moreover, for hybrid applications, a nickel-metal hydride battery is the most efficient. They are used by major OEMs, such as Honda, Toyota, Lexus, and others. Furthermore, nickel cadmium is also a great alternative to lead-acid batteries.

- Need for Frequent Maintenance to Increase the Life of the Battery

- Strict Rules and Regulations for Manufacturing of Lead Acid Battery

Lead Acid Battery Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.1% |

|

Base Year Market Size (2025) |

USD 49.96 billion |

|

Forecast Year Market Size (2035) |

USD 82.16 billion |

|

Regional Scope |

|

Lead Acid Battery Market Segmentation:

End-user Segment Analysis

The global lead acid battery market is segmented and analyzed for demand and supply by end users into automotive, oil & gas, utilities, telecommunications, construction, marine, and others. Out of the seven end users of lead-acid batteries, the telecommunications segment is estimated to gain the largest market share over the projected time frame. The growth of the segment can be attributed to the rising adoption of mobile phones, followed by the rapid penetration of the internet all across the world. Today, there are more than six billion smartphone subscriptions globally, and in the coming years, that figure is expected to increase by several hundred million more. The nations with the most smartphone users are China, India, and the United States. In addition to this, around 5 billion people used the internet as of January 2023, or approximately 64% of the world's population. Of this total, over 4 billion people, or nearly 60% of the world's population, used social media.

Application Segment Analysis

The global lead acid battery market is also segmented and analyzed for demand and supply by application into portable, and stationary. Amongst these two segments, the portable segment is expected to garner a significant share. Portable lead acid batteries are highly used in electric vehicles, and they are dragged and deployed at the construction for powering tools. In 2021, sales of electric vehicles doubled to 6.6 million across the globe. Additionally, sales of electric vehicles increased significantly through 2022, reaching 2 million worldwide in the first quarter, a three-quarter increase from the same period a year earlier. Furthermore, the batteries were suitable for powering electric shovels, hand tools, and other equipment on the construction site.

Our in-depth analysis of the global market includes the following segments:

|

By Type |

|

|

By Application |

|

|

By End User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Lead Acid Battery Market Regional Analysis:

APAC Market Insights

Asia Pacific region is anticipated to hold over 54.9% market share by 2035, attributed to rising power shortages and increasing capacity of off-grid power systems. The intense heatwave in 2023 coincided with the greatest power outage in more than six years. Indians from all across the nation including Jammu and Kashmir to Andhra Pradesh are experiencing power outages that range anywhere from two hours to eight hours or longer. Furthermore, in 2021, China's off-grid renewable energy capacity increased by almost 5% to 906.23 gigawatts. Besides this, the market growth in the region is also attributed to rising in the number of lead acid battery importers. The Ministry of Environment, Forest & Climate Change (MoEFCC) / Central Pollution Control Board has registered 82 importers of lead acid batteries under Rule 5 of the Batteries (Management & Handling) Regulations, 2001.

North American Market Insights

The North American lead acid battery market, amongst the market in all the other regions, is also predicted to hold the second largest market share by the end of 2035. The market growth in the region is expected on the account of the rising use of lead-acid batteries for battery backup in case of power outages. Several catastrophic weather events in 2021 put pressure on the electricity grids in the United States. On average, households lost power for seven hours and twenty minutes, with severe weather events such as hurricanes, wildfires, and snowstorms accounting for more than five of those hours, or about seventy-two percent.

Lead Acid Battery Market Players:

- East Penn Manufacturing Company

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Leoch International Technology Ltd.

- Yokohama Group of Companies

- Enersys

- Exide Industries Ltd.

- GS Yuasa Corporation

- Hoppecke Batterien GmbH & Co. KG.

- Crown Battery

- C&D Technologies

- NorthStar

Recent Developments

-

GS Yuasa Corporation subsidiary TataAutoComp GY Batteries Private Ltd. in India reveals its plan to double its capacity for yearly manufacturing of motorcycle lead-acid batteries to 8.4 million units.

-

Enersys, the maker of ODYSSEY batteries, and TravelCenters of America (TA) are collaborating to provide NorthStar PRO Group 31 and ODYSSEY Performance batteries for heavy-duty applications at all TA outlets across the nation.

- Report ID: 4726

- Published Date: Sep 10, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Lead Acid Battery Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.