Law Enforcement Software Market Outlook:

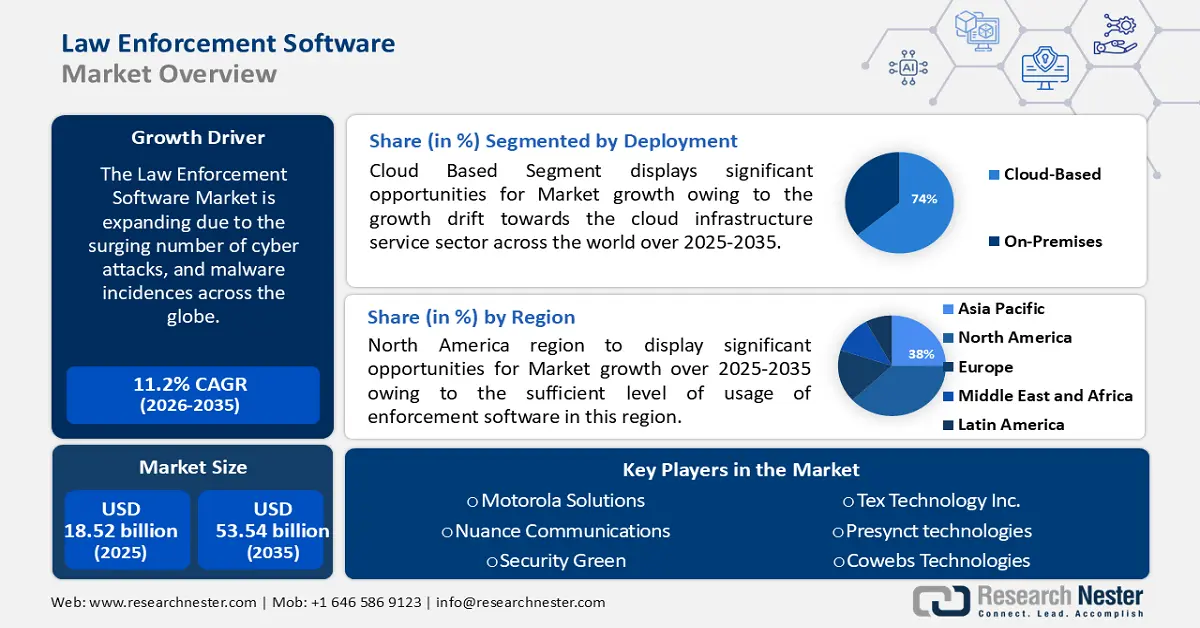

Law Enforcement Software Market size was over USD 18.52 billion in 2025 and is projected to reach USD 53.54 billion by 2035, witnessing around 11.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of law enforcement software is evaluated at USD 20.39 billion.

These technologically adapted agencies with sophisticated, data-driven tools for strategy formulation and decision-making, with the adoption of mobile and cloud services by these firms further promise industry development. As 23% of firms across the globe tremendously integrate AI to upscale crime prevention. Moreover, 34% of companies integrating AI on the limited edge, and 46% of firms or industries still trying to assess its potential.

In addition, these factors that are believed to fuel the growth of the market include the expanding fusion of advanced technologies such as machine learning, predictive analytics, and artificial intelligence (AI) that offer boosting opportunities for resource deployment and crime analysis.

Key Law Enforcement Software Market Insights Summary:

Regional Highlights:

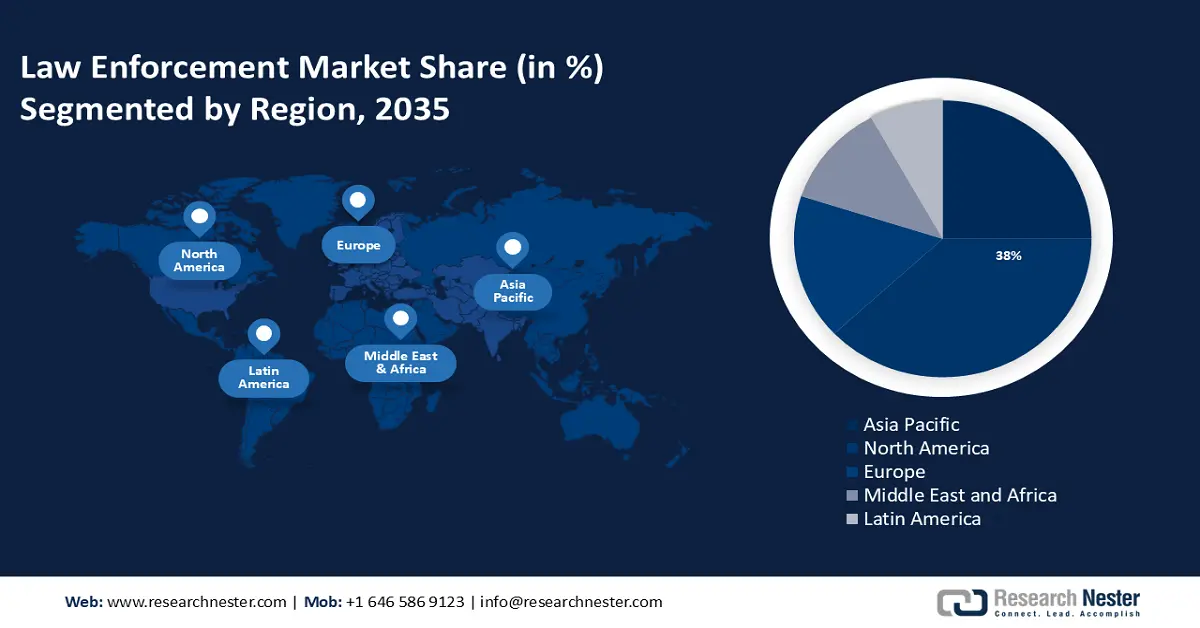

- The North America law enforcement software market will secure over 38% share by 2035, driven by widespread use of enforcement software and government funding.

- The Asia Pacific market will attain a 25% share by 2035, attributed to technological innovations and heightened awareness of enforcement software.

Segment Insights:

- The cloud-based segment in the law enforcement software market is anticipated to secure a 64% share by 2035, fueled by the shift towards cloud infrastructure services favored for security and operational benefits.

- The case management segment in the law enforcement software market is expected to witness significant growth through 2035, fueled by increasing implementation of case management solutions to streamline operations.

Key Growth Trends:

- Surge in Malware Incidences and Cyber Attacks

- Data Integration in Smart City and Public Safety Initiatives

Major Challenges:

- Regulatory Compliance and Data Security

- Intelligence operations are very much important for crime prevention and resolution but implementing the necessitated measures can be challenging.

Key Players: CivicEye, Accenture, Motorola Solutions, Nuance Communications, ESRI, Numerica Corporation, eForce Software, Matrix Pointe Software, Presynct technologies, Magnet AXIOM.

Global Law Enforcement Software Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 18.52 billion

- 2026 Market Size: USD 20.39 billion

- Projected Market Size: USD 53.54 billion by 2035

- Growth Forecasts: 11.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (38% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, United Kingdom, Germany, China, Japan

- Emerging Countries: China, India, Brazil, Mexico, Singapore

Last updated on : 16 September, 2025

Law Enforcement Software Market Growth Drivers and Challenges:

Growth Drivers

- Surge in Malware Incidences and Cyber Attacks: All these observed data, in light of cyber threats, necessitate robust law enforcement software capable of efficiently mitigating and combating such risks, driving demand for advanced cybersecurity solutions in the public safety sector. The cyberattacks are intensifying. Recorded data noting an average of 12 attacks per minute, including 2 novel malware samples, in 2023. A classic amount of 91% of this malware was transmitted via email. IBM reports further highlight a 42% increase in breaches caused by ransomware over the last year, with these incidents taking 50 days longer to identify.

- Data Integration in Smart City and Public Safety Initiatives: The importance of data integration within enterprise operations is undeniable. With over 80% of business leaders emphasizing the importance of data integration plays an essential role in maintaining continuity. With recorded data noting that 67% of enterprises presently rely on data integration for business intelligence and analytics, another bunch of 24% plans to adopt such practices of data integration in the upcoming 12 months. It can be observed that the shift towards cloud-based or hybrid-cloud data integration solutions by 65% of organizations emphasizes a shift toward more flexible and scalable infrastructures. Therefore, in the context of smart cities and public safety initiatives, efficient data integration plays a paramount importance.

Challenges

- Regulatory Compliance and Data Security: Law enforcement software users are engaging with stringent government regulations like the Criminal Justice Information Services (CJIS) in the U.S. and the General Data Protection Regulation (GDPR) in Europe. These regulatory bodies mandate stringent controls over the management of sensitive data, remarkably shaping the market’s trajectory. While their main target is to assist law enforcement in their duties and protect personal information but, compliance with these regulations can be complex and costly.

- Intelligence operations are very much important for crime prevention and resolution but implementing the necessitated measures can be challenging.

- The enforcement of strict data security measures and the need for surveillance that respects privacy rights create a complex environment for law enforcement agencies.

Law Enforcement Software Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

11.2% |

|

Base Year Market Size (2025) |

USD 18.52 billion |

|

Forecast Year Market Size (2035) |

USD 53.54 billion |

|

Regional Scope |

|

Law Enforcement Software Market Segmentation:

Deployment Segment Analysis

The cloud-based segment in the law enforcement software market is estimated to gain the largest revenue share of about 64% in the year 2035. The segment growth can be attributed to the overall growth drift towards the cloud infrastructure service sector, which has seen fueling growth by 24% year on year, generating approximately USD 180 billion annually as commendable revenue. These solutions are preferred for their adherence to federal policies and their undisputed role in preventing security breaches. With the other operational benefits like cost and time savings, it clearly shows why law enforcement agencies are accelerating their embrace of cloud infrastructure services.

Application Segment Analysis

The case-management segment in the law enforcement software market is estimated to gain a significant share of about 54% in the year 2035. The segment growth can be attributed to the case management pivotal sectoral growth in the industry which was dominant in 2022. The increasing implementation of case management solutions in law enforcement agencies, which streamlines operations by enabling rapid access to information, improving transparency, issuing real-time updates, reducing paperwork, and centralizing data management, drives this predicted growth.

Our in-depth analysis of the global market includes the following segments:

|

Deployment |

|

|

Application |

|

|

End User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Law Enforcement Software Market Regional Analysis:

North American Market Insights

The law enforcement software market in North America, is anticipated to hold the largest share of about 38% by the end of 2035. The market growth in the region is expected on account of the sufficient level of usage of enforcement software within the local organizations, the systematic formalization of legislative workspaces, and further encouraging the adequate provision of IT technology. Furthermore, the strategic expansions in community policy initiatives, are underscored by the Department of Justice’s allocation of approximately USD 139 million in funding towards digital policing to adapt policing models to other factors contributing to regional growth. Training initiatives for law enforcement personnel on implicit bias, racial profiling, intervention duties, and procedural justice, supported by approximately USD 42 million in anti-bias program funding, are anticipated to boost law enforcement market expansion. Furthermore, the regional sectoral growth is bolstered by the presence of major industries.

APAC Market Insights

The Asia Pacific law enforcement software market is estimated to the second largest, registering a share of about 25% by the end of 2035. This anticipated growth is partly a response to the challenges faced in 2021 when Asian organizations suffered the most cyber-attacks worldwide, accounting for around 26% of the attacks against organizations by continent. The demand for advanced technological products for law enforcement, essential in the prevention of such criminal activities, is consequently on the rise. This surge in growth is propelled by technological innovations, the establishment of standardized automated processes for general examinations, and a significantly heightened awareness within government agencies about the benefits of enforcement software. The robust growth trajectory of the Asian Pacific sector is underpinned by the region’s commitment to adopting cutting-edge solutions and enhancing law enforcement capabilities through strategic technology investments, directly addressing the security vulnerabilities exposed in the previous year.

Law Enforcement Software Market Players:

- CivicEye

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Accenture

- Motorola Solutions

- Nuance Communications

- ESRI

- Numerica Corporation

- eForce Software

- Matrix Pointe Software

- Presynct technologies

- Cowebs Technologies

Recent Developments

- CivicEye, a provider of law enforcement software solutions, formed a partnership with FRONTLINE public safety solution. The goal of this collaboration was to combine civic RMS with FRONTLINE’s extensive range of products to enhance public safety.

- Magnet forensics collaborated with coweb’s technologies to improve the investigation process. This partnership focused on integrating magnet forensic digital investigation tool with coweb’s open-source intelligence platform to provide comprehensive investigation capabilities.

- Report ID: 5932

- Published Date: Sep 16, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Law Enforcement Software Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.