Kombucha Market Outlook:

Kombucha Market size was USD 5.3 billion in 2025 and is anticipated to reach USD 16.5 billion by the end of 2035, increasing at a CAGR of 13.8% during the forecast period, i.e., 2026-2035. In 2026, the industry size of kombucha at USD 6 billion.

The market is gradually transitioning from a niche health beverage to a mainstream staple, effectively fueled by a significant shift towards experiential consumption and functional wellness. Besides, the growth is no longer considered serendipitous, but rather it is actively engineered by strategic industrial drivers and macro-trends. These include a rise in hard kombucha, which is alcohol-based, along with superfood infusion and ingredient sophistication. According to an article published by the Food Chemistry Advances in October 2022, kombucha is usually produced by fermenting green or black tea that has been readily sweetened with 5% to 8% of sugar and also inoculated with a consortium of yeast and acetic acid bacteria.

Moreover, the aspect of sustainability as an ultimate brand pillar, with increased focus on circular packaging, regenerative sourcing, as well as brand segmentation and proliferation, is also uplifting the kombucha market globally. As per an article published by NLM in July 2022, it has been estimated that almost 235 kombucha organizations have been successfully distributed through Asia, North America, and Europe, displaying increased consumption by the global patient population. Besides, the regular consumption of nearly 100 grams does not result in health risks, but excessive intake, which is more than 340 grams, is considered risky. Meanwhile, the market is witnessing brands getting dedicated to particular customers, such as athletes and keto dieters, which is positively impacting the market’s exposure.

Key Kombucha Market Insights Summary:

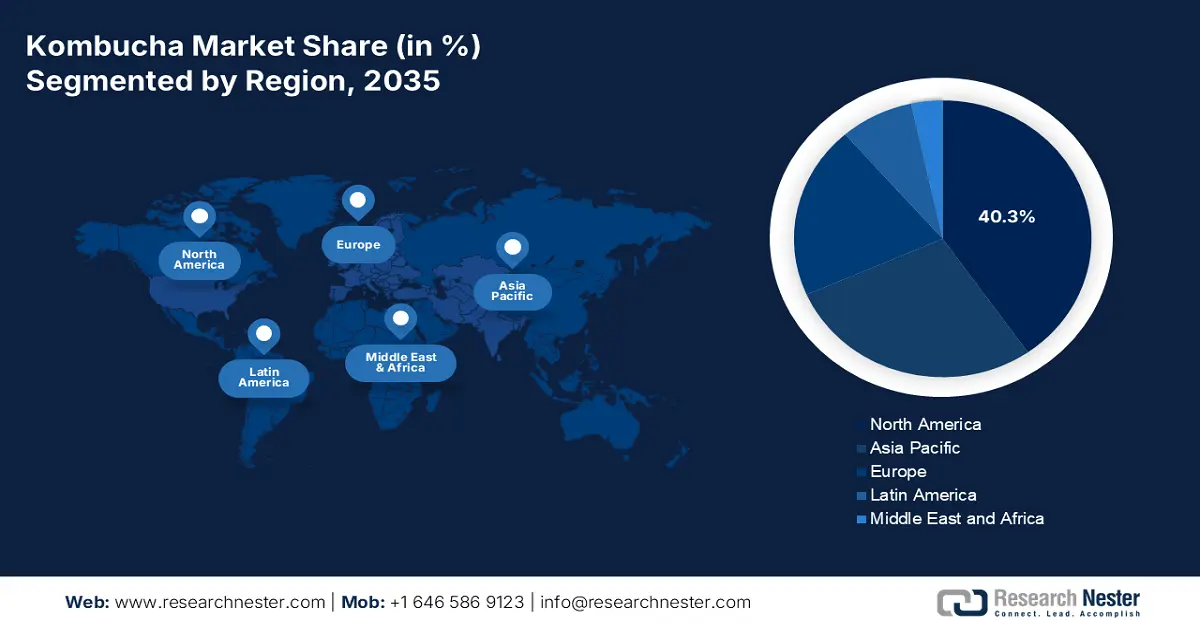

Regional Highlights:

- North America is anticipated to secure a 40.3% share by 2035, in the kombucha market, supported by expanding probiotic awareness, diversified retail penetration, and rising functional product demand owing to increasing consumer awareness regarding probiotics and gut health.

- By 2035, Europe is projected to be the fastest-growing region, reinforced by stringent food-safety regulations, wellness-centric culture, and strong organic certification frameworks attributed to deeply ingrained wellness and health culture.

Segment Insights:

- By 2035, the conventional segment is set to capture a 65.8% share in the kombucha market, strengthened by traditional fermentation attributes that preserve authentic flavor identity impelled by the presence of foundational and traditional elements that tend to enable fundamental fermentation processes and readily define the actual flavor profile of the drink.

- The bottles segment is expected to hold the second-largest share by 2035, supported by its capacity to retain carbonation pressure essential for flavor enhancement and product longevity owing to creating a sealed environment wherein the carbon dioxide is produced during the fermentation process, which cannot be escaped.

Key Growth Trends:

- The proactive health management

- Mainstream retail incorporation

Major Challenges:

- Intense market saturation and competition

- Cold chain logistics and perishability

Key Players: GT’s Living Foods, GT’s Living Foods, København Kombucha, Remedy Drinks, GO Kombucha, Læsk, Lo Bros, VIGO KOMBUCHA, Brothers and Sisters, BB Kombucha, MOMO KOMBUCHA, Real Kombucha, Equinox Kombucha.

Global Kombucha Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 5.3 billion

- 2026 Market Size: USD 6 billion

- Projected Market Size: USD 16.5 billion by 2035

- Growth Forecasts: 13.8% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (40.3% Share by 2035)

- Fastest Growing Region: Europe

- Dominating Countries: United States, China, Germany, United Kingdom, Japan

- Emerging Countries: India, Brazil, South Korea, Australia, Canada

Last updated on : 13 October, 2025

Kombucha Market - Growth Drivers and Challenges

Growth Drivers

- The proactive health management: The single most driving factor for the market is the scientific validation of gut health to ensure well-being, which includes mental and immunity health. According to an article published by the Frontiers Organization in September 2022, the human gut microbiota usually carries almost 150 times more genes in comparison to the overall human genome. Therefore, global customers are increasingly seeking functional probiotics, and kombucha is considered an accessible and palatable delivery system, thereby making it suitable for the market’s enhancement.

- Mainstream retail incorporation: The market is no longer confined to health food stores, but its placement has been expanded in aisles of major convenience stores, club stores, and supermarkets. As per the January 2022 MDPI article, kombucha is typically prepared by readily fermenting sweetened green or black tea, along with tea broth, with a consistency rate of 10% to 20%. This is the most suitable production process, after which kombucha beverages are easily distributed through channels, such as health and convenience stores, as well as online retailers.

- Focus on digitalized first brand building: The presence of social media platforms, especially TikTok and Instagram, is considered instrumental in educating new potential consumers. These platforms readily showcase brand authenticity, as well as drive viral trends for the market’s upliftment. In addition, brands that are successful effectively utilize digitalized storytelling to successfully demystify fermentation, along with building a loyal community. As stated in the February 2022 NLM article, commercial kombucha products, such as Better Booch Ginger Boost, Canned Brew Dr. Ginger Lemon, Kevita Master Brew Ginger Kombucha, and others, constitute approximately 86% of commercial kombucha sales, particularly in the U.S., thereby suitable for the market’s exposure.

Fermented Milk Products 2023 Export and Import Driving the Kombucha Market

|

Components |

Rate/Valuation |

|

Global exports |

USD 2.8 million |

|

Top destination |

Singapore (USD 1.0 million) |

|

Fastest-growing economy |

U.S. (USD 141,000) |

|

Export share |

0.05% |

|

Top origin |

Germany (USD 1.6 million) |

|

Import share |

0.041% |

Source: OEC

Challenges

- Intense market saturation and competition: The low actual gap to entry has resulted in saturation in the market with different small and regional kombucha brewers. This has created intensified competition for restricted shelf space in retail stores, which drives squeezed margins and slotting fees. Besides, brands in the market are currently competing not only with each other but also with adjacent categories, such as hard seltzers, probiotic shots, and functional sparkling waters. This saturation has pressured organizations to readily invest in brand differentiation through exclusive flavors, compelling brands, and sleek packaging to combat commoditization.

- Cold chain logistics and perishability: As an unpasteurized, raw, and live-culture product, kombucha has a restricted shelf life and needs to be refrigerated from production to point of sale. This cold-chain demand tends to complicate logistics and create a surge in expenses in comparison to shelf-stable beverages, which causes a hindrance in the kombucha market globally. This usually limits distribution reach to locations with dependable refrigeration and diminishes flexibility for retailers. Besides, any breakage in the cold chain can escalate fermentation, change the flavor, and effectively spoil the product, resulting in lost and wasted revenue.

Kombucha Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

13.8% |

|

Base Year Market Size (2025) |

USD 5.3 billion |

|

Forecast Year Market Size (2035) |

USD 16.5 billion |

|

Regional Scope |

|

Kombucha Market Segmentation:

Product Type Segment Analysis

The conventional segment in the market is anticipated to garner the largest share of 65.8% by the end of 2035. The segment’s exposure is highly fueled by the presence of foundational and traditional elements that tend to enable fundamental fermentation processes and readily define the actual flavor profile of the drink. According to an article published by NLM in May 2025, the U.S. is regarded to be the most dynamic and significant market, with a 50% share, and the total budget for functional foods is valued at an estimated USD 280 billion, thus bolstering the segment’s exposure.

Packaging Segment Analysis

The bottles segment in the kombucha market is projected to constitute the second-largest share during the forecast timeline. The segment’s exposure is driven by its importance since it comprises the required pressure developed during carbonation, creating the required fizz and enhancing flavor through secondary fermentation. In addition, this process effectively extends shelf life and combats unwanted spoilage and explosions. Besides, bottles usually create a sealed environment wherein the carbon dioxide is produced during the fermentation process, which cannot be escaped, thereby making it suitable for the segment’s upliftment.

Distribution Channel Segment Analysis

The supermarkets and hypermarkets segment in the market is projected to constitute the third-largest share by the end of the forecast period. The segment’s development is fueled by the tactical placement of products, high foot traffic, and unparalleled consumer accessibility of products in beverage or chilled health-and-wellness aisles. For brands, achieving space in these particular retailers offers huge scale and brand legitimacy. However, this particular distribution channel constitutes challenges, such as critical demand for flawless cold-chain logistics, increased slotting fees for squeezing producer margins, and intensified competition for prime placement.

Our in-depth analysis of the global market includes the following segments:

|

Segment |

Subsegments |

|

Product Type |

|

|

Packaging |

|

|

Distribution Channel |

|

|

Flavor |

|

|

Price Point |

|

|

Alcohol Content |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Kombucha Market - Regional Analysis

North America Market Insights

North America in the kombucha market is anticipated to account for the largest share of 40.3% by the end of 2035. The market’s growth in the region is readily fueled by an increase in consumer awareness regarding probiotics and gut health, mainstream retail distribution, robust disposable income, functional innovation, administrative certification, and focus on sustainability. According to an article published by the Economic Research Service in June 2025, sugar deliveries for beverage and food usage have been lowered by 25,000 STRV to 12.1 million, particularly in the U.S., thereby enhancing the market in the overall region.

The market in the U.S. is growing significantly, owing to regulatory and premiumization maturation, the customer’s demand for low-sugar and organic options, intense support from the USDA's National Organic Program, and effective retail channel expansion. As stated in the August 2023 NLM article, the aspect of added sugar intake among youth and children in the country is extremely high, with almost 65% of those aged between 2 to 19 years not catering to the 2020-2025 Dietary Guidelines for Americans’ suggestions to restrict sugar that constitutes less than 10% of overall energy intake. This has denoted a huge growth opportunity for the market in the country, with increased focus on low sugar intake.

Sugar Utilization and Supply in the U.S.

|

Components |

2023-2024 |

2024-2025 |

2025-2026 |

|

Beginning stocks |

1,843 |

2,131 (May and June) |

2,032 (May) |

|

Total Production |

9,313 |

9,311 (May) |

9,285 (May) |

|

Total Imports |

3,840 |

2,944 (May) |

2,475 (May) |

|

Total Supply |

14,995 |

14,387 (May) |

13,791 (May) |

|

Total Exports |

249 |

100 (May and June) |

100 (May and June) |

|

Miscellaneous |

81 |

- |

- |

|

Total Deliveries |

12,534 |

12,255 (May) |

12,255 (May) |

|

Total Usage |

12,864 |

12,355 (May) |

12,355 (May) |

|

Stock-to-use ratio |

16.6% |

16.4% (May) |

11.6% (May) |

Source: Economic Research Service

Canada market is also growing due to the robust emphasis on localized sourcing and health claims compliance, strong oversight by Health Canada for regulating particular health probiotics under the Natural Health Products (NHP) framework. In addition, the sudden push toward sustainable and localized production is also boosting the market in the country. As stated in the October 2023 Food Chemistry Advances article, the Center of Diseases Control of British Columbia (BCCDC) noted that pH levels should not be lower than 2.5, while the alcohol level should not be over 1%, thereby ensuring to maintenance food safety plan in the country.

Europe Market Insights

Europe in the kombucha market is expected to emerge as the fastest-growing region during the projected duration. The market’s development in the region is highly attributed to deeply ingrained wellness and health culture, especially in the North and West regions, strict regional food safety and labeling policies, which are administered by the Europe Food Safety Authority (EFSA). Besides, the strong need for organic certification in the region is also boosting the market. For instance, as noted in the April 2025 USDA article, an arrangement has been made with Europe Union, wherein organic wine can be exported to the region, comprising 100% organic ingredients, and non-organic substances are not permitted under 7 CFR 205.605 are readily prohibited, thus suitable for the market’s upliftment.

The market in the UK is gaining increased exposure, owing to the aspect of a well-established health food retail industry and a generous customer base that is extremely receptive to wellness trends. In addition, the market’s growth is also driven by consumers appealing to seek low-alcohol and functional alternative options to cider and beer. As per an article published by GFI Europe in September 2025, the latest research has stated that advanced ways of producing regular foods by utilizing fermentation can add £9.8 billion (€11.2 billion) to the country’s economy, which has bolstered the market’s demand.

The kombucha market in Germany is also developing due to the increased focus on certified organic and domestically sourced ingredients, as well as trends that readily align with kombucha’s ultimate value proposition. Additionally, the Federal Ministry of Food and Agriculture proactively promotes the concept of organic farming, which is also fueling the market’s development in the overall country. According to the 2025 World of Organic Agriculture data report, the international organic drink and food sales have reached 136 billion euros as of 2023, with Germany’s contribution accounting for 16,080 million euros, thus making it suitable for uplifting the market.

APAC Market Insights

Asia Pacific market is considered to grow steadily by the end of the predicted timeline. The market’s exposure in the region is highly driven by a rise in disposable incomes, increased urbanization, and a deep-seated cultural familiarity with fermented beverages and foods. In addition, the market in South Korea and Japan has demanded premium and functional varieties, while emerging economies, such as India and China, are fueled by huge urban populations. Besides, the aspect of government support for functional food advancement, with agencies in South Korea and China readily establishing clear administrative regulations for the market’s welfare.

The kombucha market in China is gaining increased exposure, owing to the presence of the China Food and Drug Administration (CFDA), which has established a standard green channel for clearing health foods, which has diminished the registration timeline for products with suitable probiotic advantages. In addition, this regulatory efficacy has readily escalated the market entry for both international and domestic brands, therefore driving intensified innovation and competition. Besides, the presence of different tea varieties is also uplifting the overall market in the country.

The market in India is also growing due to the existence of a young and health-conscious urban population. Additionally, the Ministry of Food Processing Industries (MoFPI) readily supports this particular segment through the availability schemes, such as the Pradhan Mantri Kisan SAMPADA Yojana, which effectively offers grants for food processing facilities. According to an article published by NLM in February 2025, undernutrition is a massive health challenge among domestic adolescents, wherein 253 million falls into the age group ranging between 10 to 19 years. Therefore, this denotes a huge growth opportunity for the market to be readily adopted by the country’s population to ensure healthy lifestyles.

Fermented Beverages 2023 Export and Import in Asia

|

Countries |

Export |

Import |

|

India |

USD 113,000 |

USD 331,000 |

|

Sri Lanka |

USD 49,300 |

- |

|

United Arab Emirates |

USD 36,400 |

USD 1,200 |

|

Japan |

USD 5,800 |

USD 149,000 |

|

Hong Kong |

USD 2,560 |

- |

|

Maldives |

USD 1,840 |

- |

|

South Korea |

- |

USD 95,400 |

|

Thailand |

- |

USD 3,210 |

Source: OEC

Key Kombucha Market Players:

- GT’s Living Foods

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- GT’s Living Foods

- København Kombucha

- Remedy Drinks

- GO Kombucha

- Læsk

- Lo Bros

- VIGO KOMBUCHA

- Brothers and Sisters

- BB Kombucha

- MOMO KOMBUCHA

- Real Kombucha

- Equinox Kombucha

The international market is effectively fragmented and readily characterized by a significant mix of large-scale beverage corporations and pioneering independent brands that are able to enter through acquisition. The competitive intensity is deliberately high, with notable players adopting different core strategies to achieve an edge. Besides, the aspect of product innovation is considered paramount, with relentless focus on the latest flavor profiles, rapid extension of the hard kombucha segment, and functional ingredient infusion. Meanwhile, strategic branding is also essential, since organizations either position themselves as mass-market, small-scale craftsmen, or authentic, and easily accessible to wellness brands, thus suitable for the overall market globally.

Here is a list of key players operating in the market:

Recent Developments

- In September 2025, Lifeway Foods, Inc. proudly declared Muscle Mates, which is an innovative ready-to-drink functional beverage that tends to pair 20 grams of protein, along with 5 grams of Lifeway’s 12 live and active probiotics as well as creatine.

- In July 2025, Kirkland & Ellis effectively advised Generous Brands for a tactical deal to acquire Health-Ade from private equity organizations, such as Manna Tree and First Bev, with the intention of achieving almost USD 1 billion in retail sales.

- Report ID: 66

- Published Date: Oct 13, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Kombucha Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.