Intravenous Pegloticase Market Outlook:

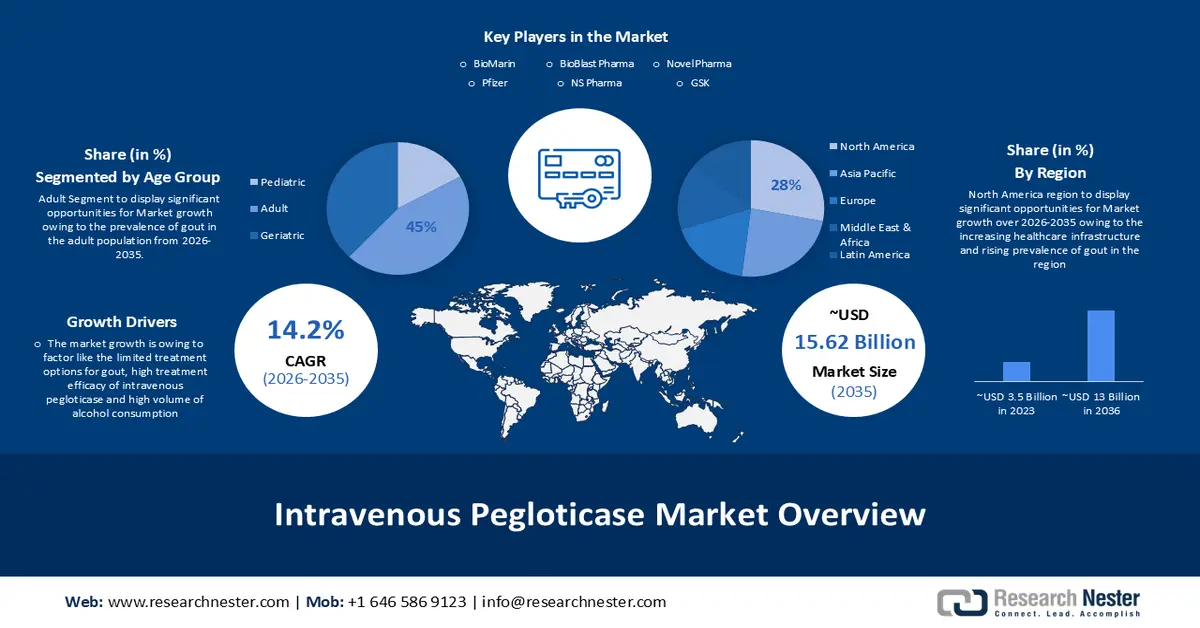

Intravenous Pegloticase Market size was over USD 4.14 billion in 2025 and is anticipated to cross USD 15.62 billion by 2035, witnessing more than 14.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of intravenous pegloticase is assessed at USD 4.67 billion.

The market is growing as a result of the rising prevalence of chronic and refractory gout among the global population. Intravenous pegloticase is used for the treatment of chronic and refractory gout in adults. It lowers uric acid levels and is typically prescribed when standard treatment has been ineffective. According to research, roughly 9.2 million people are afflicted with chronic and refractory gout, with men diagnosed more often than women.

In addition to these, the intravenous pegloticase market growth is owing to the aging global population. Gout typically occurs in men who are between the ages of forty and fifty years old. With people living longer lives than average, there is an increase in the number of geriatric people worldwide.

Key Intravenous Pegloticase Market Insights Summary:

Regional Highlights:

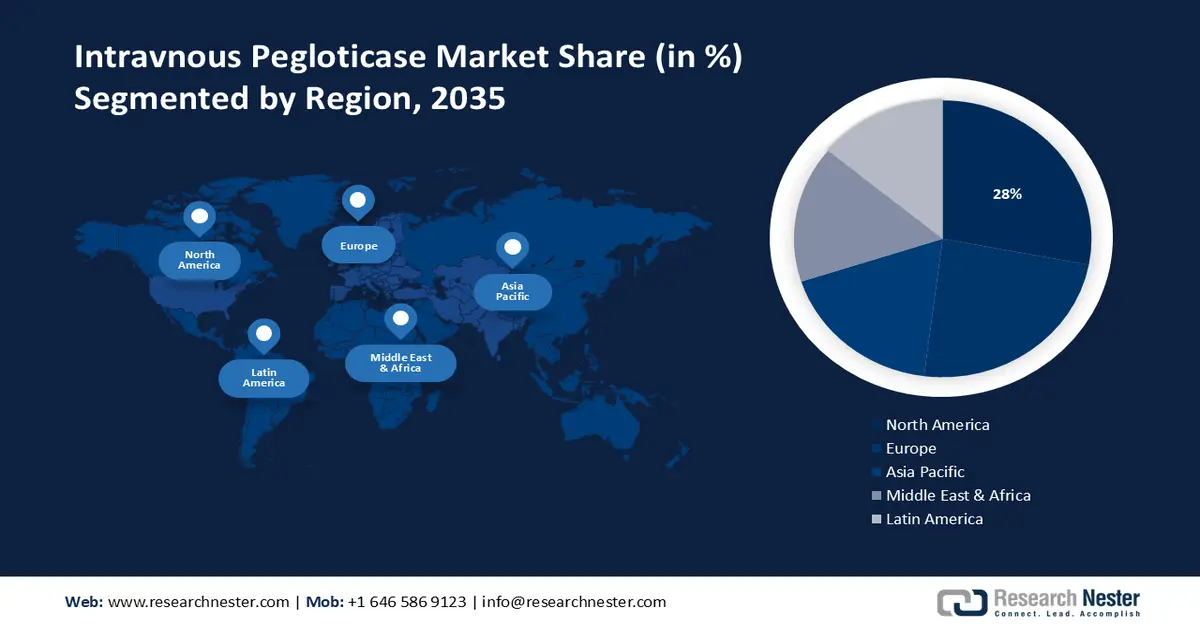

- North America is projected to hold a 28% share by 2035, owing to the rising prevalence of chronic and refractory gout alongside expanding healthcare infrastructure.

- Asia Pacific is expected to account for ~22% share by 2035, propelled by the growing aging population and increasing incidence of gout in the region.

Segment Insights:

- The adult segment in the intravenous pegloticase market is projected to account for 45% share by 2035, owing to the rising prevalence of gout among adults.

- The hospital pharmacies segment is expected to hold a 46% share by 2035, driven by increased patient visits and the essential role of hospital pharmacies in medication delivery.

Key Growth Trends:

- High Volume of Alcohol Consumption

- High Treatment Efficacy of Intravenous Pegloticase

Major Challenges:

- High cost

Key Players: Agmen Inc., BioMarin, Sarepta Therapeutics, Benitec Biopharma Inc., Bioblast Pharma, PTC Therapeutics, NS Pharma, Nobel Pharma Co. Ltd, Santhera Pharmaceuticals, Pfizer Inc., Fibrinogen, GSK.

Global Intravenous Pegloticase Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 4.14 billion

- 2026 Market Size: USD 4.67 billion

- Projected Market Size: USD 15.62 billion by 2035

- Growth Forecasts: 14.2%

Key Regional Dynamics:

- Largest Region: North America (28% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Canada, Germany, United Kingdom, France

- Emerging Countries: China, India, Japan, South Korea, Australia

Last updated on : 28 November, 2025

Intravenous Pegloticase Market - Growth Drivers and Challenges

Growth Drivers

- High Volume of Alcohol Consumption: According to data from the World Health Organization in 2018 approximately the worldwide consumption of alcohol was 6.2 liters of alcohol per person 15 years and older. An estimate of unrecorded consumption accounts for 26% of the worldwide total consumption. This high rate of alcohol consumption has been linked to a higher prevalence of gout, as alcohol can raise uric acid levels in the body which is a key factor in gout development. Consequently, as alcohol patterns evolve, with more individuals engaging in heavy or regular drinking, the incidence of gout may rise, driving the demand for treatment like intravenous pegloticase to manage severe cases.

- High Treatment Efficacy of Intravenous Pegloticase: Intravenous Pegloticase has demonstrated high efficacy in reducing serum uric acid levels and resolving symptoms of severe gout, even in patients with treatment-resistant disease. Its ability to rapidly break down uric acid crystals and maintain low uric acid crystals and maintain low uric acid levels over an extended period makes it a compelling treatment option for individuals who have not responded well to conventional therapies. The proven effectiveness contributes to the growing demand for the adoption of intravenous pegloticase in the management of severe gout, further driving intravenous pegloticase market growth.

- Limited Treatment Options for Gout: Managing gout can pose challenges, and numerous patients fail to optimal symptom control using traditional treatments like nonsteroidal anti-inflammatory drugs (NSAIDs) such as meloxicam, ibuprofen, naproxen, and indomethacin. Intravenous pegloticase stands out as a crucial treatment choice. Its unique mechanism offers hope to patients who have failed to respond to conventional treatment. As a result, the lack of satisfactory alternatives drives demand for intravenous pegloticase, positioning it as a vital solution for the management of chronic and refectory gout, thus contributing to intravenous pegloticase market growth.

Challenges

- High cost: Intravenous pegloticase can cost significantly more than other conventional gout treatments, limiting access for lower-income households. This dissuades patients from seeking or continuing treatment leading to lower adoption rates. Thus, resulting in reduced market penetration and slower revenue growth for the market

- Side effects such as anaphylaxis which is associated with the use of intravenous pegloticase are expected to cause challenges for the market growth.

- Lack of awareness among the patients can let the condition remain undiagnosed and untreated in many cases which can hinder the intravenous pegloticase market growth.

Intravenous Pegloticase Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

14.2% |

|

Base Year Market Size (2025) |

USD 4.14 billion |

|

Forecast Year Market Size (2035) |

USD 15.62 billion |

|

Regional Scope |

|

Intravenous Pegloticase Market Segmentation:

Age Group Segment Analysis

In terms of age group, the adult segment is is anticipated to hold 45% share of the global intravenous pegloticase market by 2035. The segment growth can be attributed to the increasing presence of gout disease in the adult population. According to research, the global gout prevalent cases in individuals aged 15-39 years was 5.21 million in 2019 with the annual occurrence gradually increasing from 38.71 to 46 per 100,000 population from 1990 to 2019. The higher prevalence of gout in adults can be credited to the level of estrogen in their body and consumption of diet such as red meat and alcohol which are responsible for the regulation of uric acid that causes gout.

End Users Segment Analysis

The hospital pharmacies segment in the intravenous pegloticase market is estimated to gain a significant share of about 46% in the year 2035. The segment growth can be attributed to the high frequency of patients in the hospitals. As patients seek medical care and treatment from the hospital, the demand for pharmaceutical services within the healthcare faculties has surged as a result almost every hospital has its pharmacy. Hospital pharmacies play a crucial role in ensuring patients receive the medications they need promptly and safely during their stay.

Our in-depth analysis of the global market includes the following segments:

|

Age Group |

|

|

Indication |

|

|

End Users |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Intravenous Pegloticase Market - Regional Analysis

North American Market Insights

North America industry is estimated to dominate majority revenue share of 28% by 2035, as a result of growing prevalence of chronic and refractory gout amid the global population. The market growth in the region is also expected on account of the high prevalence of gout in the adult population. According to researchers, in 2018 there were approximately 13 million prevalent cases of gout were recorded in the United States. This number is expected to rise due to factors like unhealthy lifestyles and the aging population of this region. Additionally, increasing healthcare infrastructure is driving the expansion further in North America. As healthcare facilities like hospitals and clinics enhance their capabilities and accessibility more patients gain access to specialized treatments like intravenous pegloticase. This infrastructure growth in this region translates to improved patient care pathways, streamlined treatment delivery, and better integration of specialty services. Thus, the alignment between rising gout prevalence and the development of healthcare infrastructure is expected to spur the market growth of the intravenous pegloticase market in the North American region.

APAC Market Insights

The Asia Pacific intravenous pegloticase market is estimated to be the second largest share of about ~22% by the end of 2035. The market’s expansion can be attributed majorly to the high product demand due to high growing aging population and increasing incidence of gout in the region. In 2019, there were 16.2 million cases of gout in China, were men and women accounting for 12 million and 4.1 million respectively. Furthermore, studies suggest that estimated gout case counts are high in Asia Pacific regions as there were 6 million cases in East Asia, 7 million cases in South Asia, and 0.6 million cases in Australasia. The increasing prevalence of gout in the region can be attributed to factors such as changes in lifestyle, dietary habits, and an aging population. As the incidence of gout rises there is a growing need for effective treatment like intravenous pegloticase. Thus, driving the intravenous pegloticase market growth of intravenous pegloticase in the region.

Intravenous Pegloticase Market Players:

- Agmen Inc

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- BioMarin

- Sarepta Therapeutics

- Benitec Biopharma Inc

- Bioblast Pharma

- PTC Therapeutics

- NS Pharma

- Nobel Pharma Co. Ltd

- Santhera Pharmaceuticals

- Pfizer Inc.

- Fibrinogen

- GSK

Recent Developments

- Amgen announced the opening of its manufacturing site in Central Ohio, the newest in its global operations network and the most advanced facility to date. The nearly 300,000-square-foot facility will employ 400 full-time staff. It also features open workspaces to foster collaboration and has been designed to meet the highest environmental sustainability standards, in support of Amgen's commitment to achieve carbon neutrality for all operations by 2027.

- PTC Therapeutics, Inc. announced an agreement with Royalty Pharma plc. to monetize up to USD 1.5 billion of the Evrysdi royalty stream. Under the agreement, Royalty Pharma acquires additional royalties on Evrysdi for USD 1.0 billion upfront. The agreement includes options for PTC to sell up to all of its retained royalties on Evrysdi for up to USD 500 million or for Royalty Pharma to acquire half of such retained royalties for up to USD 250 million at a later date. PTC maintains all economics associated with up to USD 250 million in remaining commercial sales milestones associated with Evrysdi global net sales.

- Report ID: 5846

- Published Date: Nov 28, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Intravenous Pegloticase Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.