Intraocular Lens Market Outlook:

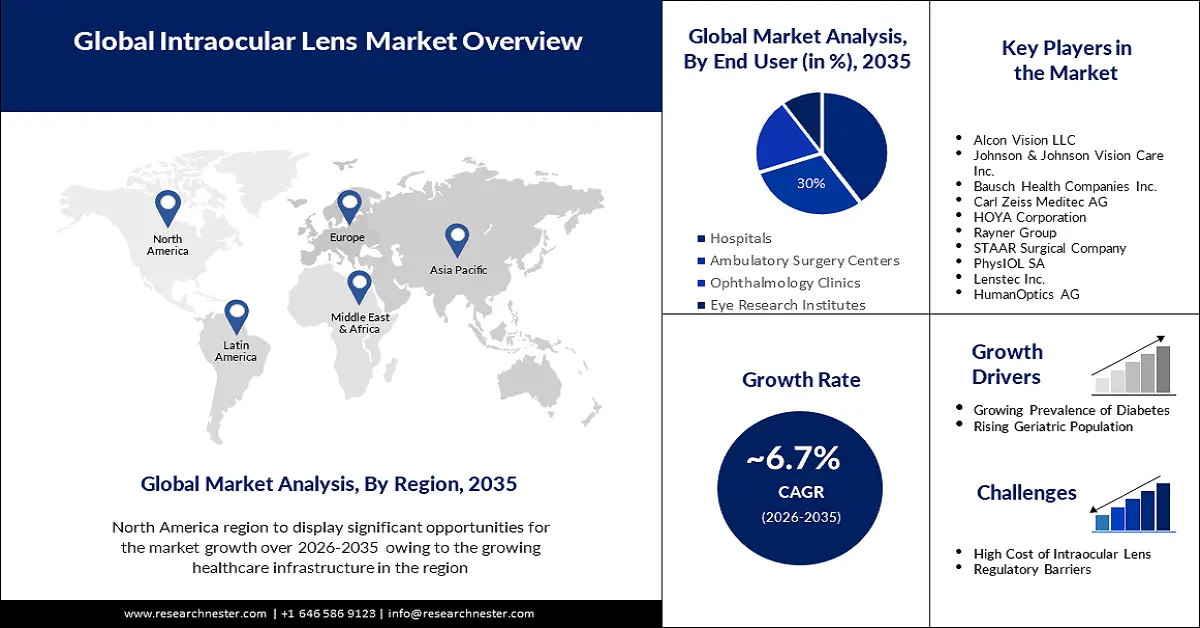

Intraocular Lens Market size was over USD 4.85 billion in 2025 and is poised to exceed USD 9.28 billion by 2035, growing at over 6.7% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of intraocular lens is estimated at USD 5.14 billion.

The growth of the market can be attributed to the growing prevalence of eye disease which includes macular degeneration, diabetic retinopathy, and glaucoma. According to the International Diabetes Federation, people living with diabetes are projected to reach 783 million by 2045, also the number of people with diabetic retinopathy will reach 191 million by 2030. Diabetes patients who have persistently high blood sugar levels may develop diabetic retinopathy, which damages the blood vessels in the retina of the eye.

Other than this, eye disease could also lead to the formation of cataracts which could further boost the demand for cataract surgery. One of the most frequent eye surgery operations worldwide is cataract removal. According to the National Institutes of Health in 2025, the cataract surgical rate has been reported from 36 to 12,800 per million population across different countries. Improved vision is the main goal of cataract surgery, which is accomplished by removing the clouded lens and replacing it with a clear IOL. The IOL increases visual acuity and enables patients to see clearly by correcting the eye's refractive defect.

Key Intraocular Lens Market Insights Summary:

Regional Highlights:

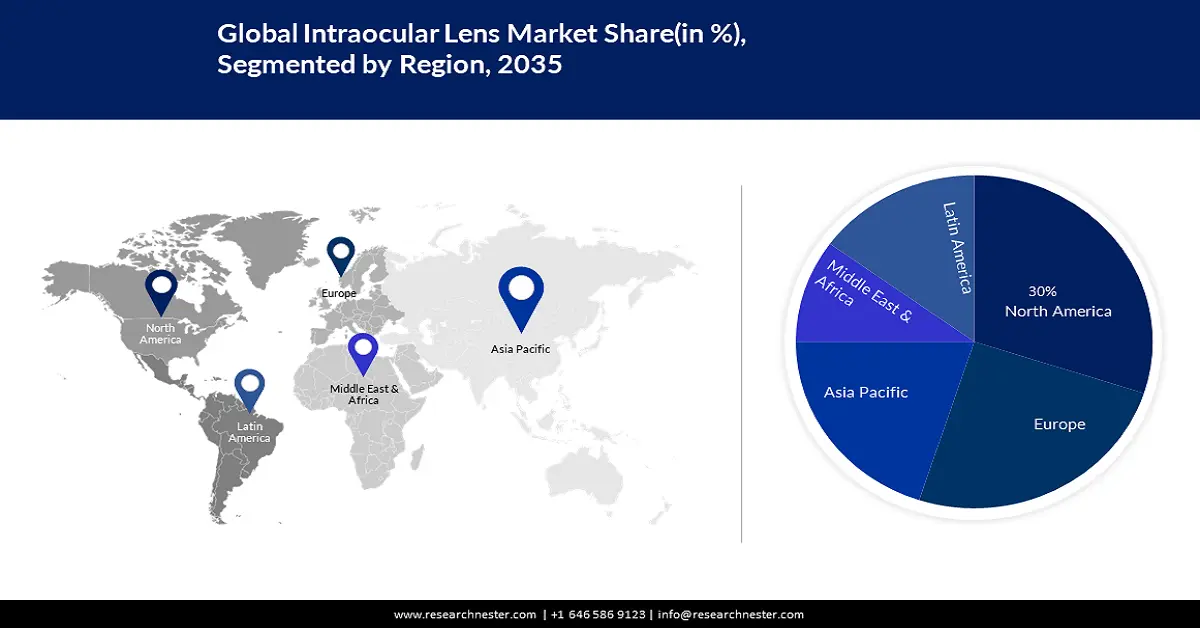

- The Europe intraocular lens market is anticipated to maintain the largest share by 2035, driven by aging population and increasing demand for innovative intraocular lenses.

- The Asia Pacific market is projected to experience significant growth from 2026 to 2035, attributed to common eye conditions and expanding medical tourism and insurance coverage.

Segment Insights:

- The hospital end-user segment in the intraocular lens market is expected to achieve the highest market share by 2035, driven by the growing number of cataract surgeries in hospitals funded by governments.

Key Growth Trends:

- Rising geriatric population

- Rising screen exposure

Major Challenges:

- Regulatory Barriers

- Complications associated with the intraocular lenses

Key Players: Alcon Vision LLC, Johnson & Johnson Vision Care Inc., Bausch Health Companies Inc., Carl Zeiss Meditec AG, HOYA Corporation, Rayner Group, STAAR Surgical Company, PhysIOL SA, Lenstec Inc., HumanOptics AG.

Global Intraocular Lens Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 4.85 billion

- 2026 Market Size: USD 5.14 billion

- Projected Market Size: USD 9.28 billion by 2035

- Growth Forecasts: 6.7% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Europe

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, Japan, China, India

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 10 September, 2025

Intraocular Lens Market Growth Drivers and Challenges:

Growth Drivers

- Rising geriatric population: According to the World Health Organization, one in six persons on the planet will be 60 years of age or older by the year 2030. Age is a major risk factor for cataracts, which is the main cause of vision loss in older persons. Hence the growing geriatric population is driving up demand for intraocular lenses. These factors are propelling the growth of the market during assessed time.

- Rising screen exposure: According to Pew Research Center in March 2024, 38% of teens say that they spend too much time on their smartphones. This leads to increased demand for intraocular lenses because more people are exposed to screens, primarily due to prolonged use of electronic screens, such as those on computers and mobile devices. This will increase the incidence of vision issues such as asthenopia (eye strain).

- Rising awareness of eye health: The World Health Organization commemorates World Sight Day on the second Thursday of October every year to raise awareness about the importance of protecting eyes and vision. The growth of the market can also be attributed to factors such as rising surgical procedures, and the advent of advanced diagnostic tools. People get to understand the disease and respective treatment.

Challenges

- Regulatory Barriers: Some manufacturers may find it difficult to launch new items into the market since the regulatory approval procedure for medical devices such as intraocular lenses may be time-consuming and expensive. Additionally, regulatory regulations may differ from nation to nation, adding to the entry obstacles for manufacturers.

- Complications associated with the intraocular lenses: The major problem with the lenses is that the user may develop corneal edema, retinal detachment, or glaucoma. The longer the IOL stays dislocated, there would be higher the risk of scarring.

Intraocular Lens Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6.7% |

|

Base Year Market Size (2025) |

USD 4.85 billion |

|

Forecast Year Market Size (2035) |

USD 9.28 billion |

|

Regional Scope |

|

Intraocular Lens Market Segmentation:

End-user Segment Analysis

The hospital segment is anticipated to garner the highest revenue by the end of 2035. The growth of the segment can be attributed to the growing number of cataract surgeries in hospitals funded by governments. For instance, in the U.S., there is free cataract surgery under the Mission Cataract USA for people of all ages who can't afford it. Similarly, in India, Netra Jyoti Abhiyan was launched in 2022 to conduct mission-mode cataract surgeries on a huge level. Additionally, private hospitals offer specialized follow-up clinics and support services to aid patients in their recovery and handle any issues related to eyes that may occur.

Type Segment Analysis

The mono-focal segment is expected to have significant growth due to a lower risk of producing visual disturbances such as halos, glare, and diminished contrast sensitivity. Moreover, when compared to multifocal or accommodating IOLs, mono-focal IOLs are less likely to have issues including lens displacement.

Our in-depth analysis of the global intraocular lens market includes the following segments:

|

Type |

|

|

Material |

|

|

End User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Intraocular Lens Market Regional Analysis:

North America Market Insights

The intraocular lens market in North America is projected to witness growth by the end of 2035, backed by growing healthcare investment and the rising prevalence of cataracts. IOLs and cataract surgery are usually covered by favorable reimbursement rules in North America, which has expanded the use of premium IOLs among patients and medical professionals.

According to the Centers for Medicare & Medicaid Services in December 2024, U.S. healthcare spending grew 7.5% in 2023, reaching USD 4.9 trillion or USD 14,570 per person. In the country, minimally invasive surgery methods such as femtosecond laser-assisted cataract surgery (FLACS) and microincision cataract surgery (MICS) are becoming common.

Europe Market Insights

The Europe intraocular lens market is estimated to be the second-largest due to the presence of aging in the European population. Age-related clouding of the natural lens of the eye could lead to cataracts, which could impair vision. Europe is home to a large number of creative businesses and research organizations that are creating new and sophisticated IOLs. Patients and surgeons are turning to these new technologies to get better visual results, which is propelling market expansion. According to the government of the UK in the financial year 2022, there were over 409,000 admissions to hospitals for cataract surgery in England.

Asia Pacific Market Insights

The intraocular lens market in the Asia Pacific is also estimated to have significant growth over the forecast period. Eye conditions including cataracts, diabetic retinopathy, and age-related macular degeneration are very common. Many nations in the Asia-Pacific are well-liked spots for medical tourism, particularly for eye surgery. Moreover, the insurance coverage for cataract surgery and IOLs is expanding in several nations around the Asia-Pacific.

Intraocular Lens Market Players:

- Alcon Vision LLC

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Johnson & Johnson Vision Care Inc.

- Bausch Health Companies Inc.

- Carl Zeiss Meditec AG

- HOYA Corporation

- Rayner Group

- STAAR Surgical Company

- PhysIOL SA

- Lenstec Inc.

- HumanOptics AG

The competitive landscape of the market is rapidly evolving as established key players, health giants and new entrants are investing in novel technologies. Key players in the market are focused on developing new technologies and products catering to the stringent regulatory norms and consumer demand. These key players are adopting several strategies such as mergers and acquisitions, joint ventures, partnerships, and novel product launches to enhance their product base and strengthen their market position. Here are some key players operating in the global market:

Recent Developments

- In February 2025, Johnson & Johnson declared the launch of the TECNIS PureSee intraocular lens that is purely refractive for people suffering from presbyopia. These are designed to provide uninterrupted, high-quality vision and superior contrast.

- In October 2023, Bausch + Lomb launched enVista Aspire intermediate optimized mono-focal and toric intraocular lenses. These lenses are designed to provide a broader depth of focus with proven benefits.

- Report ID: 4856

- Published Date: Sep 10, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Intraocular Lens Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.