Interventional Radiology Market Outlook:

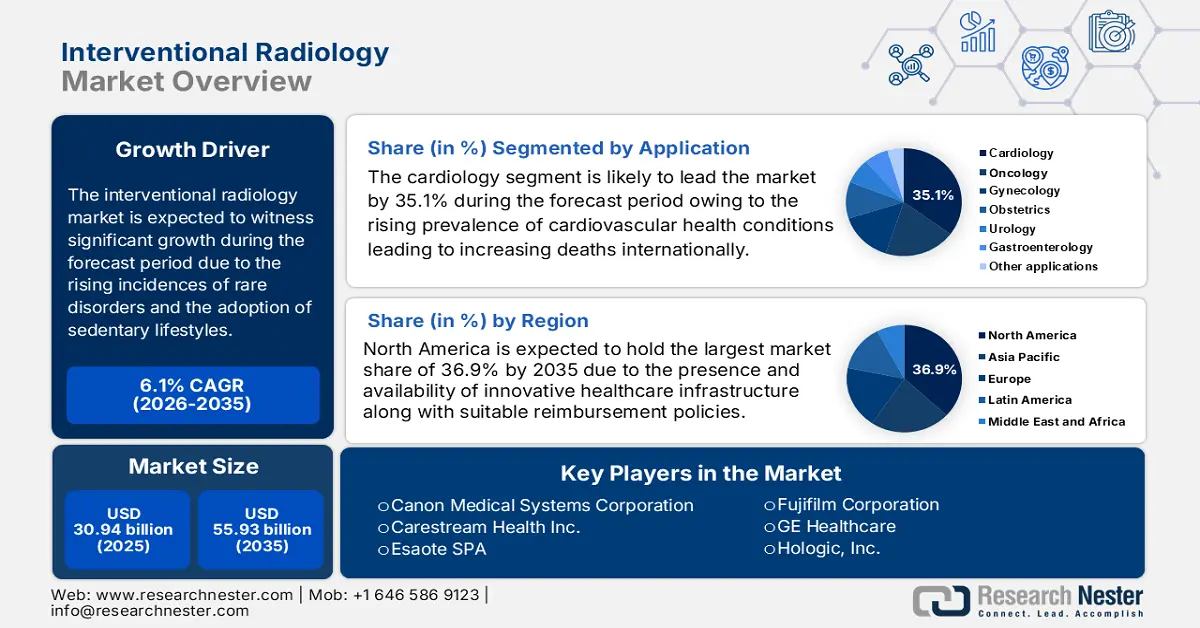

Interventional Radiology Market size was over USD 30.94 billion in 2025 and is projected to reach USD 55.93 billion by 2035, witnessing around 6.1% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of interventional radiology is evaluated at USD 32.64 billion.

The interventional radiology market is expanding rapidly, driven by the advancements in minimally invasive technologies across various fields and the rising prevalence of chronic diseases such as cancer, cardiovascular, and neurological disorders. The progress in the healthcare sector is gaining traction due to reduced recovery times, lowered risks, and improved patient outcomes, making interventional radiology the preferred outcome alternative to traditional surgeries. With continued research, the increasing geriatric population, and rising adoption of image-guided interventions the market is anticipated to witness steady growth further.

In March 2024, according to WHO report over 1 in 3 people were affected by neurological conditions, the leading cause of illness and disability worldwide which underscores the demand for interventional radiology. It also highlights that more than 80% of neurological deaths and health concerns occur in low- and middle-income nations as the treatment access varies. Countries with high income have up to 70 times more healthcare professionals per 100,000 people than low- and middle-income countries which evidences the health disparities in the market. This incidence of neurological concerns and lack of healthcare professionals is anticipated to drive growth in the market.

Key Interventional Radiology Market Insights Summary:

Regional Highlights:

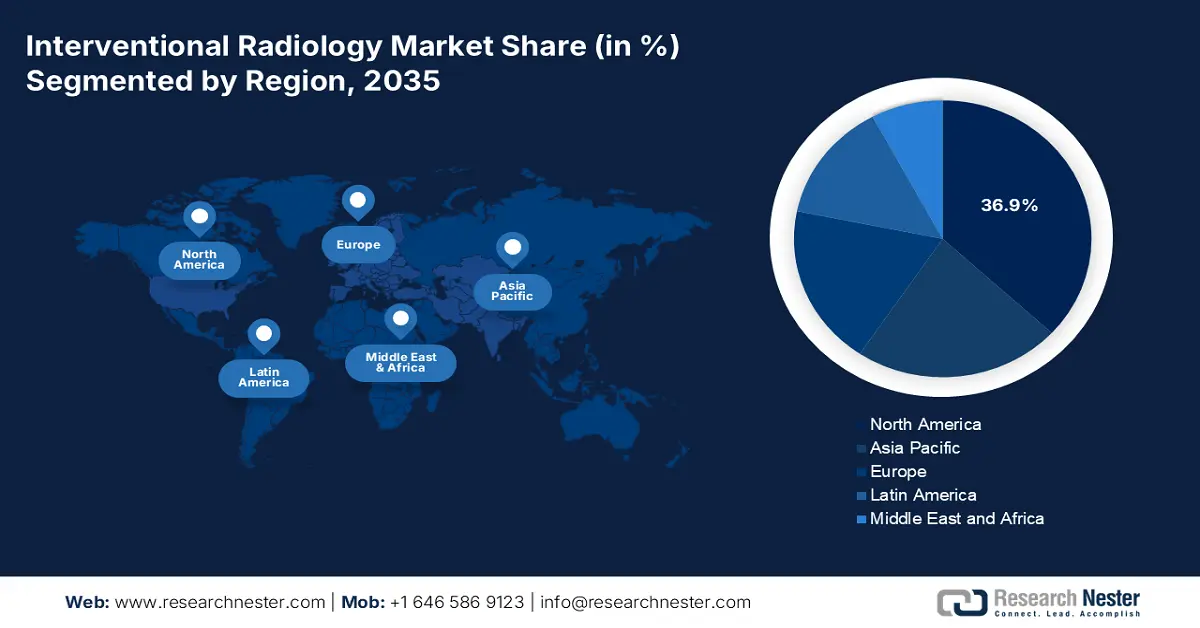

- North America’s 36.9% share in the Interventional Radiology Market is driven by advanced healthcare infrastructure and innovations in interventional radiology, positioning it as a leader through 2035.

- Asia Pacific's Interventional Radiology Market is expected to grow rapidly from 2026–2035, driven by adoption of advanced solutions and public-private collaborations.

Segment Insights:

- Interventional Radiology segment is expected to capture a 35.10% share by 2035, driven by increased use of minimally invasive procedures for cardiovascular disease management.

Key Growth Trends:

- Rising prevalence of chronic diseases and aging population

- Technological advancements

Major Challenges:

- High cost of equipment

- Shortage of skilled professionals

- Key Players: GE Healthcare, Siemens Healthineers, Koninklijke Philips N.V, Canon Medical Systems Corporation, Carestream Health Inc., Hologic Inc., Agfa-Gevaert Group, Cook, Agfa-Gevaert Group, Samsung Healthcare, Medtronic.

Global Interventional Radiology Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 30.94 billion

- 2026 Market Size: USD 32.64 billion

- Projected Market Size: USD 55.93 billion by 2035

- Growth Forecasts: 6.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (36.9% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, Japan, United Kingdom, France

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 12 August, 2025

Interventional Radiology Market Growth Drivers and Challenges:

Growth Drivers

- Rising prevalence of chronic diseases and aging population: The increased incidence of chronic diseases such as cardiovascular diseases (CVD), carcinoma, and neurological concerns significantly drive the market growth. According to WHO report in February 2025, cancer is one of the leading causes of death worldwide accounting for 10 million deaths in 2020, that is one in six deaths. Additionally, 30% of cancer cases are in developing countries which highlight the health disparities and the requirement for advanced treatment solutions. The market aids in cancer management by providing procedures such as tumor ablation and embolization.

- Technological advancements: Continuous innovations in technology such as image-guided procedures, AI-driven diagnostic tools, and robotic-assisted interventions contribute to the market growth by improving patient outcomes with procedural accuracy. Compared with traditional surgeries, minimally invasive procedures offer faster recovery and lower complications which improves the consumer base for the radiology industry. For instance, in February 2021 Siemens Healthineers introduced Corindus in India, enabling robotic vascular interventions that allow remote controlled stent placements, especially for coronary artery disease making IR a preferred alternative.

Challenges

- High cost of equipment: The increasing costs of image-guided technologies, and robotic-assisted interventions are expensive and pose significant challenges for both healthcare providers and patients. These expenses are further exacerbated by the need for MRI-guided focused ultrasound systems and catheterization platforms, thus creating a challenge in the market as they require substantial investment. Furthermore, the huge cost can limit the availability in underdeveloped countries and might not be covered by insurance further discouraging the interventional radiology market expansion.

- Shortage of skilled professionals: The interventional radiology procedures require trained professionals with expertise in disease-specific treatment procedures straining the adoption of advanced technologies. Furthermore, the demand for interventional radiologists is outpacing the supply as healthcare facilities face hurdles in the recruitment of skilled professionals, severely impacting the market. Limited training programs in different countries coupled with gaps in expertise create restrictions and restraints on the market.

Interventional Radiology Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6.1% |

|

Base Year Market Size (2025) |

USD 30.94 billion |

|

Forecast Year Market Size (2035) |

USD 55.93 billion |

|

Regional Scope |

|

Interventional Radiology Market Segmentation:

Application (Cardiology, Oncology, Gynecology, Obstetrics, Urology, Gastroenterology)

Cardiology segment is predicted to hold over 35.1% interventional radiology market share by the end of 2035. Procedures such as stenting, embolization, and angioplasty increase the demand for interventional radiology as they are highly efficient in managing conditions including peripheral vascular disease and coronary artery disease. For instance, the October 2024 CDC report stated that heart disease is the leading cause of death. In 2022, 702,880 people died from this condition accounting for 1 in every 5 deaths. Additionally, due to coronary heart disease, 371,506 people were estimated to die in 2022. Therefore, interventional radiology transforms CVD management through minimally invasive processes further fueling the market expansion.

Product (Angiography systems, Ultrasound imaging systems, CT scanners, MRI systems, Fluoroscopy systems, Biopsy devices)

Based on the product, the angiography systems segment is anticipated to grow at a considerable rate in the interventional radiology market during the forecast period. The growing demand for these systems caters to their usage in both diagnostic and therapeutic applications as they reduce radiation exposure and provide precise images, thus leading to the segment’s growth. In February 2024, Philips launched a new Azurion neuro biplane system at ECR 2024 to speed up and improve marginally invasive diagnosis for neurovascular conditions offering both 2D and 3D imaging. This improves efficiency and highlights the growing demand for high-performance angiography systems in the market.

Our in-depth analysis of the global market includes the following segments:

|

Product |

|

|

Application |

|

|

End users |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Interventional Radiology Market Regional Analysis:

North America Market Analysis

North America interventional radiology market is likely to account for revenue share of around 36.9% by 2035. The region benefits from its advanced healthcare infrastructure along with the presence of leading medical device firms contributing to market expansion. In February 2022 Siemens Healthineers introduced Artis Icono biplane with detectors specially designed for diagnosing and treating cardiac arrhythmia, coronary heart disease, and structural heart disease. Besides, increasing patient outcomes and stroke, aneurysm are additionally propelling market growth in the region.

The interventional radiology market in the U.S. is driven by advancements in technology and the rising geriatric population. Additionally, the market expansion is due to hospitals and outpatient facilities adopting image-guided interventions for their health concerns reducing the requirement for conventional surgeries. Furthermore, in December 2024 Terumo Interventional Systems announced the launch of its R2P NaviCross peripheral support catheter in the country. The purpose was to expand its radial to peripheral portfolio used in complex peripheral artery disease procedures, thus driving market expansion.

Canada's market is witnessing steady growth due to its emphasis on improving healthcare access across its vast geography along with the involvement of the government to provide effective healthcare funding. Additionally, with a focus on ensuring advancements and cutting-edge innovations, robotics are being readily adopted for procedural efficacy and overcoming challenges posed by the country’s remote and rural regions. With all these implementations, the market is expected to amplify in the country.

Asia Pacific Market Statistics

APAC interventional radiology market is projected to witness the fastest growth during the forecast period. Countries such as Japan, India, China, South Korea, and Australia are focusing on improving the adoption of advanced solutions along with public-private collaborations to enhance access to efficient treatments. For instance, in October 2024, Bangkok Dusit Medical Services Public Co. Ltd (BDMS) and Samsung Medison signed a Memorandum of Understanding (MoU) for medical imaging solutions and to drive digital transformation in the healthcare industry. Therefore, both these organizations are responsible for ensuring digital transformation in the healthcare industry, driving the market in the region.

India's market is expanding majorly due to the rising burden of diseases and growing medical tourism. The increasing investments in advanced imaging technology further fuel the market expansion in the country. For instance, in December 2024, AIIMS and Wipro collaborated to establish the AI Health Innovation Hub which can significantly boost market innovation and expansion for a greater outcome by the end of 2035.

China's market is witnessing growth due to its rapidly aging population and increasing healthcare reforms. The local government’s emphasis on digital healthcare is further accelerating the adoption of interventional radiology technologies. Despite cancer and heart concerns, the market in the country is anticipated to expand across various applications such as urology and musculoskeletal disorders. For instance, in November 2021, Microlmaging Medical Equipment Co. Ltd. collaborated with Seimens Healthineers and received NMPA marketing approval for its first digital subtraction angiography system.

Key Interventional Radiology Market Players:

- GE Healthcare

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Siemens Healthineers

- Koninklijke

- Philips N.V

- Canon Medical Systems Corporation

- Carestream Health Inc

- Hologic, Inc

- Agfa-Gevaert Group

- Cook

- Agfa-Gevaert Group

- Samsung Healthcare

- Medtronic

- Konica Minolta Healthcare Americas, Inc.

Technology-based firms are embarking on their leadership across the world assisting in identifying ideal alternatives to traditional surgeries. In April 2024, Medtronic announced its new live stream technology integrated with AI-driven analysis for laparoscopic and robotic-assisted processes. This eventually sets the latest standards in the market, thus allowing interventional radiology companies to focus on regional as well as global expansion significantly.

Below is the list of some key players in the market:

Recent Developments

- In May 2024 GE HealthCare announced its collaboration with Medis Medical Imaging which focuses on non-invasive coronary assessments to treat coronary artery disease.

- In September 2023, Canon Medical introduced the Alphenix Sky 12 HD interventional system with the new 12” ×12” High-Definition (Hi-Def) Detector to help improve visualization during interventional radiology.

- In November 2022 Konica Minolta Healthcare Americas, Inc. introduced its next-generation, compact point-of-care ultrasound system (POCUS), SONIMAGE® MX1 Platinum which delivers exceptional resolution image quality.

- Report ID: 7372

- Published Date: Aug 12, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Interventional Radiology Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.