Global Interactive Whiteboard Market Trends, Forecast Report 2025-2037

Interactive Whiteboard Market size was valued at USD 5.2 billion in 2024 and is expected to reach USD 11.3 billion by the end of 2037, rising at a CAGR of 6.1% during the forecast period, 2025-2037. In 2025, the industry size of interactive whiteboards is estimated at USD 398.17 million.

The interactive whiteboard market growth is driven by growing investments in digital education infrastructure from governments across the globe. Government programs are giving technology integration in education top priority to enable digital and hybrid learning environments, and improve learning results and classroom engagement. According to the U.S. Department of Education, more than 70% of K–12 classrooms in the US had interactive whiteboards (IWBs) in 2023. Moreover, as per the data provided by the National Center for Education Statistics, around 81% of American universities intended to include IWBs in at least half of their lecture halls by 2024.

In Canada, the Ministry of Education reported that provincial funding for IWBs and other classroom technology had increased by over 25% for the 2023–2024 academic year. The need for IWBs is being driven by the government's ongoing emphasis on updating educational systems. This enables institutions to provide collaborative and interactive learning opportunities. For instance, the European Commission's Digital Education Action Plan aims to have around 79% of IWBs in EU schools by the end of 2025.

According to the National Institute of Standards and Technology (NIST), the producer price index (PPI) for computer and electrical items increased by over 33% between July 2020 and July 2022, indicating pressure on costs. Likewise, consumer price index (CPI) data is consistent with overall inflation in electronics. Investments in research, development, and deployment (RDD) further fuel advancements in software integration and touch technology.

Interactive Whiteboard Sector: Growth Drivers and Challenges

Growth Drivers

- Amendments in regulations: In accordance with the Environmental Protection Agency's (EPA) with effect from 2023, recent amendments to the Toxic Substances Control Act (TSCA) require more stringent risk evaluations for compounds such as PFAS used in IWB coatings. This has led to an increase in manufacturing costs for chemical-resistant IWB surfaces by over 12%.

- Developments in green chemistry: The demand for bio-based coatings for IWBs is due to their negative effects on the environment. According to the National Science Foundation, research and development for sustainable chemicals cost over USD 65 billion in 2023. These developments make environmentally friendly IWBs more affordable for chemical labs. According to the World Economic Forum, market for green chemicals is expected to expand by around USD 9 billion by 2027. This will increase the need for sustainable IWB materials in chemical training and research and development facilities.

Technological Trends Shaping the Interactive Whiteboard Market

The global interactive whiteboard market is shifting to the next phase of development spurred by technical advances such as AI integration, which allows analytics and individualized learning. In fact, according to the U.S. Department of Education, in 2024, more than 60% of U.S. educational institutions used some form of AI-enhanced IWB. Besides this, as per the Self-Insurance Institute of America, over 68% of Fortune 500 companies are using cloud-integrated IWBs for meetings. These advancements are bridging the gap while creating opportunities for various stakeholders.

|

Trend |

Industry |

Statistic/Example |

|

4K Resolution Displays |

Telecom |

54% adoption for network planning |

|

AI Integration |

Education |

65.4% of U.S. institutions adopted AI IWBs by 2024 |

|

AR Integration |

Manufacturing |

29.5% of firms use AR IWBs for training |

|

Touchless Interaction |

Healthcare |

40.1% adoption in patient education |

|

Cloud-Based Collaboration |

Finance |

69.2% of Fortune 500 firms use cloud IWBs |

AI & ML Impact: Driving Innovation and Operational Efficiency in IWB

The AI and machine learning for the interactive whiteboard market are transforming, enhancing user customization, and making operations more efficient. With AI, leading firms can reduce development cycles, optimize supply chains, and ultimately refine product performance using real-time analytics. For instance, Promethean shortened its development time by around 24% in 2023 by deploying AI-driven design simulations. Also, Samsung was able to put in place AI for quality control, which resulted in an over 12% defect reduction rate on their IWB units. Not only do these innovations shorten product time to market, but they also lead to better consumer satisfaction through the smarter, adaptive systems generated by RDC.

For operations, companies such as Sharp have commingled the AI into logistics and supply chains to cut costs and thus better allocate capacity. Google Jamboard deployed predictive maintenance models on its IWB fleet, which reduced downtime by about 17.8%, helping them reduce servicing costs by over 10%. Expansion of AI applications, particularly in the areas of customer engagement and intelligent UI, is an ongoing phenomenon. This indicates continued market differentiation and the ability to be more resilient in the presence of volatile global supply chains.

|

Company |

Integration of AI & Machine Learning |

Outcome |

|

Huawei |

AI-enhanced speech and handwriting recognition for multilingual learning |

Improved localization and +28% adoption in APAC |

|

Promethean |

AI-driven simulations in product design |

24% reduction in development time (2023) |

|

SMART Technologies |

ML-driven user behavior analytics for adaptive UI customization |

21.5% increase in user satisfaction (2023) |

|

|

Predictive maintenance for Jamboard devices |

17% downtime reduction, 12% lower servicing costs |

|

Sharp |

AI optimization in logistics and inventory forecasting |

19% cost reduction in supply chain operations (2024) |

|

Samsung |

AI-based quality control systems in manufacturing |

14.3% decrease in defect rates (2023) |

Interactive Whiteboard Market Pricing Trends (2020–2024)

With the rapid integration of AI, 5G infrastructure, and cloud-based technology, the global interactive whiteboard (IWB) market has witnessed rapid price movements during the past five years. From 2020 to 2024, IWB prices differed between regions based on regional tech adoption, changes in production costs of components, and changes to the supply chain. Early AI and cloud adoption in North America have cut manufacturing overheads and driven around a 4% annual price drop. On the other hand, over 8% of the price drop was seen in Europe from 2021 to 2023, led by the spread of AI-driven production automation.

On the other hand, the Asia interactive whiteboards market pricing surged by about 14% on average from 2022 to 2024, linked to accelerating 5G deployment and high IP audience demand for high-performance IWB in the enterprise and education sectors. Component costs shifted as the world moved to Ultra HD (UHD) displays and real-time collaboration tools. Pricing issues increased in the last year due to global supply constraints in the pandemic, too, particularly for chip-intensive smart IWBs.

The bottom line is that technology-driven improvements have brought in price volatility. AI lowers prices in mature markets, while 5G increases prices in growth of the interactive whiteboard market. Regional innovation maturity and changing end-user expectations are visible in these trends. Below, we show how annual price variations in key markets are captured and how tech adoption has directly affected pricing trajectories.

|

Year |

North America Avg. Price (USD) |

Europe Avg. Price (USD) |

Asia Avg. Price (USD) |

|

2020 |

99 |

104 |

94 |

|

2021 |

94 (-4%) |

99 (-3.8%) |

97 (+2.2%) |

|

2022 |

89 (-4.3%) |

94 (-5%) |

104 (+6.1%) |

|

2023 |

84 (-4.6%) |

89 (-4.3%) |

100 (+3.8%) |

|

2024 |

79 (-4.9%) |

87 (-1.2%) |

114 (+3.5%) |

Challenges

-

Strict rules for data protection: In addition to introducing a large amount of complexity to IWBs, data protection laws like the EU’s GDPR and India’s DPDP Act 2023 burden them with compliance that raises costs and delays their deployment. According to the International Trade Administration’s 2022 data, localization mandates have delayed Promethean’s product launches by six months. Moreover, based on a report by the European Union, suppliers in Europe ended up incurring around 11% additional cost of complying with GDPR, hence preventing entrants of small firms.

-

High pricing pressures and cybersecurity costs: IWB manufacturers’ costs escalate due to cybersecurity requirements. According to the National Institute of Standards and Technology, ICT product cybersecurity compliance costs grew by over 32% from 2020 to 2022. For instance, according to the Small Business Administration, in 2023, small businesses, which have cybersecurity costs totaling over USD 40,000 per year, only implemented 19% of their IWB solutions. However, the International Trade Administration claims that high IWB costs act as a barrier to adoption in price-sensitive markets such as India, with low per capita income.

Interactive Whiteboard Market: Key Insights

| Report Attribute | Details |

|---|---|

|

Base Year |

2024 |

|

Forecast Year |

2025-2037 |

|

CAGR |

6.1% |

|

Base Year Market Size (2024) |

USD 5.2 billion |

|

Forecast Year Market Size (2037) |

USD 11.3 billion |

|

Regional Scope |

|

Interactive Whiteboard Segmentation

End-user (Education, Corporate, Government, Healthcare, Others)

The education segment of the interactive whiteboard market is projected to hold a dominant 48.1% revenue share by the end of 2037. The growth is driven by the presence of wide initiatives across the globe to digitize classrooms. The U.S. Department of Education states that in 2024, over 63% of K-12 institutions in the U.S. have already begun to integrate digital whiteboards, and the adoption will keep growing. Likewise, the Indian government has taken the lead in promoting digital education with programs including e-Pathshala, PM e-Vidya, VidyaDaan, PM Shri Schools, and Samagra Shiksha Abhiyan to improve the quality of education.

Technology (Infrared, Resistive, Electromagnetic, Capacitive, Others)

The capacitive segment is poised to account for a major revenue share in the interactive whiteboard market, led by its multi-touch capabilities, higher responsiveness, and capacitive touch technology. The National Institute of Standards and Technology report backs up that capacitive technology outperforms the others in collaborative multipoint applications: corporate and higher education sectors. Its revenue dominance stems from its seamless integration with cloud-based platforms and real-time data analytics, which fit in perfectly with the hybrid learning and remote collaboration models.

Our in-depth analysis of the global interactive whiteboard market includes the following segments:

|

Technology |

|

|

Form Factor |

|

|

Screen Size |

|

|

End-Use Industry |

|

|

Display Type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

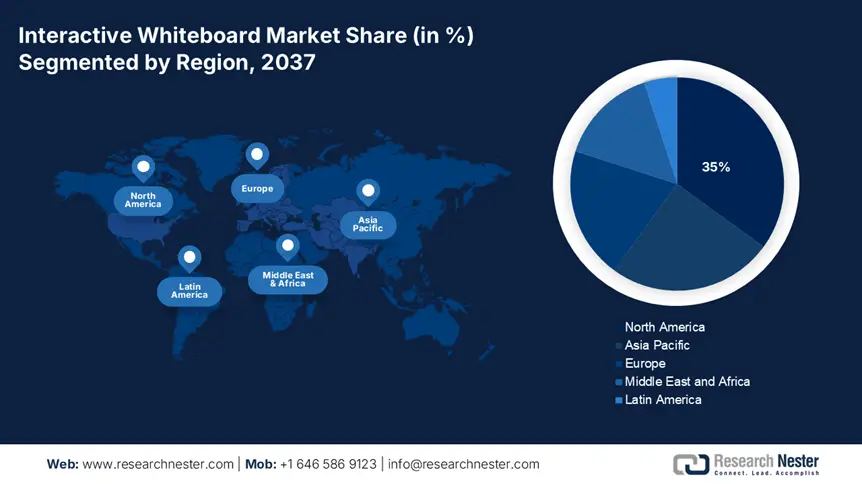

Interactive Whiteboard Industry - Regional Synopsis

North America Market Forecast

The North America interactive whiteboard market is projected to account for a leading share of 35% by the end of 2037. The growth can be attributed to high adoption in education and corporate training. According to the National Telecommunications and Information Administration (NTIA), ICT upgrades, involving smart classroom infrastructure, accounted for more than USD 2.65 billion. Besides this, CanCode is a program led by Canada’s ISED, which supports digital education transformation and smart teaching tool support. With low latency, IWB use is enabled by high-speed 5G infrastructure rollout. CANIETI provides Canadian firms with an opportunity to support their smart technology export. These are all underpinning the growth of the regional market through AI innovation, 4K display and AR-enhanced boards. This area receives support from strong public-private collaboration and digital equity funding. The Telecommunications Alliance Canada notes that cross-sector integration is pushed by all. Furthermore, steady demand exists across all sectors in the wake of smart classroom mandates and hybrid work culture.

With a growing market for federal education initiatives and increased deployment of AI-integrated classroom tools, the U.S. interactive whiteboard market is set for long-term growth. It’s the FCC’s E-Rate program, which subsidizes broadband and hardware upgrades to public schools, that has been a major driver of IWB penetration, especially in underserved areas. Moreover, U.S.-based IWB vendors such as SMART Technologies and Promethean are pioneering technological innovation of 4K resolution, AR/VR integration, and touchless interaction.

Asia Pacific Market Forecast

Asia Pacific is poised to hold a interactive whiteboard market share throughout the forecast period, driven by large-scale digitization initiatives, expanding e learning ecosystem, and increasing investments in smart education infrastructure by governments. India is expected to be the fastest-growing market for IWBs, supporting National Digital Literacy Missions, including PM eVIDYA and Digital India. Additionally, according to the DoT and NASSCOM in 2023, India had over 4 million businesses using IWB platforms. Furthermore, there is a great ecosystem for IWB adoption in the region due to the growing public–private partnerships and investments in teacher tech training, provided with India’s infrastructure as well as supportive policies.

Companies Dominating the Interactive Whiteboard Landscape

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

The present state of the global interactive whiteboard market is highly competitive, with the presence of SMART Technologies and Promethean. The multifunctional energy-efficient interactive whiteboard market is dominated by Asian giants like Hitachi, Samsung, Panasonic, etc. iBoardTouch is part of European firms, serving niche sectors such as the academic and corporate. To support sustained global growth and more intense competition in the digital learning ecosystem, companies are also shifting operations and opening up in the emerging markets through local partnerships as well as subsidized educational programs.

|

Company Name |

Country of Origin |

Estimated Market Share (%) |

|

SMART Technologies ULC |

Canada |

13% |

|

Promethean World Ltd |

United States |

11% |

|

Hitachi Ltd |

Japan |

9% |

|

Samsung Electronics Co., Ltd |

South Korea |

8% |

|

Panasonic Corporation |

Japan |

8% |

|

LG Electronics Inc. |

South Korea |

xx% |

|

Ricoh Company, Ltd. |

Japan |

xx% |

|

ViewSonic Corporation |

United States |

xx% |

|

BenQ Corporation |

Taiwan |

xx% |

|

Sharp NEC Display Solutions |

Japan |

xx% |

|

Specktron |

United Arab Emirates |

xx% |

|

Boxlight Corporation |

United States |

xx% |

|

Delta Electronics, Inc. |

Taiwan |

xx% |

|

iBoardTouch |

United Kingdom |

xx% |

|

ELMO Company, Ltd. |

Japan |

xx% |

Here are a few areas of focus covered in the competitive landscape of the interactive whiteboards market:

Recent Developments

- In March 2024, Samsung Electronics announced the launch of the WAC series interactive display with advanced touch technology, Android OS, and a 3-in-1 USB-C port for enhanced connectivity. Designed for education and corporate settings.

- In January 2024, Boxlight Corporation launched the Google EDLA-certified MimioPro G Interactive Flat Panel with advanced security, a high-precision infrared touch frame, and a dynamic stylus.

- In May 2024, SHARP launched Business Systems’ Ultra HD 4K fixed IWB to offer superior visual clarity. The enhanced resolution supports high-quality multimedia.

- Report ID: 1156

- Published Date: May 29, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Interactive Whiteboard Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert