Infusion Pump Market Outlook:

Infusion Pump Market size was over USD 15.53 billion in 2025 and is projected to reach USD 30.84 billion by 2035, witnessing around 7.1% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of infusion pump is evaluated at USD 16.52 billion.

The growth of the market is primarily attributed to the higher prevalence of cancer across the globe. The World Health Organization (WHO) published a report stating that in 2020 almost 10 million people died on account of cancer, making the disease the leading cause of death worldwide. Besides this, the increasing ratio of chronic diseases such as neurological disorders and diabetes along with the advancement of drug delivery technologies are further factors that are boosting the market growth over the forecast period.

The global infusion pumps market trends such as the growing prevalence of kidney and other stomach-related diseases and ongoing advancements in medical technologies are projected to influence the growth of the market positively over the forecast period. It is observed that around 12% of the global population is living with chronic kidney disease (CDK) and around 1 million people die every year due to these diseases across the globe. Moreover, mounting spending on medicine R&D and significantly emerging demand for infusion pumps in home care facilities are further expected to flourish the growth of the market during the forecast period. For instance, as of 2021, around 0.04 million home care providers were functioning in the United States. Therefore, such factors are anticipated to hike the growth of the market over the forecast period. Also, the rising geriatric population which needs long-term care therapies, and the high focus of leading market players on on-site care management for specialty medicines is anticipated to impetus a significant revenue generation. Furthermore, the increase in the number of surgical procedures performed across the globe, growing cases of medication errors, and high demand for ambulatory infusion pumps are other factors that are anticipated to boost the growth of the global infusion pump market.

Key Infusion Pump Market Insights Summary:

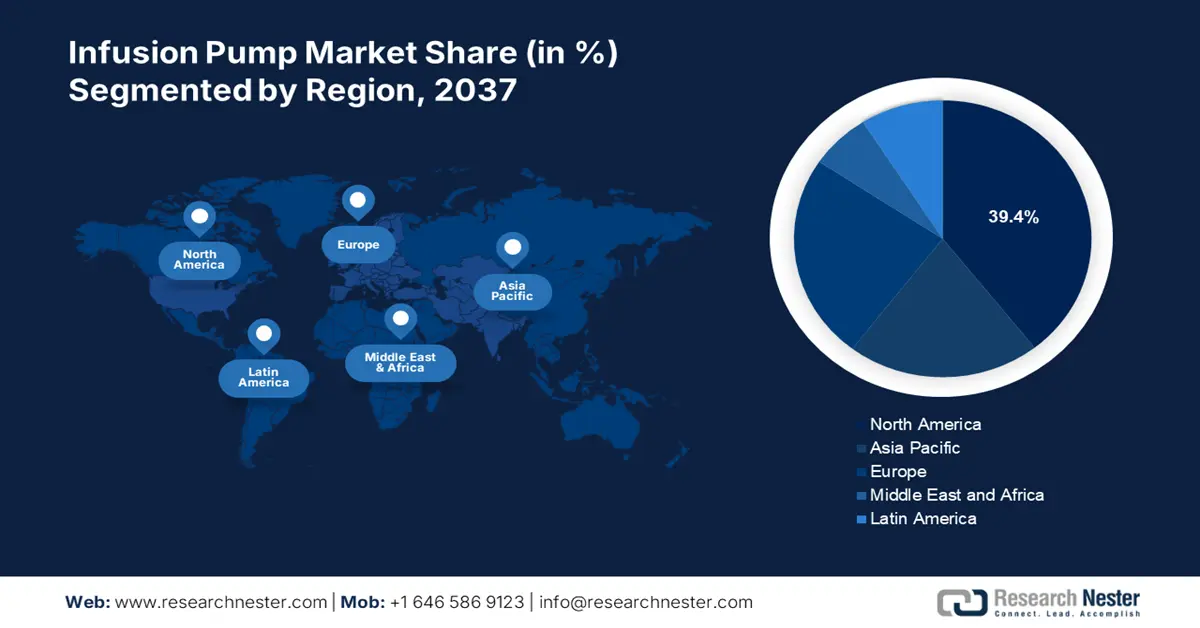

Regional Highlights:

- The North America infusion pump market will hold over 39.4% share by 2035, attributed to the increasing prevalence of chronic diseases and demand for advanced infusion pumps.

Segment Insights:

- The home care facility segment in the infusion pump market is projected to hold the largest share by 2035, driven by the rising adoption of ambulatory pumps and high costs of prolonged hospitalization.

- The insulin segment in the infusion pump market is poised for remarkable CAGR during 2026-2035, driven by the rising utilization of insulin infusion pumps by people with diabetes globally.

Key Growth Trends:

- Growing Number of People in the Need of Pain Management

- Skyrocketing Demand for Infusion Pumps in Neonatology

Major Challenges:

- Booming Number of Medication Errors

- Lack of Requisite Technology such as Wireless Connectivity

Key Players: Becton, Dickinson and Company, Baxter Healthcare Corporation, CODAN Medizinische Gerate GmbH & Co KG, Shenzhen MedRena Biotech Co., Ltd., B. Braun SE, ICU Medical, Inc., Terumo Corporation, Moog Inc., Ypsomed Group, NIPRO Corporation.

Global Infusion Pump Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 15.53 billion

- 2026 Market Size: USD 16.52 billion

- Projected Market Size: USD 30.84 billion by 2035

- Growth Forecasts: 7.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (39.4% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, Japan, China, United Kingdom

- Emerging Countries: China, India, Japan, South Korea, Taiwan

Last updated on : 9 September, 2025

Infusion Pump Market Growth Drivers and Challenges:

Growth Drivers

- Increasing Cases of Diabetes - Diabetes is a condition in which the human body doesn’t produce an adequate amount of insulin or can’t utilize it resulting in too much storage of blood sugar in the bloodstream. Diabetes can be very discomforting to live with and can also be life-threatening. In such conditions, infusion pumps are utilized to release recommended doses of insulin to control the increment of blood sugar after the meal. Therefore, diabetes care devices are needed in order to deliver insulin to the body or control the sugar level, and it is projected to drive the market’s growth. The latest report released by the World Health Organization in 2022, revealed that around 422 million people across the world are living with diabetes with 1.5 million deaths owing to diabetes.

- Growing Number of People in the Need of Pain Management – With the escalation of both chronic and acute diseases, people suffer from discomfort and pain during the diagnosis and treatment processes. In addition, implantable drug infusion pumps are used to provide drug delivery on continuous basis for pain management in patients. For reducing aches and soreness, the demand for infusion pumps is anticipated to soar and bring lucrative growth opportunities for market growth. For instance, it is observed that nearly 3.5 million suffer from chronic daily migraines, meanwhile, approximately 75% of the adults in the United States are reported to be living with severe back pain.

- Booming Penetration of Hemophilia Across the Globe - The number of people estimated to be living with hemophilia worldwide is around 200 thousand while hemophilia A affected around 150 thousand people in 2019.

- Skyrocketing Demand for Infusion Pumps in Neonatology – The World Health Organization estimated that nearly 6,700 newborn babies die each day summing up to 47% of death of children aged under 5 years across the globe.

- Significant Growth in Global Health Expenditure - As per the data released by the World Bank, it was demonstrated that worldwide health expenditure reached around 9.83% of GDP in 2019.

Challenges

- Booming Number of Medication Errors – Many times, medication errors such as miscalculations, unit errors, push-button mistakes, and alarm errors occur while using the infusion pumps. Hence, this factor is estimated to hinder market growth over the projected time frame.

- Lack of Requisite Technology such as Wireless Connectivity

- Requirement for Higher Initial Investment

Infusion Pump Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

7.1% |

|

Base Year Market Size (2025) |

USD 15.53 billion |

|

Forecast Year Market Size (2035) |

USD 30.84 billion |

|

Regional Scope |

|

Infusion Pump Market Segmentation:

Pump Type

The global infusion pump market is segmented and analyzed for demand and supply by pump type into ambulatory, enteral, implantable, insulin, volumetric, PCA, and others, out of which, Over the forthcoming years, the insulin segment is expected to grow remarkably. The growth of the segment can be accounted to the rising utilization of insulin infusion pumps by people living with diabetes globally. For instance, in 2019, approximately 1 million people were anticipated to lose their lives due to diabetes across the globe. Moreover, the surge in the promising technological advancement in the insulin pump field is also propelling the growth of the infusion pump market over the forecast period.

End-user

The global infusion pump market is also segmented and analyzed for demand and supply by end-user into home care facilities, research centers, hospitals, and others. Out of these three segments, the home care facility is anticipated to hold the largest share during the assessment period. The major factor that is attributed to segment growth is the rising adoption of ambulatory pumps and the high need for on-site care management. Another growth factor of the segment is expected to be the high costs associated with prolonged hospitalization which increases the preference for infusion pumps in home care settings. On the other hand, the hospital segment is also projected to garner a notable revenue generation by the end of the forecast period. The presence of a high number of hospitals around the globe along with advanced facilities for infusion pump installation and rising global healthcare expenditure are the major factors that are expected to fuel the adoption rate of the infusion pump in the future. According to the World Bank, in 2019, the global health expenditure reached USD 1,121.9 per capita. Furthermore, other factors that are anticipated to contribute positively to segment growth are the rising government support to develop hospital infrastructure and favorable policies associated with hospitals along with the rising patient pool visiting hospitals daily.

Our in-depth analysis of the global market includes the following segments:

|

By Pump Type |

|

|

By Type |

|

|

By Technology |

|

|

By End-User |

|

|

By Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Infusion Pump Market Regional Analysis:

North America Market Insights

North America region is poised to dominate around 39.4% market share by 2035, attributed to the increasing prevalence of chronic diseases and demand for advanced infusion pumps. For instance, nearly 36 million Americans were projected to be living with diabetes summing up to 10% of the entire population in 2019. Moreover, a significant surge in the premium-priced infusion pumps to improve the healthcare services quality and the presence of the major key players in the region is further expected to push the market growth over the forecast period. The rapid expansion of the healthcare industry along with the high adoption of ambulatory pumps and the high need for fast diagnosis and treatment is also anticipated to boost the preference for infusion pumps in the upcoming years. In addition, the region's expanding healthcare industry and rising awareness about the advantages offered by infusion pumps are also anticipated to boost the market growth during the forecast period.

Infusion Pump Market Players:

- Becton, Dickinson and Company

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Baxter Healthcare Corporation

- CODAN Medizinische Gerate GmbH & Co KG

- Shenzhen MedRena Biotech Co., Ltd.

- B. Braun SE

- ICU Medical, Inc.

- Terumo Corporation

- Moog Inc.

- Ypsomed Group

- NIPRO Corporation

Recent Developments

-

Baxter Healthcare Corporation to acquire clearance for U.S. Food and Drug Administration (FDA) for its Novum IQ syringe infusion pump. The product comes with Dose IQ safety software, the latest developments for infusion therapy. Novum IQ SYR is attached to the Connectivity Suite of Baxter’s IQ Enterprise.

-

ICU Medical, Inc. to acquire recognition as top-performing Smart Pump EMR-Integrated by KLAS Research for its Plum 360. The award is offered based on the feedback of thousands of healthcare providers and a side-by-side comparison of IV smart pumps.

- Report ID: 4452

- Published Date: Sep 09, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Infusion Pump Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.