Industry 5.0 Market Outlook:

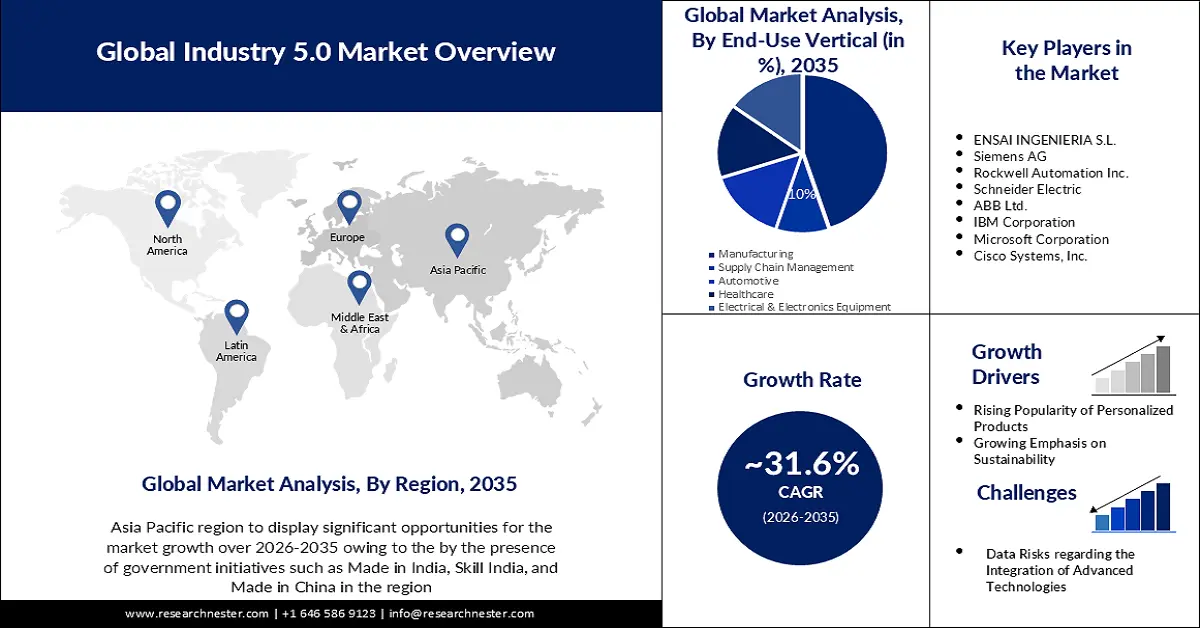

Industry 5.0 Market size was valued at USD 83.31 billion in 2025 and is expected to reach USD 1.3 trillion by 2035, registering around 31.6% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of industry 5.0 is evaluated at USD 107 billion.

The reason behind the growth is impelled by the rising emergence of advanced technologies, namely industrial Internet of Things (IIoT) and artificial intelligence, as these are indispensable for effective data collection, analysis, and feeding the gathered insights into the manufacturing process to create improved products, and drive business success in the era of Industry 5.0. For instance, by 2025, it's predicted that there will be more than 30 billion linked devices worldwide.

The rapid industrial digitization is believed to fuel the market growth. The industrial sector as a whole is quickly changing owing to digital transformation as a result the manufacturing sector is adopting new technologies at a quick pace to enhance all facets of the production process, including data analytics and factory automation.

Key Industry 5.0 Market Insights Summary:

Regional Highlights:

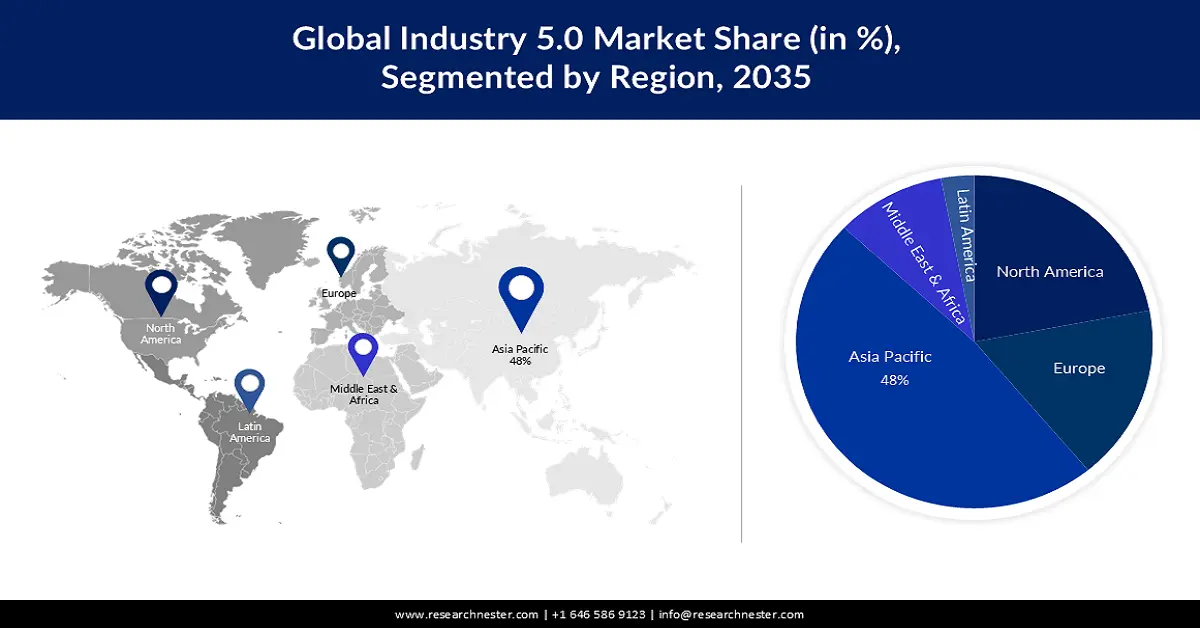

- The Asia Pacific industry 5.0 market leads with a 48% share by 2035, fueled by government initiatives like "Made in India" and "Made in China," which aim to position the region as a global manufacturing hub.

- The North America market will secure the second largest share by 2035, driven by the growing adoption of advanced technologies, such as AI and cloud-based machine learning services in business and various sectors.

Segment Insights:

- The manufacturing segment in the industry 5.0 market is set to achieve a 45% share by 2035, fueled by Industry 5.0’s potential to personalize manufacturing, optimize resources, and support climate goals.

Key Growth Trends:

- Rising Popularity of Personalized Products

- Growing Emphasis on Sustainability

Major Challenges:

- Rising Popularity of Personalized Products

- Growing Emphasis on Sustainability

Key Players: ENSAI INGENIERIA S.L., Siemens AG, Rockwell Automation Inc., Schneider Electric, ABB Ltd., IBM Corporation, Microsoft Corporation, Cisco Systems, Inc., General Electric Company.

Global Industry 5.0 Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 83.31 billion

- 2026 Market Size: USD 107 billion

- Projected Market Size: USD 1.3 trillion by 2035

- Growth Forecasts: 31.6% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (48% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, China, Japan, South Korea

- Emerging Countries: China, India, South Korea, Japan, Singapore

Last updated on : 9 September, 2025

Industry 5.0 Market Growth Drivers and Challenges:

Growth Drivers

- Rising Popularity of Personalized Products - The goal of Industry 5.0 is to revolutionize the manufacturing sector, by focusing on product personalization and customization with the help of different software levels and 3D digital product production capabilities to meet the unique demands and preferences of clients. For instance, additive manufacturing makes it feasible to create complex and one-of-a-kind products by offering huge degrees of personalization and customization, which enables businesses to create goods that precisely meet the unique requirements of their clients.

- Growing Emphasis on Sustainability- Human-centered, Industry 5.0 prioritizes sustainability and is increasingly being embraced by manufacturers to meet sustainable development targets, which go beyond merely minimizing, reducing, or mitigating climate damage to include actively pursuing initiatives to improve the planet. Industry 5.0, which integrates smart machines with existing value chains to make them more sustainable, is regarded as a crucial strategy to combat climate change.

- Increasing Role of Collaborative Robots - Industry 5.0 describes human-robot and human-machine collaboration that aspires to connect people with cooperative robots to bring back the human touch in development and production and achieve the objectives for sustainability and increased resilience. Moreover, businesses may increase the effectiveness of intelligent automation, and make the interaction between people and machines smoother by implementing collaborative robots and immersive technologies such as virtual reality (VR).

Challenges

- Data Risks regarding the Integration of Advanced Technologies - The incorporation of cutting-edge technologies may pose new risks to data privacy and cybersecurity and may introduce additional hazards to the physical integrity of machinery and equipment owing to its enhanced interoperability and usage of common communications protocols. Industry 5.0 uses automation and artificial intelligence, which poses risks to the company since the applications are centered on ICT systems. Big data is essential to Industry 5.0 manufacturing as it may provide manufacturers with a wealth of information about their consumers, operations, and business however, concerns regarding data privacy and confidentiality are raised by the enormous volumes of data, particularly in light of the possibility of unauthorized access or breaches.

- Need for Standardized Regulations

- Interoperability Issues among Diverse Technologies may Cause Insoluble Challenges, such as Vendor lock-in

Industry 5.0 Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

31.6% |

|

Base Year Market Size (2025) |

USD 83.31 billion |

|

Forecast Year Market Size (2035) |

USD 1.3 trillion |

|

Regional Scope |

|

Industry 5.0 Market Segmentation:

End-Use Vertical Segment Analysis

Manufacturing segment is poised to capture over 45% industry 5.0 market share by 2035. Industry 5.0 will drastically alter the manufacturing sector, and can support the individualized manufacturing process to enable businesses and industries to actively supply solutions for society to preserve resources, promote social stability, and address climate targets, and will lead to better automation of industrial processes.

Moreover, Industry 5.0 is a new paradigm for production, which aids in increasing production, cutting expenses, increasing competitiveness, decreasing human injury, and yielding consistent and uniform output.

Application Segment Analysis

The smart factories segment in the industry 5.0 market is set to garner a notable share shortly. The smart factory is a cyber-physical system that expresses the ultimate purpose of digitalization in production through the use of cutting-edge technologies including artificial intelligence (AI) and machine learning. Smart factories are highly digitalized and can automate and optimize themselves to improve processes and offer opportunities to generate new kinds of efficiency and flexibility. Moreover, the implementation of Industry 5.0 IoT technology in manufacturing facilities is seen as the next evolution of the smart factory, built upon the principles of Industry 4.0.

Our in-depth analysis of the global industry 5.0 market includes the following segments:

|

End-Use Vertical |

|

|

Enterprise |

|

|

Application |

|

|

Technology |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Industry 5.0 Market Regional Analysis:

APAC Market Insights

Industry 5.0 market in Asia Pacific is predicted to account for the largest share of 48% by 2035, impelled by the presence of government initiatives such as Made in India, Skill India, and Made in China. India hopes to establish itself as a manufacturing hub which is expected to result in higher demand for Industry 5.0 as it has a lot of potential to work with these initiatives. Moreover, the "Made in India" campaign is built around four pillars that the Indian government has determined to stimulate entrepreneurship in the country and establish it as the top global manufacturing destination for product development, and assembly.

In addition, "Made in China 2025" is a campaign that the Chinese government has started which is a state-led industrial program and national strategic plan of the Chinese Communist Party (CCP) that aims to establish China as a global leader in high-tech manufacturing, and quickly grow its high-tech sectors and base of advanced manufacturing to catch up with—and eventually surpass-Western technological prowess in advanced industries.

North American Market Insights

The North America Industry 5.0 market is estimated to be the second largest, during the forecast timeframe, led by the growing adoption of advanced technologies. In terms of AI development, the US leads the globe, and with its worldwide IT giants, the region has been a hub for technological innovation. For instance, more than 70% of US businesses have already incorporated AI into some aspect of their operations. Additionally, the market is increasing as cloud-based machine learning services are becoming more and more popular in North America which is an innovative technology that is positively transforming business, healthcare, education, and finance.

Industry 5.0 Market Players:

- KUKA AG

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- ENSAI INGENIERIA S.L.

- Siemens AG

- Rockwell Automation Inc.

- Schneider Electric

- ABB Ltd.

- IBM Corporation

- Microsoft Corporation

- Cisco Systems, Inc.

- Accel

- General Electric Company

Recent Developments

- Nexus Integra, a company based in Valencia, Spain, launched Nexus Integra Platform, which is a software predicted to drive the transformation of an industrial company into Industry 5.0.

- Accel a global venture capital firm announced applications for its AI and Industry 5.0 cohort from entrepreneurs in the UAE, Southeast Asia, and India to offer individualized mentorship, and industry-specific advice from leading operators and entrepreneurs, and help businesses develop teams, evaluate concepts, and raise financing through a series of mentorship sessions.

- Report ID: 3603

- Published Date: Sep 09, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Industry 5.0 Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.