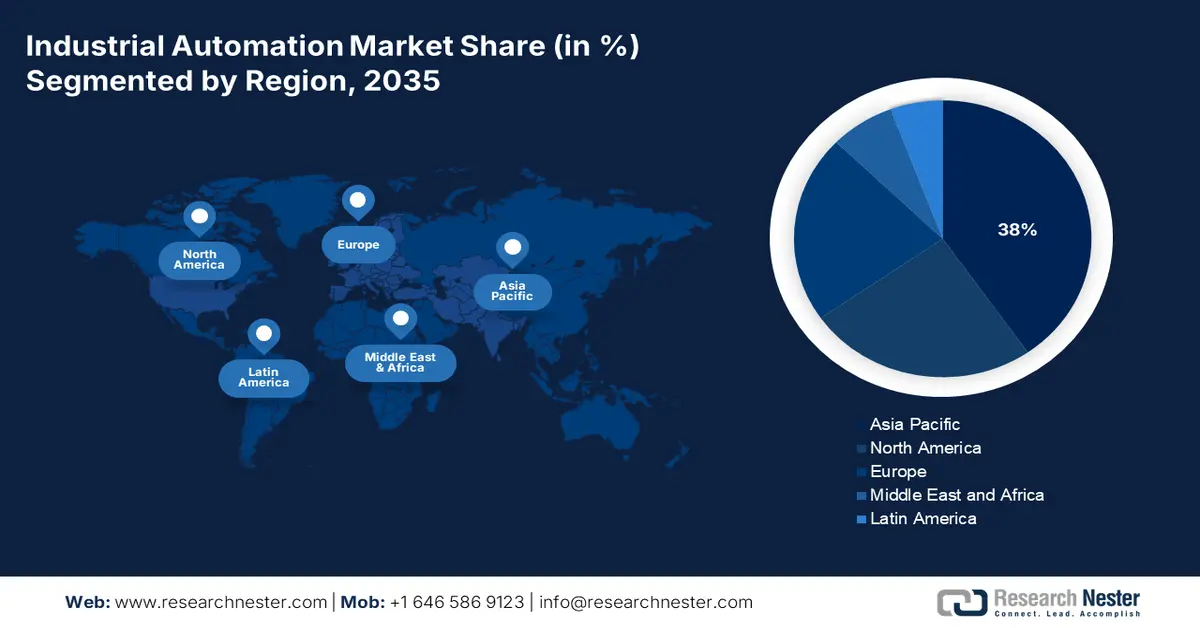

Industrial Automation Market Regional Analysis:

APAC Market Insights

Asia Pacific region in industrial automation market is poised to hold more than 38% revenue share by 2035. The region's automation sector is thriving, since a large number of industries are expanding and emergence of different industrial robots are being created especially in China, India, Japan, etc. According to the International Federation of Robotics (IFR), Asia remains the world's largest market for industrial robots. 74% of all freshly positioned robots in 2021 were installed in Asia and in 2020 it was 70%.

The industrial automation market has expanded in China as a result of the country's robust economic growth and technological advancement. According to the World Bank, China is now classified as an upper-middle-income nation. Even though China declared severe poverty to be eliminated in 2020, 17.2 percent of the population was predicted to be living in 2023 below the World Bank's Upper-Middle-Income Country (UMIC) poverty line, which is equal to USD 6.85 a day (in 2017 PPP prices).

The Indian industrial automation development mainly lies in the immense development of the country in making automation products. Moreover, leading Indian software businesses are collaborating with automation solution suppliers to support and install level 2 and 3 automation technologies, including MES, SCADA, and HMI.

Japan is known for being a global leader in the production of robotics and AI tools which will further help the industrial automation revenue to grow in this country. According to the International Federation of Robotics (IFR), with 47,182 collaborative robot installations, there was a 22% increase in 2021. In 2021, Japan's operating stock amounted to 393,326 units (+5%).

European Market Insights

Industrial automation market size for Europe region is poised to regitser substantial growth till 2035, owing to the rising demand for the automotive industry in this region. As stated in the report of the International Federation of Robotics (IFR) while demand from the general industry increased by 51%, demand from the automotive sector remained stable. Additionally, 2021 saw a 24% increase in robot installations in Europe, reaching 84,302 units.

Industrial automation demand in the United Kingdom is driven by the rising operational stock of robots in this country. In fact, in 2021, the number of robots in operation was estimated to be 24,445 units (+6%).

In Germany, industrial automation will encounter massive growth because this country belongs to the five biggest robot markets globally driven by the rising exports of robots from this country. Germany's industrial robot exports increased 41% to 22,870 units, surpassing the pre-pandemic total.

The industrial automation sector will also be huge in France due to the rising annual installation of robots in this country. This country is positioned as the third-largest robot installation market in the European region. Furthermore, robot installations reached 5,945 units in 2021, an 11% increase.