Industrial and Automotive Power Transmission Products Market Outlook:

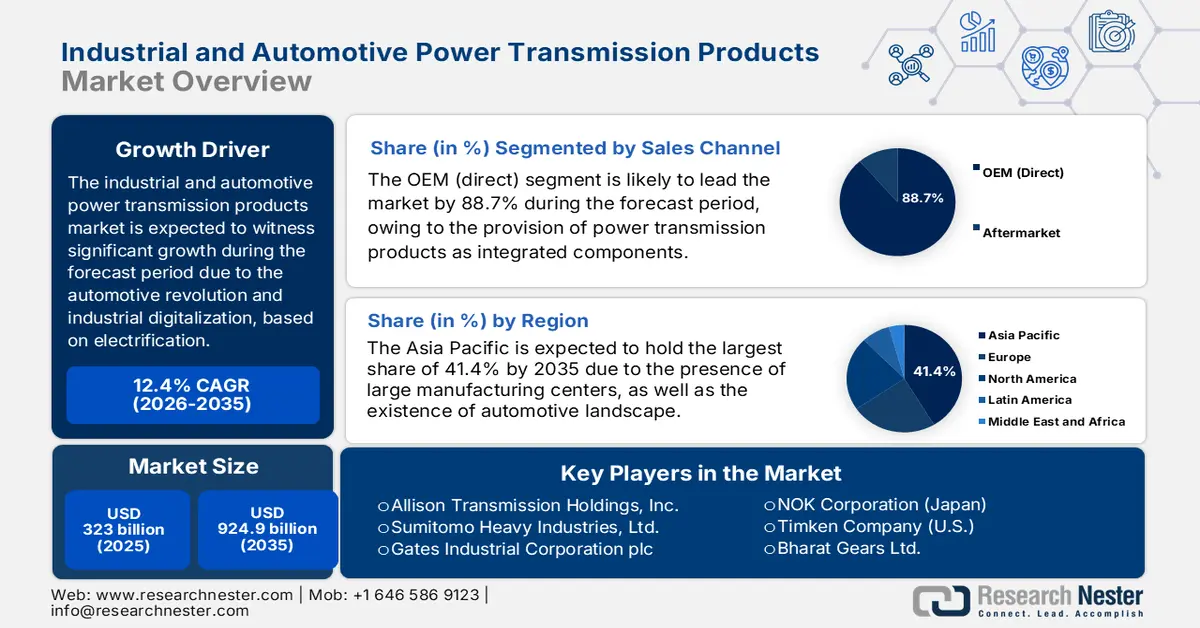

Industrial and Automotive Power Transmission Products Market size was over USD 323 billion in 2025 and is estimated to reach USD 924.9 billion by the end of 2035, expanding at a CAGR of 12.4% during the forecast timeline, i.e., 2026-2035. In 2026, the industry size of industrial and automotive power transmission products is evaluated at USD 363 billion.

The industrial and automotive power transmission products market is witnessing a transformative phase, which is driven by the parallel revolutions in automotive electrification and industrial digitalization. In addition, this industrial and automotive power transmission products market has encompassed components, such as actuators, axles, drives, and gears, which are considered the essential electromechanical and mechanical backbone that enable power and motion transfer across vehicles and factories. According to an article published by the IEA Organization in 2025, electric car sales readily topped 17 million globally as of 2024, denoting a rise by over 25%. Additionally, 3.5 million cars have been sold in the same year, in comparison to 2023. Based on this growth, China has significantly maintained its position in this field, with electric car sales increasing by 11 million. Besides, there has been a record surge in sales by almost 40% to effectively reach 1.3 million, with the U.S. selling 1.6 million electric cars, thus making it suitable for the market’s growth.

International Growth of Electric Car Sales (2014-2024)

|

Years |

China |

Europe |

U.S. |

Rest of World |

|

2014 |

- |

0.1 million |

- |

- |

|

2015 |

0.1 million |

0.1 million |

0.1 million |

- |

|

2016 |

0.3 million |

0.1 million |

0.1 million |

- |

|

2017 |

0.5 million |

0.1 million |

0.1 million |

0.1 million |

|

2018 |

0.8 million |

0.2 million |

0.2 million |

0.1 million |

|

2019 |

0.8 million |

0.4 million |

0.2 million |

0.1 million |

|

2020 |

0.9 million |

0.8 million |

0.2 million |

0.1 million |

|

2021 |

2.7 million |

1.2 million |

0.5 million |

0.1 million |

|

2022 |

4.4 million |

1.6 million |

0.8 million |

0.1 million |

|

2023 |

5.4 million |

2.2 million |

1.1 million |

0.2 million |

|

2024 |

6.4 million |

2.2 million |

1.2 million |

1.0 million |

Source: IEA Organization

Furthermore, the aspect of connected and smart components, along with e-axle proliferation, system integration, the presence of advanced and lightweight materials, and digital twin simulation, are other factors that are driving the industrial and automotive power transmission products market’s upliftment globally. As per an article published by the U.S. Bureau of Labor Statistics in February 2023, the electric vehicle sales in the U.S. are poised to reach 40% of overall passenger cars by the end of 2030, as well as 50% by the same year. Besides, as per the 2025 IEA Organization article, there is a huge demand for electric vehicle batteries, which has reached over 750 GWh as of 2023, denoting a 40% rise from 2022. Moreover, internationally, 95% of growth in the battery demand originated from increased electric vehicle sales, and the remaining 5% derived from SUV sales, thereby creating a positive outlook for the overall industrial and automotive power transmission products market’s exposure.