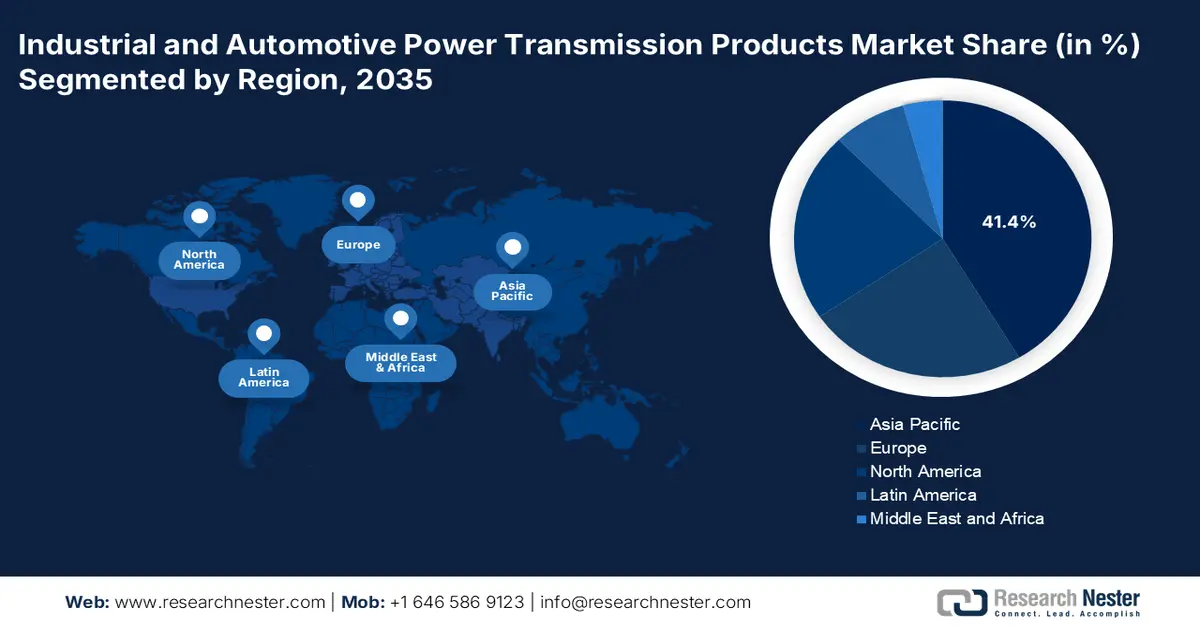

Industrial and Automotive Power Transmission Products Market - Regional Analysis

APAC Market Insights

The Asia Pacific in the industrial and automotive power transmission products market is anticipated to hold the highest share of 41.4% by the end of 2035. The market’s upliftment in the region is highly attributed to its dual role as the international manufacturing center and fastest-growing automotive landscape, especially for electric vehicles. Besides, huge governmental investments in industrial automation, along with the existence of supportive policies for local battery adoption and manufacturing, are also driving the market’s growth in the region. According to an article published by the ITA in September 2025, with over USD 165 billion in investment, there is a growing demand for industrial automation, robotics technologies, and IoT-based services in India, thereby making it suitable for bolstering the market’s exposure in the overall region.

India, in the industrial and automotive power transmission products market, is growing significantly due to the unprecedented confluence of policy-driven manufacturing growth and increased electrification of transport. Besides, the government's Production Linked Incentive (PLI) schemes for advanced chemistry cell batteries, auto components, and automobiles are readily catalyzing massive investments for localized electric vehicles manufacturing. Furthermore, as per an article published by the PIB Government in December 2024, the PLI scheme has outlined a budget of ₹25,938 crore, intended to boost the country’s manufacturing capabilities for Advanced Automotive Technology (AAT) products, combat cost disabilities, and develop a strong supply chain, which denotes an optimistic outlook for the market’s exposure and expansion.

China, in the industrial and automotive power transmission products market, is also growing due to the aspect of unparalleled manufacturing, along with a wide-ranging and state-directed industry policy, which focuses on green transition and technological supremacy. In addition, the Made in China 2025 initiative, as well as its successor approaches, have readily prioritized innovative manufacturing, which comprises new energy vehicles and high-precision robotics. As per the July 2025 State Council Information Office report, the country has significantly registered a record of 5.6 million latest energy vehicles, demonstrating a year-over-year (YoY) increase by 27.8%. Additionally, this also caters to 44.9% of new automobile registrations, which has readily underscored the country’s clean energy transition, thus suitable for boosting the overall market’s exposure.

North America Market Insights

North America in the industrial and automotive power transmission products market is predicted to emerge as the fastest-growing region by the end of the stipulated duration. The market’s development in the region is highly propelled by the CHIPS Act and the U.S. Inflation Reduction Act (IRA), along with rapid automotive electrification and advanced manufacturing reinvestment. As per the 2025 National Telecommunications and Information Administration article, the Broadband Equity Access and Deployment Program (BEAD) Program, functioning under the IIJA, is considered a USD 42.4 billion federal grant program. This has aimed to connect every person in the region to high-speed internet by providing grants for partnerships to develop standard infrastructure. In addition, the NTIA has declared fund allocation for all 56 territories and states as of June 2023, which is also suitable for boosting the market.

The U.S. in the industrial and automotive power transmission products market is gaining increased traction, owing to the strong convergence of technological transformation and industrial policy. In addition, the U.S. Department of Energy (DOE) has highlighted innovative manufacturing, particularly for electric vehicle drivetrains, with generous funding strategies for optimizing drive and motor system efficiency. According to an article published by the U.S. DOE in 2025, the provision of USD 8 billion in commitments and loans to projects has successfully supported the production of over 4 million fuel-efficient vehicles and also ensured more than 35,000 direct employment opportunities across states. Besides, there are other LPO investments that have also escalated the country’s auto manufacturing, thereby making it suitable for the market’s development.

LPO Investments to Escalate Auto Manufacturing in the U.S. (2022)

|

Project Name |

Loan Program |

Owner |

Loan Type |

Loan Amount |

|

FORD |

ATVM |

Ford Motor Company |

Direct Loan |

USD 5.9 billion |

|

NISSAN |

ATVM |

Nissan North America |

Direct Loan |

USD 1.4 billion |

|

TESLA |

ATVM |

Tesla Motors |

Direct Loan |

USD 465 million |

|

ULTIUM CELLS |

ATVM |

Ultium Cells, LLC |

Direct Loan |

USD 2.5 billion |

Source: U.S. Department of Energy

Canada in the industrial and automotive power transmission products market is also developing due to its association with its severe minerals benefit, as well as the presence of the clean industrial policy. In addition, the Innovation, Science and Economic Development Canada (ISED) is proactively supporting the development of a regional electric vehicle supply chain, such as power transmission components, through the Net-Zero Accelerator initiative and the Zero-Emission Vehicles (iZEV) program. As stated in an article published by the Government of Canada in November 2025, the Oil to Heat Pump Affordability Program offers almost USD 10,000 to cover expenses for modifying an oil heating system, and this is readily eligible for homeowners across the country. Meanwhile, the program also provides USD 25,000 in grants for houseowners, especially in territories and provinces, thus stimulating the need for advanced power transmission, which is positively impacting the market’s growth in the country.

Europe Market Insights

Europe in the industrial and automotive power transmission products market is projected to witness steady and considerable growth during the forecast duration. The market’s growth in the region is highly driven by the robust green industrialization agenda, which has been exemplified by the regional Net-Zero Industry Act for mandating domestic manufacturing advantages for clean technologies. This has directly spurred the need for innovative and high-efficiency motors, gearboxes, and drives across industries, such as renewable energy equipment and electric vehicle battery giga factories. According to the 2025 IEA Organization report, there has been a continuous increase in electric vehicle sales, starting from 1.2 million in 2021, which is followed by 1.6 million in 2022, 2.2 million in 2023, as well as 2.2 million in 2024. Therefore, with such an upsurge in sales, there is a huge growth opportunity for the market in the region.

The industrial and automotive power transmission products market in Germany is gaining increased exposure, owing to its emergence as the automotive and industrial manufacturing hub, which is presently undergoing a dual transformation towards Industry 4.0 and electromobility. Besides, the German Federal Ministry for Economic Affairs and Climate Action (BMWK) is proactively funding this transition through the Future Factories program as well as the Digital Now investment grant program. As per an article published by the IEA Organization in 2025, the country’s government has provided financial aid, amounting to EUR 902 million, for successfully installing a battery cell giga factory, particularly in Heide. This funding opportunity is significantly supported by state aid, thereby creating an unprecedented need for power transmission.

The industrial and automotive power transmission products market in France is also growing due to an increase in the push for industrial sovereignty, as well as a rapid transition in energy. According to an article published by the France Government in May 2024, the France 2030 investment plan readily represents €54 billion of investment to significantly ensure transition in the overall economy. In addition, 50% of the fund caters to decarbonizing the economy, and the remaining 50% is dedicated towards innovative and emerging players. Besides, France Relance is yet another exceptional €100 billion recovery plan, which has been initiated by the government to ensure cohesion, competitiveness, and constitute an ecological transition. Therefore, with all these investments, the market is gradually growing in the country.