Immunomodulators Market Outlook:

Immunomodulators Market size was over USD 243.8 billion in 2025 and is poised to exceed USD 466.31 billion by 2035, witnessing over 6.7% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of immunomodulators is estimated at USD 258.5 billion.

Immunomodulators are considered drug treatments that can enhance immune responses under certain health conditions including Chron’s disease, juvenile idiopathic arthritis, lupus, multiple sclerosis, plaque psoriasis, and many more. For instance, methotrexate comprises a suitable success induction ranging between 30% to 86% for at least 6 months, as stated in the November 2022 NLM article. In addition, the incorporation of biotechnology has observed extraordinary advances, particularly in the development of biologics and precision therapies revolutionizing the landscape. Therefore, all these drug developments and innovations are highly responsible for the upliftment of the market globally.

Moreover, the expansion of the immunomodulators market is attributed to the occurrence of respiratory diseases resulting in the demand for immunomodulatory therapies. In addition, even pharmaceutical organizations have come forward with the provision of drugs that are cost-effective for patients. In this regard, AstraZeneca in March 2024 declared an expansion in savings-based programs for its overall US inhaled respiratory portfolio. The purpose of this expansion was to provide a suitable payer’s pricing of medicines not more than USD 35 per month. Moreover, this assisted vulnerable patients suffering from chronic obstructive pulmonary disease (COPD) and asthma, thus a positive impact for the market to expand.

Key Immunomodulators Market Insights Summary:

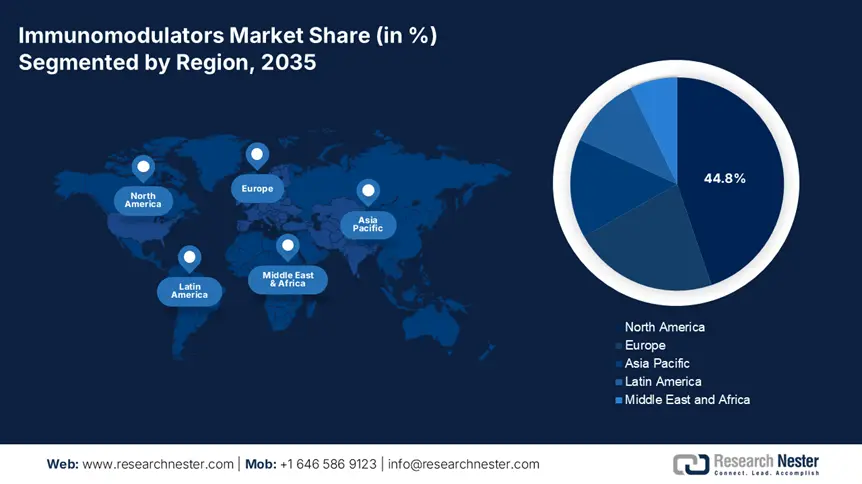

Regional Highlights:

- North America commands a 44.8% share in the Immunomodulators Market, driven by innovative therapies and pharmaceutical advancements, positioning it for significant growth through 2035.

- Asia Pacific's immunomodulators market expects the fastest growth by 2035, driven by rise in immune disorders and elderly population.

Segment Insights:

- Immunosuppressants segment are expected to maintain a 57.2% market share by 2035, propelled by their critical role in organ transplants and autoimmune disease treatment.

Key Growth Trends:

- Advancements in oncology

- Emergence of infectious disorders

Major Challenges:

- Limited comprehension of the immune system

- Side-effects of immunomodulating drugs

- Key Players: Abbott Laboratories, Amgen, Inc., Biogen Inc., Bristol-Myers Squibb Company.

Global Immunomodulators Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 243.8 billion

- 2026 Market Size: USD 258.5 billion

- Projected Market Size: USD 466.31 billion by 2035

- Growth Forecasts: 6.7% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (44.8% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, Japan, United Kingdom, China

- Emerging Countries: India, China, Brazil, Mexico, Turkey

Last updated on : 12 August, 2025

Immunomodulators Market Growth Drivers and Challenges:

Growth Drivers

- Advancements in oncology: The rise in cancer cases has resulted in advancements in oncology which in turn is a driving factor for the immunomodulators market. According to the February 2024 WHO report, in 2022 approximately there were 20 million new cancer cases and 9.7 million deaths. Owing to these, it is essential to develop innovative therapies to aid the condition. According to the January 2025 article published by AACR, the provision of precision medicine, immunotherapy, adoption of artificial intelligence (AI), and cancer prevention strategies have been readily implemented, thus a positive outlook for the market to grow.

- Emergence of infectious disorders: The expansion of the immunomodulators market is expected to increase owing to the surge in the cause of infections. The 2024 WHO statistical report stated that with the COVID-19 occurrence, there has been an increase in communicable diseases by 20.3% in 2020 and 28.1% in 2021. However, with effective research and development, there has been the identification of explicit immune pathways and targets that can be purposefully moderated to combat emerging pathogens, potentially giving rise to a wave of groundbreaking immunomodulators.

Challenges

- Limited comprehension of the immune system: The constrained understanding of the immune system acts as a significant challenge to the expansion of the immunomodulators market. Despite prominent strides in the dominion of immunology, the complex and multi-layered nature of the immune system remains partially masked in mystery. This complexity poses a daunting challenge when attempting to develop highly tailored immunomodulatory treatments. Also, researchers and pharmaceutical entities frequently engage with the intricacies of refining the immune response with a high degree of accuracy, all while navigating unforeseen consequences.

- Side-effects of immunomodulating drugs: Common side-effects of these drugs such as drowsiness, fatigue, diarrhea, loss of appetite, and nausea can make patients reduce the intake, which results in the enhancement of the immunomodulators market. Besides, improper recommendations from healthcare professionals and unfollowing of the dosage content can result in adverse effects. Also, improper chemical content in these drugs owing to lack of training among manufacturers is a huge hindrance for the market upliftment globally.

Immunomodulators Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6.7% |

|

Base Year Market Size (2025) |

USD 243.8 billion |

|

Forecast Year Market Size (2035) |

USD 466.31 billion |

|

Regional Scope |

|

Immunomodulators Market Segmentation:

Product (Immunosuppressants, Immunostimulants)

Immunosuppressant segment is set to dominate over 57.2% immunomodulators market share by 2035. The segment is subjected to the widespread adoption of providing organ transplantation and managing autoimmune ailments. Besides, severe advances have been made for immunosuppressive agents based on signal pathway. As per an article published by Frontiers Organization in May 2022, the bioavailability of tofacitinib was 74%, and its metabolism was evaluated based on hepatic drug enzymes CYP3A4 and CYP2C19. This drug selectively inhibits JAK1 kinase, JAK2 kinase, and JAK3 kinase pathways, denoting it as a prototype drug.

Application (Oncology, Respiratory, HIV)

Based on application, the HIV segment is anticipated to dominate the immunomodulators market at a considerable rate throughout the assessed period. The segment’s growth is attributed to the increase in the prevalence of HIV/AIDS globally. For instance, in 2023, 39.9 million people suffered from this condition internationally, out of which 1.4 million of the population were children between 0 to 14 years of age, and 38.6 million were adults over 15 years, as stated in the 2025 WHO report. To combat this, combination antiretroviral therapy (ART) is one of the most appropriate therapies to aid the infection, thus ensuring a positive impact on the market.

Our in-depth analysis of the global immunomodulators market includes the following segments:

|

Product |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Immunomodulators Market Regional Analysis:

North America Market Analysis

North America immunomodulators market is anticipated to hold revenue share of more than 44.8% by 2035. The region has a huge presence of pharmaceutical and biotechnology organizations catering to overcome rare disease conditions with the adoption of immunomodulatory therapies. For instance, in April 2024, Bristol Myers Squibb and 2seventy Bio, Inc. notified the U.S. FDA approval of Abecma for handling adult patients with relapsed multiple myeloma after two or more prior lines of therapy including an immunomodulatory agent (IMiD), a proteasome inhibitor (PI), and an anti-CD38 monoclonal antibody, based on results from the KarMMa-3 trial.

The enthused urge in the U.S. immunomodulators market is due to the provision of innovative therapies through the development of advanced drugs. As per the May 2024 NLM article, a study was conducted to understand the patterns of dupilumab use, the first systemic drug approved for the treatment of atopic dermatitis (AD). A total of over 81 million patients were considered for the evaluation, out of which among 1,358 patients the use of dupilumab increased from 72% to 84% after its approval. Besides, 92% of patients who readily utilized dupilumab between 2019 and 2021 received no alternative form of treatment since the existing one was suitable. Moreover, patients over 60 years of age were more likely to receive dupilumab, thus driving the market demand.

The immunomodulators market in Canada will flourish owing to the prevalence of governmental guidelines and principles catering to patients with severe health conditions. As per the February 2025 Government of Canada report, immunoglobulin therapy is suitable for pre and post-exposure of temporary passive protection against infections. Besides, in January 2025, AstraZeneca invested USD 570 million in the country to advance the growing global hub and clinical delivery. This will result in over 700 high-skilled jobs, across all areas of the business. In addition, the investment will support the move to a larger, state-of-the-art office facility in the Greater Toronto Area (GTA), Ontario, thus suitable for the market upliftment.

APAC Market Statistics

Asia Pacific is expected to emerge as the fastest-growing nation in the immunomodulators market during the forecast timeline. Factors including the escalating occurrences of autoimmune disorders, infectious maladies, and malignancies have spurred the demand for immunomodulatory therapies in the region. In addition, the region's expanding elderly population is more prone to immune-related ailments. According to the 2025 WHO report, the proportion of aged people over 60 years of age in the Southeast Asia region is projected to increase to 13.7% and 20.3% by 2030 and by 2050. Therefore, this eventually will increase non-communicable diseases, which in turn will increase the demand for immunomodulators.

India is subjected to a huge demand for the use of herbal medicines as traditional therapies to aid diseases, which is driving the growth of the immunomodulators market. For instance, tulsi is the most common herbal plant that boosts the immune system. In March 2022, the World Health Organization and the Government of India agreed to establish the WHO Global Centre for Traditional Medicine. This initiative is supported by an investment of USD 250 million from the Government of India to harness the potential of traditional medicine as immunomodulators from across the world through modern science and technology to improve the health of people.

The immunomodulators market in China is gaining more traction owing to the availability of traditional medicines. As per a study conducted by the Journal of Agriculture and Food Research in December 2024, a systematic investigation was initiated on the effects of synbiotics on immune function by using a cyclophosphamide-induced immunosuppressed mouse model. The study denoted that synbiotics reduced the relative abundance of Firmicutes from 67.41% to 44.06% while enhancing the relative abundance of Bacteroidota from 30.42% to 53.77%. Therefore, the implementation of the immunomodulator effect on traditional medications proved to have a positive impact, thus suitable for the market growth in the country.

Key Immunomodulators Market Players:

- Abbott Laboratories

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Amgen, Inc.

- Biogen Inc.

- Bristol-Myers Squibb Company

- Eli Lilly and Company

- F. Hoffmann-La Roche Ltd.

- Johnson & Johnson

- Mallinckrodt plc

- Merck Sharp & Dohme Corp.

- Novartis AG

- Nuvig Therapeutics, Inc.

- Pfizer Inc.

- Teva Pharmaceutical Industries Ltd.

Key companies are focusing on enhancing their customer base to achieve a modest edge in the industry which is a driving force for the immunomodulators market. Therefore, several organizations are undertaking various strategic initiatives such as mergers and acquisitions and partnerships with other major organizations. For instance, in August 2024, Mallinckrodt plc stated its entry into a definitive agreement under which CVC Capital Partners Fund IX will acquire the company's Therakos business for a purchase price of USD 925 million, subject to customary adjustments. The purpose of this was to ensure supplementary investments in the continued research, development, indication expansion, and geographic expansion of Therakos.

Here's the list of some key players:

Recent Developments

- In December 2024, Nuvig Therapeutics, Inc. announced a USD 161 million Series B financing and progression to Phase 2 development with novel, second-generation immunomodulator. This funding was co-led by pharmaceutical organizations and new investors to diversify the pipeline and provide transformative medicines to patients.

- In August 2023, Pfizer Inc. stated that the U.S. FDA has approved ELREXFIO (elranatamab-bcmm) for the treatment of adult patients with relapsed multiple myeloma (RRMM) who have received at least four prior lines of therapy, including a proteasome inhibitor, an immunomodulatory agent, and an anti-CD38 monoclonal antibody.

- Report ID: 7325

- Published Date: Aug 12, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Immunomodulators Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.