Immunochemistry Market Outlook:

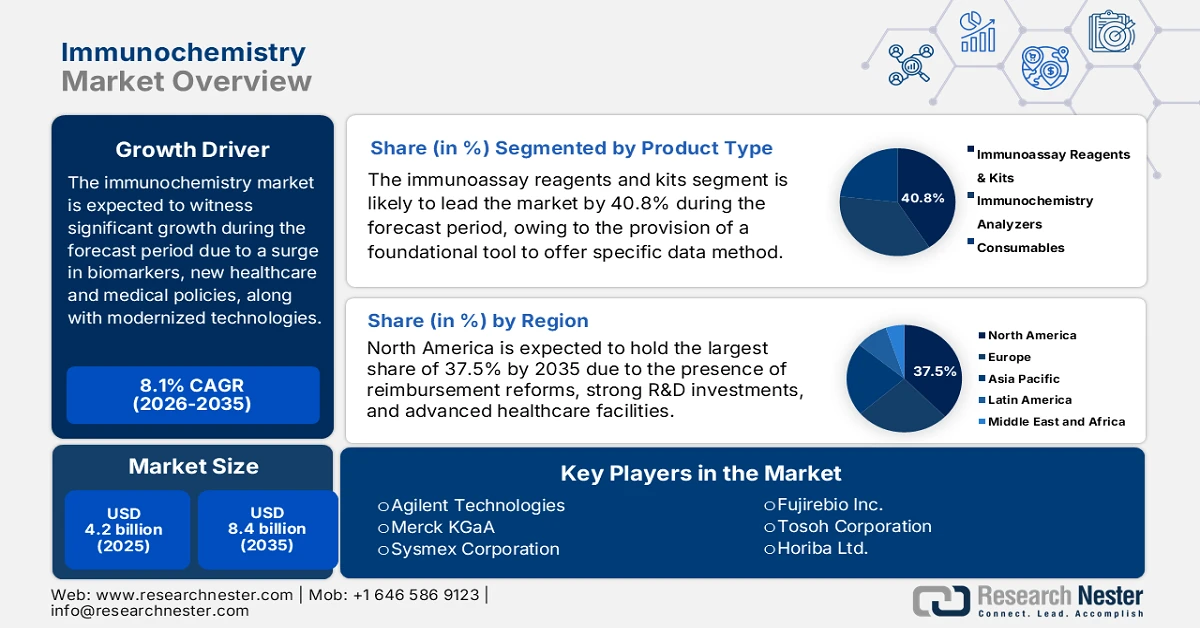

Immunochemistry Market size was over USD 4.2 billion in 2025 and is estimated to reach USD 8.4 billion by the end of 2035, expanding at a CAGR of 8.1% during the forecast timeline, i.e., 2026-2035. In 2026, the industry size of immunochemistry is estimated at USD 4.5 billion.

The international immunochemistry market is deliberately witnessing a rapid adoption, owing to its ability to identify biomarkers with high specificity and sensitivity. Additionally, the market is also expanding in size, along with diversifying its scope with the newest healthcare policies, patient-centric models, and technologies that are reshaping the demand. According to official statistics published by NLM in January 2023, the Marker database comprises 26,374 genetic biomarkers that are associated with over 319 diseases or conditions. Besides, in terms of protein biomarkers, the similar database represents 142 biomarkers that readily cover more than 160 diseases. Moreover, YKL-40, which is a glycoprotein with 3 amino acids tyrosine, lysine, and leucine, especially in the N-terminal and with a molecular weight of 40 kDa, has been proven as a biomarker for detecting pleural effusion, thus driving the market’s exposure.

Furthermore, the aspects of cloud integration, digitalized pathology, sustainability and green diagnostics, biomarker and personalized medicine expansion, along with decentralized testing models, are also uplifting the immunochemistry market globally. As stated in an article published by NLM in August 2025, the integration of artificial intelligence (AI) into dermatopathology constitutes the support of the international medical community, with an increase in the percentage of consensus for boosting diagnostic accuracy and efficiency, with 84.1% of dermatologists believe to include in medical education. Besides, deep learning algorithms, particularly convolutional neural networks, have readily demonstrated an accuracy of 95% in diagnostics in dermatopathology. Therefore, this increased digital technology integration has proliferated the market across different regions.

Key Immunochemistry Market Insights Summary:

Regional Highlights:

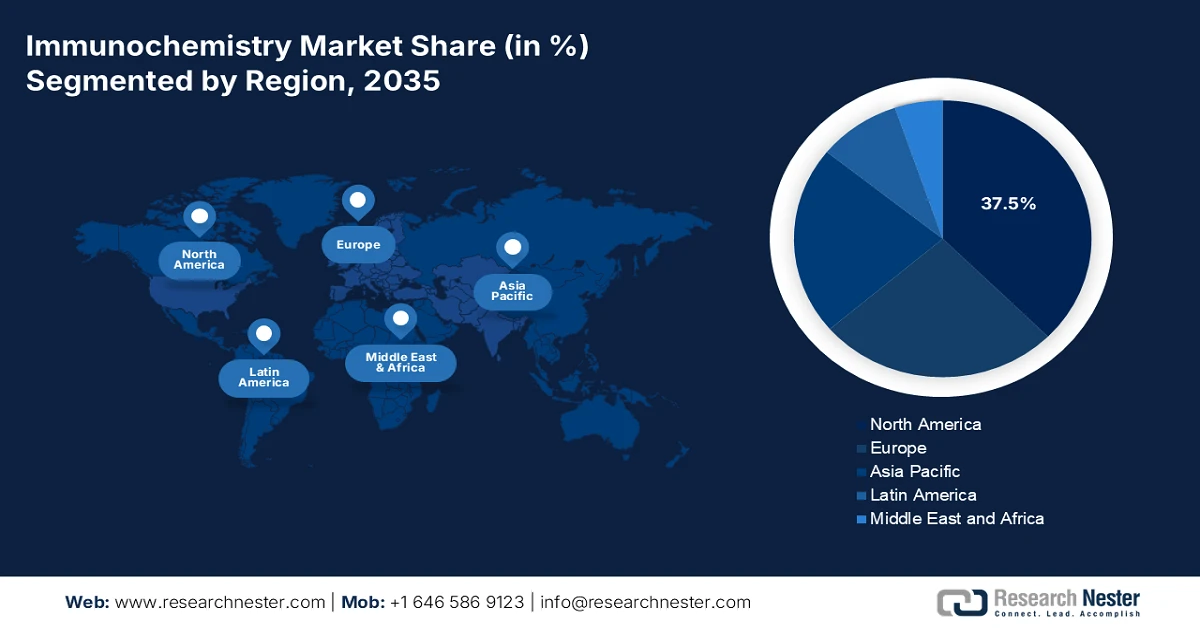

- North America is projected to command a 37.5% share of the immunochemistry market by 2035, supported by strong reimbursement frameworks, intensive R&D activity, and advanced healthcare systems amid rising cancer incidence.

- Asia Pacific is anticipated to register the fastest expansion over 2026–2035, underpinned by growing public healthcare spending, expanding patient pools, and sustained government investment in diagnostic infrastructure.

Segment Insights:

- The immunoassay reagents and kits segment is expected to capture a dominant 40.8% share by 2035 in the immunochemistry market, reinforced by its critical role in research, industrial applications, and clinical diagnostics through highly specific and sensitive analyte detection.

- The oncology application segment is forecast to secure the second-largest market share by 2035, stimulated by escalating global cancer prevalence and the essential use of immunochemistry techniques in precise tumor characterization.

Key Growth Trends:

- Rise in chronic disease burden

- Expansion in healthcare accessibility

Major Challenges:

- Regulatory complexity and compliance

- Shortage of skilled workforce

Key Players: Roche Diagnostics (Switzerland), Abbott Laboratories (U.S.), Thermo Fisher Scientific (U.S.), Danaher Corporation (U.S.), Siemens Healthineers (Germany), Bio-Rad Laboratories (U.S.), Beckman Coulter (U.S.), Agilent Technologies (U.S.), Merck KGaA (Germany), Sysmex Corporation (Japan), Fujirebio Inc. (Japan), Tosoh Corporation (Japan), Horiba Ltd. (Japan), Mindray Medical International (China), Randox Laboratories (UK), Biomerieux SA (France), Cell Signaling Technology (U.S.), CSL Limited (Australia), Seegene Inc. (South Korea), Transasia Bio-Medicals Ltd. (India).

Global Immunochemistry Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 4.2 billion

- 2026 Market Size: USD 4.5 billion

- Projected Market Size: USD 8.4 billion by 2035

- Growth Forecasts: 8.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (37.5% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, Japan, China, United Kingdom

- Emerging Countries: India, South Korea, Brazil, Singapore, Australia

Last updated on : 30 January, 2026

Immunochemistry Market - Growth Drivers and Challenges

Growth Drivers

- Rise in chronic disease burden: The international increase in autoimmune diseases and cardiovascular disorders is rapidly increasing the demand for the market, especially in Latin America and the Asia Pacific. According to official statistics published by the CDC Government in October 2024, 919,032 people died from cardiovascular disease, which is equivalent to 1 in every 3 deaths. Additionally, the payer’s pricing for heart disease is almost USD 417.9 billion, which includes healthcare services, lost productivity, and medicines, owing to death. Besides, every year, nearly 805,000 people in the U.S. suffer from a heart attack, and of these, 605,000 constitute their first heart attack, and 200,000 cases occur for the second time, thereby positively impacting the market globally.

Death Percentage Caused by Heart Disease Across Global Ethnic Group (2024)

|

Region/Race |

Death (%) |

|

Alaska Native |

15.5 |

|

Asia |

18.6 |

|

Black (Non-Hispanic) |

22.6 |

|

Native Hawaii or Other Pacific Islander |

18.3 |

|

White (Non-Hispanic) |

18.0 |

|

Hispanic |

11.9 |

|

Overall |

17.4 |

Source: CDC Government

- Expansion in healthcare accessibility: Countries, such as Malaysia, Brazil, and India, are significantly investing in public health programs, which have increased patient accessibility to the market and are driving industrial penetration. As per an article published by the Health Affairs Organization in January 2026, the healthcare expenditure in the U.S. has effectively reached USD 5.3 trillion, denoting a rise by 7.2% as of 2024, which is similar to the growth in 2023. Besides, private health insurance enrollment has also increased from 207.0 million as of 2023 to 214.3 million in 2024, which comprises Affordable Care Act Marketplace enrollment of 21.1 million. Further, there has been a surge in Medicaid enrollment by over 92.2 million in 2023, all of which is readily responsible for the market’s growth.

- Increase in government healthcare investments: The presence of national health agencies across Asia, Europe, and the U.S. is significantly allocating suitable budgets to strengthen diagnostic infrastructure for the market globally. As stated in an article published by the World Health Organization in December 2023, based on the universal health coverage aspect, the international expenditure on health effectively reached USD 9.8 trillion or 10.3% of the international gross domestic product (GDP). Besides, nearly 11% of the world’s population resided in countries that spent less than USD 50 per person every year, and meanwhile, the average per capita health spending was almost USD 4,000 in high-income nations, which denotes a positive impact for the market’s upliftment.

Challenges

- Regulatory complexity and compliance: The immunochemistry market operates under stringent regulatory frameworks, which vary across regions. In the U.S., the FDA enforces rigorous approval processes, while Europe follows EMA guidelines, and the Asia Pacific countries have their own regulatory bodies. This fragmented landscape creates delays in product launches and increases compliance costs for manufacturers. Companies must navigate multiple approval pathways, often requiring extensive clinical validation and documentation. Small-scale firms, in particular, face challenges in meeting these requirements due to limited resources. Regulatory hurdles also extend to quality assurance, data security, and patient safety standards, which are becoming stricter with the rise of digital diagnostics.

- Shortage of skilled workforce: The market requires highly trained professionals to operate analyzers, interpret results, and maintain quality standards. However, there is a global shortage of skilled laboratory technicians and pathologists, particularly in developing regions. This shortage is exacerbated by the rapid adoption of advanced technologies, which demand specialized training. Many healthcare systems lack structured programs to upskill professionals in immunochemistry, leading to inefficiencies and diagnostic errors. In rural and underserved areas, the absence of trained staff often forces reliance on centralized labs, delaying results and impacting patient outcomes. Even in developed countries, the demand for skilled personnel outpaces supply, creating bottlenecks in diagnostic workflows.

Immunochemistry Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

8.1% |

|

Base Year Market Size (2025) |

USD 4.2 billion |

|

Forecast Year Market Size (2035) |

USD 8.4 billion |

|

Regional Scope |

|

Immunochemistry Market Segmentation:

Product Type Segment Analysis

The immunoassay reagents and kits segment, which is part of the product type, is anticipated to garner the largest market share of 40.8% by the end of 2035. The segment’s upliftment is highly driven by its emergence as a foundational tool in industry, research, and modern medicine, offering specific and sensitive methods for quantifying analytes. According to official statistics published by Biologicals in May 2025, there exist more than 3.5 million antibody-driven products, and 99% are animal-based, such as recombinant, monoclonal, and polyclonal, while the remaining less 1% are animal-free antibodies. Besides, AbCalis is significantly utilized with more than 10 billion antibodies from an estimated 100 donors, which is effectively boosting the segment’s growth. Besides, the continuous supply of clinical trial kits across different countries is also denoting a huge growth opportunity for the market.

2023 Clinical Trial Kits Export and Import

|

Countries |

Export (USD) |

Import (USD) |

|

U.S. |

294 million |

144 million |

|

UK |

107 million |

- |

|

Germany |

88.6 million |

- |

|

Malaysia |

- |

279 million |

|

China |

- |

74.9 million |

|

Global Trade Valuation |

1.2 billion |

|

|

Global Trade Share |

0.0053% |

|

|

Product Complexity |

0.99 |

|

Source: OEC

Application Segment Analysis

By the end of the forecast period, the oncology segment, part of the application, is projected to hold the second-largest share in the market. The segment’s growth is highly fueled by the rising prevalence of cancer worldwide. Immunochemistry techniques such as immunohistochemistry (IHC) and immunoassays are critical in cancer diagnostics, enabling the detection of tumor markers, hormone receptors, and genetic mutations. These methods provide clinicians with precise information about tumor type, stage, and potential treatment pathways, making them indispensable in personalized medicine. The increasing adoption of immunochemistry in oncology is driven by government-backed cancer screening programs, growing awareness of early detection, and advancements in biomarker research.

Technology Segment Analysis

Based on the technology segment, the chemiluminescence immunoassay (CLIA) sub-segment is expected to account for the third-largest share in the immunochemistry market during the stipulated duration. The sub-segment’s development is highly propelled by utilizing chemiluminescent labels to detect antigen-antibody reactions, producing highly accurate results even at very low analyte concentrations. This makes it particularly valuable in detecting infectious diseases, cardiac markers, and oncology biomarkers. In comparison to conventional ELISA methods, CLIA offers faster turnaround times, higher throughput, and improved reproducibility, making it the preferred choice in modern diagnostic laboratories. The technology’s ability to integrate with automated analyzers reduces manual errors and enhances workflow efficiency, which is critical for large-scale hospital and laboratory settings.

Our in-depth analysis of the market includes the following segments:

|

Segment |

Subsegments |

|

Product Type |

|

|

Application |

|

|

Technology |

|

|

End user |

|

|

Testing Method |

|

|

Research Use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Immunochemistry Market - Regional Analysis

North America Market Insights

North America immunochemistry market is anticipated to garner the highest share of 37.5% by the end of 2035. The market’s upliftment in the region is highly fueled by the presence of government reimbursement programs, robust research and development investments, and innovative healthcare infrastructure. According to official statistics published by the America Cancer Society Organization in 2025, almost 40% of newly diagnosed cancers affect the adult population in the U.S., accounting for nearly 811,000 cases as of 2025. These cases are potentially unavoidable since 19% cancers are caused by tobacco smoking, 8% by excessive body weight, and 5% by increased alcohol consumption. Besides, over 18 million people in the region have a history of invasive cancer, the majority of which have been diagnosed. Therefore, with a surge in cancer cases, there is a huge growth opportunity for the market in the region.

Estimated New Cancer Cases and Deaths in America by Gender (2025)

|

|

New Cases |

New Deaths |

||||

|

Components |

Both Gender |

Male |

Female |

Both Gender |

Male |

Female |

|

All sites |

2,041,910 |

1,053,250 |

988,660 |

618,120 |

323,900 |

294,220 |

|

Oral Cavity and Pharynx |

59,660 |

42.500 |

17,160 |

12,770 |

9,130 |

3,640 |

|

Digestive System |

362,200 |

201,190 |

161,010 |

174,520 |

100,250 |

74,270 |

|

Respiratory System |

245,700 |

124,700 |

121,000 |

130,200 |

68,340 |

61,860 |

|

Bones & Joints |

3,770 |

2,150 |

1,620 |

2,190 |

1,240 |

950 |

|

Soft Tissue (including heart) |

13,520 |

7,600 |

5,920 |

5,410 |

2,960 |

2,450 |

Source: America Cancer Society Organization

The immunochemistry market in the U.S. is growing significantly, owing to federal healthcare allocations, reimbursement programs, and generous investment in innovative diagnostics and laboratory capacity. Based on government estimates published by the CDC Government in April 2025, 76.4% of the country’s adults, accounting for 194 million, reported suffering from more than 1 chronic condition as of 2023. This includes 59.5%, 78.4%, and 93.0% of young, mid-life, and older adults, respectively. In addition, 51.4%, which is 130 million adults, are affected with multiple chronic conditions (MCC), with 27.1%, 52.7%, and 78.8% of young, midlife, and old adults. Moreover, the prevalence significantly increased from 52.5% to 59.5% for more than 1 condition, and 21.8% to 27.1% for MCC, thereby denoting a huge growth opportunity for the market in the country.

The provision of robust provincial and federal healthcare expenditure, diagnostic programs, partnerships with biotech firms, the integration of AI in diagnostic imaging, and the adoption of digitalized platforms are uplifting the market in Canada. Based on government estimates published by the Government of Canada in January 2026, the National Strategy for Drugs for Rare Diseases has been launched and provides an ongoing fund of almost USD 500 million every year to assist people with suitable drugs for rare diseases. In addition, the strategy also offered USD 1.4 million in funding availability to domestic territories and provinces based on a 3-year agreement to help in offering better accessibility and coverage. Besides, as per the August 2024 NCBI article, the country comprises 432 MRI units across 11 jurisdictions that have been identified by the Canada Medical Imaging Inventory (CMII) between 2022 and 2023, which is bolstering the market’s growth.

APAC Market Insights

The Asia Pacific immunochemistry market is expected to emerge as the fastest-growing region during the forecast period. The market’s development in the region is highly propelled by an increase in government-funded healthcare expenditure, large-scale patient demand, and the provision of government investment in diagnostic infrastructure. Besides, according to official statistics published by NLM in June 2024, an estimated 75% of the population in Thailand is under the universal health coverage (UHC) scheme. Besides, as per a data report published by the APACMED Organization in April 2022, investments in UHC in the region generated USD 2.5 trillion. In addition, regional patients and stakeholders, along with healthcare professionals, have witnessed accurate and rapid testing solutions, all of which are significantly responsible for uplifting the market in the region.

The immunochemistry market in China is gaining increased traction, owing to the aspect of government-based healthcare investments, an expansion in the patient base, urban healthcare infrastructure, manufacturing and innovation capacity, and policy support. As stated in an article published by NLM in August 2023, the country comprises 12,000 public hospitals, deliberately offering healthcare services to over 900 million people, which accounts for more than 70% of the overall population. Moreover, yearly patient visits accounted for 437,000 as of 2022, along with conducting 8,442 operations, 45,900 discharged patients, 1,200 transferred patients, and USD 726 million in income. Therefore, with the continuous increase in hospital facilities, the market is continuously developing in the overall country.

An increase in government funding, a large patient population, public health strategies, cost-effective diagnostic solutions, and private sector growth are certain drivers that are boosting the immunochemistry market in India. Based on government estimates published by the Ministry of Health and Family Welfare in December 2024, the Department of Health Research (DHR) has successfully integrated a Central Sector Scheme for establishing a strong network of laboratories for managing national calamities and epidemics, by providing Rs. 324 Crore. In terms of this, an overall 163 Viral Research & Diagnostic Laboratories (VRDLs) have been significantly sanctioned across different research institutions and medical colleges. Additionally, of these, 11 VRDLs comprise a regional status, suitable for detecting high-risk infectious pathogens of public health significance, thus making it suitable for boosting the market’s growth.

Europe Market Insights

Europe market is projected to witness considerable growth by the end of the stipulated period. The market’s growth in the region is highly driven by the existence of government-funded screening programs, infectious disease diagnostics, and a rise in cancer cases. According to official statistics published by NLM in March 2025, the region recorded 4,471,422 cancer cases, which is 280 per 100,000 people as of 2022, with 27.9% cumulative risk. In addition, the male population accounted for 2,359,303 cases, with 31.9% cumulative risk, along with the female population, catering to 2,112,119 cases with 24.7% cumulative risk. Moreover, West and North Europe comprised the highest incidence rates, with Denmark resulting in 374.7 per 100,000, owing to advanced healthcare and screening, thus enhancing the market’s demand in the whole of the region.

Cancer Incidence and Mortality in Europe by Gender Population (2022)

|

Region |

Gender |

Population |

New Cases |

Age Standardized Rate |

Cumulative Risk |

Top 3 Leader Cancers |

Mortal Cancer Deaths |

|

East Europe |

Male |

137,314,603 |

680,411 |

295.9 |

31% |

Prostate, lung, and colorectum |

380,56 |

|

Female |

154,548,370 |

680,908 |

226.3 |

22.8% |

Breast, colorectum, and corpus uteri |

316,82 |

|

|

Both Gender |

291,862,973 |

1,361,319 |

250.5 |

26.1% |

Breast, colorectum, and lung |

697,39 |

|

|

North Europe |

Male |

52,963,352 |

386,085 |

337.9 |

32.6 |

Prostate, lung, and colorectum |

149,83 |

|

Female |

54,164,287 |

335,992 |

293 |

27.9% |

Breast, colorectum, and lung |

131,79 |

|

|

Both Gender |

107,127,639 |

722,077 |

312.5 |

30.1% |

Prostate, breast, and lung |

281,62 |

|

|

South Europe |

Male |

74,143,121 |

531,344 |

311 |

31.1% |

Prostate, lung, and colorectum |

250,04 |

|

Female |

77,501,382 |

440,855 |

247.6 |

23.9% |

Breast, colorectum, and lung |

191,35 |

|

|

Both Gender |

151,644,503 |

972,199 |

275.1 |

27.3% |

Breast, colorectum, and lung |

441,39 |

|

|

West Europe |

Male |

96,820,948 |

761,463 |

338.2 |

33.1% |

Prostate, lung, and colorectum |

311,42 |

|

Female |

100,087,764 |

654,364 |

277.1 |

26.6% |

Breast, colorectum, and lung |

254,25 |

|

|

Both Gender |

196,908,712 |

1,415,827 |

304 |

29.7% |

Breast, colorectum, and lung |

565,67 |

|

|

All Europe |

Male |

361,242,024 |

2,359,303 |

319.6 |

24.7% |

Prostate, lung, and colorectum |

1,091,871 |

|

Female |

386,301,803 |

2,112,119 |

253.4 |

24.7% |

Breast, colorectum, and lung |

894,222 |

|

|

Both Gender |

747,543,827 |

4,471,422 |

280 |

27.9% |

Breast, colorectum, and lung |

1,986,093 |

Source: NLM

The immunochemistry market in Germany is gaining increased exposure, owing to the adoption of innovative diagnostics, robust healthcare expenditure, and the presence of infectious and oncology disease programs. As per an article published by NLM in February 2024, there has been an increase in invasive S. pyogenes isolates by 142%, and meanwhile, H. influenzae isolates also increased by 90% in the country. Besides, the influenza virus has been detected in 28% of hospitalized patients, along with 18% of respiratory syncytial virus and 11% of severe acute respiratory syndrome coronavirus type 2. Moreover, adults in the country are more than 55 years old, and are commonly affected with S. aureus, accounting for 14.4 per 100,000 population, and S. pneumoniae with 2.1 per 100,000 population, thereby denoting an optimistic outlook for the market’s expansion.

The presence of ABPI-based affordability initiatives, NHS-driven cancer screening programs, easy patient accessibility, and governmental commitment to precision medicine are drivers that are positively uplifting the immunochemistry market in the UK. As stated in an article published by the UKRI Organization in July 2023, the Medical Research Council’s precision medicine strategy, since its commencement, has become a major part of the domestic research approach, with a generous commitment of £75 million in funding for a wide range of research consortia. As per an article published by the UK Parliament in October 2025, the life sciences industry is critical for domestic economic growth and investment, and it readily contributes more than £146 billion in turnover and also employs over 359,000 people across over 6,170 businesses. The industry’s productivity is 2.5 times the country's average, thus making it crucial to the government’s growth mission.

Key Immunochemistry Market Players:

- Roche Diagnostics (Switzerland)

- Abbott Laboratories (U.S.)

- Thermo Fisher Scientific (U.S.)

- Danaher Corporation (U.S.)

- Siemens Healthineers (Germany)

- Bio-Rad Laboratories (U.S.)

- Beckman Coulter (U.S.)

- Agilent Technologies (U.S.)

- Merck KGaA (Germany)

- Sysmex Corporation (Japan)

- Fujirebio Inc. (Japan)

- Tosoh Corporation (Japan)

- Horiba Ltd. (Japan)

- Mindray Medical International (China)

- Randox Laboratories (UK)

- Biomerieux SA (France)

- Cell Signaling Technology (U.S.)

- CSL Limited (Australia)

- Seegene Inc. (South Korea)

- Transasia Bio-Medicals Ltd. (India)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- Roche Diagnostics is a global leader in immunochemistry, with its Cobas analyzers widely adopted in hospitals and labs. The company’s strong focus on oncology and infectious disease diagnostics positions it as a dominant player in Europe and worldwide.

- Abbott Laboratories’ Architect and Alinity platforms are central to immunoassay testing, particularly in infectious disease and cardiology. Its broad global presence and continuous innovation in reagents and kits make it a key driver of market growth.

- Thermo Fisher Scientific provides advanced immunoassay reagents and instruments, with a strong emphasis on research applications. Its integration of immunochemistry into precision medicine and biotechnology research strengthens its competitive edge.

- Danaher Corporation, through subsidiaries such as Beckman Coulter, has a strong footprint in immunochemistry diagnostics. The company focuses on automation and workflow efficiency, making its systems essential for large-scale clinical laboratories.

- Siemens Healthineers is a major player in immunoassay analyzers, with its Atellica platform offering high-throughput solutions. Its strong Europe-driven base and investment in digital diagnostics enhance its leadership in immunochemistry.

Here is a list of key players operating in the global market:

The worldwide immunochemistry market is highly competitive, dominated by multinational corporations such as Roche, Abbott, and Thermo Fisher, alongside regional leaders in Asia-Pacific like Sysmex, Mindray, and Seegene. Strategic initiatives include mergers and acquisitions, expansion into emerging markets, and heavy investment in research and development for advanced immunoassay platforms. Companies are increasingly adopting digital pathology, AI-driven diagnostics, and point-of-care testing solutions to strengthen their market position. Government-backed healthcare programs and collaborations with research institutes further enhance competitiveness. Besides, in January 2025, ImmunityBio, Inc. announced the significant progress in its continuous discussions with the U.S. Food and Drug Administration (FDA) regarding 3 crucial areas of its clinical development pipeline for non-muscle invasive bladder cancer, as well as non-small cell lung cancer, thus bolstering the immunochemistry industry’s growth.

Corporate Landscape of the Immunochemistry Market:

Recent Developments

- In January 2026, Biogen Inc. declared that the U.S. FDA has successfully granted the Breakthrough Therapy Designation for litifilimab for aiding cutaneous lupus erythematosus (CLE), which is a first in-class, humanized IgG1 monoclonal antibody (mAb) targeting blood dendritic cell antigen 2.

- In December 2025, Kura Oncology, Inc. announced new data demonstrating a suitable safety profile and encouraging antileukemic activity for KOMZIFTI by combining venetoclax and azacytidine to aid acute myeloid leukemia harboring NPM1 mutations.

- In October 2024, Astellas Pharma Inc. notified that the U.S. FDA has readily approved VYLOY in combination with fluoropyrimidine- and platinum-containing chemotherapy for the first-line treatment of adults with locally advanced unresectable or metastatic human epidermal growth factor receptor 2.

- Report ID: 8373

- Published Date: Jan 30, 2026

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Immunochemistry Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.