Hyper-Converged Infrastructure Market Outlook:

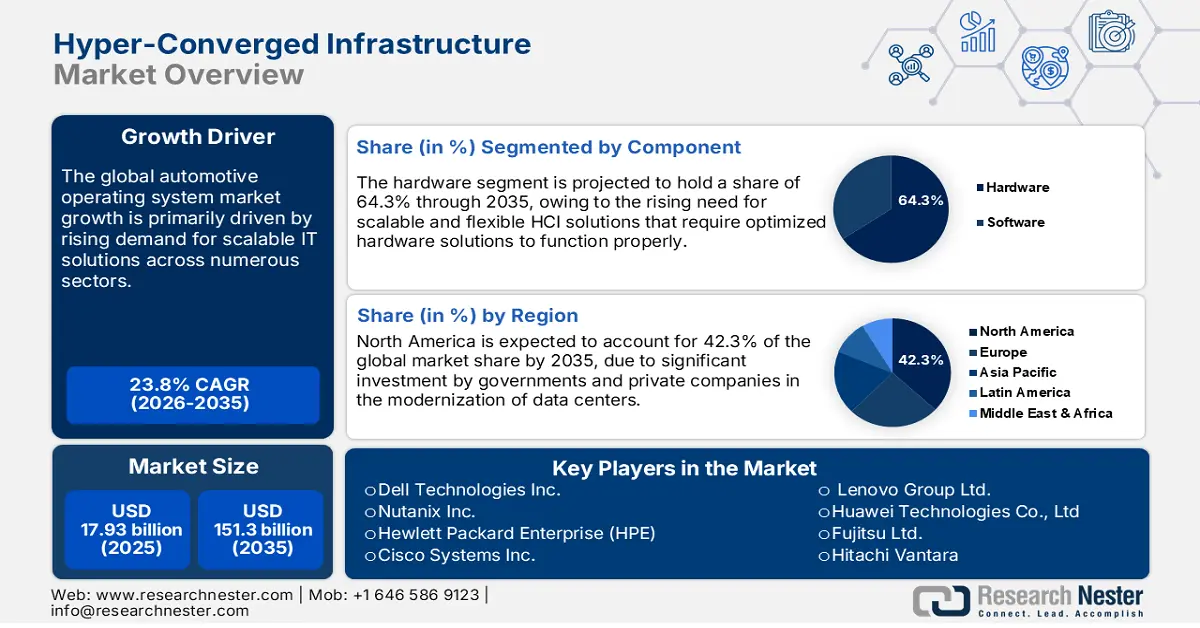

Hyper-Converged Infrastructure Market size was valued at USD 17.93 billion in 2025 and is projected to reach USD 151.3 billion by the end of 2035, rising at a CAGR of 23.8% during the forecast period, i.e., 2026-2035. In 2026, the industry size of hyper-converged infrastructure is assessed at USD 22.1 billion.

The market is poised for significant growth due to the rising demand for scalable IT solutions across various sectors. There have been humongous IT modernization efforts by governments to promote the widespread adoption and use of hyper-converged infrastructure (HCI). As reported by the U.S. Government Accountability Office in June 2025, the Department of Defense (DOD) set a budget of USD 10.9 billion for 24 major IT programs initiated between 2023 and 2025. Market players are acknowledging that the deployment of HCI systems in networking or computing can result in enhanced resource utilization and cost savings.

DOD’s Actual and Planned Costs for Selected IT Business Programs from FY 2023 through FY 2025

|

Initiatives |

Actual Budget (USD Million) 2023 |

Planned (USD Million) 2025 |

|

Department of Defense Healthcare Management System Modernization |

792 |

628 |

|

Navy Enterprise Resource Planning |

431 |

616 |

|

Joint Operational Medicine Information Systems |

141 |

212 |

|

Advancing Analytics |

102 |

163 |

|

Military Health System Information Platform |

110 |

151 |

|

Global Combat Support System-Marine Corps/Logistics Chain Management |

81 |

131 |

|

Enterprise Business Systems-Convergence |

1 |

139 |

|

Theater Medical Information Program-Joint Increment 2 |

32 |

69 |

Source: GAO

The need for cost reduction in organizations is anticipated to accelerate the adoption of hyper-converged infrastructure over time. Companies are eliminating the need to use and maintain multiple specialized hardware and software, since in HCI, computation, storage, and networking are consolidated into an individual system. Several technology companies are contributing to increasing the market availability of HCI, which can help other industrial businesses reduce operational costs. For example, at CloudFest 2025 in March 2025, ZTE and Virtuozzo unveiled their strategic partnership to launch a new HCI solution. The HCI solution is incorporated with S3 object storage software and high-performance server hardware with Virtuozzo Hybrid Infrastructure.

Key Hyper-Converged Infrastructure Market Insights Summary:

Regional Insights:

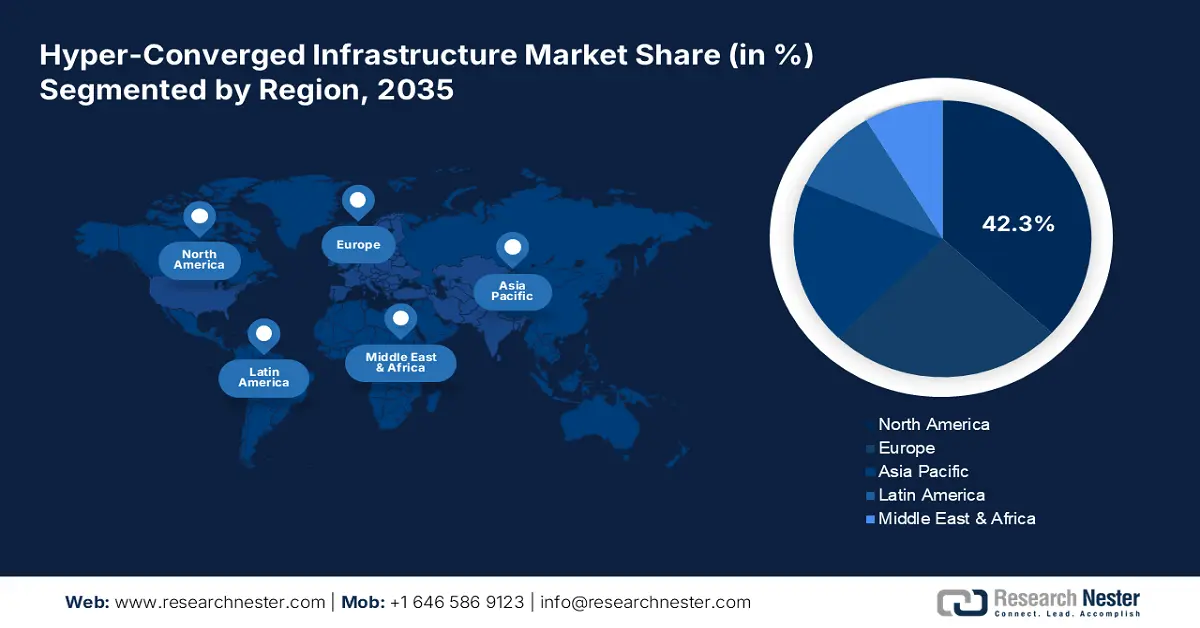

- By 2035, North America is projected to secure a 42.3% share in the Hyper-Converged Infrastructure Market, underpinned by substantial public and private investments directed toward modernizing data-center infrastructure.

- By 2035, Asia Pacific is anticipated to attain a robust share, enabled by rapid industrial growth across IT, telecom, and BFSI sectors coupled with government initiatives advancing smart-city ecosystems.

Segment Insights:

- By 2035, the hardware segment in the Hyper-Converged Infrastructure Market is projected to hold a 64.3% share, propelled by the escalating demand for scalable and flexible HCI systems supported by advancements in integrated hardware components.

- By 2035, the virtual critical applications segment is anticipated to secure a notable market share, supported by rising needs for secure and scalable IT infrastructure among financial and healthcare institutions driven by heightened data-privacy requirements.

Key Growth Trends:

- Rising adoption of hybrid and multi-cloud strategies

- Rising emphasis on data security and compliance

Major Challenges:

- Vendor lock-in concerns

Key Players: Dell Technologies Inc., Nutanix Inc., Hewlett Packard Enterprise (HPE), Cisco Systems Inc., Lenovo Group Ltd., Huawei Technologies Co., Ltd., Fujitsu Ltd., Hitachi Vantara, IBM Corporation, NEC Corporation, Inspur Group, Supermicro (Super Micro Computer Inc.), Atos SE, HCLTech, Datacom Grou.

Global Hyper-Converged Infrastructure Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 17.93 billion

- 2026 Market Size: USD 22.1 billion

- Projected Market Size: USD 151.3 billion by 2035

- Growth Forecasts: 23.8% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (42.3% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, United Kingdom, Japan

- Emerging Countries: United States, China, Germany, United Kingdom, Japan

Last updated on : 3 October, 2025

Hyper-Converged Infrastructure Market - Growth Drivers and Challenges

Growth Drivers

- Rising adoption of hybrid and multi-cloud strategies: Government agencies, besides businesses, play a crucial role in the growth of the hybrid and multi-cloud infrastructure. As per the report by the World Bank, published in March 2025, developing economies are ubiquitously applying cloud-first policies. The use of hybrid and multi-cloud deployments for government purposes is also increasing. Market players are relying on HCI for the smooth integration of the cloud platforms and optimizing resource allocation. Prominent companies have incorporated HCI-enabled platforms that help in the seamless deployment of the hybrid or multi-cloud services. This allows companies to handle workloads in cloud infrastructure with higher efficiency.

- Rising emphasis on data security and compliance: Rising cases of cybersecurity globally is a key factor expected to fuel market growth in the coming years. According to the Cyber Security Breaches Survey 2024, around 50% businesses and 32% of charities in the UK alone witnessed cyberattacks in the last 12 months. Similarly, as disclosed by the CSIS in December 2024, cyberattacks on government entities surged by 138% government between 2019 and 2023. HCI systems render state-of-the-art security features and access control, adhering to the National Institute of Standards and Technology framework. Enterprises and governments need to align their IT environment with well-known frameworks and include HCI’s security features to shield data.

Top 10 Countries in Terms of Cybercity Measures Implemented by Central Governments

|

Rank |

Country |

National Cyber Security Index |

|

1. |

Czeh Republic |

98.3 |

|

2. |

Canada |

96.6 |

|

3. |

Estonia |

96.6 |

|

4. |

Finland |

95.8 |

|

5. |

Romania |

92.5 |

|

6. |

Poland |

92.5 |

|

7. |

Belgium |

92.5 |

|

8. |

Germany |

90.8 |

|

9. |

France |

89.1 |

|

10. |

Spain |

89.1 |

|

11. |

Denmark |

89.1 |

Source: NCSI

- Rising adoption of AI and automation technologies: Businesses are consistently adopting AI-enabled HCI solutions to resolve potential issues associated with operational efficiency and business process automation. Key players in the market are also active in the development of such HCI solutions. For example, Hitachi Vantara and Cisco collaboratively launched a new co-engineered solution in February 2025 for Red Hat Shift, a leading cloud application platform. The HCI solution is incorporated with the compute and networking systems of Cisco and Virtual Storage Platform (VSP) arrays of Hitachi Vantara.

Challenges

- Vendor lock-in concerns: The dependence on a particular vendor for HCI solutions raises concerns for long-term costs and flexibility. Various organizations are apprehensive about reduced flexibility from incorporating HCI solutions. Key companies utilize closed architecture and restrict any type of interoperability with 3rd party solutions. Also, switching vendors may include exorbitant retraining and relicensing. Sanctions that have been imposed on certain countries, due to geopolitical tensions, including war, have restricted the vendor availability of HCI solutions there.

Hyper-Converged Infrastructure Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

23.8% |

|

Base Year Market Size (2025) |

USD 17.93 billion |

|

Forecast Year Market Size (2035) |

USD 151.3 billion |

|

Regional Scope |

|

Hyper-Converged Infrastructure Market Segmentation:

Component Segment Analysis

The hardware segment is projected to account for share of 64.3% by the end of 2035. This can be attributed to the rising need for scalable and flexible HCI solutions such as such as integrated servers, networking elements, and storage, that require optimized hardware solutions to function properly. Technology companies are consistent in innovating hardware solutions, effective in modernized HCI solutions. In August 2023, the Data Center Intelligence Group (DCIG) awarded Huawei FusionCube as one of the best enterprise HCI providers. The recognition was for diverse computing ecosystems, intelligent O&M management, and flexible hardware integration.

Application Segment Analysis

By the end of 2035, the virtual critical applications segment is expected to acquire a remarkable market share, owing to the growing demand for more secure and scalable IT infrastructure in financial institutions and the healthcare sector for data privacy and confidentiality. The ongoing remote working trend is also increasing the demand for centralized IT management, possibly to be enabled with the use of HCI solutions. The integration of HCI solutions is integral in businesses across various industries for scalability and flexibility, with the rising adoption of cloud computing.

End Use Segment Analysis

The BFSI segment is projected to hold a high revenue share by 2035, on account of the stringent regulations obligating organizations to implement robust measures to ensure data security. The Digital Personal Data Protection Act 2023 was introduced in India in August 2023. The law has obligated businesses to store and use crucial data more securely, leading to an increasing integration of HCI solutions, due to functions that include data encryption and centralized policy management. The IT department in banks requires a zero-trust architecture for the protection of the financial data, indicating demand for HCI solutions.

Our in-depth analysis of the global hyper-converged infrastructure market includes the following segments:

|

Segments |

Subsegments |

|

Component |

|

|

Enterprise |

|

|

Application |

|

|

End Use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Hyper-Converged Infrastructure Market - Regional Analysis

North America Market Insights

North America is projected to garner a leading position with 42.3% market share by 2035. The growth of the market is fueled by significant investment by governments and private companies in the modernization of data centers. The region is a hub for an advanced technological landscape, and almost all the sectors are fortifying their IT architecture. For instance, in January 2025, the U.S. government allocated USD 42.5 billion to expand broadband access and provide high-speed internet access. This is the testimony that the government is committed to enhancing the country’s digital infrastructure, indicating a rising need for HCL solutions.

The hyper-converged infrastructure market in the U.S. is expected to register a robust CAGR during the forecast period, due to rising initiatives by the federal government to regulate and upgrade communication systems. As reported by the Office of the Attorney General in March 2024, amendments were initiated in the California Consumer Privacy Act of 2018 (CCPA), which has led to the provision of new privacy rights to consumers, including their rights to change, delete, and prevent third-party access to personal information available to businesses. This is pushing the vendors of HCI solutions to innovate more to avoid complexities in the management of software-defined systems. Rapid investment by organizations across multiple industries in digital transformation is indicating the scope of rising adoption of HCI solutions.

The market in Canada is fueled by widespread adoption of cloud services and rising security mandates for data security from the government. Stringent regulations are compelling market players to include robust data protection solutions and raise the privacy standards. Through the initiation of Cloud Adoption Strategy 2023, the Government of Canada Cloud Strategy 2018 was updated, introducing new compliance for reference, recordkeeping, and research. This is likely to lead to an increased adoption of the HCI solutions in organizations, especially when there is widespread availability of vendors. Additionally, the government offers schemes to incentivize digital transformation, influencing a growing demand for HCI solutions.

Europe Market Insights

The hyper-converged infrastructure market in Europe is set to operate with an extensive revenue share by the end of 2035, owing to various government initiatives and investments made for digital transformation. In November 2021, the European Commission declared the launch of the Digital Europe Program, infusing USD 2.3 billion to speed up the digital transformation. Access to such funding support is likely to make the HCI integration increasingly convenient for organizations with lower investment capabilities. International investments are also taking place for data center proliferation in the UK, accelerating the demand for scalable and flexible IT solutions powered by HCI. As per the report of the HM Government, published in October 2024, 4 U.S.-based companies announced USD 8.4 billion of investment in total to enhance the UK’s AI capacity through data center proliferation.

Germany hyper-converged infrastructure market is expected to register a lucrative CAGR throughout the forecast timeline, due to a focus of the government on the promotion of Industry 4.0 and advanced technology integration, including AI, ML, and IoT, increasing the demand for HCI solutions for scalable and flexible management of IT tools. The government intends to use Industry 4.0 optimally to strengthen the manufacturing base of the country as well, influencing a rapid adoption of HCL solutions in the sector. Robust expansion of AI is also revolutionizing the HCI landscape by enabling streamlined orchestration, predictive maintenance, and workload management. As reported by the U.S. Trade Administration in May 2024, around 508 AI start-ups emerged in 2023 in Germany.

The UK HCI market is predicted to experience a rapid CAGR during the study period, attributed to the rising need for sophisticated IT management. Surging cybersecurity attacks across the country is also expected to increase the HCI integration in organizations. As per the report by the Department for Science, Innovation & Technology in June 2025, 43% of businesses, equating a count of 612,000, and 30% of charities, which is equivalent to 61,000, experienced cyberattacks in the last 12 months. Businesses across various industries are researching measures to be taken to reduce operational costs, expected to lead to the adoption of HCI solutions.

Asia Pacific Market Insights

Asia Pacific hyper-converged infrastructure market is projected to acquire a robust share by the end of 2035, owing to the drastic expansion of the end use industries, including IT, telecom, BFS, and others. As disclosed by the India Brand Equity Foundation in May 2025, the IT and business services market in India was projected to reach a value of USD 100 billion by the end of 2025. Rapid industrialization and investments by governments to establish smart cities are influencing the likelihood of a rising adoption of HCI solutions. As disclosed by the Swiss Government Departments in May 2025, the urbanization rate in China surged to 66% in 2023.

China HCI market is anticipated to expand exponentially throughout the forecast timeline, owing to the strong promotion of digital transformation by the government, increasing the attractiveness of HCI integration. As per the report by the State Council, published in May 2025, the government finalized a goal for large businesses to achieve 85% of numerical control in their key production processes by 2027. With rapid 5G expansion, a drastic data influx has been taking place. This is boosting the demand for HCI solutions so that centralized and scalable management of a large pool of data can be enabled. 5-G subscriptions in China surpassed 1 billion, which led to the establishment of 29 stations per 10,000 individuals, as of December 2024.

India is projected to emerge as an expanding HCI market from 2026 to 2035, on account of the government initiatives encouraging digital transformation in organizations. The government is also emphasizing the adoption of cloud adoption. As reported by the Press Information Bureau in December 2024, more than 300 government departments are active in the use of cloud services, contributing to the country’s digital public infrastructure. The need for organizations to manage workflow in a remote environment is also expected to accelerate the growth of HCI adoption in India.

Key Hyper-Converged Infrastructure Market Players:

- Dell Technologies Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Nutanix Inc.

- Hewlett Packard Enterprise (HPE)

- Cisco Systems Inc.

- Lenovo Group Ltd.

- Huawei Technologies Co., Ltd.

- Fujitsu Ltd.

- Hitachi Vantara

- IBM Corporation

- NEC Corporation

- Inspur Group

- Supermicro (Super Micro Computer Inc.)

- Atos SE

- HCLTech

- Datacom Grou

The competitive landscape of the hyper-converged infrastructure market is rapidly evolving as established key players, IT giants, and new entrants are investing in cybersecurity. Key players in the market are focused on developing robust data centers and products catering to the stringent regulatory norms and consumer demand. These key players are adopting several strategies, such as mergers and acquisitions, joint ventures, partnerships, and novel product launches, to enhance their product base and strengthen their market position.

Below is the list of the key players operating in the hyper-converged infrastructure market:

Recent Developments

- In May 2025, Arcfra was recognized as a representative vendor in the 2025 Gartner Market Guide. For the organizational full-stack hyper-converged infrastructure software, gaining increasing popularity, the company achieved the milestone.

- In March 2025, Sangfor Technologies unveiled its strategic partnership with CITIC Telecom International CPC Limited for the collaborative development of SmartCLOUD C-FUSION hybrid cloud series. It is innovative, trusted, and compliant, integrated with Sangfor’s full-stack HCI architecture.

- In March 2024, Dell Technologies became the first Microsoft partner to update the Azure Stack HCI with 23H2. The update is allowing shipment of platforms based on Dell multicloud (MC), encompassing a factory staging of Azure Stack HCI 23H2.

- Report ID: 4792

- Published Date: Oct 03, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.