Hyperautomation Market Outlook:

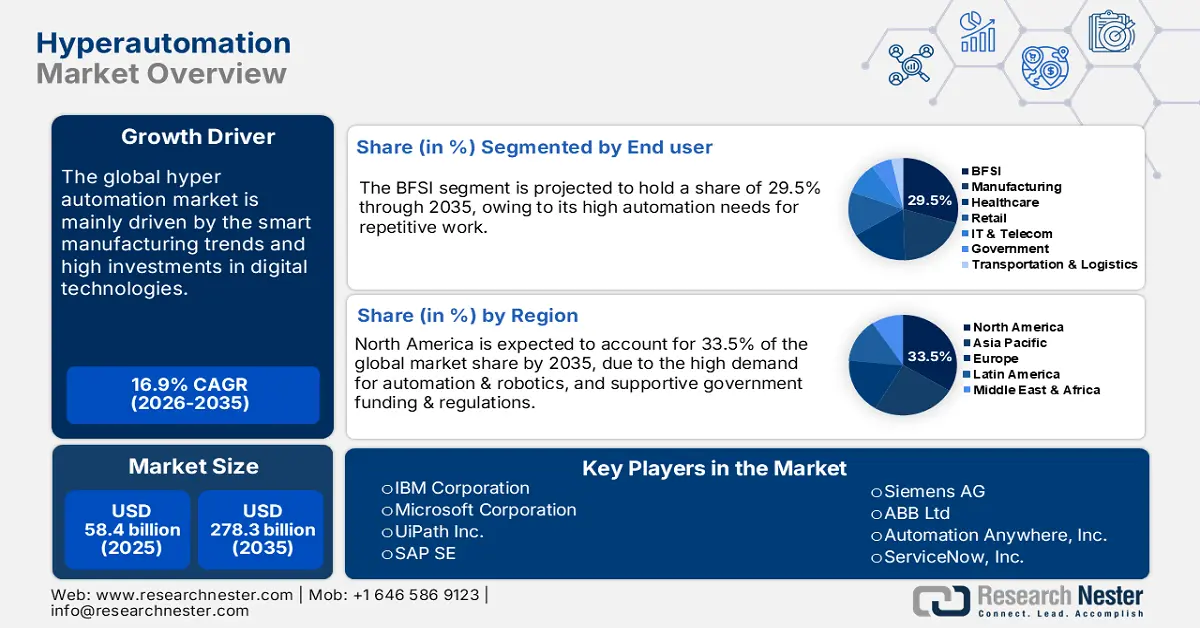

Hyperautomation Market size was USD 58.4 billion in 2025 and is estimated to reach USD 278.3 billion by the end of 2035, expanding at a CAGR of 16.9% during the forecast period, i.e., 2026-2035. In 2026, the industry size of hyperautomation is evaluated at USD 68.2 billion.

The macroeconomic shifts in producer pricing and intelligent production infrastructure investments are influencing the market growth. The analysis by the U.S. Bureau of Labor Statistics (BLS) states that the industrial machinery manufacturing’s Producer Price Index (PPI) was calculated at 258.440 in August 2025. The same source also states that the Consumer Price Index (CPI) for information technology, hardware, and services registered a relative importance of 1.644 in December 2024. The stable supply chain is estimated to fuel the production and trade of hyperautomation.

|

PPI industry group data for Industrial machinery manufacturing, not seasonally adjusted |

||||||||||||

|

Year |

Jan |

Feb |

Mar |

Apr |

May |

Jun |

Jul |

Aug |

Sep |

Oct |

Nov |

Dec |

|

2022 |

216.691 |

218.806 |

220.720 |

229.772 |

231.477 |

231.805 |

235.224 |

234.492 |

234.930 |

234.497 |

235.351 |

235.003 |

|

2023 |

237.930 |

241.298 |

242.381 |

243.645 |

245.089 |

244.746 |

244.173 |

244.200 |

244.505 |

243.846 |

243.927 |

244.298 |

|

2024 |

247.546 |

248407 |

248.590 |

249.569 |

251.317 |

251.969 |

252.058 |

252.884 |

253.297 |

253.332 |

253.117 |

253.123 |

|

2025 |

254.807 |

255.969 |

256.617 |

256.891 |

256.396(P) |

258.389(P) |

258.621(P) |

258.440(P) |

|

|

|

|

Source: BLS

The domestic operations of component assembling are expected to increase in developed regions such as North America and Europe in the coming years. This shift is majorly backed by the aim to reduce geopolitical and shipping risks. Furthermore, the factory automation needs are anticipated to propel the revenues of key players during the foreseeable period.

Key Hyperautomation Market Insights Summary:

Regional Highlights:

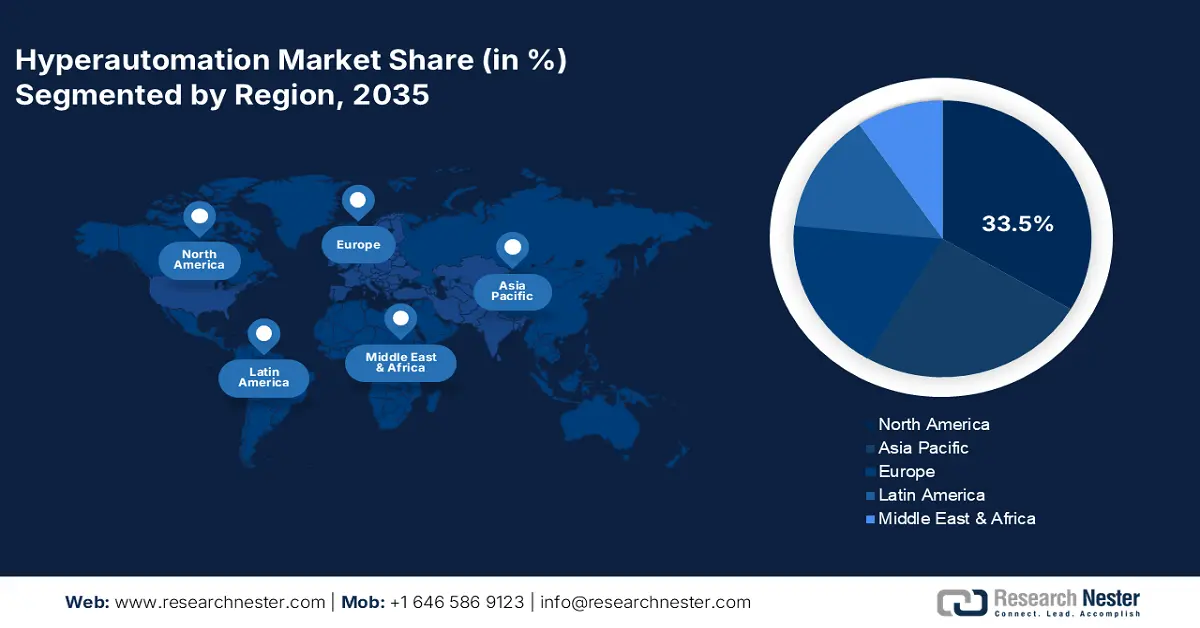

- By 2035, North America is set to command a 33.5% share of the Hyperautomation Market, bolstered by expanding enterprise automation initiatives and smart manufacturing ecosystems owed to supportive government policies.

- Across 2026–2035, Asia Pacific is expected to grow rapidly at a 16.8% CAGR as rising public-private investments and Industry 4.0 deployments intensify adoption of hyperautomation technologies encouraged by expanding 5G integration.

Segment Insights:

- By 2035, the robotic process automation (RPA) segment in the Hyperautomation Market is forecast to account for 35.9% of total share, supported by its scalability and operational efficiency advantages propelled by rising automation needs.

- Through 2026–2035, the BFSI segment is anticipated to hold a 29.5% share as institutions accelerate automation spending to enhance efficiency impelled by increasing smart-automation investments.

Key Growth Trends:

- Industry 4.0 & smart manufacturing trends

- Global rise in digital transformation budgets

Major Challenges:

- Infrastructure limitations

- Cross-border data transfer restrictions

Key Players: IBM Corporation, Microsoft Corporation, UiPath Inc., SAP SE, Siemens AG, ABB Ltd, Automation Anywhere, Inc., ServiceNow, Inc., LG CNS, Samsung SDS, Tata Consultancy Services (TCS), Infosys Limited, DXC Technology, Silverlake Axis Ltd., Capgemini SE.

Global Hyperautomation Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 58.4 billion

- 2026 Market Size: USD 68.2 billion

- Projected Market Size: USD 278.3 billion by 2035

- Growth Forecasts: 16.9% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (33.5% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: India, South Korea, Singapore, Brazil, United Arab Emirates

Last updated on : 25 September, 2025

Hyperautomation Market - Growth Drivers and Challenges

Growth Drivers

- Industry 4.0 & smart manufacturing trends: The increasing trend of Industry 4.0 and smart manufacturing is creating a profitable environment for hyperautomation companies. The International Federation of Robotics reported that in 2023, the number of working robots worldwide grew by 9.7% to 4,281,585. The countries with the most robots in use are China (41%), Japan (10.2%), the United States (8.9%), South Korea (8.9%), and Germany (6.3%). The integration of smart technologies in the manufacturing and logistics sectors is expected to attract numerous companies in the market during the study period. Asia Pacific is estimated to lead the investments for smart factory developments in the coming years.

- Global rise in digital transformation budgets: The governments’ increasing investments in digital transformation are set to increase the installation of hyperautomation systems. The International Telecommunication Union (ITU) and OECD analysis reveal that the digital transformation budgets are booming across all G20 economies. The government of India allocated around USD 1.2 billion over five years for AI and automation infrastructure under the Digital India program, revealed by the Ministry of Electronics and Information Technology (MeitY) in March 2025. Thus, the developing markets are most opportunistic for hyperautomation solution producers.

- Industry-specific hyperautomation trends: Hyperautomation is widely used in the healthcare sector as it aids in streamlining patient data management and supports telemedicine workflows. It also helps in automating insurance claims, which increases their sales growth. Hospitals and clinics also benefit from reduced administrative load, faster billing cycles, and improved patient care coordination through the application of hyperautomation technologies.

Challenges

- Infrastructure limitations: The infrastructure gaps in the poor and developing markets are hampering the installation of hyperautomation technologies. The limited internet connectivity also acts as a drawback for the employment of hyperautomation systems. The World Bank report states that in 2022, around 36% of Sub-Saharan Africa had access to stable broadband. This directly reflects the limitation of real-time industrial automation.

- Cross-border data transfer restrictions: The strict data protection rules and policies are expected to hinder cloud automation to some extent. For instance, India’s Digital Personal Data Protection Act 2023 does not allow the cross-border flow of data. The variation in laws in different regions is creating a big hurdle for innovation for hyperautomation companies. The delay in new market entries also limits the earning opportunities from the latest trends.

Hyperautomation Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

16.9% |

|

Base Year Market Size (2025) |

USD 58.4 billion |

|

Forecast Year Market Size (2035) |

USD 278.3 billion |

|

Regional Scope |

|

Hyperautomation Market Segmentation:

Technology Segment Analysis

The robotic process automation (RPA) segment is projected to capture 35.9% of the global hyper automation market share by 2035. The high return on investments and scalability properties are increasing the demand for robotic process automation technologies. These technologies are widely employed by sectors such as automotive, electronics, manufacturing, and logistics, where repetitive process needs are high. RPA’s ability to enhance operational efficiency is set to fuel its application in the manufacturing and federal sectors. Overall, the automation needs are set to accelerate the demand for RPA technologies in the years ahead.

End user Segment Analysis

The BFSI segment is anticipated to hold 29.5% of the global market share throughout the forecast period. To increase the repetitive work speed and overall efficiency, the BFSI sector is increasingly investing in automation technologies. The Federal Financial Institutions Examination Council (FFIEC) is promoting the use of smart automation to ensure compliance with changing digital risk frameworks by financial institutions. The report by the World Economic Forum (WEF) reveals that financial services companies spent nearly USD 35 billion on AI in 2023. This represents that BFSI is an opportunistic marketplace for hyperautomation manufacturers.

Deployment Mode Segment Analysis

The cloud-based segment is projected to account for 52.5% of the global market share throughout the study period, due to cost-effectiveness and scalability. The subscription model makes cloud-based hyperautomation solutions more cost-efficient and accessible. The increasing remote and hybrid work trend is further increasing the demand for cloud-based hyperautomation technologies. The automation initiatives across several industries are also accelerating the installation of cloud-based platforms.

Our in-depth analysis of the global market includes the following segments:

|

Segment |

Subsegments |

|

Technology |

|

|

End user |

|

|

Deployment Mode |

|

|

Component |

|

|

Function |

|

|

Enterprise Size |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Hyperautomation Market - Regional Analysis

North America Market Insights

The North America market is poised to account for 33.5% of the global revenue share through 2035. The booming investments in enterprise automation and smart manufacturing are propelling the revenues of key players. The strong presence of leading companies and the existence of robust connectivity networks are accelerating the installation of hyperautomation technologies. The supportive government policies in both the U.S. and Canada are increasing the trade of hyperautomation systems.

The U.S. hyperautomation system sales are expected to increase at a high pace during the study period. High investments in digital infrastructure growth and IoT trends are fueling the demand for automated systems. The National Telecommunications and Information Administration (NTIA) study estimates that more than USD 42.45 billion was allocated for the expansion of 5G networks. These investment strategies are set to support industrial IoT and real-time automation in the country.

The government-backed ICT modernization tactics are estimated to fuel hyperautomation installations in Canada. In December 2024, the Minister of Innovation, Science, and Industry launched Canada’s Sovereign AI Compute Strategy. The plan is set to invest up to CAD 2 billion, as announced in the 2024 Budget. The supportive digital initiatives are set to increase the adoption of hyperautomation technologies in small and medium-sized enterprises. The robotics trend in the automotive, electronics, manufacturing, and logistics sectors is also estimated to fuel the overall market growth in the coming years.

Europe Market Insights

The Europe hyperautomation market is estimated to hold the second-largest global revenue share through 2035. The digitalization trend is creating a lucrative environment for hyperautomation technology producers. The supportive government policies and subsidies are expected to accelerate advanced analytics adoption. EU’s Digital Europe Programme and Horizon Europe initiatives are further fueling innovation by funding AI and automation projects.

Germany is expected to lead the sales of hyperautomation technologies, owing to its strong industrial base and digitalization strategies. The International Federation of Robotics (IFR) reveals that nearly 28,355 units of robots were installed in the country in 2023. The Industrie 4.0 trend and robust use of robotics are accelerating the sales of hyperautomation technologies. The EU-wide sustainability and data governance frameworks are expected to drive innovations in hyperautomation systems in the years ahead.

The UK hyperautomation market is estimated to increase at a high pace between 2026 and 2035. The mature financial services sector and vibrant tech ecosystem are pushing the adoption of hyperautomation systems. The cloud-first strategies are also attracting several international investors. The NHS-led digital transformation programs are further anticipated to amplify the application of hyperautomation solutions.

APAC Market Insights

The Asia Pacific hyperautomation market is anticipated to increase at a CAGR of 16.8% between 2025 and 2037. The growth in public-private investment strategies, the government’s cloud-first moves, and the Digital Bharat initiative are set to increase the sales of hyperautomation technologies in the years ahead. The high demand for automation and robotics in the automotive, manufacturing, electronics, and logistics sectors is expected to double the revenues of key market players during the foreseeable period. The Industry 4.0 trends and high adoption of 5G networks are promoting the adoption of hyperautomation technologies.

The robust government initiatives and ICT investments are projected to enhance China's position in the regional landscape. In July 2024, the State Council Information Office announced that China has built a world-leading information and communication network with 3.84 million 5G base stations. These represent over 60% of all 5G base stations worldwide. The easy access to advanced connectivity networks is set to accelerate the demand for hyperautomation technologies. The Made in China initiative is also expected to propel the production of hyperautomation technologies in the coming years.

The smart manufacturing and logistics trends are expected to double the revenues of hyperautomation companies in India during the foreseeable period. The strategic government programs, such as Digital India and Make in India, are also accelerating the demand for robotics and automation technologies. The automotive, electronics, and manufacturing sectors are estimated to create a win-win environment for hyperautomation companies during the study period.

Key Hyperautomation Market Players:

- IBM Corporation

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Microsoft Corporation

- UiPath Inc.

- SAP SE

- Siemens AG

- ABB Ltd

- Automation Anywhere, Inc.

- ServiceNow, Inc.

- LG CNS

- Samsung SDS

- Tata Consultancy Services (TCS)

- Infosys Limited

- DXC Technology

- Silverlake Axis Ltd.

- Capgemini SE

The leading companies in the hyperautomation market are dominating their position by introducing improved automation and cloud-first platforms. The manufacturers are employing several organic and inorganic marketing strategies, such as new product launches, technological innovations, strategic partnerships & collaborations, mergers & acquisitions, and global expansion to double the profit shares. The industry giants are targeting untapped markets to earn lucrative gains.

Here is a list of key players operating in the global market:

Recent Developments

- In October 2024, IBM Corporation announced the launch of IBM watsonx Code Assistant. It is a tool built for businesses to help speed up software development.

- In February 2024, Hyperscience launched the Hyperscience Hyperautomation Network, a new partner program that uses AI and machine learning to improve back-office tasks for customers. It’s the first program of its kind aimed at building a network to deliver super-efficient automation solutions to the market.

- Report ID: 3960

- Published Date: Sep 25, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Hyperautomation Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.