Hydrobromic Acid Market Outlook:

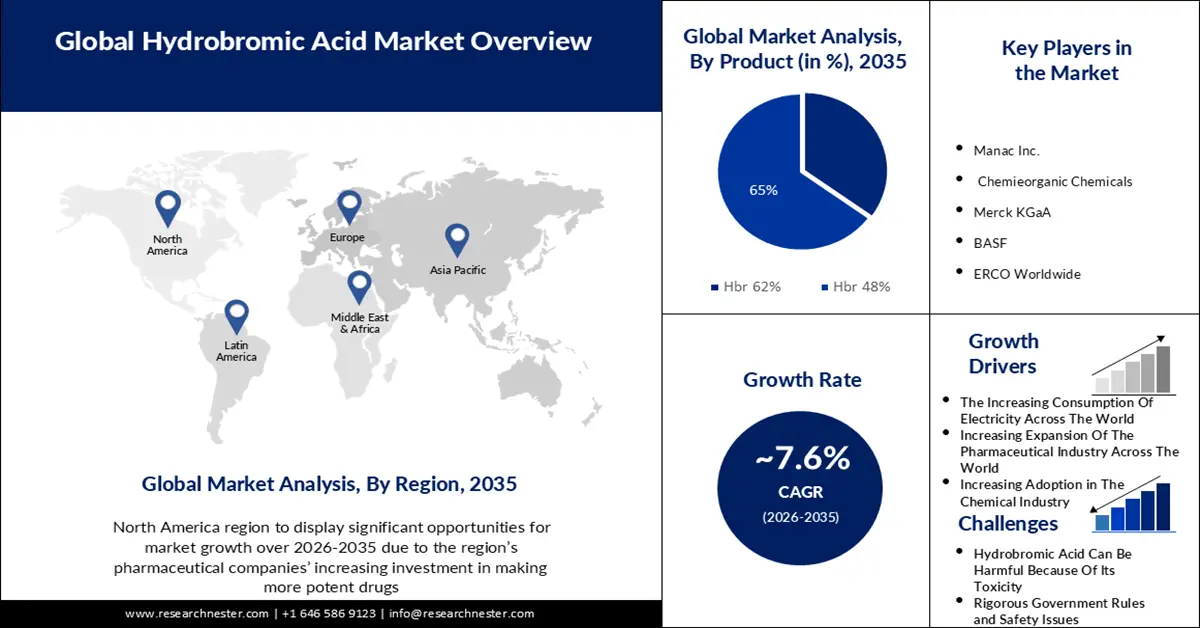

Hydrobromic Acid Market size was over USD 909.36 million in 2025 and is projected to reach USD 1.89 billion by 2035, growing at around 7.6% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of hydrobromic acid is evaluated at USD 971.56 million.

The primary reason behind the exceptional growth of the market is the increasing consumption of electricity across the world and hydrobromide acid is an important element electrical industry. In 2022, the complete global electricity generation was around 29,000 TWh. Total primary energy is shifted into multiple types, comprising, but not restricted to, electricity, heat, and motion. Some basic energy is lost at the time of the shift to electricity, as noticed in the United States, where a little over 60% was lost in 2022.

Another reason that will also drive the market of hydrobromic acid is the increasing expansion of the pharmaceutical industry across the world. The pharmaceutical industry is in charge of the research, development, generation, and distribution of drugs. The market has noticed substantial expansion during the past two decades, and pharma profits across the world summed at 1.48 trillion U.S. dollars in 2022. Sales of the pharmaceutical markets in BRICS and MIST countries two-folded in 5 years, touching a market share of around 20%. The transformation toward these new markets has contributed to the immense populations, increasing prosperity, and rising life likelihood in BRICS and MIST countries. Additionally, organizations are noticing flattened expansion of advanced markets, closure of patents leading to the up-selling of less costly usual medications, and tight rules imposed in mature markets. Specific attention must thus be provided to these growing markets. The planning adopted by pharmaceutical organizations that expect to grow in these markets must be accommodated to the pace of growth of every country.

Key Hydrobromic Acid Market Insights Summary:

Regional Highlights:

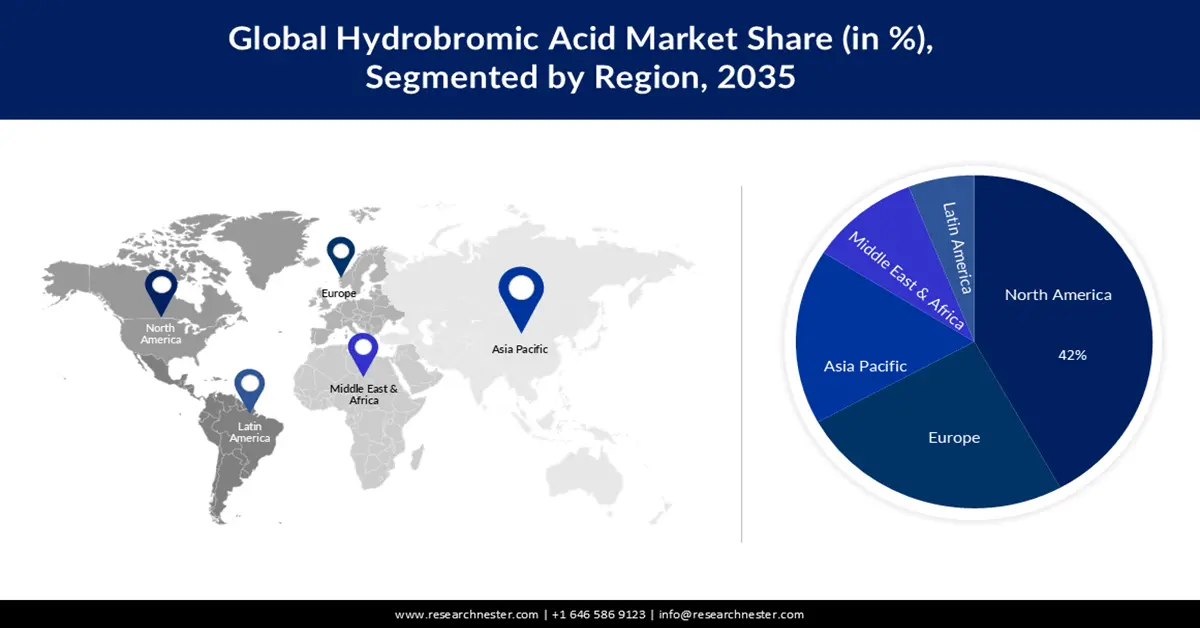

- The North America region of the hydrobromic acid market is projected to command nearly 42% revenue share by 2035, attributed to escalating investments by pharmaceutical companies in developing more potent drugs.

- The Europe region is expected to witness notable growth through 2035, stemming from the rising prevalence of chronic diseases across the region.

Segment Insights:

- The Hbr 48% segment of the hydrobromic acid market is anticipated to secure a 65% share by 2035, propelled by increasing investment in the pharmaceutical industry.

- The chemical segment is projected to account for 40% of the revenue share by 2035, owing to the broad expansion of the global chemical industry.

Key Growth Trends:

- Increasing Adoption in The Chemical Industry

- Rising Use of Hydrobromic Acid as Pesticides

Major Challenges:

- Hydrobromic Acid Can Be Harmful Because Of Its Toxicity

- Attainability of Alternative Product

Key Players: Manac Inc., Chemieorganic Chemicals, Merck KGaA, BASF, ERCO Worldwide, Haiwang Chemical, BLUESTAR ENTERPRISES, Alpha Chemika, Jordan Bromine, Kemira, Kaname Chemicals Co., Ltd., JFE Chemical Corporation, Shoko Co., Ltd., Toagosei Co., Ltd.

Global Hydrobromic Acid Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 909.36 million

- 2026 Market Size: USD 971.56 million

- Projected Market Size: USD 1.89 billion by 2035

- Growth Forecasts: 7.6%

Key Regional Dynamics:

- Largest Region: North America (42% Share by 2035)

- Fastest Growing Region: Europe

- Dominating Countries: United States, China, Germany, Japan, India

- Emerging Countries: Brazil, South Korea, Mexico, Indonesia, Turkey

Last updated on : 27 November, 2025

Hydrobromic Acid Market - Growth Drivers and Challenges

Growth Drivers

- Increasing Adoption in The Chemical Industry- Bromine is implemented in multiple inorganic and organic materials. Since it is a component, it cannot be alternated with other components without the properties of the material being transformed, frequently substantially. However, some bromine agents, mainly organic compounds, are sensitive to alteration by-products with totally varied chemistries. Essential characteristics for its utilization in inorganic agents comprise its oxidation capacity and its comparatively high molecular weight (related to chlorine). Attribution results show that the treatment with HBr solution leads to the rise of acidic groups and the reduction of fundamental groups on the carbon surface. The therapy with HBr solution generates a lot of lactonic groups on the carbon. BET decision shows that a few micropores and mesopores are produced by the treatment with HBr solution. The rise of acidic groups and amplification of surface area is due to the modification of the skill to adsorb Cr(VI) ions. Lactonic groups and micropores play a main role in adsorbing Cr(VI) from water.

- Rising Use of Hydrobromic Acid as Pesticides -Pesticides are necessary in agricultural generation. They have been utilized by farmers to tackle weeds and insects, and their exceptional rises in agricultural components have been reported. The rise in the world’s population in the 20th century could not have been feasible without a parallel rise in food generation. About one-third of agricultural materials are generated relying on the application of pesticides. Without the implementation of pesticides, there would be a 78% loss of fruit gen, a 54% loss of vegetable generation, and a 32% loss of cereal generation. Thus, pesticides play a crucial role in limiting diseases and raising crop cultivation across the world.

- Increase in Adoption of Agrochemicals -In answer to the reduced profits and margins in the earlier, agrochemicals industry players concentrated on strengthening their market share through enhanced mergers & acquirements (M&A), expanding their geographical expansion, raising investment in research and development (R&D) of the latest active components, and increasing material offerings with digital as a major agent. However, challenges go on to stay, basic among them comprise longer product development cycles and escalating costs, increasing strictness of regulatory needs, farm subsidy reduction, and quickened pace of change inside and in adjacent markets. The agricultural enzymes are massively adopted.

Challenges

- Hydrobromic Acid Can Be Harmful Because Of Its Toxicity -In a relative toxicity study, hydrogen bromide caused more massive burns to the skin than hydrogen chloride or hydrogen iodide. In another study relating the severe toxic impacts of hydrogen fluoride, hydrogen bromide, and hydrogen chloride, rats were exposed to 1200 ppm hydrogen bromide for 40 min. Rats were isolated into two groups. The first group comprised ordinary mouth-breathing rats and the second group comprised rats fitted with an apparatus to imitate nose breathing. Over twice as many rats in the pseudo-mouth-breathing group deceased as in the nose-only group and none deceased in the control group. Eye irritation was not reported in humans at any of the tested considerations. One singular noted nasal or throat irritation at the 3ppm level. The odor was perceptible at all concentrations tested. Higher levels of inhalation disclosure can generate pulmonary edema.

- Attainability of Alternative Product

- Rigorous Government Rules and Safety Issues

Hydrobromic Acid Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

7.6% |

|

Base Year Market Size (2025) |

USD 909.36 million |

|

Forecast Year Market Size (2035) |

USD 1.89 billion |

|

Regional Scope |

|

Hydrobromic Acid Market Segmentation:

Product Segment Analysis

The Hbr 48% segment is expected to hold 65% share of the global hydrobromic acid market by 2035. The reason behind this segment’s dominance is the rising investment in the pharmaceutical industry and Hbr 48% is immensely used in making medications. The pharma industry is incorporated into some major multinational organizations. Depending on prescription drug sales, U.S. organization Pfizer has been among the global foremost pharmaceutical organizations for many years. The organization, which has its international headquarters in New York City, produced a total profit of over 100 billion U.S. dollars in 2022. A lot of the foremost pharma organizations come from the United States, and, thus, it is no astonishment that the country has the biggest national health and pharmaceutical market globally.

Application Segment Analysis

The chemical segment in the hydrobromic acid market is projected to account for 40% of the revenue share by 2035. This supremacy of the segment will be noticed due to the wide expansion of the chemical industry across the world. In 2023, a calculated USD 2.8 trillion was spent internationally on energy, with over 60% invested in clean energy technology, like sustainable resources, EVs, and battery storage. Part of this has been in answer to the regulation of the United States that is assisting to encourage private-sector investment. For instance, in the year after the CHIPS Act was approved into law, the private sector declared USD 166 billion in spending on semiconductor plants, and in the year since the IRA was approved into law, the private sector declared roughly USD 88 billion in clean energy manufacturing.

Our In-Depth Analysis of The Global Market Includes the Following Segments:

|

Type |

|

|

Product |

|

|

Application |

|

|

End-Use Industry |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Hydrobromic Acid Market - Regional Analysis

North American Market Insights

The hydrobromic acid market in the North America region will have the highest growth during the forecast period and will hold almost 42% revenue share. This supremacy will be noticed due to the region’s pharmaceutical companies’ increasing investment in making more potent drugs. It is noticed that around 244 thousand publications straight associated with drugs, of which 16% recognized NIH funding completing USD 36 billion. Contrarily, it is seen that 2 million publications associated with the biological aims of these drugs, of which 21% recognized NIH funding totaling USD 195 billion. Two-thirds of the research funding was for investigator-influenced Research Projects or Research Program Projects and Centers that give research infrastructure, and less than one-third was associated with government-influenced and maintained Cooperative Agreements of Intramural Research.

European Market Insights

The hydrobromic acid market in the Europe region will have significant growth in the forecast period. This growth will be noticed because of the increasing prevalence of chronic disease in this region. Chronic diseases, like heart disease, stroke, cancer, chronic respiratory diseases, and sugar, are by a long shot the foremost cause of mortality in Europe, showing 77% of the entire disease pressure and 86% of all deaths. These diseases are connected by usual risk factors, fundamental factors, and scopes for intervention.

Hydrobromic Acid Market Players:

- Manac Inc.

- Company Overview

- Business Planning

- Main Product Offerings

- Financial Execution

- Main Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Chemieorganic Chemicals

- Merck KGaA

- BASF

- ERCO Worldwide

- Haiwang chemical

- BLUESTAR ENTERPRISES

- Alpha Chemika

- Jordan Bromine

- Kemira

Recent Developments

29 January 2024: Merck KGaA, a foremost science and technology organization, declared the opening of the Merck Digital Hub in Singapore, the first external of the US and Europe for the digital business of Merck. Assisted by the Singapore Economic Development Board (EDB), the Digital Hub focuses on driving developments inside the healthcare and semiconductor industries.

26 January 2024: Merck KGaA, a foremost science and technology organization, has agreed on a 10-year green power purchase agreement (PPA) with China Resources Power Holdings Co., Ltd. This is Merck's first consistent sustainable energy acquisition in China, with a projected intake of 300 gigawatt hours (GWh) in ten years.

- Report ID: 5737

- Published Date: Nov 27, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Hydrobromic Acid Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.