Hosting Infrastructure Service Market Outlook:

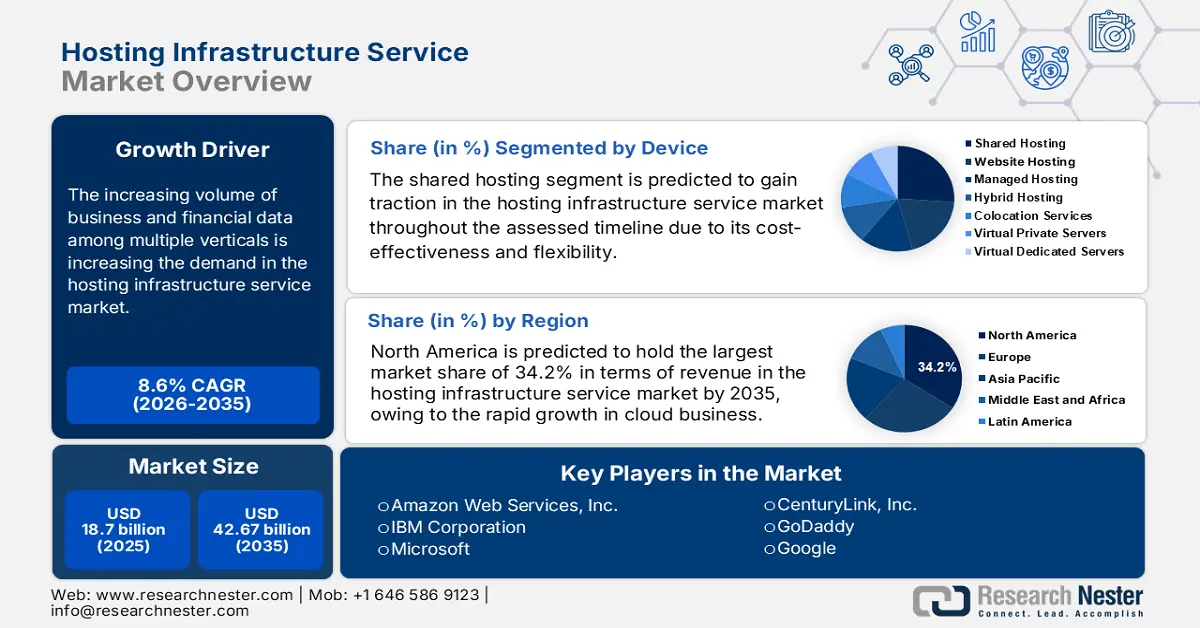

Hosting Infrastructure Service Market size was over USD 18.7 billion in 2025 and is poised to exceed USD 42.67 billion by 2035, growing at over 8.6% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of hosting infrastructure service is estimated at USD 20.15 billion.

The increasing volume of business and financial data among multiple verticals is increasing the demand in the hosting infrastructure service market. Commodities from this sector include digital content management and website infrastructure management, helping enterprises decrease their workload and focus on core activities while maintaining low operational costs. Moreover, the current trend of industrial digitalization worldwide is fueling growth in this sector. This can also be testified by the rapid penetration of Internet of Things (IoT) devices, which is expected to witness a boom by 2029, reaching 39.0 billion (United Nations), as they require low-latency and geographically distributed infrastructure.

Furthermore, cost saving is one of the major driving factors in the market globally. The expenditure on hardware and networking equipment installation, operation, and maintenance is significantly high, which pushes businesses to seek affordable alternatives. As a solution, hosting infrastructure service (HIS) providers help them scale up and down their storage as per their needs through the innovative pay-as-you-go pricing model. For instance, in January 2025, Leaseweb Global introduced a highly efficient virtual private server (VPS) solution, offering exceptional price performance, fast local storage, and easy deployment. Their monthly packages start from only USD 4.5 and are flexible to customer requirements.

Key Hosting Infrastructure Service Market Insights Summary:

Regional Highlights:

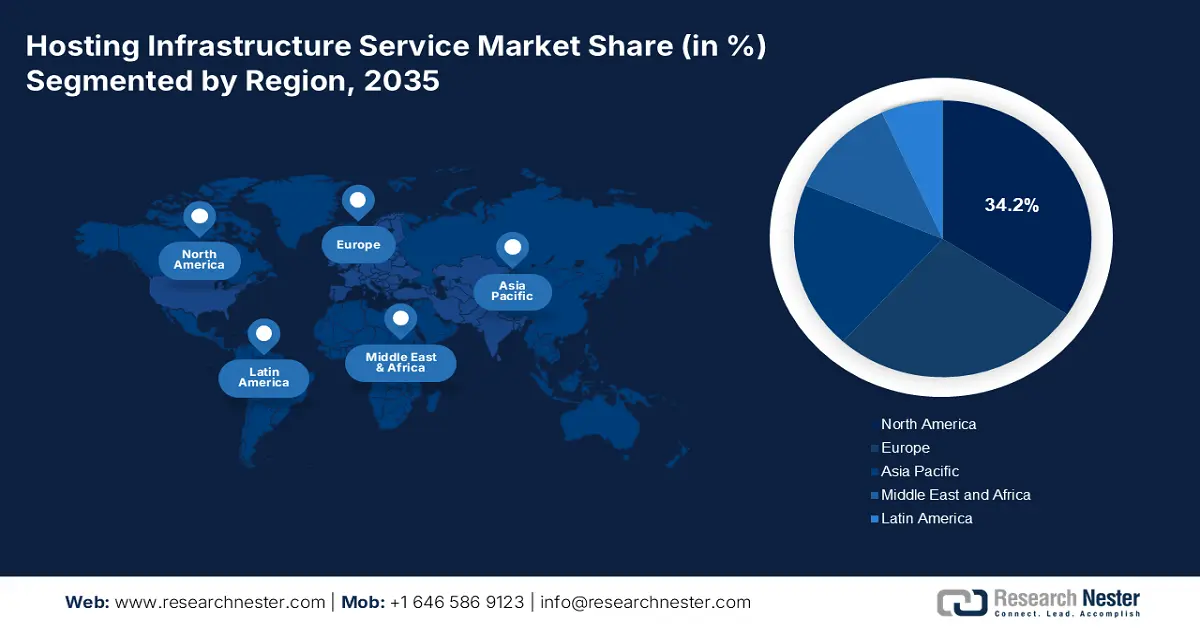

- The North America hosting infrastructure service market is projected to secure a 34.20% share by 2035, driven by the rising focus on data center consolidation and the rapid growth in the use of cloud-based storage.

Segment Insights:

- The shared hosting segment in the hosting infrastructure service market is anticipated to gain considerable share by 2035, influenced by its cost-effectiveness and flexibility for SMEs.

- The large enterprises segment in the hosting infrastructure service market is expected to secure a notable revenue share by 2035, driven by high data requirements and complex networking needs enabling heavy investment.

Key Growth Trends:

- Growing popularity of e-commerce operations

- Technological advances in available solutions

Major Challenges:

- Concerns about data privacy and sustainability

Key Players: Amazon Web Services, Inc., Bio-Rad Laboratories, Inc., F. Hoffmann-La Roche Ltd., QIAG GoDaddy, Hewlett Packard, Google, IBM Corporation, Rackspace Inc., CenturyLink, Inc., Internap Corporation, Microsoft, Hetzner, ServerMania.

Global Hosting Infrastructure Service Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 18.7 billion

- 2026 Market Size: USD 20.15 billion

- Projected Market Size: USD 42.67 billion by 2035

- Growth Forecasts: 8.6% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (34.2% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, United Kingdom, Germany, Canada

- Emerging Countries: China, India, Singapore, Japan, Brazil

Last updated on : 8 September, 2025

Hosting Infrastructure Service Market Growth Drivers and Challenges:

Growth Drivers

- Growing popularity of e-commerce operations: The remarkable emergence of online businesses in both developed and developing countries is creating a surge in the hosting infrastructure service market. According to a report from the United Nations, the rate of e-commerce sales in 43 selected countries across America, Europe, and Asia, such as the U.S., China, and Japan, grew by 60.0% from 2016 to 2022. It also mentioned that the sales value reached USD 27.0 trillion in 2022, accounting for 75.0% of the global GDP. Thus, as the need for streaming platforms and digital content to magnify commercial benefits heightens, the investment in reliable hosting servers increases.

- Technological advances in available solutions: The introduction of AI model training and big data analytics is the utilization of the offerings from the hosting infrastructure service market in enhancing high-performance computing (HPC) and storage capabilities. On this note, in June 2024, CoreWeave signed a 12-year partnership with Core Scientific to get 200 megawatts of hosting infrastructure for its HPC operations and NVIDIA GPU site modification. This contract is expected to bring a revenue of over USD 3.5 billion to Core Scientific during the agreed tenure, consolidating its leadership in AI-based data generation across North America.

Challenges

- Concerns about data privacy and sustainability: The growing threat of cyberattacks and associated financial losses often creates hesitation among industries holding sensitive information, such as healthcare, for investing in the hosting infrastructure service market. Being a third-party controller and service provider, gaining the trust of customers is essential to retain the company’s reputation and profit margin. As a result, compliance with the stringent regulatory frameworks for protecting individual’s personal data, such as HIPPA, makes it difficult for new entrants to establish their significance. Furthermore, the rising concerns about the impact of IT waste on the environment may also hinder wide adoption in this field.

Hosting Infrastructure Service Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

8.6% |

|

Base Year Market Size (2025) |

USD 18.7 billion |

|

Forecast Year Market Size (2035) |

USD 42.67 billion |

|

Regional Scope |

|

Hosting Infrastructure Service Market Segmentation:

Service Segment Analysi

The shared hosting segment is predicted to gain traction in the hosting infrastructure service market throughout the assessed timeline with a considerable share. The cost-effectiveness and flexibility of these offerings make them the most suitable option for small- and medium-sized enterprises (SMEs), testifying to the continuous propagation of this segment. In addition, the advanced features, such as collaboration and productivity tools, of shared hosting allow companies to cultivate remote work culture, which is often found to be a cost-saving approach. In this regard, in February 2025, i2Coalition formed a group, named Secure Hosting Alliance (SHA), of 23 hosting providers, including WebPros, DreamHost, GoDaddy, and others. This move was intended to create shared solutions for the web hosting industry.

End user Segment Analysis

In terms of end user, the large enterprises segment is expected to hold a notable share in the hosting infrastructure service market by 2035. The enormous amount of data and complex networking architecture of these entities force them to assign a scalable and liable service provider. In addition, their economic scale and financial liberty allow them to invest heavily in this sector, making them the highest and priority payors in this field. On this note, in May 2024, InMotion Hosting upscaled its newly inaugurated East Coast Data Center by incorporating 100 new dedicated servers to cope with the demand for enterprise-grade infrastructure. Furthermore, the importance of large-sized firms in driving the economy and technological revenue in individual countries is positioning this segment at the forefront.

Our in-depth analysis of the global hosting infrastructure service market includes the following segments:

|

Service |

|

|

End user |

|

|

Verticals |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Hosting Infrastructure Service Market Regional Analysis:

North American Market Insights

North America is predicted to hold the largest market share of 34.2% in terms of revenue in the hosting infrastructure service market over the discussed period. The rising focus on data center consolidation and rapid growth in the use of cloud-based storage across this region is expected to drive its proprietorship. Additionally, the ongoing trend of digital transformation among domestic industrial and technology giants is bolstering its global competency and engagement. For instance, in September 2024, Microsoft announced the initiation of transferring its IT infrastructure to the cloud with the help of Microsoft Azure monitoring, patching, backup, and security tools. This signifies the presence of an accepting and progressive environment in this landscape.

The U.S. is augmenting the hosting infrastructure service market with the nationwide popularity and the utilization of digital and connected governance. For instance, till September 2024, the number of datasets across multiple levels of government, available in Data.gov was 300,000. Moreover, the reliance of the country’s industrial growth on these data sources pushes them to gather more information, increasing demand for reliable hosting facilities. In this regard, the U.S. Department of Commerce reported that the amount of revenue from industries, relying on government data, doubled to USD 750.7 billion in 2022 from 2012. Considering this growth, the Federal government further invested USD 3.5 billion in data collection over the 2023 fiscal year.

APAC Market Insights

Asia Pacific is anticipated to be a fast-growing region in the hosting infrastructure service market across the analyzed timeframe. The increased usage of virtualization and recent advances in cloud computing are fueling the region’s progress in this sector. Rapid industrialization and digitalization in developing economies such as China and India are also poised to raise adoption and innovation in HIS, attracting both domestic and international leaders to participate in this landscape. For instance, in March 2025, SNS Network Technology collaborated with NVIDIA to bring a fully managed, local AI-cloud-based infrastructure service to Malaysia. The alliance further aimed at constructing an AI factory with a 50-50 utility distribution in commercial workload management and nationwide AI adoption.

India is bolstering a large consumer base and a lucrative opportunity for global leaders in the hosting infrastructure service market. The country’s emergence is highlighted due to the presence of several growth factors such as government support for digitalization, the enlarging data center industry, and broadening IoT implementation. For instance, in September 2024, the Ministry of Electronics and Information Technology (MeitY) launched the Vishvasya-Blockchain Technology Stack, offering Blockchain-as-a-Service with a geographically distributed infrastructure. Similarly, IBEF reported that the data center industry in India was valued at USD 4.5 billion in 2023, which is projected to reach USD 11.6 billion by 2032, exhibiting a CAGR of 10.9%. These figures testify to the future augmentation of this nation in this field.

Hosting Infrastructure Service Market Players:

- Amazon Web Services, Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- GoDaddy

- Hewlett Packard

- IBM Corporation

- Rackspace Inc.

- CenturyLink, Inc.

- Internap Corporation

- Microsoft

- Hetzner

- ServerMania

The hosting infrastructure service market is evolving and witnessing new business opportunities with the growing adoption of artificial intelligence and machine learning in data management. Key players are increasingly investing in AI exploration projects and initiatives to upscale their product pipeline and capabilities. For instance, in November 2023, Amazon Web Services and NVIDIA allied to cultivate the most advanced infrastructure, software, and services for empowering and managing AI innovations. This new cohort features next-generation GPUs, CPUs, AI software, virtualization & security, Elastic Fabric Adapter (EFA) interconnect, UltraCluster scalability, and more. Such key players are:

Recent Developments

- In March 2025, Hetzner was opted for by Nokia to upgrade its data center and core network infrastructure with 400G and 800G interconnectivity. This deployment enhanced Hetzner's hosting infrastructure, aiming to provide scalable, automated, and sustainable services across Europe.

- In March 2025, ServerMania launched a new cloud infrastructure as a service (IaaS) solution, AraCloud, to keep up with growing digital demands. This hosting tool is designed to serve businesses seeking enterprise-grade cloud computing without unnecessary complexity or costs.

- Report ID: 838

- Published Date: Sep 08, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.