Horizontal Directional Drilling Market Outlook:

Horizontal Directional Drilling Market size was valued at USD 12.11 billion in 2025 and is likely to cross USD 31.99 billion by 2035, registering more than 10.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of horizontal directional drilling is assessed at USD 13.22 billion.

The robust infrastructure development activities are boosting the underground horizontal directional drilling activities. The booming urban and industrial growth is fueling construction activities and thereby opening lucrative doors for horizontal directional drilling companies. The smart city initiatives are set to double the revenues of horizontal directional drilling companies in the years ahead. The high investments in metro rail, road, airport, water treatment, and energy projects are augmenting the demand for horizontal directional drilling services. The favorable government policies and funding are attracting several horizontal directional drilling companies to expand their operations in emerging economies.

The G20 Outlook reveals that the investment needs in the global rail sector are expected to increase from USD 417.0 billion in 2024 to USD 537.0 billion by 2035. The same source also estimates that the current investment trend in the global infrastructure sector is forecast to total USD 3.0 trillion in 2025. Furthermore, the ongoing top infrastructure projects worldwide, including NEOM, Grand Paris Express, HS2, a high-speed rail network, the Regional Environmental Sewer Conveyance Upgrade Program (RESCU), and the Brenner Base Tunnel, are propelling the revenues of horizontal directional drilling companies.

Key Horizontal Directional Drilling Market Insights Summary:

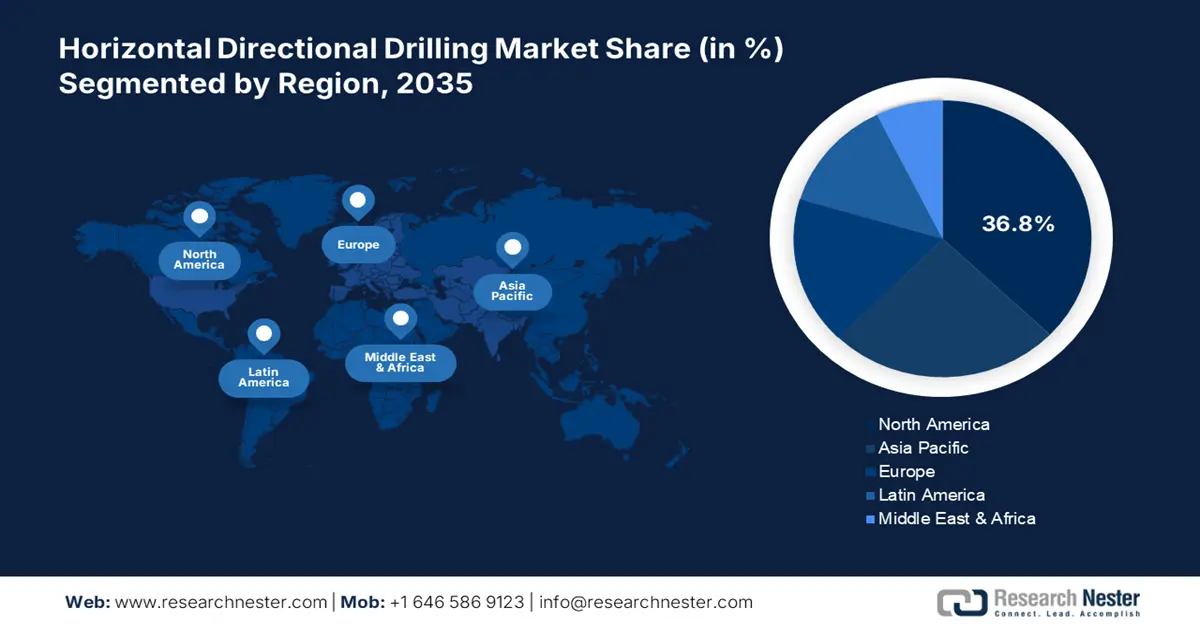

Regional Highlights:

- North America leads the Horizontal Directional Drilling Market with a 36.8% share, supported by strong presence of leading companies and investments in metal, hydrocarbon, and clean energy projects through 2026–2035.

Segment Insights:

- The Onshore segment is forecasted to capture 60.3% market share by 2035, propelled by the abundance of metals, minerals, and fuels in onshore areas driving drilling investments.

- Oil & Gas Excavation segment is projected to hold a 45.80% share by 2035, driven by robust global demand for crude oil and gas, augmenting drilling activities worldwide.

Key Growth Trends:

- Green energy transformation

- Rise in offshore hydrocarbon drilling

Major Challenges:

- Dominated by industry giants

- High costs required for innovations

- Key Players: Patterson-UTI Energy, Inc., SLB, Nabors Industries, American Augers, Inc., Nawtek GmbH, and Barbco, Inc.

Global Horizontal Directional Drilling Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 12.11 billion

- 2026 Market Size: USD 13.22 billion

- Projected Market Size: USD 31.99 billion by 2035

- Growth Forecasts: 10.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (36.8% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Canada, Germany, Japan

- Emerging Countries: China, India, Brazil, Mexico, Russia

Last updated on : 12 August, 2025

Horizontal Directional Drilling Market Growth Drivers and Challenges:

Growth Drivers

- Green energy transformation: The robust shift towards green energy is anticipated to increase the sales of horizontal directional drilling technologies. The rise in clean energy project expansions, which require underground cabling, is directly fueling the demand for horizontal directional drilling services. The Pinnapuram project of Greenko Group is the world’s largest GW-scale integrated clean energy plant in India with 1,000 MW of wind, 1,680 MW of pumped hydropower, and 4,000 MW of solar capacity. This USD 4.2 billion worth of project comprises USD 3 billion for the solar and wind generation infrastructure and USD 1.2 billion for the pumped storage component. Such big developments in developing economies are likely to propel the revenue growth of the horizontal directional drilling companies in the years ahead.

- Rise in offshore hydrocarbon drilling: The increasing public-private investments in offshore hydrocarbon exploration are emerging as high-earning opportunities for horizontal directional drilling companies. The need for accurate pipeline techniques is propelling the demand for horizontal directional drilling services. The International Energy Agency (IEA) projects that the offshore oil and natural gas production in the new policies scenario is estimated to reach 27.4 mboe/d and 29.6 mboe/d, respectively, by 2040. The majority of new discoveries are being explored in oceans and are set to fuel the sales of advanced horizontal directional drilling technologies in the coming years.

Challenges

- Dominated by industry giants: The new companies aiming to enter the horizontal directional drilling business or the small-scale companies focusing on expansion find it difficult due to the high CAPEX. The high initial investment and lack of skilled workforce create a barrier to growth for budget-constrained companies. To compete with the dominant companies, the small and new players are entering into collaboration strategies and are also focusing on favorable government initiatives, such as funding or schemes.

- High costs required for innovations: The cost associated with the introduction of advanced technologies acts as a barrier for horizontal directional drilling companies. Many companies in price-sensitive markets find it difficult to enable new product launches. Budget-constrained companies are often being acquired by big players, leaving the global space concentrated. Price factor majorly deters innovations and new market entries, hampering the competitive growth.

Horizontal Directional Drilling Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

10.2% |

|

Base Year Market Size (2025) |

USD 12.11 billion |

|

Forecast Year Market Size (2035) |

USD 31.99 billion |

|

Regional Scope |

|

Horizontal Directional Drilling Market Segmentation:

Application (Onshore, Offshore)

The onshore segment is expected to capture 60.3% of the global horizontal directional drilling market share by 2035. The abundance of metals, minerals, and fuels in onshore areas is increasing the applications of horizontal directional drilling services. Many companies are investing in onshore drilling operations, owing to the better geographical structure than their offshore counterparts. For instance, in February 2025, Zephyr Energy Plc revealed that it completed drilling operations at the State 36-2 LNW-CC-R well. Apart from this, the increasing urban needs due to continuous infrastructure upgrades are further creating a profitable environment for horizontal directional drilling companies.

End user (Telecommunication, Oil & Gas Excavation, Utility, Others)

The oil & gas excavation segment is poised to account for 45.8% of the global horizontal directional drilling market share throughout the assessed period. The high demand for crude oil and gas is increasing the drilling activities across the world. The U.S. Energy Information Administration (EIA) states that the global oil inventories are likely to expand by 0.6 million b/d in the second quarter of 2025. Furthermore, the IEA estimates that the global natural gas demand stood at 3.89 EJ in 2024. North America dominates the natural gas demand, followed by Asia Pacific and Europe. The robust oil and gas consumption is directly augmenting the application of horizontal directional drilling technologies for exploration purposes.

Our in-depth analysis of the global horizontal directional drilling market includes the following segments:

|

Technique |

|

|

Parts |

|

|

Application |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Horizontal Directional Drilling Market Regional Analysis:

North America Market Forecast

The North America horizontal directional drilling market is anticipated to hold 36.8% of the global revenue share by 2035. The strong presence of leading companies is significantly contributing to the overall market growth. The positive public-private investments in metal and hydrocarbon mining processes are directly influencing the sales of horizontal directional drilling technologies. The hefty investments in clean energy projects are fueling the revenues of horizontal directional drilling companies in the U.S. and Canada.

The infrastructure upgrade projects in the U.S. are fueling the sales of horizontal directional drilling technologies. The significant involvement in crude oil production and increasing exploration of onshore and offshore hydrocarbons are likely to fuel the demand for horizontal directional drilling services. The U.S. EIA report highlights that the field production of crude oil increased from 12,554 thousand b/d in January 2024 to 13,146 thousand b/d in January 2025. The continuous rise in oil production represents constant drilling and exploration activities happening in the country.

The robust oil production and existence of sand reserves are set to offer lucrative earning opportunities for horizontal directional drilling companies in Canada. The Canadian Association of Petroleum Producers (CAPP) highlights that the country possesses 14 refineries with crude oil refining capacity of 1.9 million b/d. Nearly 95.0% of the country’s oil production is dominated by sand reserves. The YTD average Canadian production of natural gas and oil amounted to 18.1 billion cubic feet per day and 5.7 million barrels per day, in 2024, respectively.

Asia Pacific Market Statistics

The Asia Pacific horizontal directional drilling market is set to increase at the fastest pace from 2025 to 2035. The booming infrastructure development projects are fueling the demand for horizontal directional drilling services. Industrial and urban growth is the prime driver for the sales of horizontal directional drilling technologies. The rail, road, airport, energy, telecommunications, and water treatment sectors are propelling the applications of horizontal directional drilling systems. The G20 Outlook reveals that around USD 51 trillion in investment is needed in Asia’s infrastructure sector.

China’s expanding energy sector is poised to double the revenues of horizontal directional drilling market companies in the years ahead. The expanding mining activities in the country are likely to boost the sales of horizontal directional drilling services in the coming years. The report by the Trade Commissioner Service underscores that the country's more than 15,000 major mining companies are significantly leading the exploration activities. Most mining exploration is performed underground, which is directly set to boost the horizontal directional drilling technology trade.

The increasing investment in hydrocarbon exploration projects is expected to fuel the horizontal directional drilling service demand in India. The supportive government initiatives, such as the Hydrocarbon Exploration and Licensing Policy (HELP), are estimated to boost the domestic production of hydrocarbons. The Directorate General of Hydrocarbons (DGH) reveals that the eastern offshore of the country provided 1.46 MMT of the total oil production in FY 23-24. The growing oil and gas production activities are likely to increase the sales of horizontal directional drilling systems during the forecast period.

Key Horizontal Directional Drilling Market Players:

- Patterson-UTI Energy, Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- SLB

- Nabors Industries

- American Augers, Inc.

- Nawtek GmbH

- Barbco, Inc.

- Ellingson Companies

- Prime Drilling GmbH

- Ferguson Michiana Inc.

- Herrenknecht AG

- National Oilwell Varco, Inc.

- The Toro Company

The horizontal directional drilling market companies are employing several organic and inorganic marketing strategies such as new product launches, technological innovations, mergers & acquisitions, partnerships and collaborations, and regional expansions to earn high profits. The key players are investing heavily in advancing their production folio to meet the increasing consumers' demands. They are also forming strategic partnerships and collaborations with other players to increase their market reach. Investing in developing economies is poised to offer higher gains to leading companies in the years ahead.

Some of the key players include:

Recent Developments

- In April 2025, Patterson-UTI Energy, Inc. announced its drilling activity until March. For the last three months, the company had an average of 106 drilling rigs operating in the U.S.

- In January 2024, SLB and Nabors Industries entered into a collaboration to scale the adoption of automated drilling solutions for oil and gas operators and drilling contractors. The agreement is set to offer customers advanced drilling automation applications and rig operating systems.

- Report ID: 7584

- Published Date: Aug 12, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.