Histology and Cytology Market Outlook:

Histology and Cytology Market size was over USD 22.86 billion in 2025 and is anticipated to cross USD 87.77 billion by 2035, growing at more than 14.4% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of histology and cytology is assessed at USD 25.82 billion.

The histology and cytology market is growing exponentially owing to the rising prevalence of neoplastic diseases worldwide requiring ever more specific diagnostic tests and thereby requiring cytological and histological testing. For instance, in February 2025, it was published by the WHO that, with around 10 million fatalities from the disease in 2020, cancer is one of the top causes of mortality globally due to abnormal cancer cells growth. The statistics include, 2.26 million breast cancer, 2.21 million lung cancer, 1.93 million cases of colon and rectum, 1.41 million prostate cancer, 1.20 million skin cancer, and 1.09 million stomach cancer cases.

Moreover, newer technologies such as digital pathology with AI have revolutionized diagnostic workflows to absolute accuracy and faster turnaround time. Furthermore, increased application of immunohistochemistry and molecular diagnostics provides additional cell-level information to allow for more accurate characterization of disease. For instance, in June 2024, Nucleai collaborated with Roscia. The primary goal of the partnership is for the firms to better enhance patient care by integrating Nucleai's predictive biomarker solutions into Proscia's Concentriq software platform and offering them as part of Proscia's precision medicine AI portfolio.

Key Histology and Cytology Market Insights Summary:

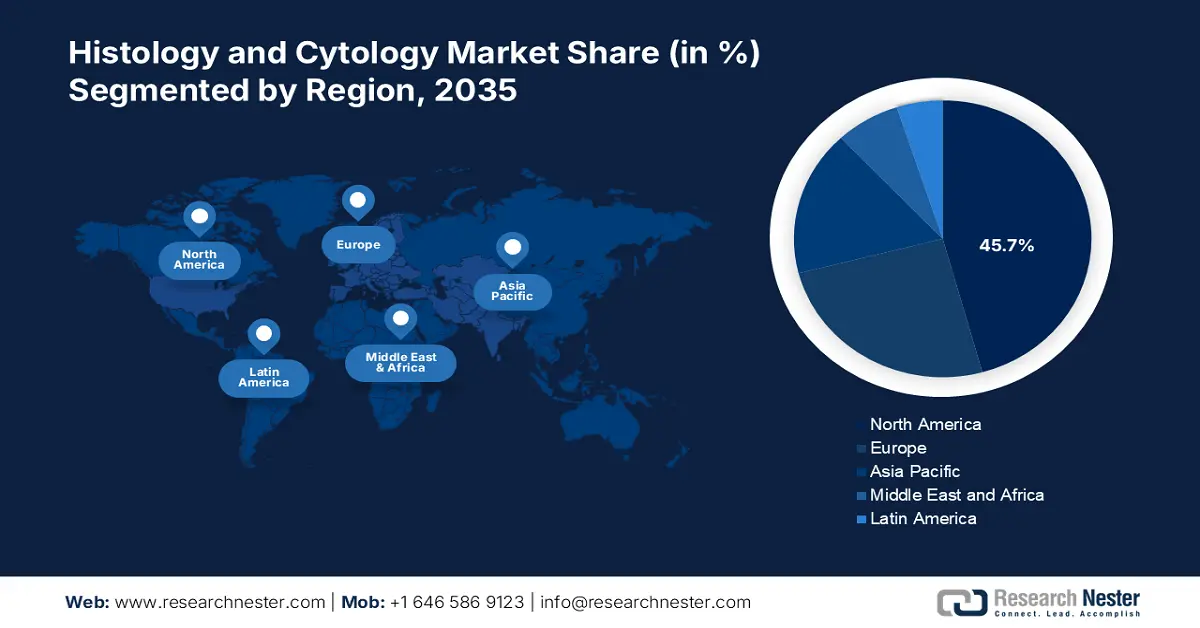

Regional Highlights:

- North America commands a 45.7% share in the Histology and Cytology Market, driven by the increasing prevalence of chronic diseases, especially cancer, and advancements in diagnostic technologies, reinforcing its leadership through 2035.

- The Asia Pacific Histology and Cytology Market is poised for lucrative growth over 2026–2035, fueled by increased awareness of disease diagnosis and supportive government healthcare policies.

Segment Insights:

- The Consumables and Reagents segment is poised for substantial growth from 2026 to 2035, driven by continuous demand for materials in routine and specialized cytological examinations.

- The Drug Discovery & Designing segment of the Histology and Cytology Market is projected to hold a 52.5% share by 2035, driven by its central role in evaluating drug candidates, particularly in preclinical testing.

Key Growth Trends:

- Rising adoption of immunohistochemistry and molecular diagnostics

- Aging global population

Major Challenges:

- Cost of advanced technologies

- Contamination risks

Key Players: F. Hoffmann-La Roche Ltd, Thermo Fisher Scientific, Inc., Danaher, Trivitron Healthcare, and more.

Global Histology and Cytology Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 22.86 billion

- 2026 Market Size: USD 25.82 billion

- Projected Market Size: USD 87.77 billion by 2035

- Growth Forecasts: 14.4% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (45.7% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, Japan, United Kingdom, France

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 12 August, 2025

Histology and Cytology Market Growth Drivers and Challenges:

Growth Drivers

- Rising adoption of immunohistochemistry and molecular diagnostics: The histology and cytology market is expanding, led by the increase in utilization of immunohistochemistry (IHC) and molecular diagnostics. IHC enhances the accuracy of diagnostics by staining the specific cellular elements, which play a crucial role in the case of diseases such as cancer. For instance, in March 2023, Aptamer Group plc has created innovative Optimer binders to spur innovation in the health sciences sector. Also it has created Optimer-Fc, a new reagent for automated immunohistochemistry (IHC) processes. These technologies, by enabling deeper understanding of cell and tissue structure, are becoming the focus of clinical diagnostics and hence fueling market growth.

- Aging global population: A robust driver of histology and cytology market growth is surging aging population. With increased life expectancy comes the attendant rise in the incidence of age-related disease, such as cancer and other chronic disease. For instance, in February 2025, it was revealed by the WHO that, by 2030, there will be 1.4 billion persons over 60 in the world, up from 1.1 billion in 2023. This population trend necessitates more diagnostic work-up, thus creating demand for histological and cytological work-up. Thus, the need for accurate and timely cellular and tissue examination to allow for proper disease control in an aging population is expanding the market.

Challenges

- Cost of advanced technologies: An increase in technology cost is a significant barrier in the histology and cytology market. The use of high-technology digital pathology scanners, automated tissue processors, and advanced molecular diagnostic instruments involves enormous capital expenditures, thus posing as an entry barrier for small laboratories and medical centers. In addition to the cost of purchase, its costs are directed towards maintenance, software updates, and the necessary, expert-level training staff will need to receive in order to operate these advanced systems. These costs can act as a hindrance to mass adoption, potentially limiting access to valuable diagnostic information and thus impacting patient care.

- Contamination risks: A critical area in the histology and cytology market which can compromise diagnostic results' reliability and validity is risk of contamination. Specifically, introduction of exogenous material, for instance, microbial contaminants or foreign cellular detritus, may produce false-negative or false-positive results and thereby affect patient care. Standard procedures should be applied rigorously, strict environmental control should be exerted, and strict sterilization of equipment practiced to minimize the risks. In addition, the use of advanced technology, which minimizes sample handling and maximizes environmental integrity, is critical in maintaining the integrity of cytological and histology samples.

Histology and Cytology Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

14.4% |

|

Base Year Market Size (2025) |

USD 22.86 billion |

|

Forecast Year Market Size (2035) |

USD 87.77 billion |

|

Regional Scope |

|

Histology and Cytology Market Segmentation:

Application (Drug Discovery & Designing, Clinical Diagnostics, Point-of-Care (PoC), Non-Point-of-Care, Research)

Based on the application segment is set to dominate histology and cytology market share of around 52.5% by the end of 2035, as it plays a central role in evaluating new drug candidates, particularly in preclinical testing. For instance, in January 2025, The CellFE T-Rest, a first-in-class cell manufacturing transfection media solution made especially for resting (quiescent) T cell workflows, was launched by CellFE. It offers a new paradigm for cell therapy manufacturers to create safer and more effective treatments by supporting a completely optimized gene editing approach that starts with resting T cells. These processes enable the indication of relevant drug efficacy and toxicity and identification of pertinent biomarkers at the cellular and tissue level, thereby playing a driver of market demand.

Product (Istruments and Analysis Software System, Consumable and Reagents)

One of the most crucial areas of growth in the histology and cytology market is the consumables and reagents segment, primarily due to the cyclical demand for the required materials such as stains, fixatives, antibodies, and other reagents applied in routine and specialized cytological and histological examination. For instance, in April 2024, Siemens Healthineers and Sysmex Corporation started distributing their combined wide hemostasis testing to laboratories in the US and Europe. This gave healthcare providers easy access to top hemostasis testing solutions that support a variety of patient conditions and disease states. The continuous nature of these tests demands a continuous supply of consumables, which translates to this segment commanding a vast percentage of the revenues of the histology and cytology market.

Our in-depth analysis of the global market includes the following segments:

|

Product |

|

|

Application |

|

|

End user |

|

|

Type Of Examination |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Histology and Cytology Market Regional Analysis:

North America Market Statistics

In histology and cytology market, North America region is estimated to account for more than 45.7% share by the end of 2035. The growing prevalence of chronic diseases, particularly cancer, which requires precise tissue and cell analysis, drives demand. Furthermore, technological advances, such as digital pathology and high-technology imaging equipment, enhancing diagnostic accuracy as well as productivity levels, work to propel the same.

U.S. histology and cytology market is robustly growing due to the ongoing research programs conducted by the market players and research institutions. For instance, in February 2024, Researchers at Massachusetts Institute of Technology created a low-cost tool to increase the safety of cell treatment, which before being implanted in a patient, a plastic microfluidic chip can eliminate some potentially dangerous cells that could develop into cancers. Furthermore, researchers at MIT and the Singapore-MIT have developed a small gadget that may help patients with spinal cord injuries receive cell therapy treatments more safely and effectively.

The histology and cytology market in Canada is witnessing significant growth due to innovations in cell therapy. For instance, in June 2024, Charting the Path to Stem Cell-Based Therapies was the title of the first scientific conference hosted by UHN's McEwen Stem Cell Institute. The one-day symposium featured the most recent developments and breakthroughs in the fields of regenerative medicine and cell therapy. The symposium's objective was to present the most recent developments in the creation of cell therapies that use human pluripotent stem cell (hPSC)-derived cells to treat a variety of degenerative and incapacitating illnesses.

Asia Pacific Market Analysis

The histology and cytology market in Asia Pacific is gaining traction and is expected to witness lucrative growth during the forecast timeline i.e. 2025-2035. This growth is attributed to the increased awareness of disease early diagnosis and implementation of regular health screening programs. Moreover, incentivization for supportive government reimbursement policies along with extremely high levels of healthcare expenditure also drives such growth trend. Hence, the market of the region is expanding at an extremely fast pace due to a wide range of reasons.

The histology and cytology market in India is expanding as a result of the investigational studies being carried across the country. For instance, in February 2024, The Central Drugs Standard Control Organization authorized NexCAR19 as the country's first CAR-T cell therapy in October 2023. A study carried out resulted from two small clinical trials in 64 patients with advanced leukemia or lymphoma in IndiaExit Disclaimer served as the basis for the clearance. Of the patients in the two studies, 67% (36 out of 53) experienced a significant reduction in the amount of their cancer (objective response), and almost half (complete response) had their cancer completely disappear.

The histology and cytology market in China is gaining noteworthy traction owing to the partnerships and strategic collaborations. For instance, in January 2025, an exclusive partnership and license agreement for the development and marketing of Vertex's povetacicept (pove) in mainland China was announced by Vertex Pharmaceuticals Incorporated and Zai Lab Limited. It is the best-in-class potential of Pove, a recombinant fusion protein therapy and dual antagonist of APRIL (a proliferation stimulating ligand) and BAFF (B cell activating factor) being investigated for the treatment of Immunoglobulin A nephropathy (IgAN) and other B cell-mediated disorders.

Key Histology and Cytology Market Players:

- Hologic, Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- BD

- Abbott

- Merck KgaA

- F. Hoffmann-La Roche Ltd

- Thermo Fisher Scientific, Inc.

- Danaher

- Trivitron Healthcare

- Sysmex Corporation

- Koninklijke Philips N.V.

The prominent players are dominating the histology and cytology market with the novel drugs and cell therapies being developed by the prominent players. For instance, in January 2023, in order to replace or sustain cells that are absent or defective as a result of degenerative illness, Genentech and Lineage Cell Therapeutics collaborated to develop allogeneic retinal pigment epithelial (RPE) cells that may be injected beneath the retina. This strategy might enable a steady flow of cells and the production of doses in advance, making them easily accessible for patients.

Here's the list of some key players:

Recent Developments

- In March 2025, Veranex announced that it has purchased the pathology and histology facility HORUS Scientific. By strengthening Veranex's end-to-end service capabilities for medtech innovation, this purchase further demonstrates the company's dedication to globalization.

- In May 2024, Quest Diagnostics and PathAI announced a multifaceted partnership aimed at accelerating the adoption of digital and AI pathology innovations to improve the quality, speed, and efficiency of cancer and other disease diagnosis.

- Report ID: 7541

- Published Date: Aug 12, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Histology and Cytology Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.