Heparin Market Outlook:

Heparin Market size was valued at USD 6.8 billion in 2025 and is projected to reach USD 11.2 billion by the end of 2035, rising at a CAGR of 5.8% during the forecast period, i.e., 2026-2035. In 2026, the industry size of heparin is estimated at USD 7.1 billion.

The heparin market is poised for steady growth owing to the increasing prevalence of cardiovascular diseases, rising awareness of blood clot-related disorders, and expanding applications in medical procedures such as dialysis and surgeries. According to official statistics from the CDC in January 2025, venous thromboembolism, including deep vein thrombosis and pulmonary embolism, affects up to 900,000 people every year in the U.S. and causes an estimated 60,000 to 100,000 deaths each year. It also underscored that a significant portion of VTE cases is healthcare-associated, occurring during or after hospitalization, surgery, or cancer treatment, and many are preventable with anticoagulant therapy or compression devices. Hence, these drives sustained hospital and clinical demand for heparin as a frontline anticoagulant for treatment and prophylaxis across surgeries, cancer care, and inpatient settings.

Furthermore, the heightened demand for anticoagulants, coupled with advancements in biopharmaceutical manufacturing, is readily enhancing the accessibility and efficiency of heparin. In this context, as per the recent findings from CMS, the continuously changing payment amounts for the HCPCS J0911 taurolidine and heparin catheter lock highlight the dynamic nature of reimbursement in the dialysis sector. These changes encourage healthcare providers, suppliers, and industry players to be proactive in managing procurement and pricing strategies. Also, by anticipating periods of higher or lower payment, stakeholders can optimize their inventory, negotiate better supply contracts, and look for value-added services. In addition, this environment of fluctuating payments also drives innovation, allowing providers to improve efficiency and patient care while capitalizing on periods of favorable reimbursement. Overall, understanding and responding to these price shifts can create opportunities for growth, cost management, and strategic positioning in the heparin market.

HCPCS J0911 Taurolidine & Heparin Catheter Lock: Effective Period, for 1.35 MG Dosage, and Payment Analysis (USD)

|

Effective Period |

Payment Amount |

|

January 1, 2026, through March 31, 2026 |

USD 5.635 |

|

October 1, 2025 -December 31, 2025 |

USD 6.046 |

|

Not specified |

USD 7.248 |

|

April 1, 2025 -June 30, 2025 |

USD 8.106 |

|

July 1, 2024 -September 30, 2024 |

USD 8.33 |

Source: CMS

Key Heparin Market Insights Summary:

Regional Highlights:

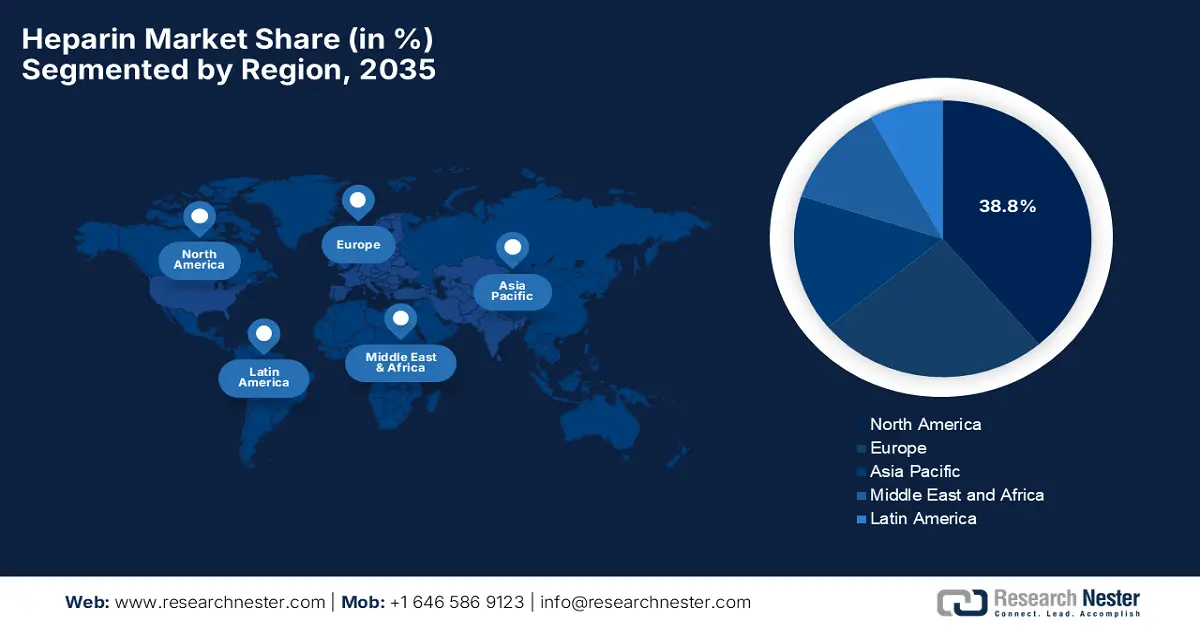

- North America is projected to command a leading 38.8% revenue share by 2035 in the heparin market, supported by advanced healthcare infrastructure and widespread integration of anticoagulant therapies across surgical, cardiology, and critical care settings, reinforced by stringent regulatory oversight and supply diversification initiatives.

- Asia Pacific is anticipated to emerge as the fastest-growing region through 2035, reflecting accelerating healthcare expenditure and expanding hospital networks, underpinned by rising awareness of thromboembolic disorders and modernization of pharmaceutical manufacturing and diagnostic capabilities.

Segment Insights:

- The subcutaneous route of administration is expected to dominate the heparin market with a 65.5% revenue share by 2035, as its extensive use in low-molecular-weight heparin therapy benefits from cost efficiency, predictable anticoagulant response, and broad clinical acceptance across high-risk patient populations.

- The low-molecular-weight heparin segment is projected to secure a substantial market share by 2035 in the heparin market, strengthened by its favorable pharmacokinetics, lower complication risk, and growing utilization in cardiovascular care and surgical prophylaxis.

Key Growth Trends:

- Rising prevalence of cardiovascular diseases

- Adoption of advanced heparin formulations

Major Challenges:

- Supply chain dependence on animal-derived sources

- Regulatory and quality compliance

Key Players: Berry Global, Inc. (U.S.), RKW Group / RKW SE (Germany), Ginegar Plastic Products Ltd. (Israel), Plastika Kritis S.A. (Greece), POLIFILM EXTRUSION GmbH (Germany), Armando Álvarez Group (Grupo Armando Álvarez) (Spain), Agripolyane (France), A. Politiv Ltd. (Israel), Trioplast Industries AB (Sweden), FVG Folien‑Vertriebs GmbH (Germany), Mitsubishi Chemical Corporation (Japan), Agriplast Tech India Pvt Ltd (India), Tuflex India (India), Thai Charoen Thong Karntor Co. Ltd. (TCT) (Thailand), Lumite, Inc. (U.S.).

Global Heparin Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 6.8 billion

- 2026 Market Size: USD 7.1 billion

- Projected Market Size: USD 11.2 billion by 2035

- Growth Forecasts: 5.8% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (38.8% share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: India, Brazil, South Korea, Singapore, Australia

Last updated on : 15 January, 2026

Heparin Market - Growth Drivers and Challenges

Growth Drivers

- Rising prevalence of cardiovascular diseases: The growing burden of cardiovascular diseases, such as coronary artery disease, atrial fibrillation, and pulmonary embolism, is the fundamental growth driver for the heparin market. In this context World Health Organization in July 2025 reported that cardiovascular diseases are the leading cause of death and are responsible for nearly 19.8 million deaths in 2022, with heart attacks and strokes accounting for 85% of these cases. The report also mentioned that the majority of CVD deaths occur in low- and middle-income countries, where there is limited access to early detection, preventive care, and treatment, exacerbating health and economic burdens. In addition, the risk factors include unhealthy lifestyles, underlying conditions such as hypertension and diabetes, highlighting the need for prevention, early intervention, and equitable healthcare access.

- Adoption of advanced heparin formulations: Expansion in the use of low molecular weight heparins, which offer better safety profiles, predictable pharmacokinetics, and simpler dosing when compared to traditional unfractionated heparin, is increasing heparin market uptake. Innovations such as next‑generation heparin formulations and novel delivery systems improve therapeutic outcomes and broaden clinical applications. In June 2024, ROVI reported that it had completed the expansion of its Escúzar plant in Spain by adding a new sodium heparin production line with a capacity of 1,200,000 MIU, essential for producing low-molecular-weight heparins. This development strengthens ROVI’s vertical integration strategy for LMWHs, a product considered essential by the European Union and a strategic segment for the company. In addition, the expansion also enhances production autonomy, supports broader clinical use of advanced heparin formulations.

- Regulatory support & drug approvals: Regulatory approvals for the newest heparin-based formulations and supportive policies help to enhance the product portfolio and facilitate heparin market progression over the forecasted years. In May 2024, the U.S. FDA announced clearance of Medtronic’s modified MVR venous reservoir bags, which include versions with the Cortiva BioActive Surface, for use in cardiopulmonary bypass surgery. It also mentioned that these devices consist of blood-contacting surfaces that are coated with nonleaching heparin, derived from porcine intestinal mucosa, thereby enhancing thromboresistance and blood compatibility. Furthermore, the U.S. FDA confirmed that the material and design changes, including a one-way stopcock update, maintain substantial equivalence to predicate devices providing safe and effective use during cardiac procedures, contributing to the heparin market expansion.

Challenges

- Supply chain dependence on animal-derived sources: The major challenge in the heparin market is the reliance on animal-derived sources such as porcine intestinal mucosa. Mostly worldwide, heparin is sourced from pigs, especially in China, which in turn creates vulnerability to supply disruptions owing to disease outbreaks, geopolitical tensions, or trade restrictions. On the other hand, Zoonotic diseases such as the African swine fever can reduce pig populations, leading to fluctuations in heparin availability and price volatility in this field. Meanwhile, the aspect of ethical and environmental concerns regarding large-scale animal farming is rising. In this context, companies face pressure to ensure a stable supply for global demand and explore sustainable alternatives, such as bioengineered or microbial heparin, wherein these solutions require R&D investment and regulatory approval, ultimately slowing adoption.

- Regulatory and quality compliance: Heparin is a critical anticoagulant, so regulatory scrutiny is intense across markets in almost all nations. Administrative bodies such as the FDA, EMA, and PMDA require stringent quality control, batch-to-batch consistency, and contamination-free production, especially after the 2008 heparin adulteration crisis. Therefore, ensuring compliance is costly and time-consuming, particularly for manufacturers who are involved in export activities on an international scale. Small variations in molecular structure can affect efficacy and safety, making analytical testing and process validation highly essential. These regulatory hurdles can also delay product launches, limit market expansion, and increase operational costs. Therefore, companies must make investments in modern manufacturing technologies, robust traceability systems, and compliance certifications, which can be challenging for smaller or emerging players in the heparin market.

Heparin Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

5.8% |

|

Base Year Market Size (2025) |

USD 6.8 billion |

|

Forecast Year Market Size (2035) |

USD 11.2 billion |

|

Regional Scope |

|

Heparin Market Segmentation:

Route of Administration Segment Analysis

Based on the route of administration, the subcutaneous subtype is expected to lead with the largest revenue share of 65.5% in the heparin market. The dominance is effectively attributable to the increasing adoption of low molecular weight heparin and its cost-effectiveness. According to the article published by NIH in March 2025, the low-molecular-weight heparins such as enoxaparin and dalteparin are mostly administered through subcutaneous injection for the prophylaxis and treatment of venous thromboembolism in hospitalized, surgical, and high-risk patients, as per FDA-approved indications and clinical guidelines. In addition, it also notes that this route is highly preferred owing to the predictable anticoagulant effects, longer half-life, and reduced need for monitoring when compared to unfractionated heparin. Furthermore, LMWHs are also recommended for special populations such as pregnant women, pediatric patients, and older adults, thereby highlighting widespread adoption of subcutaneous administration.

Type Segment Analysis

By the conclusion of 2035, the low-molecular-weight heparin segment is expected to grow with a considerable share in the heparin market. It is mostly preferred anticoagulant globally owing to more predictable pharmacokinetics, longer half-life, lower risk of heparin-induced thrombocytopenia, and reduced monitoring needs when compared with unfractionated heparin. The increasing prevalence of cardiovascular diseases and the rising number of surgical procedures worldwide are also fueling LMWH adoption. The availability of prefilled syringes and patient-friendly subcutaneous administration supports its extensive utilization in both hospital and home settings. Ongoing research and development into novel LMWH formulations and biosimilars are expected to expand market accessibility in the upcoming years. Moreover, clinical guidelines from leading health authorities continue to recommend LMWH for thromboprophylaxis in high-risk populations, reinforcing its position in the heparin market.

Source Segment Analysis

The porcine-derived heparin is anticipated to grow with a considerable share in the heparin market over the forecasted years. The growth of the segment is since porcine mucosa being the most established and widely accepted raw material for heparin APIs with consistent quality and clinical history. In May 2023, Bioiberica and Vall Companys together announced the launch of Biovall Heparin Science, which is a joint project to produce crude heparin from porcine intestinal mucosa, promoting a sustainable circular economy by reusing porcine co-products. This initiative is approved by local authorities, involves 25,000 tonnes of mucosa annually, meeting Spain’s total heparin demand under strict GMP standards. Bioiberica, the world’s leading heparin API producer that strongly emphasizes traceability, quality, and safety, reinforces porcine-derived heparin’s central role in global anticoagulant supply.

Our in-depth analysis of the global heparin market includes the following segments:

|

Segment |

Subsegments |

|

Route of Administration |

|

|

Type |

|

|

Source |

|

|

Application |

|

|

End user |

|

|

Distribution Channel |

|

|

Packaging |

|

|

Ingredients |

|

|

Strength |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Heparin Market - Regional Analysis

North America Market Insights

The North America heparin market is expected to command the largest revenue share of 38.8% by the end of 2035. The focus on advanced healthcare infrastructure and increasing adoption of anticoagulant therapies are the key factors behind the region’s leadership. Hospitals and specialty clinics in this region integrate heparin into surgical procedures, cardiology, and critical care, whereas the regulatory oversight ensures high-quality standards for both raw materials and finished products. As of the U.S. FDA data from January 2026, it is encouraging the reintroduction of bovine-sourced heparin in the U.S. to diversify the heparin supply and address risks associated with porcine heparin shortages or contamination. The agency also continues to support manufacturers through pre-IND engagement, thereby emphasizing rigorous chemistry, manufacturing, and control standards to safeguard public health, hence denoting a positive heparin market outlook.

The U.S. heparin market holds a leading position in the regional landscape owing to the continuous improvements in manufacturing, safety protocols, and monitoring practices that readily enhance patient outcomes. The presence of leading pharmaceutical manufacturers and stringent FDA regulations contributes to consistent product quality, allowing an increased uptake in the country. In February 2022, Techdow USA announced the launch of its heparin sodium injection, USP in the country by providing hospitals and healthcare networks with an affordable and reliable source of heparin. The company emphasized its vertically integrated supply chain to ensure consistent availability despite the existence of challenges in sourcing raw materials. In addition, Techdow also highlighted the safety profile of heparin, which includes adverse reactions such as hemorrhage, thrombocytopenia, and hypersensitivity by positioning itself as a long-term, dependable supplier in the country’s market.

The Canada heparin market is propelled by strong public healthcare support and adherence to Health Canada regulations. Hospitals in the country prioritize anticoagulation therapies for surgical and high-risk patients, with a prime focus on patient safety and efficacy. Simultaneously, the collaborative research with international institutions supports the development of heparin derivatives and optimized administration routes by ensuring increased clinical adoption. In this regard Drug and Health Product Portal reported that heparin sodium injection USP by Sterimax Inc. is actively marketed, with its Health Canada approval reported to be September 2024. The product consists of 5,000 units per 0.5 mL, is authorized for safe and effective use in clinical settings, supported by a detailed product monograph for healthcare professionals and patients. In addition, Health Canada also provides channels for reporting side effects, ensuring ongoing monitoring of safety and promoting regulated adoption of heparin in the country’s hospitals.

APAC Market Insights

The Asia Pacific heparin market is expected to represent the fastest growth owing to the increasing healthcare expenditure, rising awareness of thromboembolic disorders, and expanding hospital networks. Local governments across the region encourage modernization of pharmaceutical manufacturing facilities and compliance with international quality standards. In September 2024, Sysmex Corporation announced the launch of the HISCL HIT IgG assay kit, which is especially designed to measure IgG antibodies against platelet factor 4‑heparin complexes for the rapid detection of heparin-induced thrombocytopenia. The kit is compatible with Sysmex’s CN-6500 and CN-3500 automated blood coagulation analyzers, and it offers high specificity and sensitivity, reducing false positives and speeding up clinical decision-making. Furthermore, it enables faster, more accurate diagnosis and improves workflow efficiency in hospitals. The product supports safer heparin therapy and optimized patient care.

China heparin market is efficiently driven by the huge domestic production capacity and strong demand in cardiovascular and orthopedic care. The country’s market also benefits from large API manufacturers, and regulatory agencies oversee the sourcing of raw materials, particularly porcine-derived heparin, ensuring quality and safety. The continued innovations in anticoagulant therapies and collaborations between local producers and global pharmaceutical companies are rearranging the growth dynamics of the country. In July 2025, Shenzhen Hepalink Pharmaceutical Group announced the first subject enrollment and dosing for its Phase I clinical trial of H1710 Injection, which is an innovative heparin derivative targeting heparanase for advanced solid tumors. The company also notes that H1710 is designed as a highly selective heparanase inhibitor consisting of low anticoagulant activity and potential anti-tumor effects. The open-label, dose-escalation study will assess safety, tolerability, and preliminary efficacy in approximately 36 patients across three research centers.

The India heparin market is continuously growing along with the growth of tertiary care hospitals and surgical procedures requiring anticoagulation. The country’s market is a significant exporter of raw heparin, wherein the manufacturers are focused mainly on sustainable sourcing and compliance with global pharmacopeia standards. In this context, the government of India’s production-linked incentive schemes for pharmaceuticals have strengthened domestic manufacturing of critical APIs, KSMs, and DIs, reducing import dependency by thousands of crores and supporting exports. As of September 2025, 26 KSMs/APIs and 191 other APIs were produced under the schemes, generating huge amounts of domestic sales and global exports. In addition to the initiatives, including bulk drug parks in Andhra Pradesh, Gujarat, and Himachal Pradesh, it also promotes research, infrastructure development, and high-value drug production, hence increasing the potential of the heparin industry.

Europe Market Insights

The Europe heparin market is backed by well-established healthcare systems and high standards for pharmaceutical manufacturing. Simultaneously, continuous innovation in heparin derivatives and formulations, along with strict EU regulatory oversight, ensures consistent quality and safety across the region’s vast geography. In September 2025, the EDQM reported that it had established a heparin low-molecular-mass calibration CRS batch 6 for use in determining molecular mass distribution of low-molecular-weight heparins under the European Pharmacopoeia monograph. The batch’s fitness for use was confirmed through studies conducted by the EDQM’s biological standardisation programme by ensuring high-quality standards for heparin products across Europe. Furthermore, this reference material, adopted by the European Pharmacopoeia Commission, supports consistent manufacturing, regulatory compliance, and safe clinical use in surgeries, dialysis, and cardiovascular care, hence making it suitable for standard heparin market growth.

Germany heparin market is growing on account of its advanced clinical applications and integration of heparin in most of the critical care procedures. Pharmaceutical manufacturers in the country maintain quality standards, whereas hospitals emphasize evidence-based protocols for anticoagulation therapy. Collaboration between research institutions and industry players accelerates innovation in low-molecular-weight heparins and safer administration methods. In the country, the updated Rili‑BAEK 2023 guidelines specify that for certain lab tests, including potassium measurement, heparin‑plasma or whole blood must be used rather than serum to avoid erroneous results. These pre-analytical requirements are mainly aimed at ensuring accurate laboratory testing for patient care, and must be fully implemented within three years of publication, reinforcing high standards in hospital and diagnostic laboratory procedures where heparin monitoring is highly critical.

The UK heparin market is mainly focused on efficient anticoagulation management within NHS hospitals and specialized care units. Regulatory authorities in the country enforce strict compliance with manufacturing and safety standards. Simultaneously, there has been an increased adoption of low-molecular-weight heparins for predictable dosing, whereas ongoing research and clinical trials aim to optimize patient outcomes and reduce adverse events. In May 2025, NHS England published a procurement notice for the national supply of low molecular weight heparins in which the contracts are running from March 2026 to February 2028 and are extendable to 2030. It also mentioned that the estimated contract value is £73.2 million (USD 90 million), including VAT by covering multiple regions across England. Hence, this official pipeline notice highlights the NHS’s commitment to securing LMWH therapies for consistent anticoagulation management in hospitals and specialized care units.

Key Heparin Market Players:

- Shenzhen Hepalink Pharmaceutical Co., Ltd. (China)

- Yantai Dongcheng Pharmaceutical (China)

- Nanjing King‑Friend Biochemical Pharmaceutical (China)

- Hebei Changshan Biochemical Pharmaceutical Co., Ltd. (China)

- Qingdao Jiulong Biopharmaceutical Co., Ltd. (China)

- Changzhou Qianhong Biopharma Co., Ltd. (China)

- Pfizer Inc. (USA)

- Baxter International Inc. (USA)

- B. Braun Medical Inc. (Germany)

- Fresenius SE & Co. KGaA (Germany)

- Sanofi S.A. (France)

- Bioiberica S.A.U. (Spain)

- Opocrin S.p.A. (Italy)

- Dr. Reddy’s Laboratories Ltd. (India)

- Biocon Ltd. (India)

- Bharat Serums and Vaccines Ltd. (India)

- Daewoong Pharmaceutical Co., Ltd. (South Korea)

- Teva Pharmaceutical Industries Ltd. (Israel)

- Fresenius Kabi USA, LLC (USA)

- Sandoz (Novartis AG) (Switzerland)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- B. Braun Medical Inc. registered its position as one of the leading manufacturers of heparin-based injectable products, particularly premixed heparin solutions and infusion therapies. The company emphasizes patient safety, innovative packaging, and portfolio diversification. B. Braun opts for numerous strategic initiatives, such as expanding production capacity in Europe and the U.S., investing in R&D for novel formulations, and strengthening global distribution networks, which have allowed it to capture a leading market position.

- Pfizer Inc. is a major U.S. pharmaceutical company that has a significant presence in finished heparin products and low-molecular-weight heparins. Besides, the firm leverages international distribution, regulatory compliance, and brand reputation to maintain heparin market leadership over the recent years. In addition, Pfizer is focused on portfolio expansion, collaboration with upstream API suppliers, and investment in innovative anticoagulant therapies, thereby ensuring supply chain security and making it suitable to growing clinical demand across the world.

- Shenzhen Hepalink Pharmaceutical Co., Ltd. is the world’s largest heparin API supplier, which controls a substantial share of crude and low-molecular-weight heparin production. The firm concentrates mainly on scalable manufacturing, strict regulatory compliance, and research into novel anticoagulants. Moreover, Hepalink also secures long-term raw material contracts and actively expands exports, thereby ensuring a stable global heparin supply, particularly to Western pharmaceutical partners.

- Fresenius Kabi is a central player in this field that specializes in heparin injectables, anticoagulant therapies, and hospital infusion solutions, combining regional production excellence with global distribution capabilities. The company is also focused on capacity expansion, maintaining stringent quality standards, and product portfolio innovation. Furthermore, strategic initiatives include collaborations with upstream API suppliers and investments in low-molecular-weight heparin products, enabling Fresenius to strengthen its competitive position.

- Dr. Reddy’s Laboratories Ltd. is a leading pharmaceutical manufacturer based in India that produces heparin APIs and formulations for domestic and export markets. The company emphasizes cost-efficient manufacturing, regulatory compliance with governing bodies, i.e., U.S. FDA and EMA, and biosimilar development. Expanding global partnerships, enhancing production capacity, and investing in R&D for advanced anticoagulants are a few strategies opted for by the firm to secure its market position.

Below is the list of some prominent players operating in the global heparin market:

The global heparin market is primarily shaped by the presence of high-volume API manufacturers such as Shenzhen Hepalink and Nanjing King‑Friend, along with Western pharmaceutical leaders such as Pfizer, Baxter, Sanofi, and B. Braun. These key pioneers are focused mainly on finished injectables and LMWH products. China dominates upstream supply owing to the large-scale production and cost efficiency, whereas the U.S., Europe, and India-based companies leverage international distribution networks and branded portfolios. In December 2025, Cadrenal Therapeutics announced that it had acquired VLX-1005, which is a phase 2 12-LOX inhibitor from Veralox Therapeutics, targeting the immune-driven pathology of heparin-induced thrombocytopenia. The company also notes that this drug has shown safety and efficacy in early studies, with Orphan Drug and Fast Track designations from the FDA and EMA. This strategic acquisition strengthens Cadrenal’s pipeline in high-risk anticoagulation therapies, further encouraging more players to establish their footprint in the country.

Corporate Landscape of the Heparin Market:

Recent Developments

- In July 2025, B. Braun Medical Inc. announced the launch of 25,000 units of heparin in 0.45% sodium chloride injection in both 50 units/mL and 100 units/mL, making it the largest selection of premixed heparin bags. The products feature 2D enhanced barcodes and are manufactured using DEHP-, PVC-, and latex-free EXCEL IV containers at its Irvine, California facility.

- In February 2025, Bioparin, a Salt Lake City biotech, received a USD 306,000 Phase I STTR grant from the NHLBI to develop large-scale bio-manufacturing of heparin-like anticoagulants using engineered microbial factories, addressing supply chain, zoonotic, and environmental challenges, with a subaward to the University of Utah.

- Report ID: 3402

- Published Date: Jan 15, 2026

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Heparin Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.