Aircraft Mounts Market Outlook:

Aircraft Mounts Market size was valued at USD 1.5 billion in 2025 and is projected to reach USD 3.2 billion by the end of 2035, rising at a CAGR of 7.6% during the forecast period, i.e., 2026-2035. In 2026, the industry size of aircraft mounts is assessed at USD 1.6 billion.

The global demand for the aircraft mounts market continues to align closely with the pace of airframe production, engine deliveries, and defense procurement, mainly across the U.S., Europe, and Asia. According to the U.S. Federal Aviation Administration, 2025 to 2045 data, the U.S. mainline passenger carrier fleet is expected to rise from 4,829 to 6,854 by 2045 has a direct material impact on the demand for the aircraft mounts. Each new aircraft entering the fleet requires engine mounts, vibration isolation mounts, avionics system mounts, and airframe support mounts for system integration. As the fleet expands, the OEM production rate also rises, which increases the consumption of mounting hardware across all the structural and subsystem categories. The projected growth also enhances the lifecycle replacement demand within the MRO operations as mounts are fatigue-sensitive components requiring periodic inspection and renewal.

This growth is paralleled by the increased defense spending; for instance, the U.S. Department of Defense’s fiscal year 2024 budget has allocated significant investment in the air system and related procurement, underscoring the sustained investment in platforms requiring advanced mounting solutions. The aircraft mounts market is further driven by the urgent need for enhanced vibration-damping and isolation technologies to protect increasingly sensitive avionics and ensure structural integrity, with material advancements playing a key role in meeting the robust performance and weight requirements. Aircraft mounts are classified as aircraft parts within international trade categories. As per the OEC August 2024 to July 2025 data, the U.S. is the top exporter of aircraft parts around the globe, and the export value reached USD 138 billion. The export of the aircraft parts includes assemblies that fall within the same supply chain ecosystem as aircraft mounts. Further, the high export volumes indicate a strong domestic aerospace manufacturing base, demand for the aircraft components, and a robust supply chain, including mounts.

Key Aircraft Mounts Market Insights Summary:

Regional Highlights:

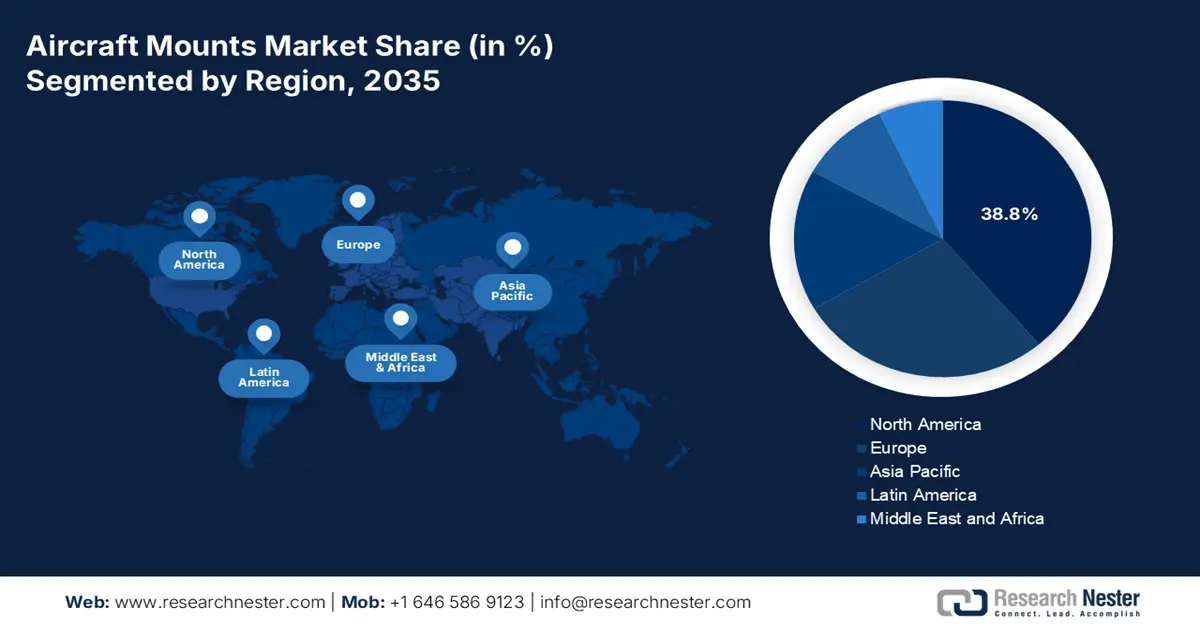

- Across 2026–2035, North America is set to command a 38.8% share of the aircraft mounts market by 2035, upheld by expanding defense programs and a mature MRO ecosystem.

- By 2035, Asia Pacific is forecast to accelerate at a 6.2% CAGR, strengthened by rising commercial air travel and large-scale military modernization.

Segment Insights:

- By 2035, the OEM segment in theaircraft mounts market is expected to secure a 58.6% share, propelled by increasing production of next-generation commercial and military aircraft.

- By 2035, commercial aviation is anticipated to dominate the aircraft type segment, sustained by expanding global passenger volumes and accelerated fleet renewal with next-gen models.

Key Growth Trends:

- Military modernization and increased defense budgets

- Aging fleet and sustained MRO demand

Major Challenges:

- High R&D and capital investment

- Complex global supply chain dynamics

Key Players: Lord Corporation (U.S.), Parker Hannifin Corp (U.S), Hutchinson SA (France), Trelleborg AB (Sweden), Eaton Corporation (U.S), Vibratech TVC (U.S), ITT Inc. (U.S), Meggitt PLC (UK), Safran S.A. (France), GMT Rubber-Metal-Technic Ltd. (Germany), Meister AG (Switzerland), Sumitomo Riko (Japan), Korean Air Aerospace Division (South Korea), Hindustan Aeronautics Ltd (HAL) (India), Héroux-Devtek Inc. (Canada), BASF (Engineered Materials) (Germany), Cadence Aerospace (U.S), Shock Tech, Inc. (U.S), Avionics Services Company (Australia), Composites Technology Research Malaysia (CTRM) (Malaysia).

Global Aircraft Mounts Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.5 billion

- 2026 Market Size: USD 1.6 billion

- Projected Market Size: USD 3.2 billion by 2035

- Growth Forecasts: 7.6% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (38.8% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, France, Germany, United Kingdom

- Emerging Countries: India, South Korea, Japan, Brazil, United Arab Emirates

Last updated on : 4 December, 2025

Aircraft Mounts Market - Growth Drivers and Challenges

Growth Drivers

-

Military modernization and increased defense budgets: Global military aircraft modernization is a primary driver for advanced mounts. The U.S. Department of the War report in March 2023, the U.S. Department of Defense budget request of USD 842 billion, with a USD 26 billion rise in the year 2023 and USD 200 billion in 2022, signals the expanded investment in military aviation programs. The essential components in the aircraft mounts are used in fighter and transport aircraft, helicopters, ISR, and unmanned systems. An increase in the defense budget, mainly in procurement, RDT&E, and sustainment, directly elevates the demand for these mounting systems. The trend necessitates mounts capable of handling high thrust-to-weight ratios and offering signature management. Suppliers must align with defense contractors and invest in R&D for materials that meet these often-classified performance specifications to capture long-term program-locked revenue streams.

- Aging fleet and sustained MRO demand: The operational lifespan of the aircraft ensures a steady aftermarket for the mount replacement and maintenance. An aging global fleet, including many aircraft over years old, undergoes a continuous maintenance cycle where worn shock and vibration mounts are replaced. This creates a predictable recurring revenue stream distinct from the cyclicality of new aircraft production. Further, companies can capitalize on this by developing deep MRO network relationships and offering cost-effective certified parts with longer service lives. This aftermarket segment is mainly resilient to economic downturns that can delay new aircraft orders. For example, the FAA’s 2023 forecast shows a significant portion of the active fleet will require sustained maintenance for decades, securing long-term demand for replacement mounts.

- Expansion of commercial airline fleets: Commercial fleet growth remains a foundational driver for aircraft mounts demand. The U.S. Department of Transportation data in March 2023 indicated that the U.S. airline passenger enplanements are rising, and in 2022, they were 853 million. This increasing passenger count increases the utilization of the aircraft and surges the fleet replacement cycles. Increased new aircraft deliveries require factory-installed mounts for engines, landing systems, and avionics. High utilization also stimulates the wear on mounts, increasing MRO-driven replacement volumes. The global air travel normalization via 2025 continues supporting OEM production stability. It forecasts the remaining on trend in 2025, the global aircraft mounts market is expected to grow as commercial build rates return to pre-pandemic levels.

Challenges

- High R&D and capital investment: Developing advanced mounts with composite materials and integrated health monitoring requires substantial upfront investment. For instance, NASA’s research into next-gen airframe structures that influence the mount design involves grants and contracts worth millions of dollars. A recent report has highlighted that the aerospace R&D intensity is higher than the average for all the manufacturing sectors. Further, the established players, such as Lord Corporation, invest heavily in the material science labs and testing facilities, a capital outlay that is prohibitive for smaller and emerging suppliers.

- Complex global supply chain dynamics: Manufacturers are exposed to disruptions in the supply of specialized raw materials such as high-performance elastomers and alloys. The recent data depict that the supply chain issues were a key factor limiting the aircraft production rates in recent years. Further, companies reduce this issue via vertical integration and multi-sourcing strategies, but new entrants lack this leverage. Geopolitical tensions and trade restrictions can further delay the critical components directly impacting the production schedules and the ability to fulfill the orders on time, crippling a new supplier's reputation.

Aircraft Mounts Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

7.6% |

|

Base Year Market Size (2025) |

USD 1.5 billion |

|

Forecast Year Market Size (2035) |

USD 3.2 billion |

|

Regional Scope |

|

Aircraft Mounts Market Segmentation:

End user Segment Analysis

The OEM is dominating the end user segment and is poised to hold the share value of 58.6% by 2035. The segment is driven by the production rates of new commercial and military aircraft. Mounts are integral, safety-critical components installed during the initial assembly, creating a direct correlation between the aircraft output and OEM demand. The segment's growth is fueled by the global demand for new fuel-efficient aircraft models from manufacturers such as Airbus and Boeing. The aftermarket is fragmented and serves maintenance needs, which is a smaller recurring revenue stream per unit compared to the initial OEM fit. The financial scale of new aircraft programs solidifies the OEM segment's primacy. According to the AIA September 2023 data, the aerospace and defense exports in the U.S. reached USD 104.8 billion in 2022, and the leading destinations for the U.S. exports are Canada, France, and the UK. This data indicates the immense value of the OEM supply chain that includes the aircraft mounts.

Aircraft Type Segment Analysis

Under the aircraft type, commercial aviation is leading the segment and is expected to hold a significant share by 2035. The dominance is propelled by the global passenger travel demand and the replacement of the older fleet with next-gen models such as the Airbus A320neo and Boeing 737 MAX families. These aircraft are the workhorses of the domestic and international routes, and their high production volumes directly translate to the demand for thousands of corresponding engines, airframes, and component mounts. The Federal Aviation Administration projects sustained growth, forecasting the U.S. carrier passenger fleet to increase over the years, highlighting the continuous demand for new aircraft and their integrated systems. this steady fleet expansion ensures that commercial aviation remains the largest aircraft mounts market for the mount suppliers.

Application Segment Analysis

By 2035, vibration isolation is fueling the application segment in the aircraft mounts market and is essential for ensuring performance and longevity. This segment holds the largest share as mounts must protect the airframe from engine vibrations and safeguard sensitive avionics and cabin systems from fatigue. The vital nature of this function is indicated by the rigorous certification requirements from bodies such as the FAA. Advanced isolation is mainly vital for new generation high bypass ratio engines and composite airframe structures that have different dynamic responses. The National Aeronautics and Space Administration actively researches the advanced structural dynamics and vibration control for the next-generation aircraft, validating the continuous technological evolution and investment in this specific application area to meet the demands and future aircraft designs.

Our in-depth analysis of the aircraft mounts market includes the following segments:

|

Segment |

Subsegments |

|

Mount Type |

|

|

Material |

|

|

Aircraft Type |

|

|

Application |

|

|

System |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Aircraft Mounts Market - Regional Analysis

North America Market Insights

North America is the dominant player in the aircraft mounts market and is poised to hold the revenue share of 38.8% by 2035. The market is driven by the high defense spending, a mature MRO sector, and a strong OEM presence. The U.S. Department of Defense’s sustained investment in next-generation aircraft such as the B-21 Raider and F-35 programs creates a consistent demand for the advanced mounting systems. Further, the FAA’s forecast of a growing commercial fleet necessitates new mounts and sustains a robust aftermarket. The key trends include the integration of the smart mounts with the health monitoring capabilities and the shift towards the lightweight composite materials to improve the fuel efficiency and performance across both commercial and military platforms.

The U.S. aircraft mounts market is driven by military modernization and commercial surges, capturing the demand. The primary trends include the heightened focus on vibration isolation for engine mounts, aimed FAA FAA-mandated inspection for the Gulfstream G500/G600 models due to the quality escapes in the engine attachments, ensuring safety in high-performance jets. According to the CSIS October 2022 report, the army’s improved turbine engine program, peaking at USD 260 million in 2022 with sustained growth, emphasizes advanced mounts for thermal efficiency, reducing the weight in airframes. This focus on lightweight, durable materials is vital for next-gen aircraft performance. Further, manufacturers are investing in R&D for composite and smart material solutions. These innovations are vital to meet the dual demands of escalating defense budgets and expanding commercial aviation capacity.

Investments Related to Aircraft Mounting

|

Investment Category |

Description |

Investment Amount |

Notes |

|

NextGen Avionics & Equipage |

Joint FAA and airline investment in aircraft avionics upgrades including mounting hardware |

FAA spent over USD 15 billion by end 2024; industry ~USD 15 billion expected |

Investments include avionics equipage necessary for new capabilities like ADS-B In, DataComm systems |

|

FAA NextGen Program Funding |

FAA’s capital program investments in air traffic control modernization and avionics systems |

Included within overall USD 36 billion NextGen program funding estimate |

Covers technology and hardware installations, including mounts supporting avionics and system integration |

|

Aircraft System Component R&D |

Research funding directed towards aerospace safety, avionics, and aircraft system innovations |

Not specifically quantified; part of FAA R&D budget |

Supports technology development relevant to aircraft mounting and integration in NextGen modernization |

Source: FAA July 2025

Canada’s aircraft mounts market is influenced by a steady fleet renewal, increased regional airline activity, and investments in aviation infrastructure. The key trends revolve around fighter procurement modernization, with USD 27.7 billion allocated for 88 fighter aircraft related to the equipment, training, and information services, sustainment set-up and services, and construction of Fighter Squadron Facilities. This data directly drives the demand for the aircraft mounts as the fighter aircraft require engine and powerplant mounts, vibration isolation mounts, and structural mounts for sensors, weapons, and electronics. As each aircraft integrates hundreds of mounting components across the critical system, large-scale procurement programs materially expand the demand base for OEM-installed and lifecycle-replacement mounts.

APAC Market Insights

Asia Pacific is the fastest growing in the aircraft mounts market and is set to grow at a CAGR of 6.2% during the forecast period. The escalating commercial air travel, military modernization, and strategic government initiatives drive the aircraft mounts market. The region’s dominance is fueled by India and China’s rapidly expanding domestic fleets alongside established aerospace hubs in South Korea and Japan. Key drivers include massive commercial orders from carriers such as IndiGo and Air India that necessitate a corresponding surge in MRO services and component demand. The military’s regional tensions are supporting significant investments in indigenous aircraft programs, such as India’s TEJAS and South Korea’s KF-21 Boramae fighter, both of which require specialized high-performance mounting systems. A key trend is the strategic push for supply chain localization with the governments promoting Make in India and Made in China 2025 to minimize the import dependency and cultivate domestic aerospace manufacturing capabilities, directly impacting the mounts supply chain.

India’s aircraft mounts market is witnessing an explosive growth and is driven by one of the world’s fastest growing commercial aviation sector and a decisive government push for defense indigenization. The primary driver is the historic fleet expansion with Indian airlines placing orders for new aircraft, directly fueling the demand for new OEM mounts and a parallel surge in the MRO services. This commercial boom is matched by the defense modernization under the Make in India initiative. As per the PIB February 2023 report the capital allocation for the Defense Services in the Union Budget 2023 to 2024 was increased to ₹1.62 lakh crore a significant portion of which funds domestic aerospace programs such as the TEJAS fighter and Dhruv helicopter creating a dedicated high value market for locally sourced mounting systems. This strategic focus ensures the domestic aircraft mounts market is poised for sustained double-digit growth throughout the decade.

China is the largest in the aircraft mounts market in the APAC region and is dominated by its state-led ambition to achieve aerospace self-sufficiency. The market is propelled by the rapid production scaling of the COMAC C919 narrow-body jet that directly competes with the Boeing and Airbus models and necessitates a complete domestic supply chain for components like engine and airframe mounts. This commercial push is complemented by the continuous modernization of the People’s Liberation Army Air Force, which fields advanced indigenous aircraft like the J-20 stealth fighter. According to the U.S. Department of Defense 2023 report on China's military power, China has more than 1,300 fourth-generation and fifth-generation combat aircraft indicating the massive scale of its fleet and the sustained high-volume demand for advanced mounting technologies required for these platforms.

Europe Market Insights

The Europe aircraft mounts market is a mature and stable sector defined by a strong aerospace OEM presence, robust EASA regulations, and significant defense modernization programs. The region’s share is anchored by countries with leading aerospace industries, namely France, Germany, and the UK. The key drivers include the high production rates of the Airbus commercial aircraft, mainly the A320neo family, which directly fuel the demand for the OEM-mounted systems. Further, the European defense spending is on an upward trajectory with initiatives such as the Future Combat Air System and Tempest program requiring next-gen mounting solutions for advanced material and stealth capabilities. A vital trend is the shift towards sustainable aviation, forcing the manufacturers to develop lighter composite mounts that contribute to minimizing the fuel consumption and emissions, aligning with the EU’s ambitious Green Deal objectives.

France is projected to hold the highest revenue share by 2035, mainly driven by its key role in the Airbus consortium and the Future Combat Air System program. As the home for the final assembly lines, France is the epicenter of the European commercial aviation production, creating a consistent high volume demand for aircraft mounts. The Ministere Des Armees report in 2025 states that in July 2024, Boeing announced the acquisition of its subcontractor Spirit AeroSystems for USD 4.7 billion. Further the Spirit AeroSystems made revenue of USD 6 billion in 2023 and produced faulty parts for Boeing’s civil aircraft, mainly the 737 MAX. Boeing is known for its re-internalization of part of the production of its aircraft in order to better detect any defects. This acquisition directly affects structural component production, quality assurance, and supply chain stability for aircraft mounts used in Boeing platforms.

The UK aircraft mounts market is forecast to be the second largest market and is driven by its sovereign combat air programs and world-leading aerospace R&D ecosystem. The UK Ministry of Defense’s commitment to the Tempest program via Team Tempest, alongside the modernization of its F-35 and Typhoon fleets, creates a concentrated demand for advanced proprietary mounting solutions. According to the UK Government’s National Shipbuilding Strategy Refresh 2023, principles of technological sovereignty and supply chain resilience are being applied across the defense sector, including aerospace, emphasizing domestic capability. This trend, coupled with research fueled by agencies such as Innovate UK into lightweight composite materials and digital design, ensures the UK market remains at the forefront of mount technology independent of European supply chains post Brexit and secures its strong market position.

Key Aircraft Mounts Market Players:

- Lord Corporation (U.S.)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Parker Hannifin Corp (U.S)

- Hutchinson SA (France)

- Trelleborg AB (Sweden)

- Eaton Corporation (U.S)

- Vibratech TVC (U.S)

- ITT Inc. (U.S)

- Meggitt PLC (UK)

- Safran S.A. (France)

- GMT Rubber-Metal-Technic Ltd. (Germany)

- Meister AG (Switzerland)

- Sumitomo Riko (Japan)

- Korean Air Aerospace Division (South Korea)

- Hindustan Aeronautics Ltd (HAL) (India)

- Héroux-Devtek Inc. (Canada)

- BASF (Engineered Materials) (Germany)

- Cadence Aerospace (U.S)

- Shock Tech, Inc. (U.S)

- Avionics Services Company (Australia)

- Composites Technology Research Malaysia (CTRM) (Malaysia)

- Lord Corporation is the dominating player in the aircraft mounts market and is known for its advanced elastomeric and hydraulic vibration isolation technologies. The company has significantly advanced the field by integrating smart material science. This integration allows for real-time vibration and load data collection directly from the engine and airframe mounts, facilitating predictive maintenance and enhancing the overall aircraft operational safety and efficiency.

- Parker Hannifin Corp uses its extensive expertise in motion and control technologies to be a dominant force in the aircraft mounts market. The company has made significant advancements by incorporating lightweight high-strength composite materials and an active damping system into its mount solutions. This evolution results in a greater vibration isolation for important avionics and cabin systems, which directly contributes to the improved aircraft performance. In 2024, the corporation generated approximately USD 20 billion in sales.

- Hutchinson SA has carved its critical niche in the aircraft mounts market via its specialized polymer and elastomer expertise. The company has pioneered the use of custom-formulated damping material in its anti-vibrant mounts, leading to significant reductions in noise and structural fatigue. This breakthrough in the aircraft mounting industry ensures that vital components are protected from hostile operational conditions, increasing the aircraft's lifespan.

- Trelleborg AB is a global leader in the aircraft mounts market and specializes in engineered polymer solutions that withstand extreme conditions. The company has made substantial advancements by developing fire-resistant and thermally stable isolation systems for engine and pylon mounts. This innovation within the aircraft mounts market is vital for improving the safety and performance of modern aircraft, ensuring critical mounting systems maintain their integrity and functionality under demanding scenarios. The company has made the net sales of SEK 34,170 million in 2024.

- Eaton Corporation applies its deep knowledge of power management and systems integration to excel in the aircraft mounts market. The company has pioneered in the development of integrated mounting systems, which manage the vibration and also contribute to overall aircraft weight reduction and fuel efficiency. This strategic breakthrough in the aircraft mounts market assures that Eaton's solutions are critical for next-generation aircraft designs, where every component must contribute to greater goals of sustainability and operational efficiency.

Here is a list of key players operating in the global aircraft mounts market:

The global aircraft mounts market is intensely competitive and is dominated by the key players from the U.S and Europe. These players use their deep material science expertise and long-standing relationships with major OEMs such as Boeing and Airbus. The key strategic initiative focuses on innovation to develop lighter, more durable, and vibration-resistant components for the next-generation aircraft. Companies are actively pursuing mergers and acquisitions to expand their product portfolios and global footprint. For example, Signia Aerospace, an Arcline Investment Management portfolio firm, announced in August 2025 that it would acquire Precise Flight, Inc., a premier developer and manufacturer of revolutionary aviation safety systems and equipment. Further, the significant shift towards the long-term maintenance and MRO service contracts is evident, resulting in recurring revenue and strengthening customer loyalty in a cyclical industry.

Corporate Landscape of the Aircraft Mounts Market:

Recent Developments

- In October 2025, Airbus, Tata Advanced Systems Limited has announced the launch of a new era: the Made in India H125 helicopter to take flight from Karnataka. The move unlocks the full potential of the rotorcraft market in South Asia.

- In September 2025, Joby, ANA Holdings kick off the next phase of air taxi development in Japan with a public flight demonstration at the Expo 2025 Osaka, Kansai, Japan. This marks a global first and a new phase in the development of Japan’s air taxi ecosystem.

- In March 2025, RTX has entered into three agreements with JetZero, the developer of a novel blended wing body aircraft, to provide key systems for the airframer's full-scale demonstrator.

- Report ID: 2747

- Published Date: Dec 04, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Aircraft Mounts Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.