Aircraft Sensors Market Outlook:

Aircraft Sensors Market size was valued at USD 7.6 billion in 2025 and is projected to reach USD 12.7 billion by the end of 2035, rising at a CAGR of 5.2% during the forecast period, i.e., 2026-2035. In 2026, the industry size of aircraft sensors is estimated at USD 8.1 billion.

Fleet expansion and regulatory-driven modernization continue to underpin the sustained demand for the aircraft sensors market across commercial, defense, and business aviation. The FAA 2023 to 2043 data indicates that the active U.S. commercial fleet is expected to exceed 6,852 in 2022 to 10,286 in 2043, with narrow-body deliveries accounting for the majority of net additions, driving the incremental requirements for the flight control, environmental monitoring, navigation, and health monitoring instrumentation across the new builds and retrofits. In parallel, the safety oversight is intensifying. The National Transportation Safety Board reports that the loss of control and system anomalies remain leading contributors in serious aviation incidents, reinforcing the airline and lessor investment in higher fidelity sensing for redundancy and condition-based maintenance.

On the operations side, the U.S. Bureau of Transportation Statistics in March 2023 indicates that the U.S. airlines carried nearly 853 million passengers in 2021, a recovery that is translating into higher utilization rates and stimulated maintenance cycles, both of which increase the recurring demand for replacement sensors and upgrades across avionics and airframe systems. Defense and space programs provide an additional stable demand base with multi-year visibility. The U.S. Department of War report in March 2023 shows that in 2024, nearly USD 842 billion was allocated towards the Department of Defense, with procurement and RDT&E lines prioritizing next-gen aircraft, unmanned systems, and survivability upgrades programs that are sensor-intensive across guidance, situational awareness, propulsion, monitoring, and structural health. These government and multilateral indicators point to a market shaped less by cyclical swings and more by structural drivers, fleet growth, safety mandates, and defense/space investment, supporting steady, multi-segment demand for aircraft sensors through the medium term.

Key Aircraft Sensors Market Insights Summary:

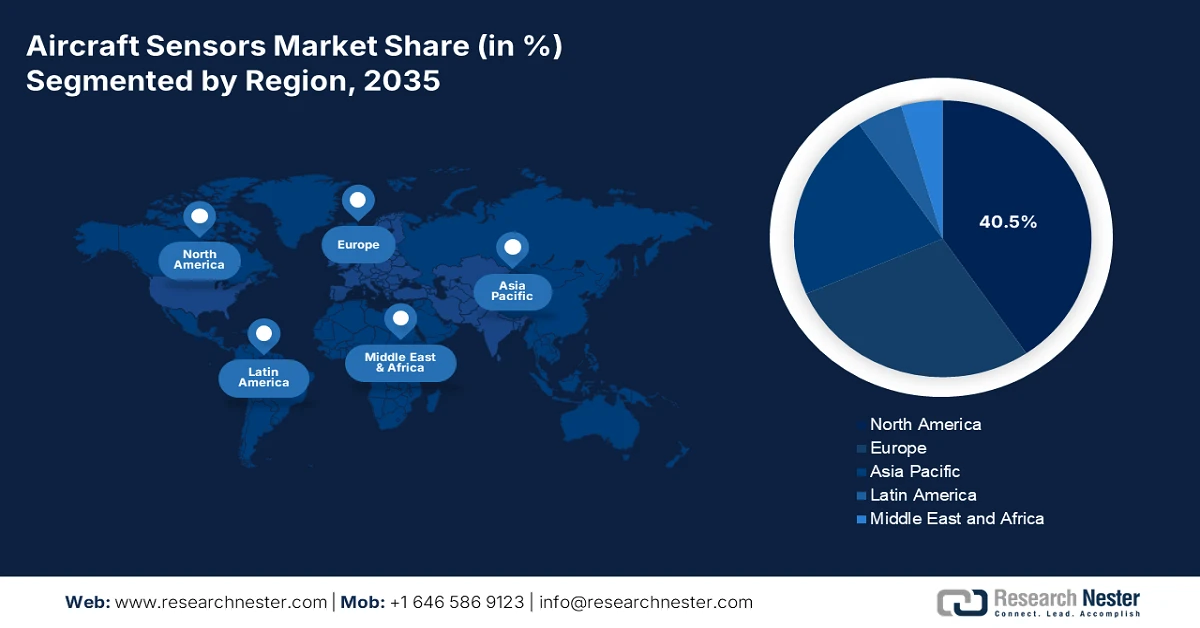

Regional Highlights:

- North America is expected to account for a 40.5% revenue share by 2035 in the aircraft sensors market, supported by large-scale defense modernization programs, a strong commercial OEM and MRO base, and accelerating adoption of smart connected sensing technologies.

- Asia Pacific is projected to expand at a CAGR of 7.3% during 2026–2035, underpinned by aggressive commercial fleet additions, rising unmanned and military aviation programs, and the regional push for aerospace self-reliance.

Segment Insights:

- Original Equipment Manufacturer (OEM) within the point of sale segment in the aircraft sensors market is forecast to hold a dominant 75.6% share by 2035, anchored in extensive sensor integration during initial aircraft production and long-term supplier relationships tied to sustained aircraft manufacturing volumes.

- Commercial Aviation under the aircraft type segment is anticipated to capture nearly half of total revenue by 2035, stimulated by large global fleet sizes and intensified airline investments in next-generation, sensor-intensive aircraft platforms.

Key Growth Trends:

- Defense modernization and increased military budgets

- Growth of unmanned and autonomous aviation

Major Challenges:

- High R&D and testing costs for advanced technologies

- Long product lifecycles and qualification cycles

Key Players: Honeywell International Inc. (U.S.), TE Connectivity Ltd. (Switzerland), Amphenol Corporation (U.S.), Safran S.A. (France), Thales Group (France), Meggitt PLC (UK), Curtiss-Wright Corporation (U.S.), Woodward, Inc. (U.S.), GE Aviation (U.S.), Collins Aerospace (U.S.), Garmin Ltd. (Switzerland), Lord Corporation (U.S.), Parker Hannifin Corporation (U.S.), Esterline Technologies Corporation (U.S.), Diehl Stiftung & Co. KG (Germany), TT Electronics plc (UK), Japan Aviation Electronics Industry, Ltd. (Japan), Bharat Electronics Limited (BEL) (India), L3Harris Technologies, Inc. (U.S.), Ultra Electronics Holdings (UK).

Global Aircraft Sensors Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 7.6 billion

- 2026 Market Size: USD 8.1 billion

- Projected Market Size: USD 12.7 billion by 2035

- Growth Forecasts: 5.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (40.5% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, France, United Kingdom

- Emerging Countries: India, Japan, Canada, South Korea, Italy

Last updated on : 22 January, 2026

Aircraft Sensors Market - Growth Drivers and Challenges

Growth Drivers

- Defense modernization and increased military budgets: Government defense spending is a primary, non-cyclical driver for advanced sensor demand, mainly for radar electro optical and electronic warfare systems. The U.S. Department of War in March 2024 highlights that the budget request includes USD 143.2 billion for procurement and R&D, a significant portion earmarked for next-generation aircraft, which are densely packed with thousands of sensors per platform. This creates a long-term funded pipeline for sensor manufacturers who can meet the stringent military specifications and cybersecurity mandates, offering stable contracts even when commercial aviation fluctuates. The growth in this sector is further underscored by the global trend, with NATO reporting that European Allies and Canada had increased defense spending for the eighth consecutive year, ensuring sustained demand across allied nations.

- Growth of unmanned and autonomous aviation: The rapid expansion of unmanned aerial systems is creating a high-growth channel for lightweight, high-precision sensors. The FAA December 2024 reports that more than 1 million drones are registered with the FAA in the U.S., with commercial operations increasingly focused on logistics inspection and public safety. Government programs supporting the UAS traffic management and detect and avoid standards are stimulating the demand for navigation vision and environment sensors optimized for autonomy. At the defense level, DoD investments in unmanned and optionally piloted aircraft further extend this trend into high-value platforms. The suppliers should prioritize the optimized sensor portfolios and modular integration approaches to serve both the civil and defense UAS market, where certification and rapid iteration coexist.

- Space programs and high altitude programs: Government-funded space and near-space initiatives are strengthening the demand for the radiation-tolerant and extreme environment sensors that are increasingly transferred into advanced aviation applications. The programs such as the NASA Artemis mission and continued federal investment in Earth observation and aeronautics research requires high reliability sensing for guidance, navigation, thermal regulation, propulsion monitoring, and structural integrity. These priorities are stimulating the supplier innovation in materials science, redundancy design, and fault-tolerant architectures capabilities that are now directly influencing the next-gen aircraft development. The same sensor standards that are being qualified for spaceflight are becoming relevant for high altitude long endurance platforms, supersonic aircraft, and future stratospheric systems where exposure to temperature extremes and radiation is comparable. As a result, the public sector space spending is emerging as a technology multiplier for advanced aviation sensor demand.

Challenges

- High R&D and testing costs for advanced technologies: Developing sensors for next gen aircraft requires immense investment in R&D for technologies such as the fiber optic sensing and advanced MEMS. The cost of designing, prototyping, and environmental testing is prohibitive. The top players tackle this by integrating sensor R&D directly into their major engine and landing gear programs, using the internal funding from the large OEM contracts. For instance, their investment in the LEAP engine’s sensor suite was amortized across thousands of units. New players lack this scale, making initial R&D a high-risk financial venture with long payback periods.

- Long product lifecycles and qualification cycles: Aircraft platforms have lifespans many years and once a sensor is qualified for a specific model it becomes the de facto standard locking in the supplier. This creates a design in the market where getting specified early is critical. The key players secured long-term positions on programs such as the Airbus A350 by engaging in co-development years before the first flight. For a new supplier, the qualification cycle alone takes years, during which they must sustain operations without sales from that program. This demands patient capital and strategic foresight many startups cannot afford.

Aircraft Sensors Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

5.2% |

|

Base Year Market Size (2025) |

USD 7.6 billion |

|

Forecast Year Market Size (2035) |

USD 12.7 billion |

|

Regional Scope |

|

Aircraft Sensors Market Segmentation:

Point of Sale Segment Analysis

Under the point of sale segment, the original equipment manufacturer is dominating the segment and is expected to hold the share value of 75.6% by 2035 in the aircraft sensors market. The dominance is due to the modern aircraft, such as the Boeing 787 or Airbus A350, which integrate thousands of sensors during initial production, creating a high-value long-term supply chain relationship. The aftermarket, while crucial for maintenance, is significantly smaller in comparison. The enduring strength of the OEM channel is directly tied to commercial aviation production rates. For example, despite supply chain challenges, the U.S. aerospace industry’s new aircraft shipments and billings showed resilience, with the piston airplane shipments reaching 1,524 in 2022, which is a rise of 8.2% from 2021, as per the AOPA February 2023 report. This data indicates a sustained OEM demand that directly fuels the sensor integration.

Connectivity Segment Analysis

Within the connectivity segment, wired sensors maintain a commanding revenue in the forecast period in the market. The dominance is due to the aerospace industry’s paramount focus on reliability, electromagnetic interference immunity, and the deterministic data transmission required for flight-critical systems such as flight controls and propulsion. While the wireless sensors are growing for health monitoring and cabin applications due to weight and flexibility benefits, wired solutions remain the mandatory standard for primary systems. A key indicator of this enduring infrastructure is a continued fleet growth that relies on wired architectures. The Federal Aviation Administration’s Aerospace depicts that the U.S. commercial carrier fleet is expected to grow, highlighting a long term expansion underpinned by traditional, reliable wired sensor networks.

Aircraft Type Segment Analysis

The commercial aviation segment is the undisputed leader in the aircraft type, capturing nearly half of the total market revenue. This dominance is fueled by the high volume of sensors installed in each new generation narrow and wide-body aircraft, coupled with the massive global fleet size and stringent regulatory requirements for continuous monitoring. The post pandemic recovery in air travel has stimulated airline investments in new fuel-efficient aircraft, which are heavily sensor-dependent for performance optimization. This trend is clearly evidenced by the production and delivery statistics. According to the U.S. BEA in September 2025, the civilian aircraft increased USD 0.7 billion in exports, underscoring the immense scale of the commercial sector that drives the sensor procurement.

Our in-depth analysis of the aircraft sensors market includes the following segments:

|

Segment |

Subsegments |

|

Sensor Type |

|

|

Aircraft Type |

|

|

Application |

|

|

Technology |

|

|

Connectivity |

|

|

Point of Sale |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Aircraft Sensors Market - Regional Analysis

North America Market Insights

The North America aircraft sensors market is dominating and is expected to hold the revenue share of 40.5% by 2035. The market is driven by the high defense procurement, a strong commercial aerospace OEM and MRO base, and robust R&D investment. The key drivers include U.S. Department of Defense modernization programs for next-gen platforms, and FAA-mandated fleet upgrades for safety and compliance. The trend towards predictive maintenance and integration of AI or ML in sensor data analytics is creating a demand for smart connected sensors. Canada’s contribution is boosted by its strategic aerospace supply chain and participation in major international programs such as F-35. Geopolitical priorities are reinforcing this leadership with initiatives such as the U.S. National Defense Industrial Strategy, which explicitly identifies sensors as a critical component area for investment and resiliency.

The U.S. aircraft sensors market is strongly shaped by the defense modernization and connected aircraft initiatives, as reflected in recent advancements from Northrop Grumman and Crane Aerospace & Electronics. The advancements from Northrop Grumman in August 2024 indicate that the ATHENA sensor under the Improved Threat Detection System program demonstrates rising investment in 360-degree missile warning and electro-optical infrared threat detection, with the application ranging from the rotary wing aircraft to tactical fleets. In parallel, the Crane Aerospace & Electronics development in March 2022 shows high accuracy CAN output proximity sensor illustrates how the U.S. based manufacturers are responding to the demand for the simplified data bus-enabled architecture supporting the UAVs, UAMs, and electrified aircraft. Together, these developments show that the U.S. sensor demand is increasingly driven by survivability, system integration, and predictive maintenance capabilities across both defense and next-generation aviation platforms.

The Canada aircraft sensors market is fundamentally shaped by the 88 F-35A procurement, a USD 15.8 billion program establishing a decades-long demand pipeline for advanced electro-optical radar and integrated sensor suites, based on the Government of Canada in October 2025. This project is governed by the Industrial and Technological Benefits Policy, which directly drives the market growth by mandating investments in the domestic aerospace sector, creating an opportunity for sensor manufacturing, maintenance, and software support. Key initiatives such as establishing a national air vehicle maintenance depot with L3Harris MAS and participation in the Australia-Canada-United Kingdom Reprogramming Laboratory ensure long term sustainment and upgrade cycle for these systems. This strategic integration into the global F-35 supply chain, coupled with the infrastructure development at Cold Lake and Bagotville, cements Canada’s niche in the high-value defense sensor technology and its associated aftermarket.

Canada’s Defense Aerospace Projects

|

Date |

Project Update |

Key Details / Outcome |

|

January 28, 2025 |

Contract award for Tactical - Special Access Program Facility (TAC-SAPF) |

Awarded a $15.8 million contract to Raymond EMC Enclosures Ltd. for secure enclosures at Cold Lake, AB. Delivery scheduled for Sep 2026 – May 2027. |

|

November 25, 2024 |

Strategic partner announced for F-35 Air Vehicle Depot investigation |

L3Harris MAS identified as partner to investigate requirements for a Canadian F-35 maintenance, repair, overhaul, and upgrade (depot) facility. |

|

October 31, 2024 |

Australia Canada United Kingdom Reprogramming Laboratory (ACURL) integration |

Canadian flag raised at ACURL at Eglin AFB, Florida, marking formal integration into the F-35 Mission Data File development team. |

|

January 9, 2023 |

Final agreement for F-35 acquisition |

Government finalized agreement with the U.S. Government, Lockheed Martin, and Pratt & Whitney for 88 F-35A aircraft. |

|

March 28, 2022 |

Entry into finalization phase with top bidder |

Announced entry into finalization phase with the top-ranked bidder, the U.S. Government and Lockheed Martin, for the F-35. |

|

December 1, 2021 |

Shortlisting of eligible bidders |

Two bidders remained eligible: Swedish Government/SAAB consortium and U.S. Government/Lockheed Martin. |

|

March – April 2021 |

Compliance Assessment Reports (CAR) issued |

CARs sent to three bidders; non-compliant bidders given time to respond. |

|

March – April 2021 |

Site preparation begins |

Site preparation work started at 4 Wing Cold Lake and 3 Wing Bagotville for future fighter infrastructure. |

Source: Government of Canada October 2025

APAC Market Insights

The Asia Pacific aircraft sensors market is the fastest growing and is poised to grow at a CAGR of 7.3% during the forecast period 2026 to 2035. The market is driven by the potent combination of massive commercial fleet expansion, assertive military modernization, and the pursuit of domestic aerospace sovereignty. The region’s commercial aviation sector is experiencing unprecedented growth. For instance, India is poised to become one of the largest aviation markets with airlines like IndiGo and Air India each requiring thousands of sensors. Military rising geopolitical tension and strategic competition are fueling significant defense budgets. Countries are investing heavily in next-gen platforms, creating a demand for the advanced indigenous AESA radars and electro-optical systems. A key overarching trend is the region’s push to reduce its dependency on Western technologies.

The growth of the unmanned aerial vehicles in India is closely aligned with the sensor-intensive operating models described in the NLM February 2021 study, making this research highly relevant to the Indian market. As mentioned in the study, the UAVs operate across a wide performance spectrum with sizes ranging from a few centimeters to tens of meters, payload weights from the tens of grams to thousands of kilograms, and operational altitudes extending from tens of meters up to 30 kilometers. The study highlights that the modern UAV missions rely on the centimeter-level positioning accuracy achieved via the sensor combination, such as IMU, GNSS, UWB, LiDAR, radar, and electro-optical systems, with indoor localization solutions achieving 10 to 20 cm precision, and obstacle detection ranges from 15 km with LiDAR and 35 km with radar. The rising demand for high-accuracy navigation, environmental, and sensing payloads positions unmanned aviation as one of the fastest-growing demand segments within the country’s aircraft sensors ecosystem.

UAV Sensor Application Specifications

|

Agriculture Monitoring and Management of Crops |

||

|

Functions |

Sensors |

Specifications |

|

Plant coverage, plant height, and color indices |

RGB camera |

Spatial resolution (1280 × 720); (1920 × 1080); (2048 × 1152); (3840 × 2160); (4000 × 3000); (4000 × 3000); (4056 × 2282); (4160 × 2340); (4608 × 3456); (5344 × 4016); |

|

Vegetation indices; physiological status of the plant |

Multispectral |

Spatial resolution (1080 × 720); (1248 × 950); |

|

Plant surface temperature; Crop Water Stress Index |

Thermal |

Spatial resolution (336 × 256); (640 × 512); (1920 × 1080) |

|

Archaeology exploratory survey and aerial reconnaissance |

||

|

Functions |

Sensors |

Specifications |

|

Detailed digital terrain and surface models; penetrating vegetated landscapes |

LiDAR |

Range from 100 m to 340 m |

|

Landscape matrix contrast detection |

Multispectral |

Resolution 1280 × 960; 1280 × 1024; 2048 × 1536; 2064 × 1544 |

|

Landscape matrix contrast detection |

Hyperspectral |

Resolution 640 × 640; 640 × 512;1024 × 1024; 2048 × 1088 |

|

Detection of measurably distinct variations between the features and their soil |

Thermal |

Resolution 160 × 120; 320 × 240; 320 × 256; 336 × 256; |

|

General |

||

|

Functions |

Sensors |

Specifications |

|

Sensing and avoiding capabilities |

Radar |

Detection range 35 km |

|

LiDAR |

Detection range 15 km |

|

|

Electro-optic sensor |

Detection range 20 km |

|

Source: NLM February 2021

The China aircraft sensors market is driven by the state-led strategy of aerospace sovereignty and massive dual-use demand. The primary engine is the Commercial Aircraft Corporation of China C919 narrow-body airliner program, which aims to challenge the Airbus Boeing duopoly. Many orders have been placed, creating a long-term demand for sensors within a new domestic supply chain. Militarily, the market is fueled by the rapid production and development of combat aircraft such as the J-20 stealth fighter and the next-gen program, which require advanced indigenous sensors to counter foreign platforms. The report from the Ministry of National Defense of the People's Republic of China in March 2024 indicates that China’s national budget report, the 2024 defense expenditure is set at 1.67 trillion yuan, marking a 7.2% YoY increase that directly funds the PLA Air Force and Navy aviation modernization and associated sensor development.

Europe Market Insights

The Europe aircraft sensors market is defined by the strong industrial foundations and strategic geopolitical investment. It is a key pillar of the global aerospace industry supported by the leading OEMs, such as Airbus, major system integrators, such as Safran and Thales, and a dense ecosystem of specialized suppliers. The market is driven by two primary forces: the urgent need for defense modernization and the generational renewal of commercial fleets for sustainability. In response to evolving security threats, European nations have significantly increased their defense budgets. The commercial push towards the next-gen fuel efficiency aircraft, alongside the development of clean sheet designs for hydrogen-powered flight, creates sustained demand for advanced pressure, temperature, and structural health monitoring sensors to optimize performance and enable predictive maintenance.

The Germany aircraft sensors market is primarily driven by its role as a lead nation in two of Europe’s most ambitious sixth-generation fighter programs, the Future Combat Air System with France and Spain, and the Global Combat Air Programme with the UK, Japan, and Italy. These projects are creating a multi-decade pipeline for research development and procurement of unprecedented sensor technologies, including the integrated radar electro optical and electronic warfare systems. This demand is reinforced by the ongoing modernization of the Luftwaffe’s existing fleet, such as the Eurofighter Typhoon with the new E-Scan radar, and the procurement of F-35A Lightning II aircraft for nuclear sharing. The foundation driver for this activity is the €100 billion Special Fund, as per the IISS March 2022 report, coupled with the commitment to permanently meet NATO’s defense spending target, ensuring sustained funding for these capabilities upgrades.

The UK aircraft sensors market is defined by the deep integration into global defense supply chains and a strong policy push for technological sovereignty and export. As the core Europe partner in the F-35 program, the UK hosts the critical industrial capacity for sensor sustainment and upgrades. Domestically, the market is fundamentally shaped by the Tempest program, which is the centerpiece of the UK’s combat air strategy and requires pioneering sensor fusion and combat cloud technologies. The UK’s commitment is backed by the significant increase in defense spending as reported in the Government data in March 2023, indicating an additional £5 billion for defense over the next two years, with a focus on replenishing munitions stocks and stimulating the next-gen programs. Further initiatives, such as the Defense and Security Industrial Strategy, aim to secure the sovereign capabilities in areas including complex sensors and radars, directly influencing the market priorities and investment.

Key Aircraft Sensors Market Players:

- Honeywell International Inc. (U.S.)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- TE Connectivity Ltd. (Switzerland)

- Amphenol Corporation (U.S.)

- Safran S.A. (France)

- Thales Group (France)

- Meggitt PLC (UK)

- Curtiss-Wright Corporation (U.S.)

- Woodward, Inc. (U.S.)

- GE Aviation (U.S.)

- Collins Aerospace (U.S.)

- Garmin Ltd. (Switzerland)

- Lord Corporation (U.S.)

- Parker Hannifin Corporation (U.S.)

- Esterline Technologies Corporation (U.S.)

- Diehl Stiftung & Co. KG (Germany)

- TT Electronics plc (UK)

- Japan Aviation Electronics Industry, Ltd. (Japan)

- Bharat Electronics Limited (BEL) (India)

- L3Harris Technologies, Inc. (U.S.)

- Ultra Electronics Holdings (UK)

- Honeywell International Inc. is a foundational pillar in the aircraft sensors market, providing mission-critical sensing solutions for flight control, navigation, and environmental systems. Their strategic initiatives focus on developing integrated smart sensor platforms that leverage aerospace-grade materials and advanced data fusion, catering to the industry’s shift towards more electric aircraft and connected aviation ecosystems. In 2024, the company made a total revenue of USD 13.1 billion.

- TE Connectivity Ltd is a dominant player in the aircraft sensors market, specializing in harsh environment connectivity and sensor solutions for extreme pressure, temperature, and vibration. Their strategy emphasizes co-engineering with OEMs to create highly reliable miniaturized sensors for actuation, propulsion, and flight control systems, ensuring performance and safety in next-gen aircraft designs. According to the 2024 annual report, the sensors make 10% of the net sales and are used in various industries.

- Amphenol Corporation excels in the aircraft sensors market via its advanced interconnect and sensor technologies designed for aviation’s demanding data and power transmission needs. The company strategically grows via targeted acquisition of niche sensor technology firms and heavy investment in R&D for lightweight high speed sensor technology firms and heavy investment in R&D for lightweight high speed sensor networks that support the avionics and in-flight entertainment systems of modern aircraft.

- Safran S.A. holds a unique position in the market as a major aircraft systems manufacturer that designs and produces its own proprietary sensors. This vertical integration strategy is key, allowing Safran to embed highly specialized sensors directly into its legendary landing gear engine and electrical power systems, ensuring optimal performance, safety, and maintenance predictability.

- Thales Group is a leader in the avionics segment of the aircraft sensors market, providing advanced sensor suites for flight decks, navigation, and surveillance. Their strategic initiatives center on creating sensor-to-cloud architectures, investing in AI-powered data analytics from sensor networks to enhance situational awareness, pilot decision making, and overall aircraft operational efficiency.

Here is a list of key players operating in the global market:

The global aircraft sensors market is defined by intense competition and rapid technological advancement and is driven by the aerospace industry’s demand for safety, efficiency, and connectivity. The key players are aggressively pursuing strategic initiatives such as mergers and acquisitions to consolidate expertise, heavy investment in R&D for next-gen smart and miniaturized sensors, and forming long-term partnerships with major OEMs such as Airbus and Boeing. For example, in July 2025, Woodward completed the acquisition of Safran’s North American electromechanical actuation business. The push towards predictive maintenance and IoT integration is further shaping the product development, with companies vying to offer comprehensive, reliable sensing solutions in both commercial and defense aviation sectors.

Corporate Landscape of the Aircraft Sensors Market:

Recent Developments

- In October 2025, Honeywell announced the launch of its new Honeywell Alternative Navigation Architecture, a software-based solution designed to ensure resilient navigation for crewed and uncrewed aircraft, as well as military surface vehicles, in environments where Global Navigation Satellite System signals are degraded, jammed or spoofed.

- In June 2025, Crane Company announced that it had signed an agreement to acquire Precision Sensors & Instrumentation, a leading provider of sensor-based technologies for aerospace, nuclear and process industries, from Baker Hughes for USD 1,060 million after adjusting for expected tax benefits with an estimated net present value of approximately USD 90 million.

- In July 2024, Baker Hughes, an energy technology company, announced the launch of two new Druck calibration solutions designed to drive efficiency and performance across aviation ground test instrumentation.

- Report ID: 8360

- Published Date: Jan 22, 2026

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Aircraft Sensors Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.