Healthcare Interoperability Solutions Market Outlook:

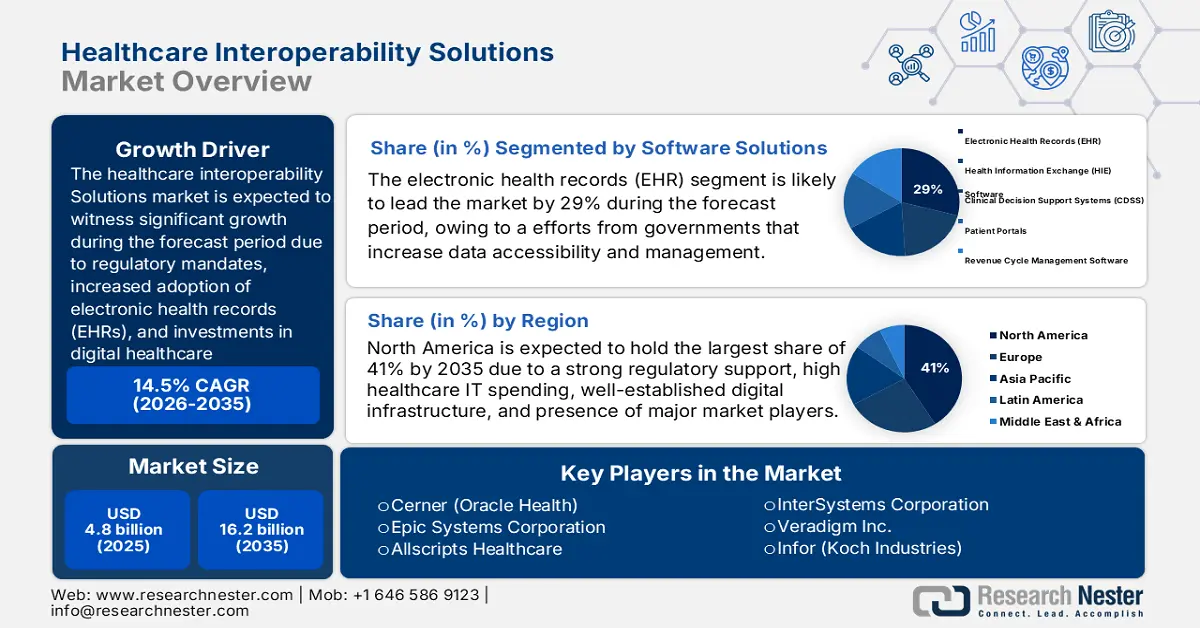

Healthcare Interoperability Solutions Market size is valued at USD 4.8 billion in 2025 and is projected to reach USD 16.2 billion by the end of 2035, rising at a CAGR of 14.5% during the forecast period, i.e., 2026‑2035. In 2026, the industry size of healthcare interoperability solutions is estimated at USD 5.5 billion.

The global market is driven primarily by regulatory mandates, increased adoption of electronic health records (EHRs), and investments in digital healthcare infrastructure. The growing patient population across integrated care settings is driving higher demand for interoperable solutions. According to the U.S. Bureau of Labor Statistics in January 2025, the consumer price index (CPI) for hospital services rose 4.0% in 2024, a reflection of increased usage of healthcare and administrative costs associated with the necessity for sophisticated data processing. In the supply chain, interoperability is increasingly vital as providers work to reduce redundant data capture and testing, and to streamline patient information between primary and specialty care networks.

Moreover, the health IT infrastructure in the market includes responsive software and device systems that support trade activities and manage costs. As per a report by the U.S. Bureau of Labor Statistics, in January 2025, the producer price index (PPI) of pharmaceutical preparations rose 1.7% in 2024 in January 2025, due to steadily increasing input costs for systems based on drug interaction data and e-prescription platforms. This rise in PPI is driven by the growing demand for advanced interoperability tools designed to enhance precision in medication management. Additionally, healthcare providers are investing in integrated platforms to avoid prescription errors and improve patient safety. With more complex drug-related data, the need for a real-time interoperable system is now considered basic from a cost standpoint and clinical outcome perspective.