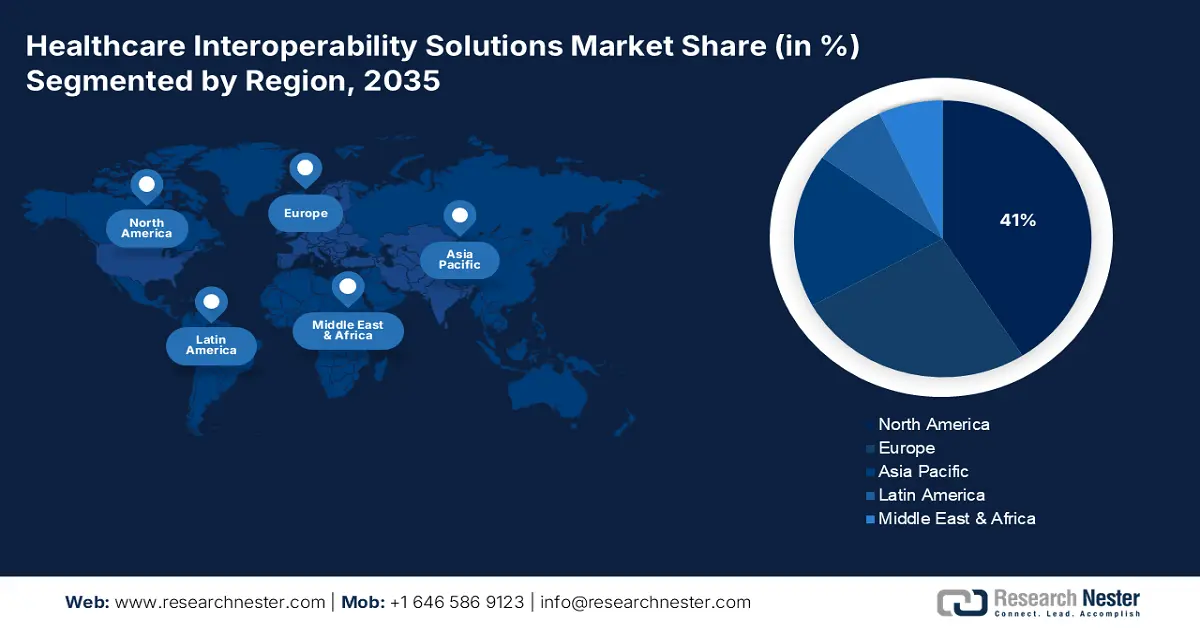

Healthcare Interoperability Solutions Market - Regional Analysis

North America Market Insights

The healthcare interoperability solutions market in North America is expected to hold the highest growth rate, 41% market share, during the forecast period, supported by strong regulatory support, high healthcare IT spending, well-established digital infrastructure, and the presence of major market players. As per a report by CMS, December 2023, hospital care services spending increased by 2.2% in 2022 to USD 1.4 trillion, yet at a slower rate compared to last year. Physician and clinical services spending increased by 2.7% to USD 884.9 billion in 2022. This growth of healthcare spending is increasing the demand for efficient solutions to improve care coordination and reduce administrative spending.

The healthcare interoperability solutions market in the U.S. is expected to grow due to government activities such as the 21st Century Cures Act, greater demand for EHR integration, robust investment in health tech startups, and emphasis on value-based care. As per a report by CMS, December 2023, spending on health care in the U.S. accelerated by 4.1% to USD 4.5 trillion during 2022, outpacing the 3.2% increase the previous year, yet much lower than the 10.6% growth last year. This increase in spending reflects added demand for systems that are interoperable and can drive efficiency, prevent duplication of services, and lower data-driven decision-making across care settings.

The healthcare interoperability solutions market in Canada is expected to grow due to national digital health plans, increased need for error-free data sharing, rising chronic disease burden, and proliferation of telehealth services. Government programs such as Canada Health Infoway are promoting the use of interoperable electronic health records and patient portals between provinces. With an aging population and increasing prevalence of chronic illnesses, care providers are being put in the position of coordinating care more effectively across settings. The growth in virtual care and telehealth capabilities through the pandemic and into its aftermath also put increased pressure on having real-time integrated data exchange.

Asia Pacific Market Insights

The healthcare interoperability solutions market in the Asia Pacific is expected to hold the fastest-growing market within the forecast period due to rapid healthcare digitization, government support for health IT infrastructure, increasing medical tourism, and growing investments by global health tech companies. Distributed across the remotest regions of the country, a model of medical care is now in place EHR or electronic health records that maintain patient data from any location, along with interoperable frameworks. Many patients with chronic conditions need integrated, patient-centered care, which is driving the use of systems with interoperable solutions.

The healthcare interoperability solutions market in China is expected to grow due to various government reforms aimed at a large increase in hospital networks, the incorporation of AI in healthcare, and a strong emphasis on health data standards. According to a report by the World Bank, 2025 suggests that, as per the World Health Organization, the current health expenditure was 5.3% of the GDP in 2022, showing an upward trend during the past ten years, while the country kept on strengthening its healthcare system. Also, the growing middle class raises awareness of healthcare.

The healthcare interoperability solutions market in India is expected to grow due to the Aayushman Bharat Digital Mission rollout, escalating EHR adoption, more investments into private healthcare, and demand for patient-centric care systems. As per a report by IBPF in July 2025, investment inflows in sectors such as hospitals & diagnostic centers and medical & surgical appliances stood at Rs. 1,01,687 crore (USD 11.82 billion) and Rs. 33,638 crore (USD 3.9 billion), respectively, over the last 5 years, which were crucial to enhancing and modernizing healthcare infrastructure across the nation. In addition, increasing penetration of smartphones and internet connectivity is enabling even broader adoption of digital health platforms.

Europe Market Insights

The healthcare interoperability solutions market in Europe is expected to grow steadily within the forecast period due to the stringent laws on data protection, worldwide eHealth initiatives, patient data exchange across borders, and increased demand for integrated healthcare systems. As per a report by Eurostat November 2024, in the countries of Europe, Germany, with 12.6%, France, with 11.9%, and Austria, with 11.2%, were the countries with the highest current healthcare expenditure relative to GDP in 2022. This is a strong financial commitment. The same attenuates towards the adoption of the latest interoperability tech to improve healthcare delivery. Simultaneously, some more effort is being put in by the Europe member states in order to come up with common standards, thus fast-tracking the integration of healthcare data across the region.

The healthcare interoperability solutions market in the UK is expected to grow due to the NHS's digital transformation strategy, post-Brexit health IT investments, increasing focus on AI-driven health solutions, and more public-private partnerships in health tech. Interoperable platforms that support advanced analytics and personalized care are in demand due to the growing focus on AI-driven health solutions. The increasing public-private partnership in health tech is further setting the agenda for developing and later deploying top-class health technologies. The partnerships address the challenges of data security, integration, and scalability.

The healthcare interoperability solutions market in Germany is expected to grow due to the introduction of the Digital Healthcare Act, the rise of demand for interoperable EHRs, the med-tech being a robust sector, and investments in digital health innovations. As per a report by Eurostat in November 2024, Germany stood first while registering the ever-higher current expenditure on healthcare among the Europe-based countries, standing at €489 billion in 2022. Amid IT infrastructure overhauls at hospitals and clinics, hotels are increasingly realizing the need to implement system integration so that patient information can flow uninterruptedly. Further, the government also supports digital transformation via dedicated funding programs on the delivery mechanism for healthcare services and health outcomes.

Current Healthcare Expenditure in Countries of Europe (2022)

|

Country |

€ million |

€ per inhabitant |

PPS per inhabitant |

% of GDP |

|

Germany |

488,677 |

5,832 |

5,317 |

12.6 |

|

France |

313,574 |

4,607 |

4,302 |

11.9 |

|

Austria |

49,897 |

5,518 |

4,751 |

11.2 |

|

Belgium |

59,626 |

5,105 |

4,339 |

10.8 |

|

Portugal |

25,370 |

2,437 |

2,823 |

10.5 |

|

Netherlands |

96,820 |

5,470 |

4,531 |

10.1 |

|

Spain |

131,114 |

2,745 |

2,814 |

9.7 |

|

Italy |

175,719 |

2,978 |

2,945 |

9.0 |

Source: Eurostat, November 2024