Hardware-assisted Verification Market Outlook:

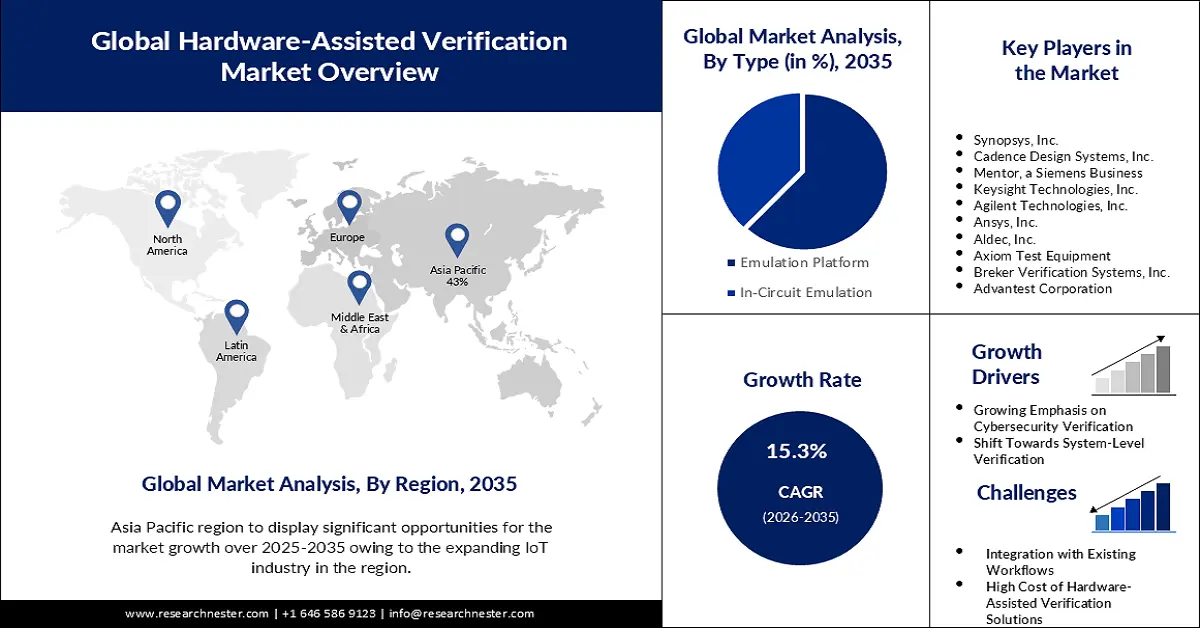

Hardware-assisted Verification Market size was valued at USD 785.68 million in 2025 and is expected to reach USD 3.26 billion by 2035, registering around 15.3% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of hardware-assisted verification is evaluated at USD 893.87 million.

The rising complexity of semiconductor designs stands as the main driver propelling the growth of the market. As technological advancements accelerate, semiconductor components power diverse applications, ranging from artificial intelligence and 5G to automotive electronics. Consequently, the intricate nature of these designs demands a robust verification process to ensure functionality, reliability, and optimal performance. The semiconductor industry is witnessing a paradigm shift towards increasingly intricate designs, driven by the insatiable demand for enhanced functionalities and performance across various sectors. According to a recent report, the global hardware-assisted verification industry is projected to grow by 9.5% by the year 2027.

Hardware-assisted verification involves the use of specialized hardware, such as emulation and FPGA-based prototyping, to accelerate the verification of complex integrated circuits (ICs) and systems-on-chip (SoCs). This approach is particularly crucial in the semiconductor industry to ensure the functionality, performance, and reliability of intricate designs. There's a trend in the industry toward "shift-left" testing methodologies, where verification tasks are moved earlier in the design cycle to catch and address issues sooner. Hardware-assisted verification contributes to this trend by enabling early testing of hardware and software components.

Key Hardware-assisted Verification Market Insights Summary:

Regional Highlights:

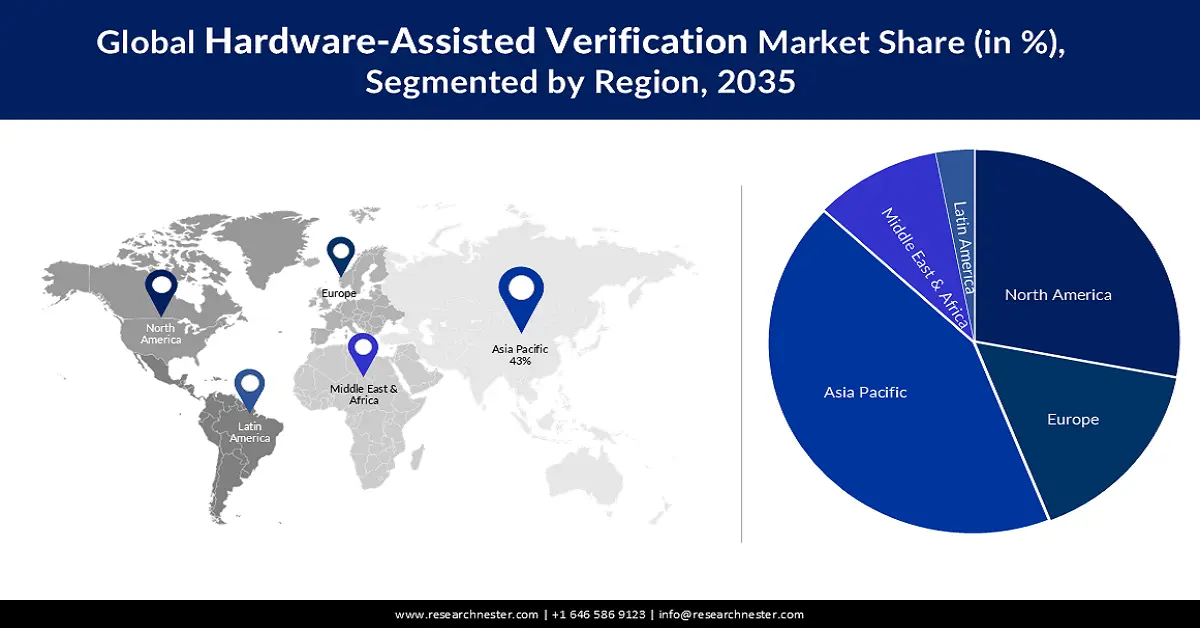

- Asia Pacific hardware-assisted verification market is anticipated to achieve a 43% share by 2035, driven by substantial investments in AI and semiconductor R&D in the region.

Segment Insights:

- The in-circuit emulation segment in the hardware-assisted verification market is anticipated to secure a 62% share by 2035, driven by the demand for real-world testing, increasing complexity of semiconductor designs, and power efficiency emphasis.

Key Growth Trends:

- Escalating Demand for High-Performance Computing (HPC) Architectures

- Growing Emphasis on Cybersecurity Verification

Major Challenges:

- Rising Design Complexity

- Integration with Existing Workflows

Key Players: Synopsys, Inc., Cadence Design Systems, Inc., Mentor, a Siemens Business, Keysight Technologies, Inc., Agilent Technologies, Inc., Ansys, Inc..

Global Hardware-assisted Verification Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 785.68 million

- 2026 Market Size: USD 893.87 million

- Projected Market Size: USD 3.26 billion by 2035

- Growth Forecasts: 15.3% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (43% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, Germany, South Korea

- Emerging Countries: China, Japan, South Korea, India, Taiwan

Last updated on : 11 September, 2025

Hardware-assisted Verification Market Growth Drivers and Challenges:

Growth Drivers

-

Escalating Demand for High-Performance Computing (HPC) Architectures - The surge in demand for high-performance computing (HPC) architectures is a significant catalyst propelling the growth of the hardware-assisted verification market. As industries increasingly leverage HPC for complex computations and data-intensive tasks, semiconductor designs supporting such architectures undergo heightened complexity. Hardware-assisted verification solutions, particularly emulation platforms and FPGA-based prototyping, become indispensable in validating the intricate interplay of hardware and software in HPC systems. Analysis indicates a substantial rise in the adoption of HPC architectures, with the global HPC sales expected to reach USD 49 billion by 2023. This underscores the parallel growth trajectory of the hardware-assisted verification market, aligning with the escalating demand for HPC solutions.

-

Growing Emphasis on Cybersecurity Verification - The rising concerns about cybersecurity in electronic systems necessitate robust verification of security features embedded in semiconductor designs. Hardware-assisted verification tools contribute to cybersecurity verification by allowing designers to test and validate security protocols, encryption algorithms, and protection mechanisms against potential vulnerabilities and threats. This emphasizes the increasing importance of cybersecurity measures across industries and the corresponding demand for hardware-assisted verification solutions to ensure the security resilience of semiconductor designs.

- Shift Towards System-Level Verification - A notable trend in semiconductor design is the shift towards system-level verification, wherein the entire system's functionality is validated rather than focusing solely on individual components. Hardware-assisted verification, particularly through emulation, allows for comprehensive system-level testing, enabling designers to identify and address issues related to hardware-software interactions and system integration early in the design cycle. This growth underscores the increasing complexity of SoC designs and the corresponding need for advanced hardware-assisted verification solutions to facilitate robust system-level verification.

Challenges

-

Rising Design Complexity - The designs of modern semiconductor components, driven by advancements in AI, 5G, and automotive technologies, are becoming increasingly complex. This complexity poses a significant challenge for hardware-assisted verification tools, as the verification process must keep pace with the intricate nature of these designs. Increased design complexity can lead to longer verification cycles, higher development costs, and potential delays in time-to-market for semiconductor products.

-

Integration with Existing Workflows

- High Cost of Hardware-assisted Verification Solutions

Hardware-assisted Verification Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

15.3% |

|

Base Year Market Size (2025) |

USD 785.68 million |

|

Forecast Year Market Size (2035) |

USD 3.26 billion |

|

Regional Scope |

|

Hardware-assisted Verification Market Segmentation:

Type Segment Analysis

The in-circuit emulation segment is estimated to hold around 62% share of the global hardware-assisted verification market by 2035. In-circuit emulation contributes to power efficiency validation by allowing designers to assess the energy consumption of semiconductor components in real-world scenarios. This is crucial in industries where power efficiency is a paramount consideration, such as IoT and mobile devices. The in-circuit emulation segment in the market is driven by a confluence of factors. These include the demand for real-world testing, the increasing complexity of semiconductor designs, integration with safety-critical systems, the need for faster time-to-market, advancements in semiconductor manufacturing, and a growing emphasis on power efficiency. As semiconductor manufacturing technologies advance, the complexity of designs increases. In-circuit emulation is well-suited to verify designs based on the latest manufacturing processes, ensuring that semiconductor components function optimally within the constraints of cutting-edge technologies.

End User Segment Analysis

The IoT industry segment in the hardware-assisted verification market is expected to garner a significant share in the year 2035. The competitive nature of the IoT industry necessitates rapid product development and deployment. Hardware-assisted verification enables designers to accelerate the verification process, reducing time-to-market for IoT devices. This is particularly crucial in industries where being the first to market confers a significant competitive advantage. The global IoT industry sales are expected to reach USD 1.4 trillion by 2026. This robust growth underscores the need for expeditious product development and deployment in the IoT sector, driving the demand for hardware-assisted verification. IoT technology is pervasive across diverse application domains, including healthcare, agriculture, smart cities, and industrial automation. Each domain has unique requirements, leading to a wide variety of semiconductor designs. Hardware-assisted verification solutions offer the flexibility to adapt to the specific needs of different IoT application domains, ensuring the reliability and functionality of semiconductor components in varied environments.

Our in-depth analysis of the global market includes the following segments:

|

Type |

|

|

End User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Hardware-assisted Verification Market Regional Analysis:

APAC Market Insights

Asia Pacific industry is poised to hold largest revenue share of 43% by 2035. Governments and private entities in the Asia Pacific region are making substantial investments in artificial intelligence (AI) and semiconductor research and development. As AI applications become more pervasive, hardware-assisted verification becomes essential in validating semiconductor designs that power AI algorithms and specialized hardware accelerators. China, a major player in the Asia Pacific region, plans to invest USD 1.4 trillion in its digital infrastructure by the year 2025, with a significant focus on AI development. This strategic investment underscores the growing importance of AI and semiconductor technologies, driving the demand for advanced verification solutions. The Asia Pacific region is witnessing widespread adoption of the Internet of Things (IoT) across various industries, including smart manufacturing. The complexity of semiconductor designs for IoT applications necessitates advanced verification methods, positioning hardware-assisted verification as a crucial enabler for the seamless integration of semiconductor components in smart manufacturing environments.

North American Market Insights

The hardware-assisted verification market in the North America region is projected to hold the second largest share during the forecast period. North America stands at the forefront of technological innovation, particularly in the semiconductor industry. The market in this region is experiencing robust growth, propelled by several key factors that reflect the dynamic landscape of semiconductor design and verification methodologies. North America holds a leadership position in semiconductor manufacturing, with major players driving technological advancements. As semiconductor designs become more intricate, the need for advanced verification solutions grows. Hardware-assisted verification tools cater to the evolving requirements of semiconductor manufacturing processes. North America, particularly Silicon Valley, is a global hub for AI and machine learning innovation. Semiconductor designs supporting AI algorithms require thorough verification. Hardware-assisted verification plays a crucial role in ensuring the reliability and performance of semiconductor components in AI applications. The North American automotive industry is at the forefront of developing autonomous vehicles and advanced driver assistance systems (ADAS). These applications demand sophisticated semiconductor designs, necessitating robust verification processes.

Hardware-assisted Verification Market Players:

- Synopsys, Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Cadence Design Systems, Inc.

- Mentor, a Siemens Business

- Keysight Technologies, Inc.

- Agilent Technologies, Inc.

- Ansys, Inc.

- Aldec, Inc.

- Axiom Test Equipment

- Breker Verification Systems, Inc.

- Advantest Corporation

Recent Developments

- Cadence acquired Future Facilities, a provider of computational fluid dynamics (CFD) software and services. The acquisition expanded Cadence's portfolio of electronic design automation (EDA) software and tools.

- Cadence acquired OpenEye Scientific Software, Inc. (“OpenEye”), a provider of computational molecular design software. The acquisition expanded Cadence's portfolio of EDA software and tools into the life sciences market.

- Report ID: 5435

- Published Date: Sep 11, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.