Greenhouse Horticulture Market Outlook:

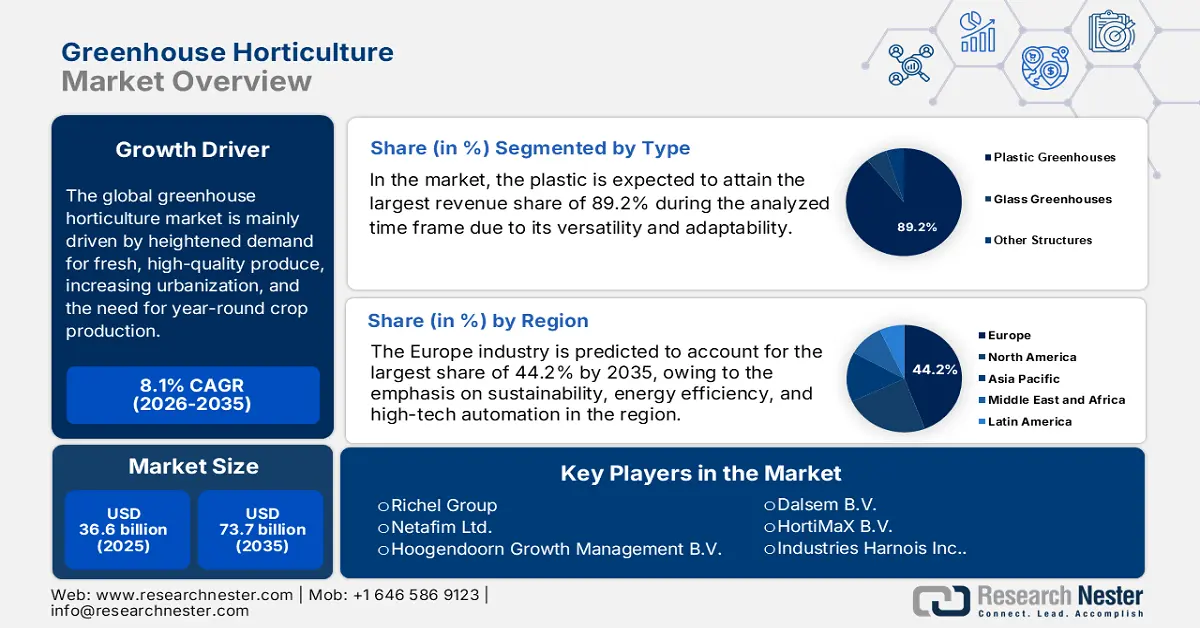

Greenhouse Horticulture Market size was valued at USD 36.6 billion in 2025 and is projected to reach USD 73.7 billion by the end of 2035, rising at a CAGR of 8.1% during the forecast period, i.e., 2026-2035. In 2026, the industry size of greenhouse horticulture at USD 39.5 billion.

The global greenhouse horticulture market is mainly driven by heightened demand for fresh, high-quality produce, increasing urbanization, and the need for year-round crop production. There has been a growing concern over food security, climate variability, and resource efficiency, which are accelerating the adoption of controlled-environment agriculture across both developed and emerging economies. The Governor of Virginia, in February 2025, announced that Oasthouse Ventures Ltd. will invest USD 104.8 million to establish its first U.S.-based low-carbon greenhouse operation in Carroll County, Virginia, producing more than 45 million pounds of tomatoes on a yearly basis for major regional retailers. It also mentioned that the project will leverage locally sourced hardwood residuals to sustainably heat a 65-acre controlled environment facility. It is supported by state grants and workforce development programs, whereas the investment reflects strong public-private collaboration to expand domestic greenhouse capacity, positively impacting greenhouse horticulture market growth in the upcoming years.

Furthermore, this aspect of supportive government policies promoting sustainable agriculture and water conservation is encouraging investments in modern greenhouse infrastructure, stimulating growth in the greenhouse horticulture market. In this regard, Source.ag, developer of AI software for controlled environment agriculture (CEA), in November 2025, announced that it raised USD 17.5 million in a Series B funding round, thereby bringing total funding to more than USD 60 million. The firm also mentioned that the investment was led by Astanor with participation from Enza Zaden and Harvest House, which will accelerate global scaling and AI product development for greenhouse operations across Europe and North America. Meanwhile, Source.ag’s platform, deployed in over 300 greenhouses spanning 2,500 hectares, efficiently supports daily fresh produce supply for 40 million people by improving yield prediction, automating irrigation, and enhancing operational efficiency throughout the value chain.

Key Greenhouse Horticulture Market Insights Summary:

Regional Highlights:

-

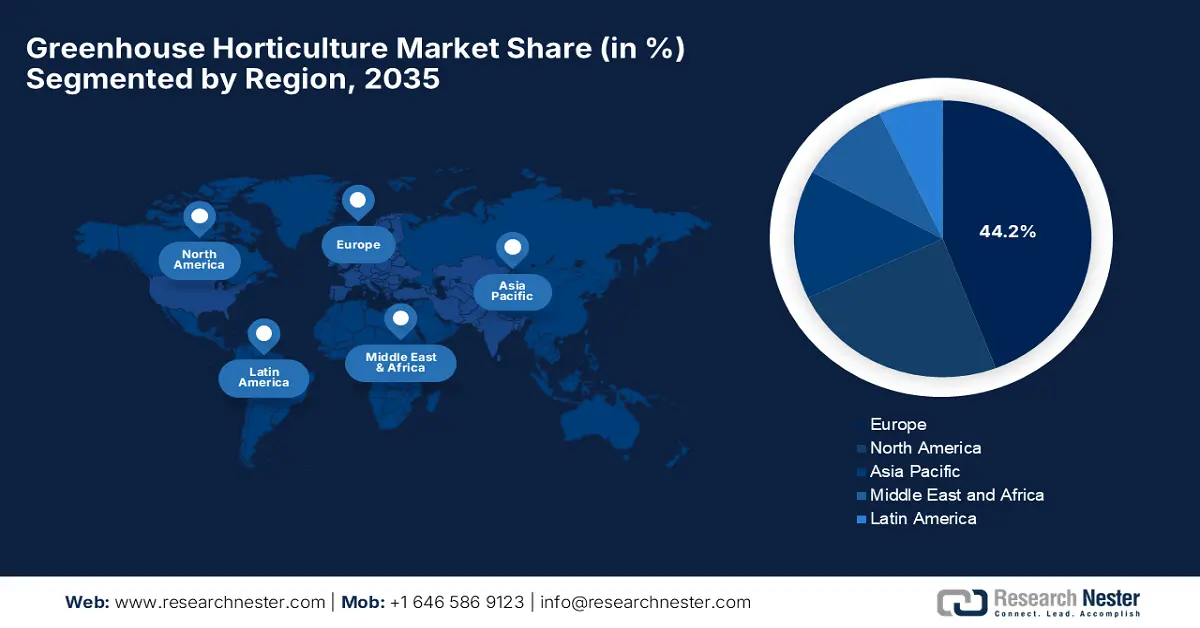

Europe is forecast to command around 44.2% revenue share by 2035 in the greenhouse horticulture market, underpinned by its strong emphasis on sustainability, energy efficiency, and high-tech automation.

-

North America is set to record rapid momentum through the 2026–2035 period, supported by advanced controlled-environment agriculture systems and technology-driven farming practices.

-

Segment Insights:

- Plastic-based (Type) segment in the greenhouse horticulture market is projected to dominate with an 89.2% revenue share by 2035, supported by its wide versatility and adaptability across greenhouse structures and coverings.

- Hydroponics (Technology) is anticipated to witness robust expansion by the end of 2035, strengthened by its ability to optimize nutrient delivery and water efficiency for higher commercial greenhouse productivity.

Key Growth Trends:

- Rising demand for year-round fresh produce

- Urbanization and changing dietary patterns

Major Challenges:

- Energy dependence and sustainability constraints

- Labor shortages and skill gaps

Key Players: Richel Group (France), Netafim Ltd. (Israel), Hoogendoorn Growth Management B.V. (Netherlands), Dalsem B.V. (Netherlands), HortiMaX B.V. (Netherlands), Industries Harnois Inc. (Harnois Greenhouses) (Canada), Priva Holding B.V. (Netherlands), Certhon Build B.V. (Netherlands), Van der Hoeven Horticultural Projects B.V. (Netherlands), Ceres Greenhouse Solutions LLC (U.S.), Oritech Solutions (Netherlands), Top Greenhouses Ltd. (Israel), Rough Brothers, Inc. (Prospiant, Inc.) (U.S.), Logiqs B.V. (Netherlands), Heliospectra AB (Sweden)

Global Greenhouse Horticulture Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 36.6 billion

- 2026 Market Size: USD 39.5 billion

- Projected Market Size: USD 73.7 billion by 2035

- Growth Forecasts: 8.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Europe (44.2% share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: Netherlands, Germany, United States, China, Japan

- Emerging Countries: India, Canada, United Kingdom, Spain, Italy

Last updated on : 15 January, 2026

Greenhouse Horticulture Market - Growth Drivers and Challenges

Growth Drivers

- Rising demand for year-round fresh produce: Consumers expect proper access to fresh and high-quality fruits, vegetables, and ornamentals throughout the year. Therefore, greenhouse horticulture enables growers to mitigate the seasonal limitations and supply fresh produce continuously. As per the article published by USDA in April 2025, USDA NIFA-funded researchers are developing best practices for growing culinary herbs in controlled environments such as greenhouses and indoor farms to increase local, year-round production, improve flavor and yield, and reduce reliance on imports, which total more than USD 294 million annually. Based on the government data, their work addresses factors such as light, water, seed density, and disease management, whereas the project aims to boost domestic herb use by 1% to 5%, increasing annual economic returns by USD 1.25 million to USD 6.25 million and supporting local economies, benefiting the overall greenhouse horticulture market growth.

- Urbanization and changing dietary patterns: The aspect of rapid urban population growth is shifting dietary preferences toward fresh, nutritious produce, whereas the proximity of greenhouse facilities to urban centers reduces transportation time and costs. In September 2024, BrightFarms announced that it had inaugurated its new 8-acre greenhouse hub in Yorkville, Illinois, which is the first of three regional hubs launching in 2024, tripling the company’s capacity to supply fresh, locally-grown leafy greens across the eastern and central U.S. The three hubs in Illinois, Texas, and Georgia will collectively increase production to 150 million pounds of leafy greens annually, using advanced greenhouse technology to maintain optimal growing conditions year-round. It is backed by Cox Enterprises, wherein BrightFarms aims to serve over two-thirds of the U.S. population and generate more than USD 300 million in revenue by the end of 2026, providing pesticide-free greens contributing to the greenhouse horticulture market growth.

- Resource efficiency and environmental constraints: Greenhouses improve water and land use efficiency when compared with traditional agriculture. Also, the controlled environments reduce water consumption through precision irrigation, enable integrated pest management, and optimize nutrient delivery, driving business in the greenhouse horticulture market. In February 2023, Realty Income Corporation and Plenty Unlimited together announced that they had formed a strategic alliance to support the development of Plenty’s indoor vertical farms, with up to USD 1 billion allocated for property acquisition and development funding, leased to Plenty under long-term net leases. The first farm is near Richmond, Virginia, will grow strawberries with Driscoll’s and serve the northeast market, whereas the future multi-farm campus is expected to produce over 20 million pounds of produce annually across multiple crops, hence denoting a positive greenhouse horticulture market outlook.

Challenges

- Energy dependence and sustainability constraints: This is the major obstacle for the expansion of the greenhouse horticulture market. The operations in this field are mostly energy-intensive, which rely on electricity and fuel for heating, cooling, lighting, and ventilation. Also, the dependency on fossil fuels makes it challenging for growers to price fluctuations as well as bureaucratic hurdles associated with carbon emissions. Meanwhile, the aspect of renewable energy solutions, such as solar, geothermal, and biomass, offers long-term sustainability, whereas their adoption necessitates additional capital as well as technical expertise. Moreover, increasing environmental regulations and sustainability standards are encouraging growers to reduce carbon footprints, making energy management a very critical challenge for maintaining regulatory compliance in the worldwide greenhouse horticulture market.

- Labor shortages and skill gaps: The greenhouse horticulture market faces considerable challenges owing to the rising wages and the shortage of skilled work personnel, who are capable of operating the advanced systems. Modern greenhouses rely on automation, climate control software, and data-based decision-making, most of the time, which in turn requires technical expertise that is often scarce, particularly in terms of rural areas. On the other hand, seasonal labor dependency adds complexity, wherein fluctuations in workforce availability impact production schedules in this field. The aspect of training and retaining skilled workers increases operational costs, whereas the labor shortages can limit expansion plans, creating a barrier for smaller growers.

Greenhouse Horticulture Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

8.1% |

|

Base Year Market Size (2025) |

USD 36.6 billion |

|

Forecast Year Market Size (2035) |

USD 73.7 billion |

|

Regional Scope |

|

Greenhouse Horticulture Market Segmentation:

Type Segment Analysis

In the greenhouse horticulture market, the plastic based on type is expected to attain the largest revenue share of 89.2% during the analyzed time frame. Their versatility and adaptability are the key factors propelling this leadership. Also, polyethylene and polyvinyl chloride (PVC) are extensively utilized in most of the greenhouse structures and covers. In October 2024, SABIC, in collaboration with Iyris and Napco National, announced that it had launched a high-tech greenhouse roofing solution in Saudi Arabia using certified circular polyethylene from its TRUCIRCLE portfolio for the National Food Production Initiative. This 0.75-hectare Al-Bada greenhouse integrates Napco’s durable PE film with Iyris’ SecondSky technology to enhance the UV stability, thermal regulation, and photosynthetically active radiation transmission. In addition, this scalable model improves water, energy, and fertigation efficiency, boosts crop yield, and demonstrates sustainable, locally produced solutions to support climate-resilient agriculture.

Technology Segment Analysis

By the end of 2035, hydroponics will grow at a progressive rate in the greenhouse horticulture market. The subtype enables efficient nutrient delivery and water use, reducing waste and optimizing growth rates, which is highly essential for commercial greenhouse profitability and water conservation. HydroBlue reported that it showcased the NFT hydroponic systems and modular seedling beds at the 2025 Garden & Agri-Tech Expo, which has also achieved recognition for practicality and sustainability, thereby attracting interest from urban farmers, educational institutions, as well as commercial growers. The company highlighted its low-energy, water-efficient NFT kits that resulted in 48 confirmed orders and 93 serious inquiries, whereas the universities explored research collaborations for seedling propagation with adjustable LED lighting and humidity control, reinforcing its reputation as an innovator in sustainable hydroponic greenhouse solutions.

Crop Type Segment Analysis

The vegetables segment is expected to grow at a considerable rate over the forecasted years in the greenhouse horticulture market. The growth of the subtype is attributable to strong consumer demand for year-round produce and food security drivers. Similarly, there has been an increased adoption of controlled environment agriculture (CEA) systems that allow growers to manipulate temperature, humidity, and light to achieve consistent high yields, efficiently driving vegetable production. Also, the continued advancements in terms of hydroponics and vertical farming technologies enhance efficiency, reduce water usage, and optimize nutrient delivery, making vegetable cultivation even more profitable. In addition, the rising awareness of healthy eating and locally sourced produce supports steady demand for greenhouse-grown vegetables across international markets.

Our in-depth analysis of the greenhouse horticulture market includes the following segments:

|

Segment |

Subsegments |

|

Type |

|

|

Technology |

|

|

Crop Type |

|

|

Component |

|

|

End use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Greenhouse Horticulture Market - Regional Analysis

Europe Market Insights

The Europe greenhouse horticulture market is predicted to dominate the entire global landscape, accounting for around 44.2% of the total revenue share by the end of 2035. The strong emphasis on sustainability, energy efficiency, and high-tech automation is the key factor behind this leadership. Countries such as the Netherlands, Germany, the UK, Spain, and Italy are leading in terms of greenhouse innovations, particularly in terms of hydroponics, vertical farming, as well as LED lighting technologies. In this regard, in November 2024, Hazera announced that it had inaugurated a new 5-hectare high-tech R&D greenhouse in Made, the Netherlands, which is aimed at advancing tomato breeding with a prime focus on disease resistance, high yield, and improved taste. It also mentioned that this facility is repurposed from an existing commercial greenhouse, emphasizing sustainability while accelerating the development of innovative tomato varieties for global markets, hence contributing to overall greenhouse horticulture market growth.

Germany greenhouse horticulture market mostly prioritizes energy-efficient and climate-resilient structures to reduce environmental impact while also maintaining productivity. Growers in the country also benefit from strong government support for sustainable agriculture and renewable energy integration. In October 2025, the German Federal Ministry of Food and Agriculture (BMLEH) reported that it runs the federal program to increase energy efficiency and co₂ reduction in agriculture and horticulture to support the country’s climate goals, aiming to cut annual agricultural emissions by 1.1 million tons of CO₂ by the end of 2030. Funding is provided under national and regional legal frameworks, which include the federal budget code, the climate and transformation fund, and EU regulations on agricultural state aid, thereby ensuring compliance and efficiency. It also mentioned that eligible investments must meet technical and professional standards, and support is distributed annually.

The UK greenhouse horticulture market is growing on account of a strong focus on enhancing local food production and reducing reliance on imports. Simultaneously, government initiatives provide support for energy-efficient greenhouse technology and urban farming projects, which in turn are encouraging more players to make investments in this field. In this regard, in April 2025, Indaver and Rivenhall Greenhouse Limited announced a decarbonisation project at the Rivenhall integrated waste management facility in Essex, to use electricity, heat, and CO₂ from the facility for efficient, year-round greenhouse crop production. The project also includes a carbon capture and usage (CCU) plant, heat exchangers, and a private-wire electricity supply to support LED-lit greenhouses, thereby enhancing yields and sustainability. Such an initiative represents a first-of-its-kind UK model linking low-carbon energy recovery with climate-resilient horticulture, boosting local food security.

North America Market Insights

The North America greenhouse horticulture market is exponentially growing owing to the presence of advanced controlled environment agriculture systems and technology-driven farming practices. The region also benefits from strong government support for sustainable agriculture initiatives and incentives for energy-efficient greenhouse construction. In this regard, BrightFarms, in December 2024, announced the inauguration of its first Texas greenhouse in Lorena by covering 1.5 million square feet and featuring advanced climate-control technology for year-round leafy green production. The facility is considered to be a part of BrightFarms’ rapid expansion across the U.S., creating over 250 local jobs and supporting sustainable, hydroponic farming methods that use less land and water than traditional agriculture. Further, it is backed by Cox Farms, the project reinforces investment in scalable, energy-efficient indoor farming, reducing transportation emissions.

In the U.S., the greenhouse horticulture market is expanding, fueled by the integration of AI, robotics, and IoT-enabled monitoring systems to improve both efficiency and sustainability. The country’s government programs and state-level initiatives also support workforce training and the adoption of green technologies, promoting resilience in food supply chains. In August 2025, AeroFarms reported that it had refinanced its debt and raised equity to support ongoing operations at its Danville, Virginia, vertical farm and fund pre-construction activities for a second farm. The company is a leading U.S. supplier of microgreens, uses patented aeroponics, robotics, AI, and 100% renewable energy to grow crops year-round with 90% less water and 230× less land when compared to traditional farming. This is supported by investors including Grosvenor Food & AgTech and Siguler Guff. This financing enables AeroFarms to expand sustainably, allowing it to maintain its leadership in climate-resilient, high-efficiency indoor agriculture.

Canada greenhouse horticulture market is maintaining a strong position in the regional dynamics owing to the resource-efficient production, the country’s harsh climate, and short growing seasons. Federal and provincial programs in the country deliberately encourage innovation in horticultural practices, which include crop diversification and integrated pest management. In December 2025, Agriculture and Agri-Food Canada and the Government of Alberta announced that they had launched the USD 10‑million growing greenhouses program to support expansion and innovation in Alberta’s greenhouse and vertical farming sector. The program funds new construction, energy-efficient systems, advanced lighting, automation, and robotics to enable year-round production of domestically grown fruits and vegetables, reducing import reliance and strengthening food security.

APAC Market Insights

The Asia Pacific greenhouse horticulture market is maintaining a strong position, facilitated by the increasing population, urbanization, and rising disposable incomes. Countries in the region are opting for modern greenhouse technologies to enhance productivity and reduce environmental impact. In this regard, in April 2025, DENSO Corporation and DELPHY Groep BV reported that they signed a memorandum of understanding to develop data-driven smart horticulture that optimizes greenhouse cultivation utilizing IoT, sensors, and digital twin technology. In addition, this collaboration aims to automate crop data collection, improve cultivation planning through DELPHY’s QMS software, and simulate plant growth for stable, sustainable production. Furthermore, by combining DENSO’s sensing and environmental control expertise with DELPHY’s cultivation knowledge, this initiative is all set to advance precision, efficient, and climate-resilient horticulture by the end of 2030.

China greenhouse horticulture market is leveraging both traditional and modern greenhouse structures to meet the high domestic demand for vegetables, fruits, and flowers. The market is primarily driven by government initiatives that are focused on food security, sustainability, and technological modernization. In January 2024, Kingpeng International Hi-Tech Corporation announced the completion of the first planting zone of its 26-hectare intelligent agriculture industrial park in Henan, China, which is a project integrating smart greenhouse production, technology, ecology, and agri-tourism. In addition to an investment of about RMB 400 million (USD 55-56 million), the park uses modern greenhouse systems and digital management to drive agricultural upgrading, improve productivity, and support farmer employment, enhancing sustainability and regional economic development.

India greenhouse horticulture market is efficiently progressing due to increasing consumer demand for high-quality fruits and vegetables, along with government programs that are proactively promoting protected cultivation. The country’s market also benefits from technological collaborations for drip irrigation, fertigation, and climate control systems. In this regard, Farmers Welfare in August 2025 highlighted horticulture as the central pillar of agricultural growth by emphasizing diversification into high-value crops to boost farmer incomes and sustainability. It is also supported by schemes such as the Mission for Integrated Development of Horticulture (MIDH), and the sector efficiently promotes protected cultivation, which includes greenhouses and polyhouses, modern technologies, and post-harvest infrastructure. In addition, horticulture production rose to 367.72 million tonnes in 2024-25. The initiative underlines strong policy backing and market potential for greenhouse horticulture in the country.

India Horticulture Production & Productivity Trends: Official Government Data

|

Indicator |

Earlier Period |

Latest Period |

Growth |

|

Total horticulture production |

280.70 million tonnes (2013-14) |

367.72 million tonnes (2024-25) |

31% |

|

Fruit production |

86.6 million tonnes (2014-15) |

112.97 million tonnes (2023-24) |

30% |

|

Vegetable production |

169.47 million tonnes (2014-15) |

207.2 million tonnes (2023-24) |

22% |

|

Fruit productivity |

14.17 t/ha |

15.80 t/ha |

Improved |

|

Vegetable productivity |

17.76 t/ha |

18.40 t/ha |

Improved |

|

Government support |

MIDH, NHB, HMNEH |

Protected cultivation, including greenhouses |

Active & ongoing |

Source: Farmer’s Welfare, Government of India

Key Greenhouse Horticulture Market Players:

- Richel Group (France)

- Netafim Ltd. (Israel)

- Hoogendoorn Growth Management B.V. (Netherlands)

- Dalsem B.V. (Netherlands)

- HortiMaX B.V. (Netherlands)

- Industries Harnois Inc. (Harnois Greenhouses) (Canada)

- Priva Holding B.V. (Netherlands)

- Certhon Build B.V. (Netherlands)

- Van der Hoeven Horticultural Projects B.V. (Netherlands)

- Ceres Greenhouse Solutions LLC (U.S.)

- Oritech Solutions (Netherlands)

- Top Greenhouses Ltd. (Israel)

- Rough Brothers, Inc. (Prospiant, Inc.) (U.S.)

- Logiqs B.V. (Netherlands)

- Heliospectra AB (Sweden)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Richel Group is identified as the global leader in terms of greenhouse construction and turnkey horticultural solutions, and it has a strong presence across Europe, North America, Africa, and the Asia Pacific. Besides, the firm specializes in steel and plastic greenhouse structures, which are especially designed for a wide range of climatic conditions. In addition, Richel opts for geographic expansion, climate-adapted designs, and sustainable farming practices to support food security as well as modern agricultural needs across the globe.

- Netafim Ltd. is yet another dominant force in this field and is a pioneer in precision irrigation. It is considered to be a key player in greenhouse horticulture owing to the presence of its advanced drip irrigation, fertigation, and digital farming solutions. The company is focused on maximizing crop yields and minimizing water and nutrient usage, making it a highly preferred partner for high-tech greenhouse operators. Further, Netafim is leveraging smart irrigation technologies, data-driven crop management, and expansion in water-scarce markets.

- Priva Holding B.V. is a leading provider of climate control, process automation, and energy management solutions for greenhouses. The company plays a critical role in enabling precision horticulture by integrating software, hardware, and data analytics into unified control platforms. Priva has its competitive advantage in its strong R&D capabilities and focus on digitalization, which includes cloud-based systems and AI-based climate optimization.

- Hoogendoorn Growth Management B.V. specializes in advanced climate computers and automation systems that allow growers to optimize growing conditions and operational efficiency. The company is best known for its user-friendly interfaces, data integration, and decision-support tools, which are suitable for most of the commercial greenhouse operations. Hoogendoorn’s strategy is mainly concentrated on continuous innovation in intelligent control systems, interoperability with third-party technologies, and global market penetration.

- Dalsem B.V. is a prominent greenhouse builder and technology integrator that is delivering high-tech and semi-high-tech greenhouse projects across the world. The company offers end-to-end solutions by combining structural design, climate systems, irrigation, and energy management. Furthermore, Dalsem also makes differentiation through customization, modular designs, and energy-efficient greenhouse concepts.

Below is the list of some prominent players operating in the global greenhouse horticulture market:

The global greenhouse horticulture market is partially consolidated and majorly technology-driven, wherein Europe-based pioneers, especially from the Netherlands, hold a dominant position. Their expertise lies in climate control, automation, and turnkey greenhouse solutions. Key players in this field also compete through innovation in smart greenhouse technologies, including AI-based climate management, precision irrigation, and energy-efficient lighting systems. In April 2025, Hoffmann Family of Companies announced that it had entered into a definitive agreement to acquire N.G. Heimos Greenhouses, which is one of the largest poinsettia growers in the U.S., in which the CEO and all employees and team members will remain, ensuring leadership continuity and operational stability. Therefore, this acquisition strengthens Hoffmann’s vertically integrated agricultural portfolio by supporting continued growth, innovation, and community-focused operations.

Corporate Landscape of the Greenhouse Horticulture Market:

Recent Developments

- In January 2026, Griffin Greenhouse Supplies announced that it is expanding its Midwest operations to enhance support for retail partners, improve product availability, speed up delivery, improve fill rates, and improve delivery reliability for growers and garden centers.

- In December 2025, Metrolina Greenhouses and South-Central Growers announced a merger under the Metrolina brand. The merger integrates all employees by maintaining site leadership and customer teams, aiming to enhance growth, shipping efficiency, and omnichannel retail capabilities.

- In January 2025, Windset Farms, in partnership with BC Hydro, reported that it had expanded its Delta, B.C., facility into western North America’s largest LED-lit greenhouse powered by renewable electricity. The upgrade reduced electricity consumption by 55% and supports year-round vegetable supply with USD 4.8 million in LED incentives and advanced energy systems.

- Report ID: 3187

- Published Date: Jan 15, 2026

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Greenhouse Horticulture Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.