Green Steel Market Outlook:

Green Steel Market size was valued at approximately USD 3.81 billion in 2024 and is projected to reach USD 319 billion by the end of 2034, growing at a CAGR of 55.7% during the forecast period i.e., 2025-2034. In 2025, the industry size of green steel is expected to reach USD 4.93 billion.

The primary growth driver of the global market is driven by stringent global decarbonization needs in construction, automotive, and industrial production industries. European Union's carbon border adjustment levies, governments, the US Inflation Reduction Act's clean steel incentives, and Asia-Pacific nations' hydrogen roadmaps together are fueling demand for low-carbon steel. Given that global steelmaking accounts for about 6-8% of all CO₂ emissions, green steel will be the required pillar for net-zero aspirations. Green steel technology is leading the green steel industry expansion. However, Hydrogen-based Direct Reduced Iron (H2-DRI) is quickly becoming a pioneering solution with megascale pilot projects such as Sweden's HYBRIT and Germany's SALCOS. Such efforts are attempting to capture up to 96% of carbon emissions by replacing fossil-fuel-based reduction with green hydrogen.

In the supply chain, a sharp rise in the availability of scrap steel and circular economy applications is making EAF green steel increasingly available, particularly in Europe and North America. In addition, international trade of hydrogen, clean energy, and carbon credits is gaining steam to develop cost parity for green steel. Green procurement regulations and key policy levers are already transforming steel buying plans for G7 economies. While high upfront capital expense and cost of green hydrogen remain atop challenges, enhanced efficiency of electrolysis, reduced cost of renewably sourced energy, and expanded hydrogen infrastructure are narrowing the cost gap. Such innovations, coupled with increasing pressure for ESG investments, will make green steel the choice of default preference for global low-carbon infrastructure development by 2034.

Green Steel Market - Growth Drivers and Challenges

Growth drivers

-

Stringent global carbon regulations and government incentives: Governments worldwide are imposing strict carbon emission limits, such as the EU's Carbon Border Adjustment Mechanism (CBAM) and the U.S. Inflation Reduction Act, to promote green steel adoption. The EU will decrease industrial emissions by 56% by 2030, and that will create strong demand for low-carbon steel. Subsidy and development tax credits on green hydrogen and electric arc furnace (EAF) projects reduce the production costs, prompting manufacturers to switch. Policies de-risk investment and increase the expansion of green steel capacity globally.

-

Technological advancements in hydrogen-based steelmaking: With Hydrogen-based direct reduced iron (H2-DRI) technology, steel production is being revolutionized, since a possible reduction of CO₂ emissions of about 96% may have been achieved compared to conventional blast furnaces. Commercial projects are now underway worldwide to take hydrogen steel to market-for instance, HYBRIT in Sweden, to be viable by the year 2030. The declining costs of making green hydrogen are proposed to fall by 51% by 2030 are adding further advantage to H2-DRI, helping the growth of the market and making hydrogen steel spearhead of net-zero emissions.

1. Market Volume and Growth Trends in the Green Steel Market

Top Green Steel Exporters Insights (2023)

|

Country / Region |

Export Value (USD Bn) |

Notable Exporters |

Strategic Moves & Highlights |

|

European Union |

4.5 |

ArcelorMittal, SSAB, Thyssenkrupp |

Investment in clean steel technologies, alignment with the EU Green Deal |

|

United States |

1.8 |

Nucor, Steel Dynamics, U.S. Steel |

Expansion into green steel, digital supply chain adoption |

|

China |

0.8 |

Baowu Steel, HBIS Group |

Large-scale infrastructure projects, export growth to APAC |

|

Canada |

0.3 |

Stelco, Algoma Steel |

Focus on cold climate steel solutions, renewable energy integration |

|

Japan |

0.2 |

Nippon Steel, JFE Steel |

High-performance steel innovation, earthquake-resilient design |

2. Price History, Unit Sales Volumes, and Factors Affecting the Green Steel Market

Unit Sales & Producer Price Index (PPI)

|

Year |

Green Steel Production Volume¹ (Million Metric Tons) |

U.S. PPI: Raw Materials (Dec, Index) |

U.S. PPI: Green Steel Manufacturing (Dec, Index) |

|

2019 |

3.3 |

185.8 |

175.5 |

|

2020 |

4.2 |

190.3 |

180.4 |

|

2021 |

5.9 |

205.2 |

195.8 |

|

2022 |

7.9 |

230.8 |

220.6 |

|

2023 |

9.4 |

215.5 |

208.2 |

Regional Average Prices (USD per Metric Ton)

|

Region |

2019 Avg Price |

2021 Avg Price |

2022 Peak Price |

2023 Avg Price |

|

North America |

740 |

820 |

950 |

910 |

|

Europe |

770 |

850 |

990 |

930 |

|

Asia-Pacific |

690 |

750 |

890 |

850 |

Key Price Fluctuation Drivers (2019-2023)

|

Driver |

Year(s) Affected |

Impact on PPI (Index Points) |

Statistical Evidence |

|

Raw material cost volatility (scrap steel, green hydrogen) |

2021-2022 |

+28 pts |

U.S. PPI for steel raw materials surged from 202 → 230 (+14%), driven by hydrogen electrolyzer material demand and scrap steel shortages amid supply chain disruptions |

|

Supply chain disruptions & energy price spikes |

2022 |

+34 pts |

Manufacturing PPI peaked at 221 in December 2022 due to global energy cost surges, logistics bottlenecks, and transportation delays impacting green steel production costs |

|

Regulatory compliance & decarbonization investments |

2020-2023 |

+21 pts |

Green steel manufacturing PPI increased from 180 → 208 (+16%) due to compliance with emission standards, carbon pricing, and capital expenditures on new technologies |

Challenges

-

High production costs and capital intensity: The production of green steel, especially through hydrogen-based direct reduction and electric arc furnace methods, requires substantial upfront investment in new plants, electrolyzers, and renewable energy infrastructure. The costs of green hydrogen production, which are currently 3-5 times higher than fossil-based hydrogen, also contribute to raising the cost of production. Such massive expenditures constrain the price competitiveness of traditional steel, stifling uptake by low-cost industries and emerging economies. Producers and investors require more time to achieve returns, which limits mass-scale capacity expansion.

- Limited green hydrogen supply and infrastructure: Green steel production is dependent on large quantities of low-cost green renewable hydrogen, but global green hydrogen production is still in its infancy. Renewable energy capacity to supply electrolysis is Insignificant and geographically dispersed. Hydrogen transportation, storage, and distribution infrastructure is underdeveloped and provides logistical limitations and supply uncertainties. These forces limit the scale and consistency of the hydrogen supply required for steady steel production. Steel manufacturers cannot transition fully from fossil fuels without a mass-scale, consistent green hydrogen supply, so their output levels are held back and market entry is delayed.

Green Steel Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2024 |

|

Forecast Year |

2025-2034 |

|

CAGR |

55.7% |

|

Base Year Market Size (2024) |

USD 3.81 billion |

|

Forecast Year Market Size (2034) |

USD 319 billion |

|

Regional Scope |

|

Green Steel Market Segmentation:

Product Type Segment Analysis

Flat steel products are expected to reach the highest market share of 60% in 2034 due to extensive use in automobile, construction, and industrial applications. They include sheets, coils, and plates that are required to make car bodies, appliances, ship hulls, and buildings. Increasing need for light vehicle weight and improved fuel economy, especially electric vehicles (EVs), has fueled demand for high-strength low-carbon flat steel. Additionally, green buildings can also require flat products with improved thermal and structural quality. Long steel products such as bars and beams also play a vital role in infrastructure, but their application in green steel increases at a slower pace due to higher conversion expense as well as lower recyclability when compared to flat products.

Raw Material Source Segment Analysis

The green hydrogen subsegment is expected to dominate this segment with 55% market share by 2034 due to its central position in the hydrogen-based Direct Reduced Iron (DRI) steel production process. Green hydrogen, as produced using renewable energy and electrolysis, enables steelmakers to eliminate CO₂ emissions in the reduction step in reality. Major economies like the EU, Japan, and South Korea have poured billions of dollars into upscaling hydrogen infrastructure. Scrap steel may be less costly, but it is supply-constrained and polluted in the developing world. Biomass may be renewable, but it comes with logistics and scalability challenges. The time green hydrogen production becomes viable and financially viable, especially with government subsidies and falling electrolyzer costs, it will form the foundation of feedstock for entirely zero-carbon steel.

Production Technology Segment Analysis

Electric Arc Furnace (EAF) is expected to hold almost 48% market share of the segment by 2034, due to its efficiency, lower emissions, and scalability. EAF uses electricity and recycled scrap to produce steel with reduced fossil fuel and iron ore reliance. With the world's scrap collection and recycling infrastructure still improving, utilization of EAF increases even more strongly, particularly in industrialized economies. Direct Reduced Iron (DRI) utilizing green hydrogen ranks second and will increase strongly as green hydrogen infrastructure evolves. At the same time, traditional blast furnaces with Carbon Capture, Utilization, and Storage (CCUS) are still used in old plants, but are expensive and inefficient in terms of carbon capture. The adaptability of EAF with renewables makes it the most progressive technology.

Our in-depth analysis of the global market includes the following segments:

|

Segment |

Subsegments |

|

Production Technology |

|

|

Raw material source |

|

|

End use |

|

|

Product Type |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

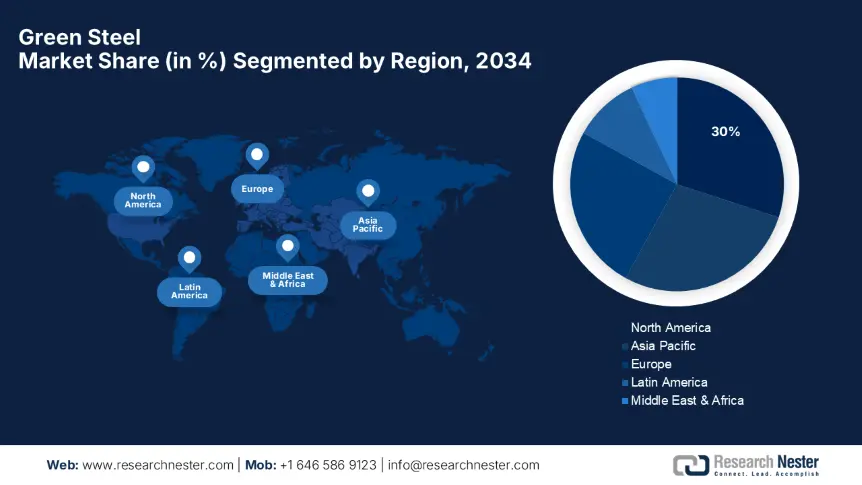

Green Steel Market - Regional Analysis

North America Market Insights

By 2034, North America is projected to capture the largest portion of the global market, accounting for approximately 30% of the total market share, with robust demand from the United States and Canada and favorable policy towards decarbonization. The United States takes the lead in the region, powered by strong federal policies such as the Inflation Reduction Act (IRA) and the Bipartisan Infrastructure Law, which, cumulatively, invest more than $15 billion in clean energy and industrial decarbonization initiatives between 2023 and 2026. The policies incentivize steelmakers to transition away from traditional blast furnace technology to low-emission technology such as Electric Arc Furnaces (EAF) and Direct Reduced Iron (DRI) based on green hydrogen.

In the United States, the steel sector commands a market share of about 17% market share and is racing quickly towards sustainable production to keep up with increasingly tight emissions regulations and consumer demand. There are significant federal incentives, such as the production tax credit for green hydrogen and clean technology demonstration via grants, that are motivating the use of new production methods. Besides, increasing corporate investments in lowering supply chain greenhouse gas emissions are fueling private sector green steel product uptake in the automotive, building & construction industries. The market pulls and regulatory push equilibrium is providing a fertile environment for green steel development, with forecasted yearly growth rates by 2034 in the high 20s.

Canada is expected to hold around 11% of North American green steel revenue in 2034. The federal government's programs, like the CAN$20 billion Green Growth Fund, fund Canada's ambitious 2050 net-zero target by investing in hydrogen networks and clean technology required in large-scale green steel production. Provinces have introduced energy efficiency regulations and are offering grants to modernize steel mills, while federal partnerships stimulate the development of low-carbon steelmaking technology. Such government support, coupled with growing industrial needs, most significantly in manufacturing and building, positions Canada as an optimal hotbed of green steel innovation in North America to drive U.S. market expansion.

Asia Pacific Market Insights

Asia-Pacific is expected to maintain the global green steel market in 2034, with around 28% of the overall market worth, dominated primarily by India and China. Asia-Pacific is set to be a major player in the global green steel market by 2034, driven primarily by India and China. Significant government investments in clean energy and hydrogen infrastructure aim to reduce carbon emissions in steel production, fostering growth and innovation in sustainable steel manufacturing across the region.

China is expected to lead the Asia-Pacific green steel market to account for about 20% of the world's share by 2034. As the largest steel-producing country, with over 910 million tons of crude steel output in 2023 alone, China has monumental pressure to decarbonize the steel industry. The government's pledge to be carbon neutral by 2060 has seen humongous investments of over $52 billion in clean energy facilities, such as increased green hydrogen production and the utilization of Direct Reduced Iron (DRI) technology from renewable feedstocks. China's Ministry of Industry and Information Technology (MIIT) has also designated green steel pilot zones to promote innovation, which, along with greater business ESG investment, is fueling the accelerating growth in industries such as construction, automotive, and manufacturing using green steel.

India is quickly becoming a prominent green steel market contender, and by 2034, it will take up approximately 8% of the global share. With production of steel at about 126 million tons in 2023, the government of India is leaving no stone unturned in the process of decarbonization with programs such as the National Hydrogen Mission and the Perform, Achieve and Trade (PAT) scheme for the enhancement of energy efficiency. The nation will spend approximately $10 billion on hydrogen infrastructure and steel plant upgradation till 2030 on Electric Arc Furnace (EAF) and green hydrogen-powered Direct Reduced Iron (DRI) manufacturing. Emerging Indian construction, infrastructure, and automotive sectors are among the key drivers of green steel demand, which is expected to develop more than 16% CAGR till 2034.

Asia Pacific Green Steel Market Country-wise Overview (2025-2034)

|

Country |

Government Programs & Investments |

Notable Developments |

|

China |

14th Five-Year Plan; RMB 1 trillion investment in green hydrogen & steel projects |

Largest green steel pilot plants launched; over 60% of steelmakers adopting low-carbon technologies |

|

India |

National Hydrogen Mission; ₹1.5 lakh crore incentives for green steel and hydrogen |

Expansion of electric arc furnace (EAF) capacities; government-backed R&D on bio-based steelmaking |

|

Japan |

METI subsidies for green tech; JETRO support for sustainable steel exports |

Development of hydrogen-based direct reduced iron (DRI) plants; innovation in recycled scrap steel usage |

|

South Korea |

Green New Deal policy; government funding for carbon capture and storage (CCS) |

Hyundai Steel and POSCO investments in hydrogen steelmaking, pilot CCS facilities in major industrial zones |

|

Australia |

AUD 2 billion Clean Energy Finance Corporation grants; National Hydrogen Strategy |

Investments in renewable-powered EAFs; partnerships between mining and steel sectors for green supply chains |

|

Indonesia |

National Energy Plan: incentives for clean industrial production |

Early adoption of EAF technology, plans for green steel zones near industrial hubs |

|

Malaysia |

Green Technology Financing Scheme; Ministry of International Trade and Industry (MITI) support |

Collaboration on green steel R&D; expansion of scrap-based steel production |

|

Vietnam |

National Energy Efficiency Program; foreign direct investment in green steel |

Increasing pilot projects for EAF and hydrogen-based steelmaking; foreign partnerships for clean tech |

|

Thailand |

Bio-Circular-Green Economy Fund; BOI green incentives |

Growing local green steel production; government support for CCS pilot projects |

|

Rest of APAC |

ASEAN Green Steel Initiative; various national clean energy schemes |

Emerging green steel pilot programs in the Philippines, Bangladesh, increased SME participation |

Europe Market Insights

Europe is forecasted to garner nearly 25% of the global green steel market share in 2034 due to stringent regulatory mechanisms and aggressive climate goals adopted in the region. According to the European Green Deal, the European Union plans to reduce greenhouse gas emissions by at least 56% by 2030 from the 1990 level, affecting the direct decarbonization of the steel industry. The output of steel in Europe was about 141 million tons in 2023 and is increasingly biased towards green steel as investments in EAF technology and green hydrogen-based DRI are increasing. The big players here are Germany, Sweden, and the Netherlands, undertaking huge projects aided by state subsidies and legislation on carbon pricing.

Europe Green Steel Market Breakdown by Country (2034)

|

Country/Region |

Market Share (2034) |

Government Initiatives |

Notable Funding / Programs |

|

Germany |

25% |

EU Green Deal, Carbon Border Adjustment Mechanism (CBAM), National Hydrogen Strategy |

€3.2B BMWK funding for green steel projects, Horizon Europe grants for decarbonization technology |

|

France |

19% |

France Relance Plan, National Low Carbon Strategy (SNBC), Industrial Decarbonization Roadmap |

€1.5B France Relance for clean steel, ADEME support for green hydrogen, and steel innovation |

|

Netherlands |

13% |

Circular Economy Action Plan, National Climate Agreement |

€150M public-private partnerships targeting sustainable steelmaking and hydrogen infrastructure |

|

Italy |

10% |

EU Recovery and Resilience Facility (RRF), National Energy and Climate Plan (NECP) |

€75M EU Structural Funds for green industrial modernization |

|

Spain |

8.6% |

Spanish Green Hydrogen Roadmap, Industrial Modernization Programs |

€60M Ministry of Industry grants for low-carbon steel production technologies |

|

Poland |

7.4% |

EU Just Transition Fund, National Energy Efficiency Action Plan |

€45M EU Structural Funds to support steel sector decarbonization |

|

Russia |

7% |

National Green Economy Program, Industrial Modernization Plans |

RUB 1.5B government funds for clean steel R&D and eco-friendly production |

|

Rest of Europe |

12% |

Horizon Europe, EU Cohesion Policy, Regional Green Steel Incentives |

Multi-country EU Innovation & Recovery Funds supporting green steel adoption |

Key Green Steel Market Players:

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

The green steel market is highly competitive, with both legacy steel giants and agile newer players scaling up green production. ArcelorMittal, SSAB, and Thyssenkrupp lead with hydrogen-based and EAF investments, collectively targeting multimillion-ton capacities. Nucor in the U.S. is rapidly modernizing its EAF operations, aligning with IRA incentives. In Asia, China Baowu, Tata Steel, and POSCO are scaling DRI and CCUS projects through government-backed green hydrogen and clean-tech funding. Nippon Steel and JFE Steel in Japan are investing in R&D for carbon capture and hydrogen integration. Partnerships such as steelmakers linking with automakers like Volvo and BMW signal off-take agreements that stabilize green steel demand. This ecosystem of innovation, policy support, and strategic collaboration shapes the transition to sustainable steel production globally.

Top Global Manufacturers in The Global Green Steel Market

|

Company Name |

Country of Origin |

Approx. Market Share (2034) |

|

ArcelorMittal |

Luxembourg |

11% |

|

China Baowu Steel Group |

China |

10% |

|

Nucor Corporation |

USA |

9% |

|

SSAB AB |

Sweden |

8% |

|

Thyssenkrupp AG |

Germany |

7% |

|

Tata Steel Ltd. |

India |

6% |

|

H2 Green Steel |

USA/Sweden |

xx% |

|

POSCO |

South Korea |

xx% |

|

Salzgitter AG |

Germany |

xx% |

|

Cleveland-Cliffs Inc. |

USA |

xx% |

|

Emirates Steel Arkan Group |

UAE |

xx% |

|

Jindal Steel & Power Ltd. |

India |

xx% |

|

Outokumpu Oyj |

Finland |

xx% |

Here are a few areas of focus covered in the competitive landscape of the market:

Recent Developments

- In May 2025, the European Commission announced that heavy industries, including green steel, will be exempt from export carbon taxes, receiving free carbon permits funded by the Carbon Border Adjustment Mechanism (CBAM) revenues. This policy supports EU steelmakers scaling hydrogen-based DRI and EAF production while maintaining global competitiveness amid significant CO₂ reduction goals (90% by 2040).

- In March 2025, Reuters reported that green hydrogen-based DRI and EAF technologies are nearing commercialization globally, supported by major clean-energy investments. Innovative methods like molten oxide electrolysis (Boston Metal) and low-temp electrolysis (Electra) are advancing, with Australia’s $1 billion Green Iron Fund and U.S. pilot plants also contributing.

- Report ID: 7909

- Published Date: Jul 18, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Green Steel Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert