Green Building Materials Market Outlook:

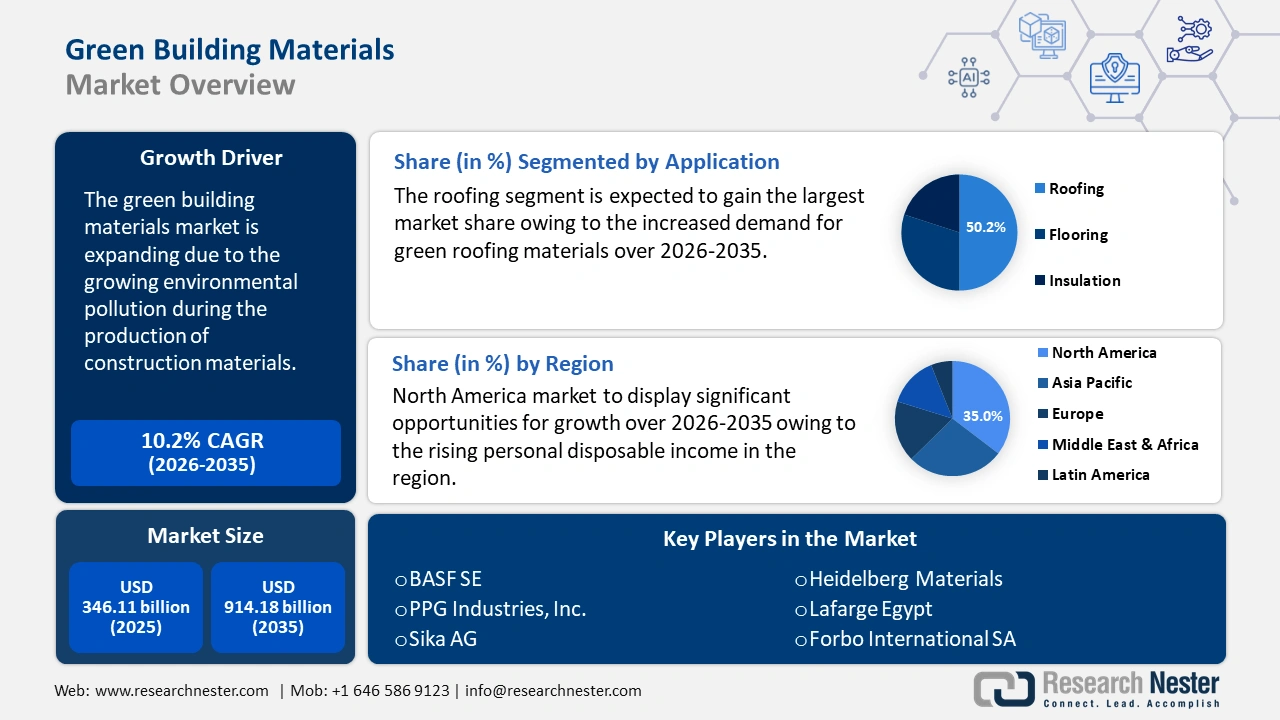

Green Building Materials Market size was over USD 346.11 billion in 2025 and is projected to reach USD 914.18 billion by 2035, witnessing around 10.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of green building materials is evaluated at USD 377.88 billion.

The growing environmental pollution is a significant driver for the green building materials market. As concerns about climate change and environmental degradation increase, there is a stronger push towards sustainable construction practices.

Green building materials are designed to minimize environmental impact, reduce energy consumption, and improve indoor air quality. This shift is driven by both regulatory requirements and a growing awareness of the need for sustainable development. For instance, many countries have implemented green building standards such as Leadership in Energy and Environmental Design (LEED) and Building Research Establishment Environmental Assessment Method (BREEAM), which promote the use of eco-friendly materials. Additionally, advancements in technology and increased availability of eco-friendly materials are further fueling the market growth.

Key Green Building Materials Market Insights Summary:

Regional Highlights:

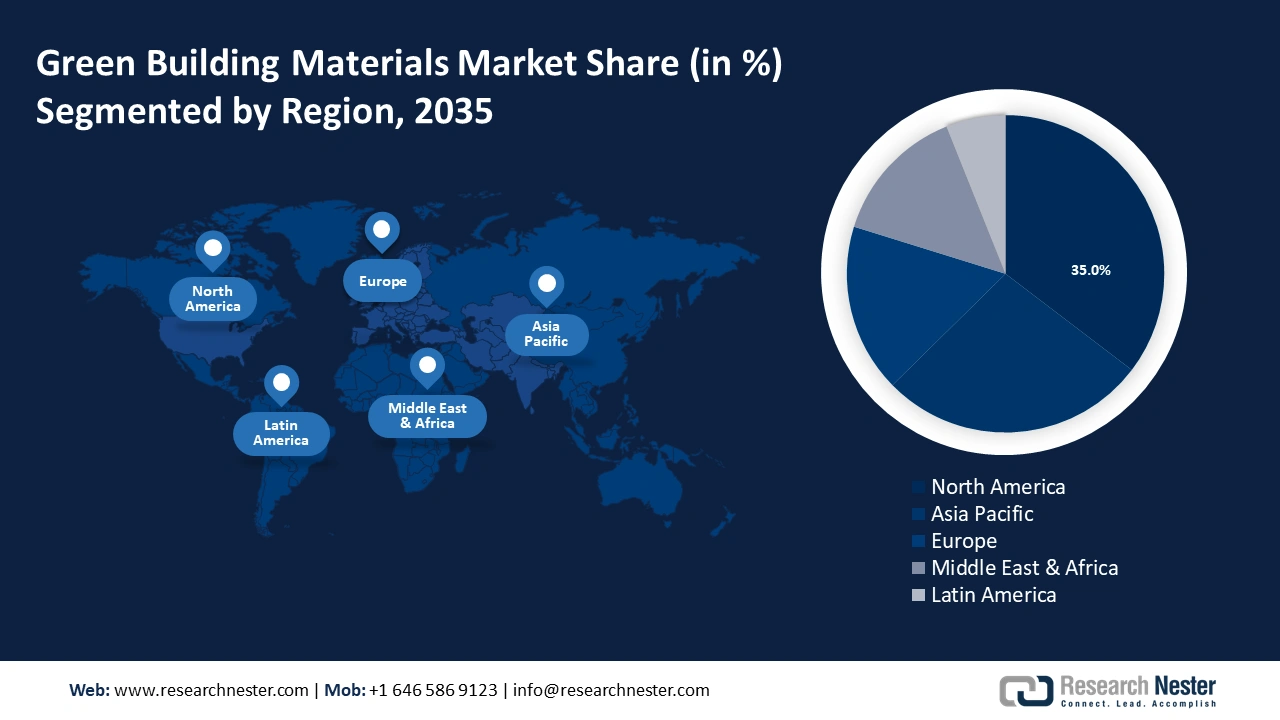

- The North America green building materials market will account for 35% share by 2035, driven by growing construction activities, increasing energy demand, and efforts to reduce carbon emissions.

- The Asia Pacific market will secure the second largest share by 2035, driven by availability of wide range of green materials and new industrial buildings driving market growth.

Segment Insights:

- The roofing segment in the green building materials market is anticipated to capture a 50.20% share by 2035, driven by the surge in demand for green roofing materials, such as solar roofing systems and green roofs.

- The residential segment in the green building materials market is forecasted to achieve a significant share by 2035, propelled by growing guidelines and building laws for energy-efficient construction.

Key Growth Trends:

- Rapid shift towards green buildings

- Better indoor air quality

Major Challenges:

- Fluctuating price of raw materials

- Lack of standardization and certification

Key Players: BASF SE, PPG Industries, Inc.,I.du Pont De Nemours and Company, Sika AG, Heidelberg Materials, Lafarge Egypt, Forbo International SA, HOLCIM, Alumasc Group plc, Bauder Ltd.

Global Green Building Materials Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 346.11 billion

- 2026 Market Size: USD 377.88 billion

- Projected Market Size: USD 914.18 billion by 2035

- Growth Forecasts: 10.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (35% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: China, India, Brazil, Mexico, Thailand

Last updated on : 18 September, 2025

Green Building Materials Market Growth Drivers and Challenges:

Growth Drivers

- Rapid shift towards green buildings: The shift towards green buildings is driving the demand for green building materials, supported by regulatory frameworks, technological innovations, and growing consumer and investor interest. Favorable government policies and consumer demand for sustainable living are leading to the growing preference for materials that have a minimized environmental impact. A major factor in the increased demand for energy-efficient buildings is the use of sustainable building materials like solar panels and insulation, which lower energy usage. For instance, the European Union’s Green Deal aims to make Europe the first climate-neutral continent by 2050, promoting green building practices.

- Better indoor air quality: Green building materials improve indoor air quality and have a good environmental impact while improving building performance. Also, green building materials are free of impurities, particularly volatile organic compounds (VOC), which are present in indoor air and pose a risk to the health of inhabitants, including cancer. Therefore, green building materials can reduce health risks by, for instance, developing fewer hazardous chemicals and limiting the use of PVC.

- Increasing demand for energy-efficient construction materials: Green building materials allow the manufacturers to recycle the waste materials used in the construction instead of using new raw materials. Also, compared to conventional materials, green building materials on the other hand consume less energy, are biodegradable, and can be decomposed effortlessly. Therefore, green building materials use less energy, water, and natural resources, produce less trash, or none (zero discharge), and are healthier for the occupants.

Challenges

-

Fluctuating price of raw materials: The availability of materials and the increased demand from end-use industries are expected to cause price fluctuations, which will limit market expansion. Due to the long-term advantages of green buildings, the adoption of these materials comes with a significant upfront investment cost. Furthermore, it is anticipated that the residential construction sector will be curtailed in many nations due to diminishing per capita income. This is anticipated to impede the construction industry's adoption of green building materials.

-

Lack of standardization and certification: Different industries may have different standards for what qualifies as a green material, which makes it challenging for professionals and consumers to make wise decisions. The establishment of globally recognized certifications and standards is essential to establishing a coherent framework that supports decision-making and guarantees the legitimacy of green building materials. Therefore, this factor may hamper the growth of green building materials market.

Green Building Materials Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

10.2% |

|

Base Year Market Size (2025) |

USD 346.11 billion |

|

Forecast Year Market Size (2035) |

USD 914.18 billion |

|

Regional Scope |

|

Green Building Materials Market Segmentation:

Application Segment Analysis

The roofing segment in the green building materials market is poised to capture a revenue share of 50.2% by 2035. The segment growth can be attributed to the surge in the demand for green roofing materials, such as solar roofing systems, green roofs, and cool roofs. According to the Environmental Protection Agency, as compared to conventional roofs, green roofs can lower building energy use by 0.7%, lowering peak electricity demand and resulting in annual savings of USD 0.23 per square foot of the roof's surface. Additionally, government incentives and regulations and growing awareness of the advantages green roofing materials have for the environment, including energy efficiency and a lower carbon footprint are some other factors accelerating the growth of the segment.

End-use Segment Analysis

The residential segment is estimated to gain a significant green building materials market share during the forecast period. The segment’s expansion can be attributed to the growing number of guidelines and building laws for energy-efficient construction. The segment is expanding due to the rising demand for eco-friendly and energy-efficient homes and by government policies and programs that encourage the use of green building materials in residential construction. For instance, the Energy Conservation (Amendment) Bill, 2022, requires all Indian States and Municipalities to adopt and apply the Energy Conservation Building Code-Residential, also known as Eco-Niwas Sahmita (ENS). The bill constitutes a major commitment to raise cumulative non-fossil fuel energy supply to 50% of national installed capacity and lower emissions intensity of India's GDP by 45% relative to 2005 levels.

Our in-depth analysis of the global market includes the following segments:

|

Application |

|

|

End-use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Green Building Materials Market Regional Analysis:

North America Market Insights

North America industry is predicted to account for largest revenue share of 35% by 2035. The market growth in the region is expected on account of the growing construction activities, increasing energy demand, and rising efforts to reduce carbon emissions. Furthermore, there has been a sharp increase in the demand for energy-efficient and environmentally friendly buildings that enhance value while minimizing environmental effects.

The U.S. government has implemented several programs and laws that support environmentally friendly building practices. The use of these construction materials is influenced by tax breaks, incentives, and more stringent energy-efficient building regulations. For instance, the Federal Sustainability Plan launched an ambitious goal to achieve net-zero emissions building by 2045.

In Canada, the growing use of energy-efficient solutions in the residential sector is driving the demand for green building materials. For instance, in 2019, the residential sector's energy efficiency increased by 32%, saving Canadians 440 PJ of energy and USD 8.5 billion in expenses, or USD 47 per household per month.

APAC Market Insights

Asia Pacific will also encounter huge growth for the green building materials market during the forecast period and will hold the second position owing to the availability of a wide range of green materials such as galvalume panels, linoleum, and fiber cement composites. Furthermore, new industrial buildings, low- and high-rise residential structures, and building retrofits will be the primary drivers of market growth in Asia Pacific.

In China, the growing consumer expenditure on property is promoting the adoption of green and eco-friendly buildings. According to the World Economic Forum, China's 13th Five Year Plan for Building Energy Efficiency and Green Building Development sets ambitious goals for green building construction and refurbishment, including a requirement that 50% of all new urban buildings be certified green buildings.

The growing deployment of strict laws and regulations for green buildings in South Korea is one of the major factors escalating market growth in the region. For instance, South Korea uses the Green Standard for Energy and Environmental Design (G-SEED), a green building certification method in which materials make up 11% of the evaluation criteria.

Green Building Materials Market Players:

- BASF SE

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- PPG Industries, Inc.

- E.I.du Pont De Nemours and Company

- Sika AG

- Heidelberg Materials

- Lafarge Egypt

- Forbo International SA

- HOLCIM

- Alumasc Group plc

- Bauder Ltd.

Market key players face intense competition from regional and global businesses who possess vast supply chains, regulatory expertise, and wide distribution networks. To grow in their current markets, businesses also enter into agreements, buy out competitors, and establish strategic alliances.

Recent Developments

- In November 2023, Heidelberg Materials made the first carbon-capped net-zero cement available to consumers in Europe under the evoZero brand. By using carbon capture and storage technology at the Heidelberg Materials facility in Brevik, Norway, evoZero achieves a net-zero footprint without the need for credits produced outside the company's value chain.

- In April 2021, Lafarge Egypt, a subsidiary of LafargeHolcim Group, announced the launch of EcoLabel cement in Egypt. The newly introduced products meet the company's eco-friendly standards, which include recycled components and a reduced carbon footprint.

- Report ID: 6372

- Published Date: Sep 18, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Green Building Materials Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.