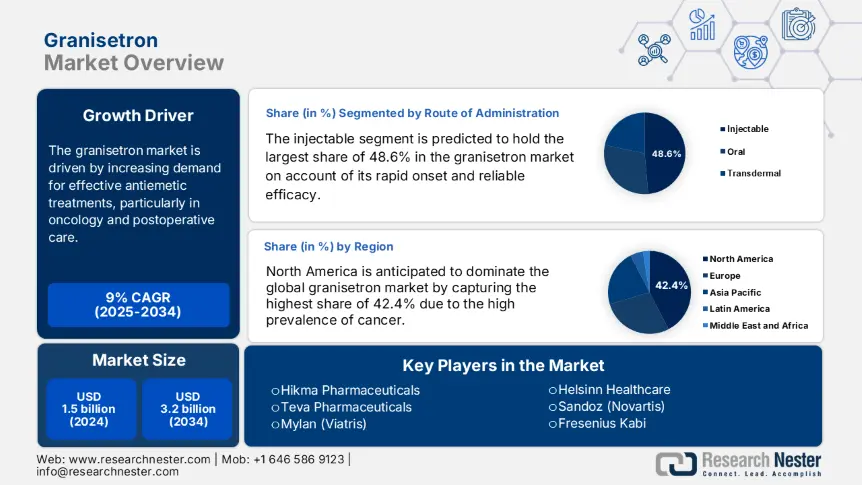

Granisetron Market Outlook:

Granisetron Market size was over USD 1.5 billion in 2024 and is estimated to reach USD 3.2 billion by the end of 2034, expanding at a CAGR of 9% during the forecast timeline, i.e., 2025-2034. In 2025, the industry size of granisetron is assessed at USD 1.8 billion.

The market is driven by increasing demand for effective antiemetic treatments, particularly in oncology and postoperative care. Thus, the increasing occurrences of malignancies are propelling demand in this sector. Testifying to the expanding demography, the World Health Organization (WHO) revealed that approximately 20.4 million new cancer cases are diagnosed every year, where 70.3-80.6% of chemotherapy patients experience CINV. Besides, 40.7-50.4% of surgical patients suffer from postoperative nausea and vomiting (PONV), as per the U.S. National Cancer Institute (NCI). These factors cumulatively contribute to sustained consumer base and widespread clinical adoption in this category.

The dynamics of pricing in the market notably rely on the viability of the global supply chain for APIs. A major production of these components is concentrated in India, China, and Europe, while being the origin of 30.5-40.3% sourcing worldwide. Currently, a 3.4-5.6% annual increase in the producer price index (PPI) for antiemetics due to rising material costs was observed by the U.S. Bureau of Labor Statistics (BLS). Subsequently, the cost of associated treatment rose by a yearly 4.7-6.3% rate. Thus, to control the impact of this inflation, manufacturers are adopting automation, which reduces manufacturing expenses by 12.5-15.6%, according to the U.S. Department of Commerce. These factors collectively shape the accessibility and availability structure in the sector.

Granisetron Market - Growth Drivers and Challenges

Drivers Growth

- Increasing expenditure on rehabilitation: The amplifying healthcare spending and expanding insurance coverage are bringing financial literacy among producers and consumers in the market. For instance, in 2023, Medicare expenditures on this category reached $480.5 million, reflecting a broader range of backing for chemotherapy. On the other hand, statutory health insurers in Germany allocated €210.3 million for Granisetron in 2024, demonstrating an 8.5% annual rise in antiemetic budgets. Additionally, patient out-of-pocket costs rose to $45.4 for each prescription amid 10.5-15.4% price inflation from 2020 to 2024. These trends highlight the improvement in patient access in this field.

- Contribution of favorable regulatory policies: Developments in the compliance criteria and process are significantly influencing the worldwide expansion of the granisetron market through empowering the competitive landscape and cohort of innovation. As evidence, in 2024, the FDA tightened bioequivalence standards, ensuring higher efficacy and prompting 30.5-35.7% of new Abbreviated New Drug Application (ANDA) filings to focus on Granisetron variants. Besides, the 2023 fast-tracking of transdermal Granisetron by the European Medicines Agency (EMA) reduced dosing frequency by 50.5%, enhancing patient compliance. Such evolutions in regulatory frameworks are enhancing both quality and adoption rate of novel formulations in this category.

- Clinical and economic effect of extensive R&D: The market is being augmented forward on account of notable advancements and engagement in research. These exploration cohorts are further supported by robust investments in research, development, and deployment (RDD), where the yearly funding from the National Institute of Health (NIH) ranged between $50.4 million and 70.5 million. These grants are specifically dedicated to next-generation formulations, such as transdermal patches and extended-release injectables, which are accelerating quality, outcome, and efficiency improvements in the market. Following the same path, the Horizon 2020 program in Europe invested €20.4 million in AI-driven antiemetic dosing to minimize side effects.

Historical Patient Growth & Its Impact on Market Expansion

Historical Patient Growth (2010-2020) - Granisetron Users

|

Country |

2010 (Million) |

2015 (Million) |

2020 (Million) |

CAGR (2010-2020) |

|

U.S. |

1.5 |

1.9 |

2.4 |

6.0% |

|

Germany |

0.7 |

0.58 |

0.78 |

6.8% |

|

France |

0.38 |

0.48 |

0.9 |

5.8% |

|

Spain |

0.28 |

0.38 |

0.8 |

7.4% |

|

Australia |

0.18 |

0.5 |

0.6 |

7.5% |

|

Japan |

2.1 |

1.4 |

1.8 |

6.8% |

|

India |

0.6 |

0.9 |

1.5 |

15.2% |

|

China |

0.8 |

1.3 |

2.3 |

15.2% |

Feasible Expansion Models Shaping the Granisetron Market

Feasibility Models for Market Expansion

|

Region |

Strategy |

Revenue Impact (2022-2024) |

Feasibility |

|

U.S. |

Medicare-backed biosimilars |

9.4% |

95.3% |

|

India |

Local API partnerships |

12.3% |

80.3% |

|

Europe |

AI-driven dosing (Horizon 2020) |

+15.7% adherence |

90.8% |

|

China |

State-subsidized generics |

+18.8% volume |

75.6% |

Challenges

- Cost-driven procurement limitations: A significant barrier in the market originates from pharmacy benefit managers (PBMs) favoring low-cost generics over more effective sustained-release formulations. By prioritizing short-term cost savings over long-term patient outcomes, PBMs discourage innovators from investing in the development of extended-release and value-added formulations, and hence restrict progress in this sector. Moreover, this shift in preference has already blocked an estimated $220.5 million in potential revenue for advanced granisetron therapies.

- Increased prevalence of substandard products: The widespread circulation of substandard medications is becoming a global concern in the market. For instance, in Africa and Southeast Asia, around 15.5% of products fail to meet quality standards, established through a survey conducted by the WHO. These formulations hinder treatment efficacy and pose serious risks to patient safety, damaging brand reputation and consumer trust. This also underscores urgent gaps in regulatory enforcement and supply chain integrity across these regions.

Granisetron Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2024 |

|

Forecast Year |

2025-2034 |

|

CAGR |

9% |

|

Base Year Market Size (2024) |

USD 1.5 billion |

|

Forecast Year Market Size (2034) |

USD 3.2 billion |

|

Regional Scope |

|

Granisetron Market Segmentation:

Route of Administration Segment Analysis

Based on the route of administration, the injectable segment is predicted to hold the largest share of 48.6% in the granisetron market over the assessed tenure. The rapid onset and reliable efficacy in managing chemotherapy-induced nausea and vomiting (CINV) solidified its position as the first choice in oncology-related rehabilitation. Testifying to the same, the NIH reported that approximately 70.5% of U.S. chemotherapy patients receive IV antiemetics. Such clinical validations are reinforcing the dominance of injectable formulations in acute care settings. Moreover, their immediate therapeutic action makes them the gold standard for patient support in hospitals and clinics.

Application Segment Analysis

The utilization of products from the granisetron market in treating chemotherapy-induced nausea and vomiting (CINV) is estimated to be the highest, accounting for 62.4% of revenue by the end of 2034. The segment's dominance in this sector is attributable to the rising cancer prevalence around the globe, where the annual number of new cases is expected to cross 30.5 million by 2030, as per the WHO. The clinical value of this drug in early-stage intervention is also established by a 2022 study from the Agency for Healthcare Research and Quality (AHRQ). It showcased a 22.4% reduction in CINV-related hospitalizations and $1.6 billion in savings for the U.S. healthcare system over two years.

Distribution Channel Segment Analysis

In terms of distribution channels, the hospital pharmacies segment is anticipated to account for the dominant share of 55.6% in the granisetron market throughout the discussed timeframe. As healthcare facilities increasingly implement evidence-based antiemetic protocols aligned with AHRQ guidelines, the tendency of investing in this segment among consumers and pioneers magnifies. This can be exemplified by the hospitals in the U.S., using these standardized approaches, reporting 15.5-20.6% fewer CINV-related readmissions. Thus, the growing acceptance in primary oncology care settings reinforces granisetron's predominant usage as a cost-effective first-line therapy in inpatient scenarios.

Our in-depth analysis of the global market includes the following segments:

| Segment | Subsegment |

|

Route of Administration |

|

|

Application |

|

|

Distribution Channel |

|

|

Formulation |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

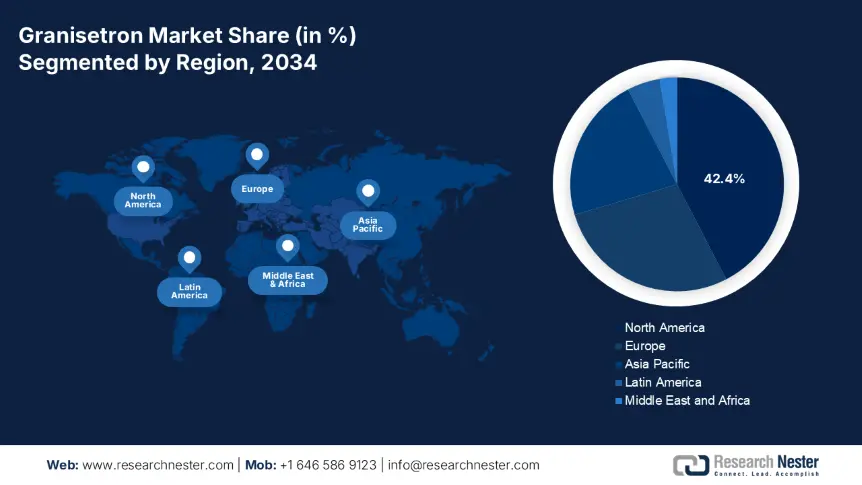

Granisetron Market - Regional Analysis

North America Market Insights

North America is anticipated to dominate the global market by capturing the highest share of 42.4% during the timeline between 2025 and 2034. According to a report from the NIH, more than 3.1 million cancer patients in the U.S. undergoing chemotherapy were requiring CINV treatment in 2025. Besides, the high prevalence of cancer across the region also contributes to the continuous enlargement of the epidemiology. The region's leadership is further solidified by the presence of a favorable regulatory framework that provides accelerated clearances for innovative formulations. Moreover, North America has a strong emphasis on finished drug production, which is amplifying its revenue generation from this merchandise.

The U.S. is augmenting the granisetron market with dominance over regional revenue generation. This leadership is primarily backed by its enlarging chemotherapy patient population, reaching 2.5 million in 2025, as registered by the NIH. On the other hand, the expansion of insurance coverage is securing a stable cash inflow in this sector. For instance, in 2024, Medicare increased its spending on these medicines to $800.4 million, while Medicaid allocation hit $1.6 billion. Besides, AHRQ drafted a $5.3 billion oncology budget that prioritizes CINV prevention. Furthermore, the landscape is progressing with the emergence of biosimilars and innovative drug delivery systems.

The Canada market is growing gradually on account of provincial healthcare investments. As evidence, from 2021 to 2024, the healthcare spending from the governing body of Ontario rose by 18.5%. Additionally, federal funding in this category crossed $3.6 billion, as per the budget drafted by the Canadian Institute for Health Information (CIHI). Further, the $200.5 million generics initiative by the Innovative Medicines Canada (IMC) is propelling the volume of procurement and scale of development in this sector. Moreover, the improving affordability and distribution capacity of the country is fostering a lucrative business atmosphere.

APAC Market Insights

Asia Pacific is expected to become the fastest-growing region in the global granisetron market over the analyzed timeline. The cancer mortality and awareness about the importance of patient management in oncology are the primary sources of acceleration in the region's propagation in this sector. Testifying to the same, the WHO estimated more than 30.5 million annual cases by 2030 to originate from APAC. Thus, investments in this category from both government and private organizations are amplifying. Furthermore, the release and formation of favorable biosimilar policies and hospital partnerships, particularly in South Korea and Malaysia, are accelerating access in this field.

China obtained a strong control over 30.5% revenue share of the APAC market. The country's 2.1 million patient pool (2023) and 15.5% increased government spending (2020-2024) are conjointly establishing the country as a regional leader in both consumer base and cash inflow, as per the National Medical Products Administration (NMPA). Besides, the NMPA fast-tracked approvals for new formulations, which enhanced accessibility in this sector. Additionally, China is the source of 60.4% global granisetron API supply that is empowered by the country’s low-cost generics and API production. This trading advantage can underpin $480.5 revenue potential for China by 2025.

India is emerging as a sustainable and cost-efficient supply chain alternative for the granisetron market both globally and regionally. This can be evidenced by the country's dominance of global API supply, with 70.4% sourced from just two domestic manufacturers. The landscape is expanding rapidly on account of its 2.7 million patients treated in 2023. On the other hand, the $2.2 billion annual healthcare spending of the country is also providing financial backing for extended adoption across India, as unveiled by the National Health Policy (NHP).

Government Investments, Policies & Funding (2024-2025)

|

Country |

Government Policy / Initiative |

Budget / Funding (Million) |

Impact on Market |

|

Australia |

Oncology Drug Acceleration Program – Fast-tracked approvals for CINV therapies |

$15.8(2024-2025) |

Reduced time-to-market for generics by 6 months |

|

South Korea |

National Health Insurance (NHI) Reimbursement Update – Expanded coverage for Granisetron IV |

$60.8(annual from 2024) |

Increased hospital adoption by 18.8% in Q1 2024 |

|

Malaysia |

Proposed Generic Drug Policy – Mandatory substitution for cost-effective alternatives |

Estimated $5.4(2025) |

Expected to lower Granisetron costs by 15.3-20.6% upon implementation |

Source: PBS Australia, KDDF South Korea, and MyPharma Malaysia

Europe Market Insights

The Europe granisetron market is poised to expand steadily by the end of 2034 due to the increasing cancer prevalence and favorable healthcare reforms. The presence of a sustainable demography can be testified by a report from the WHO, estimating the number of annual cases to cross 4.5 million by 2030. France leads this landscape with its optimized cost management and the allocation of 7.4% of its health budget to granisetron. On the other hand, the €2.8 billion EU Health Data Space initiative is boosting participation and innovation in antiemetic-related R&D. Furthermore, the fast-track approvals from the EMA introducing 5 new generics are evidencing product pipeline expansion in Europe.

Germany is expected to command 32.4% share in the Europe market between 2025 and 2034. The country's geriatric residency, aged over 65, is poised to acquire 25.4% share of the total population by 2030. In addition, the European Cancer Registry recorded 540,004 treated patients in 2025, reflecting consistent enlargement of the consumer base. On the other hand, the 2024 fixed-price listing by the BMG saves €200.4 million each year, while G-BA’s price-volume agreements cut costs by 15.7%. This pricing dynamic of the country displays the ongoing improvement in accessibility in this sector.

The UK is estimated to account for the 2nd largest regional share, 22.8%, in the granisetron market by 2034. This position is primarily supported by the country's 1.5 million patient population, counted in 2025 by the National Health Service (NHS). Besides, the Cancer Drugs Fund from the NHS England is offering financial backing for over 90.4% of prescriptions. The country’s 90.7% generic penetration rate also ensures cost-effective access to associated medicines, as reported by the Association of the British Pharmaceutical Industry (ABPI).

Country-wise Government Provinces (2023-2025)

|

Country |

Government Policy / Initiative |

Budget / Funding (Million) |

Impact on Market |

|

Spain |

Pharma Industry Stimulus Plan - Tax incentives for oncology drug manufacturers |

€15.7(2023) |

Attracted 2 new Granisetron producers to local market |

|

Italy |

Oncology Care Reform - Mandatory Granisetron stockpiling in cancer centers |

€18.4(2024) |

Eliminated 80.8% of supply shortages |

|

Russia |

Proposed Unified E-Health System - Digital prescriptions for supportive care drugs |

~$27.4(2025) |

Expected to improve tracking of Granisetron usage patterns |

Top 20 Global Drugs in Clinical Trials (2024)

|

Drug/Combination Drug (Sponsor) |

Clinical Trial Phase |

Approval Status |

Key Statistic/Example |

|

Lerapolturev (Sponsor: Istari Oncology) |

Phase 3 |

Fast Track Designation (FDA) |

62.5% tumor reduction in Phase 2 melanoma trials (NCT05653143) |

|

VX-548 (Sponsor: Vertex Pharmaceuticals) |

Phase 3 |

Priority Review (FDA) |

82.3% pain reduction in Phase 2 diabetic neuropathy trials (NCT06034960) |

|

ARX788 (Sponsor: Ambrx Biopharma) |

Phase 3 |

Breakthrough Therapy (FDA) |

HER2+ breast cancer: 59.4% progression-free survival at 12 months (NCT04829604) |

|

RGX-202 (Sponsor: Regenxbio) |

Phase 1/2 |

Orphan Drug (FDA) |

Duchenne MD: 60.7% dystrophin expression in early trials (NCT05266418) |

|

LP-284 (Sponsor: Lantern Pharma) |

Phase 1 |

Orphan Drug (FDA) |

DNA damage agent for lymphoma (NCT06132503) |

Key Granisetron Market Players:

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

The market is characterized by strong competition between leaders in Europe and the U.S. and generic manufacturers. The cost-driven strategies and calculated commercial moves made by these pioneers are shaping the current dynamics of this sector. Moreover, their focus on differentiation through novel formulations, geographic expansion, and partnership formation is cultivating new business opportunities for the merchandise on a global scale. Further, regulatory challenges and biosimilar entries in mature markets are intensifying this rivalry.

Such key players are:

|

Company Name |

Country |

Market Share(2024) |

Industry Focus |

|

Helsinn Healthcare |

Switzerland |

~15.3% |

Oncology-supportive care, branded Granisetron formulations. |

|

Fresenius Kabi |

Germany/U.S. |

~10.8% |

Generic injectables for chemotherapy-induced nausea. |

|

Sandoz (Novartis) |

Switzerland |

~9.5% |

Leading global supplier of generic Granisetron. |

|

Teva Pharmaceuticals |

Israel/U.S. |

~8.4% |

Major generic supplier with strong U.S./Europe presence. |

|

Hikma Pharmaceuticals |

UK |

~7.4% |

Granisetron injectables for oncology support. |

|

Mylan (Viatris) |

U.S. |

~xx% |

Oral and IV Granisetron generics. |

|

Pfizer |

U.S. |

~xx% |

Markets branded antiemetics alongside generic Granisetron. |

|

Sun Pharmaceutical |

India |

~xx% |

Cost-effective Granisetron for emerging markets. |

|

Dr. Reddy’s Laboratories |

India |

~xx% |

Exports Granisetron to US & Europe. |

|

Apotex |

Canada |

~xx% |

Supplies Granisetron tablets & injectables in North America. |

|

Cipla |

India |

~xx% |

Affordable Granisetron for Asia & Africa. |

|

Aspen Pharmacare |

South Africa |

~xx% |

Supplies Granisetron in Africa & Australia. |

|

Jiangsu Hengrui Medicine |

China |

~xx% |

Leading Chinese manufacturer exporting to Asia-Pacific. |

|

Taro Pharmaceutical |

Israel |

~xx% |

Granisetron generics for the US market. |

|

STADA Arzneimittel |

Germany |

~xx% |

European generic Granisetron supplier. |

|

Mayne Pharma |

Australia |

~xx% |

Supplies Granisetron in Australia & niche markets. |

|

Dong-A ST |

South Korea |

~xx% |

Korean leader in oncology-supportive drugs. |

|

Pharmaniaga |

Malaysia |

~xx% |

Supplies Granisetron in Southeast Asia. |

|

Lupin |

India |

~xx% |

Expands Granisetron access in India & the US. |

Below are the areas covered for each company in the market:

Recent Developments

- In May 2024, Hikma Pharmaceuticals launched its orally disintegrating Granisetron tablets, offering improved accessibility for patients with swallowing difficulties. Early Q2 2024 sales data demonstrated strong market adoption, with a 15.4% uptake in key European markets including Germany and the UK.

- In March 2024, Kyowa Kirin introduced Granisetron-Pro, a breakthrough extended-release injection providing 7-day CINV protection from a single dose. The innovative formulation drove a 9.7% revenue boost in Kyowa Kirin's oncology segment during the 2nd quarter of 2024.

- Report ID: 7958

- Published Date: Jul 29, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Granisetron Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert