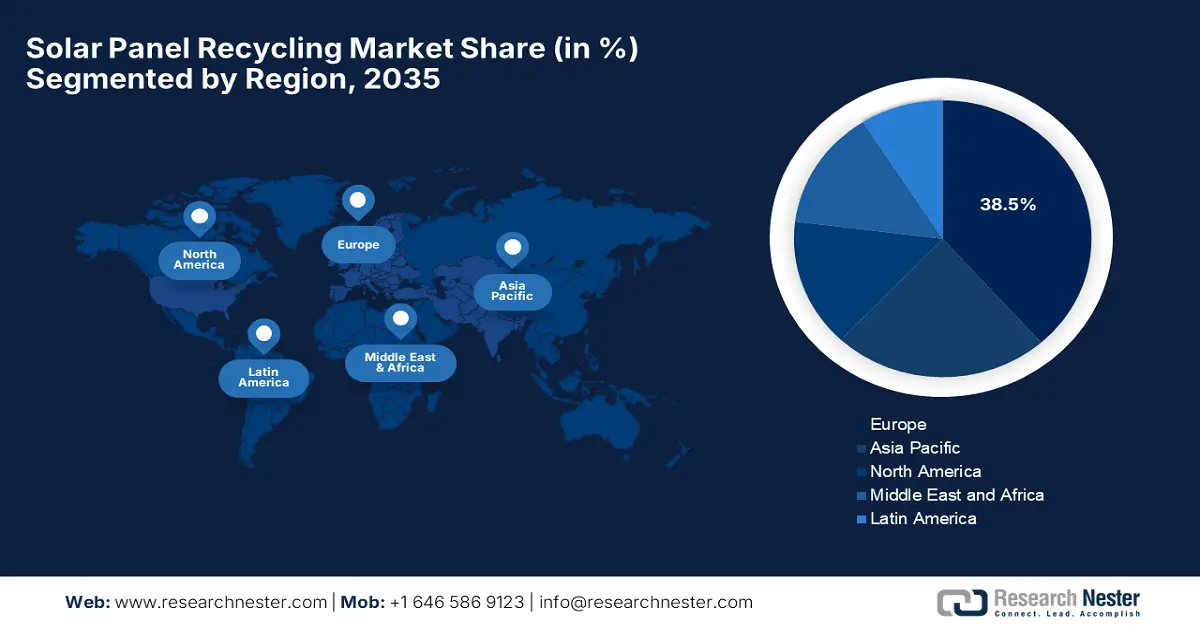

Solar Panel Recycling Market - Regional Analysis

Europe Market Insights

The Europe solar panel recycling market is forecast to emerge as the largest regional landscape, representing an estimated 38.5% share by the end of 2035. The region’s growth in this field is effectively attributable to stringent recycling regulations such as the EU’s WEEE Directive mandating electronic waste recycling and established recycling infrastructure. In September 2025, ROSI announced that it had partnered with SENS eRecycling, based in Switzerland, to provide end-of-life solar panel recycling services, thereby enabling domestic industry stakeholders to recover valuable materials such as glass, aluminum, high-purity silicon, silver, and copper. The collaboration also aims to create a circular economy for PV panels, turning waste into reusable resources while supporting strategic local supply chains. Hence, such a cross-country partnership demonstrates the significance of advanced recycling technologies in accelerating sustainable material recovery and strengthening regional resilience in this field.

Germany solar panel recycling market is maintaining a strong position in Europe owing to its long history of solar deployment and advanced waste management systems. The country’s market also represents a very high compliance rate, established recycling processes, and strong industry participation. In June 2024, SOLAR MATERIALS announced its plans to build an industrial-scale solar panel recycling plant in Magdeburg with a prime focus on expanding its annual recycling capacity to more than 10,000 tons of solar panels. The facility reflects rising demand in Germany, Europe’s one of the most prominent solar panel recycling industries, and demonstrates how increasing end-of-life PV volumes are driving investments in scalable recycling infrastructure. In addition, the project also highlights the commercialization of advanced processes that recover high-value materials such as silicon and silver, strengthening the economic viability in the country.

The U.K. solar panel recycling market is developing steadily as solar assets installed over the past decade are heading towards the end of life. The country’s market deeply emphasizes disposal and alignment with environmental standards, supported by organized collection and treatment networks. In addition, the growing focus on sustainability and resource efficiency is reshaping future market direction. In this regard, in March 2025, Waste Experts and City Electrical Factors (CEF) partnered with ROSI to launch a UK-wide solar panel recycling program, addressing the growing need for responsible end-of-life management under WEEE Directive standards. The firms also mentioned that this collaboration enables nationwide collection and processing of PV modules at ROSI’s advanced facility, by recovering up to 95% of materials, including silicon, silver, copper, aluminum, and glass, also reducing CO₂ emissions. Hence, this initiative establishes a scalable, circular solution for solar panels in the country, promoting sustainable resource recovery and minimizing landfill waste.

APAC Market Insights

The Asia Pacific solar panel recycling market is expected to register the fastest growth since it represents a significant share of worldwide solar installations. As large volumes of solar assets age across countries, the region is mainly focused on scalable and cost-efficient recycling solutions. In this regard, Sumitomo Corporation, SMFL, SMFL MIRAI Partners, ARBIZ, and SMART, in March 2024, announced that they have launched a demonstration project in Japan to establish a sustainable solar panel reuse and recycling business. This initiative is focused mainly on creating a circular supply chain by collecting, dismantling, transporting, and processing end-of-life solar panels, addressing the growing disposal challenge as solar installations expand. In addition, by integrating recycling and reuse, the project aims to reduce waste, recover valuable materials, and support Japan’s transition to a carbon-neutral and sustainable energy system, hence contributing to overall market growth.

China solar panel recycling market is well associated with its larger solar manufacturing and installation base. The country’s market is gradually strengthening regulatory oversight and encouraging recycling technologies that support domestic material recovery. In this regard, RESOLAR Energy Technology in February 2025 announced that it participated in the launch of the world’s first fully recycled photovoltaic module at the 2025 annual meeting of the Photovoltaic Recycling Industry Development Cooperation Center. By utilizing its GST green solution, the company efficiently separated high-purity glass and dismantled aluminum frames from decommissioned modules, which were then reused to manufacture new PV glass and frames. Therefore, this milestone demonstrates the feasibility of high-value recycling in China’s photovoltaic sector and represents a historic step toward circular and sustainable solar energy development.

In India, solar panel recycling is still at an early stage, but it is gaining traction, positively influenced by the expansion of utility-scale solar projects. India market is primarily shaped by the rising awareness of future PV waste and the need for sustainable disposal mechanisms. Testifying this, the Ministry of Environment, Forest and Climate Change in March 2023, notified its amendments under the E-Waste (Management) Rules, 2022 by making additions of solar PV modules, panels, and cells to the regulatory framework. In this context, manufacturers and producers are required to register on the portal, maintain inventories, store end-of-life solar waste, file annual returns, and ensure compliant processing, whereas recyclers must recover materials as per Central Pollution Control Board guidelines. It also mentioned that this regulation establishes an accountable solar waste management system in India through 2034-2035, hence indicating a positive market outlook.

North America Market Insights

The North America solar panel recycling market is evolving toward a more structured ecosystem, facilitated by the expansion in recycling infrastructure, manufacturer-led take-back programs, and partnerships between solar OEMs and specialized recyclers. On the other hand, policy discussions around waste management and sustainability are also supporting market formalization in the region. In August 2025, Illuminate USA signed a landmark five-year agreement with SOLARCYCLE with a prime focus on sourcing domestically produced solar glass for 15 GW of solar panels, supporting 3 GW annually at its Pataskala, Ohio, facility. In this context, SOLARCYCLE highlighted that it will use recycled glass from end-of-life panels to manufacture the specialized glass, advancing the circular economy for the country’s solar manufacturing. In addition, this partnership positions SOLARCYCLE’s Cedartown, Georgia, plant as the first U.S. factory producing crystalline-silicon solar glass from recycled materials, with initial deliveries targeted for early 2028.

The U.S. solar panel recycling market represents notable progress owing to the private-sector innovation, with manufacturers and recycling firms making continued investments in facilities and advanced material recovery technologies. Voluntary recycling programs from the country’s government and corporate sustainability commitments also play a key role in shaping market growth. The U.S. Department of Energy in March 2022 reported that to meet the Biden Administration’s goal of decarbonizing the U.S. electricity grid by 2035, solar installations must ramp up to 60 GW per year by 2030, with end-of-life (EOL) PV modules entering the waste stream due to aging, damage, or defects. Meanwhile, 95% of PV materials are currently recyclable, and recycling costs far exceed landfill fees, making policy support highly essential for critical sustainable EOL management. Moreover, the DOE’s SETO is developing databases to enable PV recycling, aiming to cut module recycling costs by more than half by the conclusion of 2030.

Canada solar panel recycling market is emerging along with its growing solar capacity, with an emphasis on environmentally responsible waste management. The country’s market benefits from collaboration between module manufacturers, recyclers, and project owners, which in turn is helping establish early recycling pathways. In 2024, Global Affairs Canada launched a challenge to develop scalable and cost-effective solar panel recycling solutions by targeting both crystalline-silicon and thin-film panels. This initiative seeks technologies that can safely recover critical materials such as aluminum, tellurium, gallium, and indium at any stage of a panel’s lifecycle, while preventing environmental contamination. Furthermore, this program aims to support the country’s net-zero 2050 goals by reducing landfill waste and minimizing the environmental and social impacts of solar panel disposal.