Social Distancing Gear Market Outlook:

Social Distancing Gear Market size was valued at USD 6.3 billion in 2025 and is projected to reach USD 13.5 billion by the end of 2035, rising at a CAGR of 8.9% during the forecast period, i.e., 2026-2035. In 2026, the industry size of social distancing gear is estimated at USD 6.8 billion.

The worldwide market is growing due to the emergency response against infectious outbreaks, which has sustained a steady surge in the market. Particularly in highly contagious areas, including healthcare organizations, the demand for solutions to prevent widespread transmission is driving a continuous need in this sector. Supporting this, the World Health Organization reported in September 2023 that more than 3 million deaths occur annually due to unsafe care. Additionally, up to 4 in 10 patients are harmed in primary and ambulatory settings, with as many as 80% of these incidents being preventable. Common adverse events leading to avoidable patient harm include unsafe surgical procedures, healthcare-associated infections, and unsafe blood transfusions.

Despite the expanding demographic demonstrating worldwide adoption, limitations in allocating comprehensive payers' pricing present a financial barrier in the social distancing gear industry. This challenge is further amplified by the sole reliance on raw material cost volatilities and insufficient reimbursement coverage. This inflation is reflected through the upstream movement of key economic indicators, including the producer price index (PPI) and consumer price index (CPI), in recent years. As per a report by the U.S. Bureau of Labor Statistics in January 2025, the CPI for medical care increased by 2.8% in 2024, following a rise from 2023. Within this category, hospital and related services rose by 4.0%, while physicians' services increased by 2.6%. Currently, companies are focusing on implementing smart technologies to attain a beneficial reduction in manufacturing costs, mitigating affordability issues.

Key Social Distancing Gear Market Insights Summary:

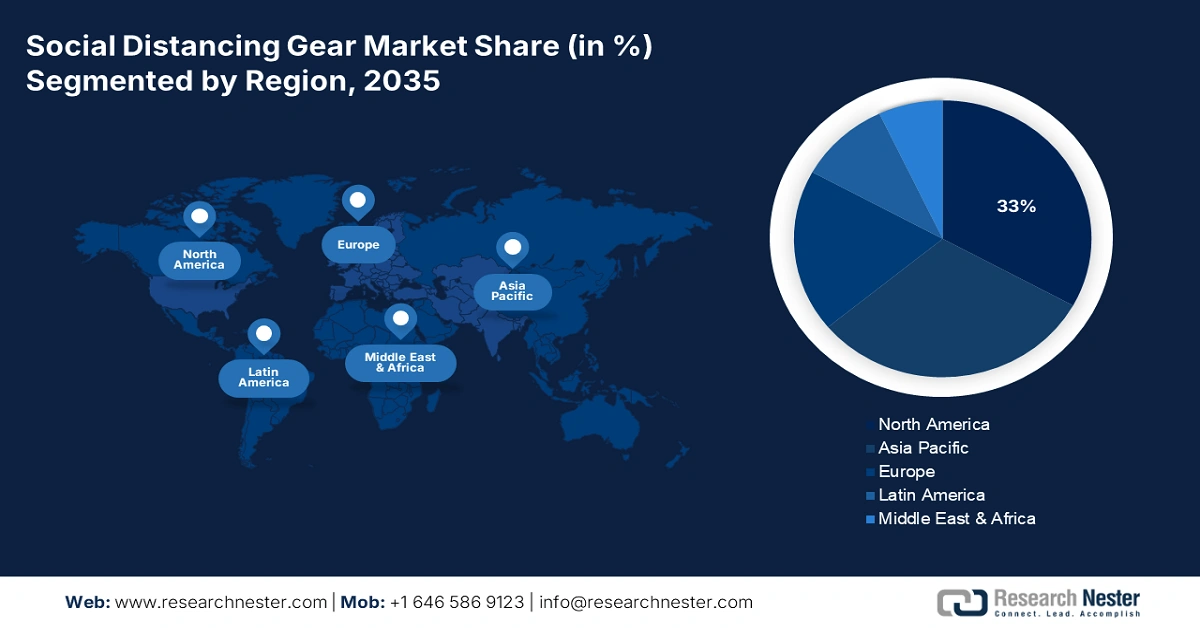

Regional Insights:

- North America is projected to hold a 33% share within the forecast period, driven by tightening regulatory mandates and federal investments in healthcare safety.

- Europe is expected to be the fastest-growing region in the forecast period, impelled by stringent infection prevention regulations and funding for hospital safety infrastructure.

Segment Insights:

- The healthcare segment is projected to account for 50.5% share by the forecast period, propelled by rising healthcare-associated infection (HAI) cases and stricter safety protocols.

- The wearable devices segment is expected to hold the highest market share within the forecast period, owing to rapid IoT penetration in medical equipment.

Key Growth Trends:

- Tightening workplace safety regulations

- Improvement in product accessibility

Major Challenges:

- Fragmentation in regulatory frameworks

Key Players: Honeywell International,Panasonic Corporation,Siemens AG,3M Company,Estimote,Zebra Technologies,Kinexon,Philips Healthcare,LG Electronics,Tata Elxsi,Samsung Electronics,Fujitsu Limited,Aeris Communications,Paxster,Shenzhen Mindray Bio-Medical

Global Social Distancing Gear Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 6.3 billion

- 2026 Market Size:USD 6.8 billion

- Projected Market Size: USD 13.5 billion by 2035

- Growth Forecasts: 8.9% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (33% Share by 2035)

- Fastest Growing Region: Europe

- Dominating Countries: United States, Germany, Japan, United Kingdom, Canada

- Emerging Countries: India, China, Brazil, Australia, South Korea

Last updated on : 26 September, 2025

Social Distancing Gear Market - Growth Drivers and Challenges

Growth Drivers

- Tightening workplace safety regulations: The corporate world is presently under pressure to install safety measures from the social distancing equipment market in meeting stringent compliance criteria to ensure worker safety. As per regulation, workplaces working at high densities have been required to institute offsetting technologies by the Occupational Safety and Health Administration in the US from 2025. As per a report published by NLM in August 2025, in the private industry sector of healthcare and social assistance, recordable injuries and illnesses decreased drastically from 665,300 in 2022 to 562,500 in 2023. This decline highlights the positive effects of heightened safety procedures and wider acceptance of protective gear to curb workplace hazards which increases the market.

- Improvement in product accessibility: The growth of e-commerce retailing and direct-to-consumer channels in the social distancing gear sector is increasing public access and product availability. As per a report by NLM August 2022, over the past 5 years, worldwide e-commerce was just 17.9% of total retail sales, and in 2022 it grew to 20.3%. Much of this shift has worked in favor of the social-distancing gear market, which has allowed for rapid distribution and increased sales of protective equipment. The convenience and reach of online platforms have ensured that consumers and businesses alike are helped.

- Increasing awareness of public health and hygiene: Growing importance in terms of public health and personal hygiene, post-COVID, is driving sales of market various industries. Hence, the governments and organizations worldwide emphasize preventive measures in the prevention of an infectious disease, including such measures as using masks, barriers, and other forms of distancing equipment. With all this concentrated attention on health safety protocols, it is plausible to say that the market witnessed sustained growth as individuals and corporations alike put a premium on purchasable protective solutions to provide safer environments.

Global Medical Instruments Trade Imbalance and Regional Specialization

Exports and Imports of Medical Instruments in 2023

|

Country |

Exports (USD) |

Imports (USD) |

|

Germany |

18.4 billion |

13.1 billion |

|

U.S. |

34.8 billion |

37.7 billion |

|

Mexico |

17.6 billion |

4.6 billion |

|

France |

3.9 billion |

6.4 billion |

|

China |

12.3 billion |

10.6 billion |

|

Japan |

7.2 billion |

6.4 billion |

|

Singapore |

2.4 billion |

2.2 billion |

Source: OEC, September 2025

Challenges

-

Fragmentation in regulatory frameworks: Different regulations in each region act as barriers to the expansion of the market worldwide. Hence, certification rules vary from one country to another, and such regulations become cumbersome to procure and costly. This sort of inconsistency eats into research and development funds, discouraging companies' interest in investing or innovating. And this crisis in product competition may force the launching of new products into the background, thereby giving an advantage to the smaller companies. Hence, global market growth depends largely on overcoming these regulatory challenges.

Social Distancing Gear Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

8.9% |

|

Base Year Market Size (2025) |

USD 6.3 billion |

|

Forecast Year Market Size (2035) |

USD 13.5 billion |

|

Regional Scope |

|

Social Distancing Gear Market Segmentation:

End user Segment Analysis

The healthcare segment in end user segment is expected to dominate the social distancing gear market with a 50.5% market share by the forecast period. The significant rise in healthcare-associated infection (HAI) cases throughout the world is pushing dedicated regulatory frameworks to implement stricter safety protocols, specifically for isolation wards. According to a report by the WHO 2024, patient harm increases the length of ICU stays by an average of 6.8 days and the length of hospital stays by 8.9 days. The impact highlights that a regulatory push is further displayed through fund allocation toward hospital barrier installations by the governments.

Product Type Segment Analysis

The wearable devices segment is expected to hold the highest market share in the product type segment in the social distancing gear market within the forecast period. The rapid penetration of IoT in medical equipment has a significantly positive impact on this segment’s adoption leadership. Additionally, the present trend of increasing connectivity in healthcare system workflows highlights efforts and funding from investors and MedTech giants. As per a report by the Centers for Medicare & Medicaid Services (CMS) in September 2025, it unveiled details on how states can apply to receive funding from the USD 50 billion Rural Health Transformation Program, which will boost IoT wearable device adoption.

Distribution Channel Segment Analysis

Our in-depth analysis of the global market includes the following segments:

|

Segment |

Sub-segments |

|

Product Type |

|

|

End user |

|

|

Application |

|

|

Distribution Channel |

|

|

Supportive Technology |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Social Distancing Gear Market - Regional Analysis

North America Market Insight

The social distancing gear market in North America is expected to hold the highest market share of 33% within the forecast period, due to tightening regulatory mandates, provincial and Federal investments, and insurance coverage expansion. This leadership is supported by policies from the Centers for Medicare & Medicaid Services (CMS), which have promoted the adoption of social distancing measures in healthcare facilities, including requirements for personal protective equipment and physical distancing protocols. The Occupational Safety and Health Administration (OSHA) has also issued guidelines to ensure workplace safety, reinforcing the need for distancing gear.

The social distancing gear market in the U.S. is growing due to heightened regulatory mandates in healthcare settings, rising funding for infection prevention in hospitals, and broader insurance and public health policy support. With guidance from CDC and OSHA strongly supporting physical distancing, wearing of PPEs, and installation of barriers, transmission may occur in congregate settings and healthcare facilities. As per a report by OSHA, July 2023, the average price for PPE in 2022 was 37.4% higher than the average price over the last 14 years, reflecting increased demand and supply constraints. New CMS rules also now impose additional staffing and space standards upon hospitals and long-term care facilities as another way to ensure a safe environment for providing care.

Europe Market Insight

The social distancing gear market in Europe is expected to hold the fastest-growing market within the forecast period due to tightening infection prevention and control (IPC) regulations across the states, rising incidence of healthcare-associated infections (HAIs), increased funding for hospital safety infrastructure, and emphasis on guidelines for preparedness and response in cross-border health threats under EU mandates. According to a report by the Europe Parliament in February 2025, over 70% of the EU’s health impact from antimicrobial resistance (AMR) is linked to healthcare-associated infections, prompting the EU Commission and European Centre for Disease Prevention and Control (ECDC) to support joint actions and co-funded programs, which will increase the market.

The market in the UK is growing due to an increased government supply of PPE for health and social care settings, mandates for free PPE to care workers, higher healthcare expenditures, and an increased regulatory focus on workplace and hospital safety. According to a report by the Government of the UK in April 2023, the Department of Health and Social Care (DHSC) of England distributed 27.1 billion articles of PPE to health and social care services, indicating continuous governmental investment in PPE supplies between 25 February 2020 and 31 March 2023, reflecting sustained governmental investment in PPE supplies. Such sustained governmental commitment to PPE availability is anticipated to see greater uptake of social distancing gear across sectors, thereby improving public health safety standards.

Current Healthcare Expenditure in 2022 (€ million)

|

Country |

€ million |

|

Belgium |

59,626 |

|

Bulgaria |

6,575 |

|

Denmark |

36,067 |

|

Germany |

488,677 |

|

Ireland |

30,983 |

|

Spain |

131,114 |

|

France |

313,574 |

Source: Eurostat, November 2025

Asia Pacific Market Insight

The social distancing gear market in the Asia Pacific is poised to secure steady growth in the market throughout the forecast period. The regional propagation is greatly committed to the expanding base of consumers, initiatives by the government, and the modernization of healthcare. As per a report by the United Nations 2023, the Asia Pacific region holds more than 60% of the world's population, with rapid urbanization contributing to higher demand for upgradation of health infrastructure in terms of infection control and social distancing. In addition, Government initiatives in nations such as India, China, and Australia have increased investment in health safety equipment substantially, fueling growth in the market.

The market in China is growing as a result of government efforts, modernization of healthcare, and growing consumer demand. The government has been making huge investments in the healthcare infrastructure, including purchasing and distributing personal protective equipment (PPE) to provide public health safety. According to a report by the People’s Republic of China in April 2025, more than 10 million individuals have already signed up for and are utilizing digital vaccination certificates, which equate to lifelong insurance for individuals, indicating a significant effort to enhance public health measures. This widespread application of health-specific digital platforms is a testament to the government's initiatives to enhance public health infrastructure and readiness.

Key Social Distancing Gear Market Players:

- Honeywell International

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Panasonic Corporation

- Siemens AG

- 3M Company

- Estimote

- Zebra Technologies

- Kinexon

- Philips Healthcare

- LG Electronics

- Tata Elxsi

- Samsung Electronics

- Fujitsu Limited

- Aeris Communications

- Paxster

- Shenzhen Mindray Bio-Medical

The social distancing gear industry is supported by increased rivalry between majors and new players to dominate the market. They are armor-plating their business strategies with innovative product designs, complete pricing, and wide distribution channels. Siemens introduced a new series of blockchain-enabled proximity tamper-proof sensors for vaccine storage rooms, synchronizing with EHRs to record distancing adherence. Furthermore, they tend to apply and adopt smart technologies such as sophisticated sensors and web-enabled devices to leverage their current pipeline of safety offerings. Additionally, their alignment with recent business trends and regional requirements is making them strong leaders for the future as well.

Here is a list of key players operating in the global market:

Recent Developments

- In August 2025, DermaRite Industries, LLC expanded an infection control product recall due to contamination with a harmful group of bacteria called Burkholderia cepacia complex, which can cause serious infections for people with weak immune systems.

- In March 2023, Sonoma Pharmaceuticals and MicroSafe Group announced that their hospital disinfectant product called Nanocyn has been officially approved by the EPA. These include MRSA (a drug-resistant bacterium), Salmonella, Norovirus, and Poliovirus.

- Report ID: 2469

- Published Date: Sep 26, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Social Distancing Gear Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.