Roofing Tiles Market Outlook:

Roofing Tiles Market size was over USD 20.85 billion in 2025 and is anticipated to cross USD 34.95 billion by 2035, witnessing more than 5.3% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of roofing tiles is estimated at USD 21.84 billion.

The market growth is due to growing population in the urban cities. According to a report by the United Nations (UN), about 50% of the global population resides in urban cities, and this percentage is expected to increase to 60% by the end of 2035. Furthermore, need for thermal insulation, along with the energy efficiency, and protective properties for the roofing tiles against cold, fire, wind, rain, hail, noise, and snow is increasing. According to the Economist Intelligence Unit, there has been an increase of about 71% in the online search of sustainable goods, globally.

Key Roofing Tiles Market Insights Summary:

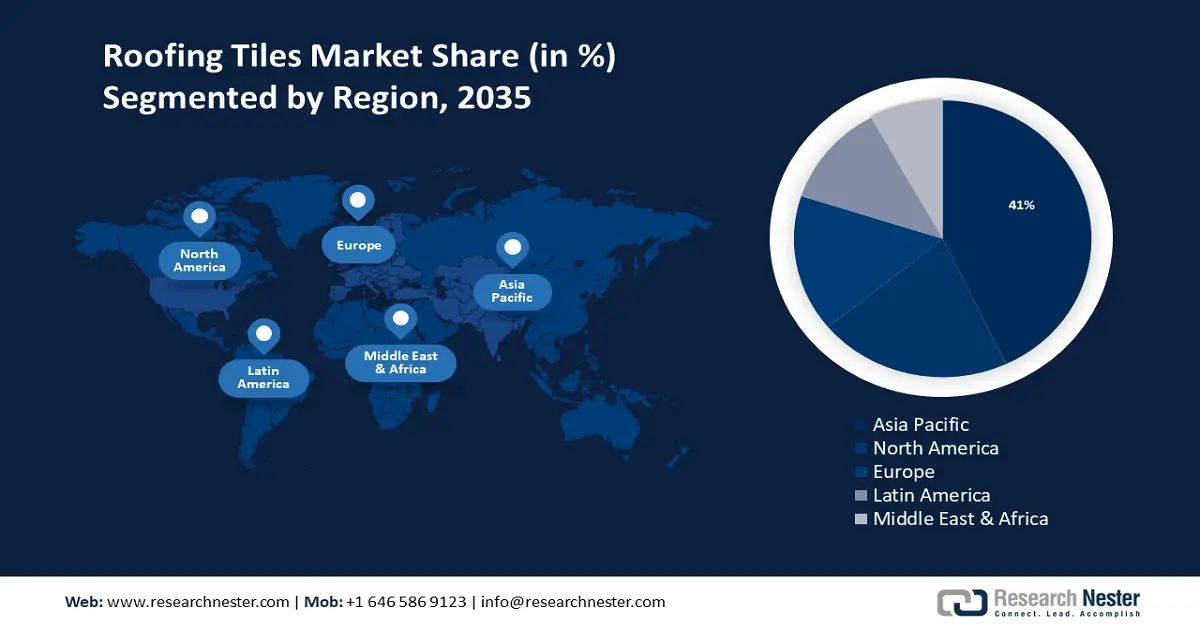

Regional Highlights:

- Asia Pacific roofing tiles market will dominate over 43% share by 2035, driven by the high number of manufacturing and construction bases and focus on energy-efficient buildings.

- North America market projects lucrative growth during the forecast timeline, driven by increasing demand for re-roofing of residential and industrial buildings.

Segment Insights:

- The clay segment in the roofing tiles market is expected to capture a 42% share by 2035, driven by growing demand for green buildings and sustainable construction materials.

- The residential (end-users) segment in the roofing tiles market is expected to maintain a noteworthy share by 2035, supported by rising per-capita income and increased spending power for home upgrades.

Key Growth Trends:

- Growing focus on energy and environment

- Growing global construction market

Major Challenges:

- Seasonal market

- Limited market opportunity along with limited innovation

Key Players: Standard Industries Inc, Tesla Inc, IKO, Etex, Fornace Lateizi Vardanega Isidoro, Vande Hey Raleigh, Eagle Roofing Products, Trevis Perkins, Boral roofing, BMI group, Wienerberger AG.

Global Roofing Tiles Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 20.85 billion

- 2026 Market Size: USD 21.84 billion

- Projected Market Size: USD 34.95 billion by 2035

- Growth Forecasts: 5.3% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (43% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Germany, India, Brazil

- Emerging Countries: China, India, Japan, South Korea, Thailand

Last updated on : 8 September, 2025

Roofing Tiles Market Growth Drivers and Challenges:

Growth Drivers

- Growing focus on energy and environment- As energy and environmental concerns are increasing globally, this is driving the demand for several renewable and green solutions meanwhile the roofing tiles are one of the key components of a building's exterior and consumer choice can have a significant impact on the energy and environmental performance. This has driven the demand for more advanced roofing tiles as a solution that is more environmentally friendly while including those titles that are made with organic and other recycled materials.

- Growing global construction market- Rapid urbanization and growing population in developing markets, particularly in Asia and Africa, are expected to continue in the coming decades. This is likely to trigger the construction of housing and commercial buildings at a significant scale. This will boost the demand for roofing tile solutions, driving roofing tiles market growth through the increased production and exports of roofing tiles from developed markets.

- Growing construction and landscaping market- The construction and landscaping industries are expected to grow significantly in the future, with the increased investment in infrastructure development and renovation projects. This is expected to boost the demand for roofing tiles, as the roofing tiles market grows proportionately with the construction and landscaping markets. The increased demand will drive market growth through the expansion of manufacturing capabilities and increased production of roofing tiles.

- Changing Consumers' Lifestyle- As lifestyle changes, so do the consumption dynamics of individuals, which influences the demand for roofing tiles services. This is because the consumption patterns of consumers are becoming more focused on convenience, flexibility, and cost-effectiveness, rather than traditional designs and materials. In addition, the trend of changing consumer lifestyles is also driven by an increasing number of consumers prioritizing experiences over physical possessions.

Challenges

- Seasonal market- The market of roofing tiles is highly impacted by the seasons, which can directly act as a restraining factor for the growth of this roofing tiles market. The roofing tiles are mainly required when the houses are under construction, and this often occurs during the summer or spring season, while repairing the roofs is more kind of a winter activity. This can result in demand spikes during certain periods and lower demand during the off-season, which can negatively impact the production rate along with the revenue and income which is generated from sales from this sector.

- Limited market opportunity along with limited innovation

- Limited manufacturing and supply

- High costs and lower consumer awareness

Roofing Tiles Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.3% |

|

Base Year Market Size (2025) |

USD 20.85 billion |

|

Forecast Year Market Size (2035) |

USD 34.95 billion |

|

Regional Scope |

|

Roofing Tiles Market Segmentation:

Product Type Segment Analysis

Clay type segment in the roofing tiles market is estimated to gain a robust revenue share of 42% by 2035, owing to growing health and environmental concerns. Green buildings are environmentally-friendly buildings with various eco-friendly features and initiatives, including energy efficiency and recycling. The green and sustainable buildings are estimated to be about 10% more than the conventional buildings, according to a recently published study. The growing demand for green buildings is driving the demand for clay tiles and roofing tiles.

Application Segment Analysis

The residential segment in roofing tiles market is poised to account for significant share by 2035, led by surge in environmental and sustainable trends. An increased concern for the environment and the growing focus on sustainable living has increased the demand for roofing systems industries that provide energy efficiency, along with reduced environmental impact, and maintain a lower carbon footprint. This has driven the demand for roofing tiles that are designed and produced with green and environmentally friendly practices in the residential housing segment, further driving its growth.

End-users Segment Analysis

The residential segment in roofing tiles market is estimated to hold a noteworthy share due to the rising per-capita income along with the growing wealth of the nation, and this has led to an increased spending power for the residential end-users. Such increased spending power has allowed residential end-users to invest more in upgrading their homes, including providing better roofing and siding options.

Our in-depth analysis of the global market includes the following segments:

|

Product Type |

|

|

Application |

|

|

End-users |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Roofing Tiles Market Regional Analysis:

APAC Market Insights

The roofing tiles market in Asia Pacific is estimated to have the largest share of about 43% by 2035, driven by higher number of manufacturing and construction bases that are present in the region. Emerging economies of several countries such as China, India, Philippines, Indonesia, and Vietnam have the highest level of expansion, with an emphasis on energy-efficient buildings. According to a survey, the average percentage of manufacturing enterprises in Asia was roughly 15% across 29 countries, with China accounting for the biggest share at 27.7%.

North American Market Insights

The North American roofing tiles market is expected to register lucrative CAGR during the forecast period, driven by a surge in demand for re-roofing of residential and industrial buildings. This is predicted to have a favorable impact on the construction workers in the region in terms of upgrading a large number of older buildings that have already outlived their intended lifespan.

Roofing Tiles Market Players:

- Standard Industries Inc

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Tesla Inc

- IKO

- Etex

- Fornace Lateizi Vardanega Isidoro

- Vande Hey Raleigh

- Eagle Roofing Products

- Trevis Perkins

- Boral roofing

- BMI group

- Wienerberger AG

Recent Developments

- Wienerberger AG, announced that they would acquire Terral's business operations which are based in France, Germany, Italy, Spain, and the United States. This acquisition would help the company to expand its presence in Europe's roofing solutions market.

- Eagle Roofing Products announced their expansion in the manufacturing capacity and they also released a new color offering in their products, specifically in the Western Canada and United States regions.

- Report ID: 2152

- Published Date: Sep 08, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Roofing Tiles Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.