Neurosurgery Software Market Outlook:

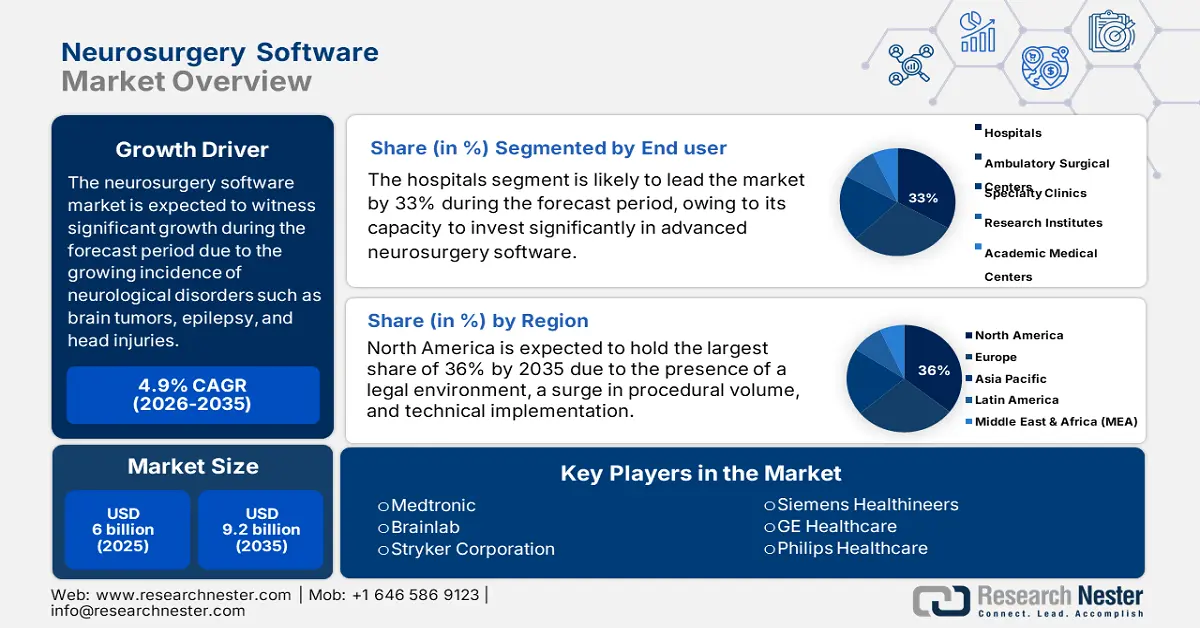

Neurosurgery Software Market size is valued at USD 6 billion in 2025 and is projected to reach USD 9.2 billion by the end of 2035, rising at a CAGR of 4.9% during the forecast period, i.e., 2026-2035. In 2026, the industry size of neurosurgery software is estimated at USD 6.2 billion.

The global neurosurgery patient pool is expanding due to the growing incidence of neurological disorders such as brain tumors, epilepsy, and head injuries. Besides, the rising cases of brain tumors, epilepsy, and traumatic brain injuries are a concern. According to a March 2024 report from the World Health Organization (WHO), the most concerning statistic is the 18% increase in overall disability-adjusted life years (DALYs) attributed to neurological conditions. This surge in cases underscores the need for advanced neurosurgery software solutions that enhance surgical precision and improve patient outcomes in the market. The demand for such software continues to rise alongside the increasing need for specialized neurosurgical procedures driven by an aging global population.

The supply chain for the market involves sourcing components from various systems, such as medical imaging, surgical navigation, and data management platforms. These components are procured from international vendors and integrated to create comprehensive software solutions. The manufacturing process in the neurosurgery software also entails specialized software development, system integration, and rigorous testing procedures to ensure compliance with all relevant medical and regulatory standards. To address the increasing demand for neurosurgical procedures and ensure the quality and reliability of software products, the implementation of robust supply chain management practices is imperative. According to a report by the OECD in February 2024, global trade in medical devices has exponentially increased over the past 30 years, reaching USD 700 billion in 2022, underscoring the growing complexity and international scope of medical device supply chains.

Key Neurosurgery Software Market Insights Summary:

Regional Highlights:

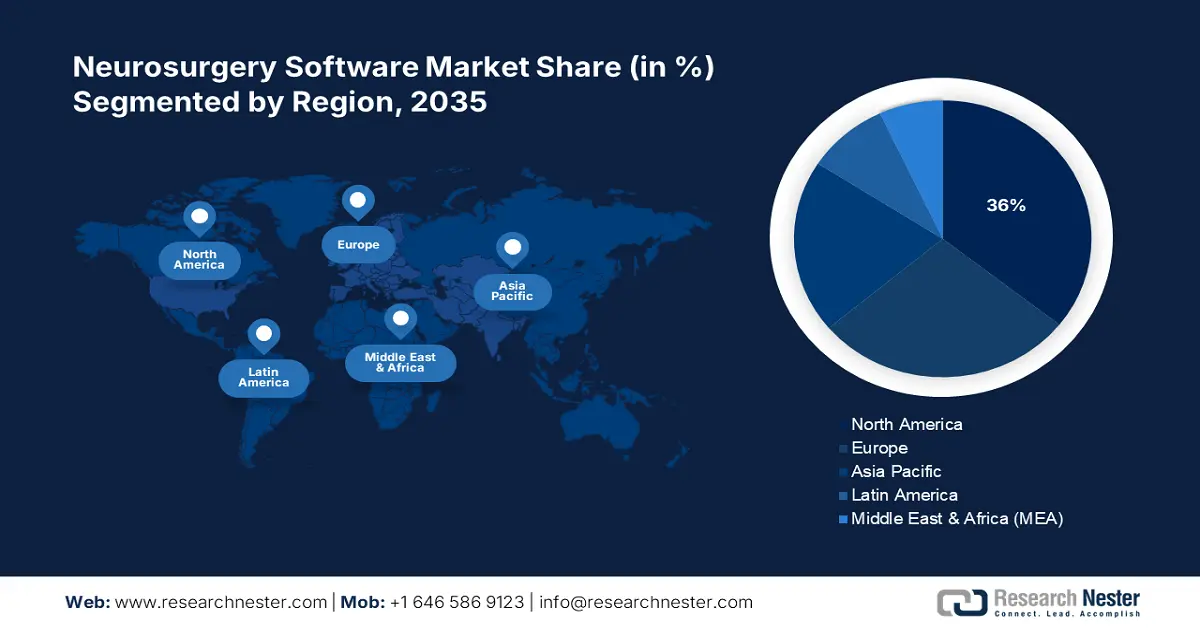

- North America is forecast to command a 36% share of the Neurosurgery Software Market by 2035, justified by stronger healthcare infrastructure and rising demand for advanced outpatient neurosurgical solutions owing to the growing neurological disease burden.

- The Asia Pacific region is set to achieve the fastest growth from 2026–2035, supported by expanding hospital infrastructure and escalating investment in neurosurgical innovation fueled by increasing neurological disease incidence.

Segment Insights:

- The hospitals subsegment in the Neurosurgery Software Market is projected to secure a 33% share by 2035, sustained by its higher investment capacity and the rising need for real-time intraoperative navigation to enhance surgical safety.

- The cloud deployment mode subsegment is expected to grow rapidly through 2026–2035, reinforced by its scalable data management capabilities and remote accessibility that streamline neurosurgical workflows.

Key Growth Trends:

- Increasing prevalence of neurological disorders

- Rising investments in research, development, and deployment (RDD)

Major Challenges:

- Regulatory compliance and approval hurdles limit market entry

- High cost of implementation restricts widespread adoption

Key Players: Medtronic, Brainlab, Stryker Corporation, Siemens Healthineers, GE Healthcare, Philips Healthcare, Intuitive Surgical, Zimmer Biomet, Elekta AB, Varian Medical Systems, Accuray Incorporated, Accenture, Nuvasive, BrainScope Company, Compumedics Limited.

Global Neurosurgery Software Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 6 billion

- 2026 Market Size: USD 6.2 billion

- Projected Market Size: USD 9.2 billion by 2035

- Growth Forecasts: 4.9% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (36% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, United Kingdom, Japan

- Emerging Countries: India, Brazil, South Korea, Singapore, United Arab Emirates

Last updated on : 5 September, 2025

Neurosurgery Software Market - Growth Drivers and Challenges

Growth Drivers

- Increasing prevalence of neurological disorders: A leading driver for the market is the global prevalence of neurological disorders. According to a March 2024 report by the WHO, over 1 in 3 individuals is affected by a neurological disorder, making it the leading cause of illness and disability worldwide. Over 80% of the loss of life and health due to neurological conditions occurs in low- and middle-income countries, where access to treatment varies widely. The advanced neurosurgery software aids doctors in the preparation and implementation of complicated operations with greater accuracy, which neurosurgery software users face today. It can help to lower the number of complications and help to cure the patients more effectively.

- Rising investments in research, development, and deployment (RDD): The growth in the market is significantly driven by increased investment in research, development, and deployment. As per the NIH September 2024 report, from their USD 48 billion medical research budget, the vast majority goes into programs that strive to enhance life and reduce the burden of disease and disability. Among these investments is an allocation for new software that enhances image-guided surgery, intraoperative navigation, and data analytics. This investment accelerates the development of neurosurgery software, enabling its acquisition and use in a growing number of hospitals and specialty centers that strive for excellent surgical outcomes and greater safety.

- Expansion of healthcare infrastructure and surgical facilities: The AI Surgeons in the market demand is fostered by a rise in healthcare investments worldwide. In both urban and suburban zones, there is a consistent rise in hospitals that are outfitted with advanced surgical technologies, along with neurosurgical software systems. The increased volume of neurosurgical surgeries acts as a stimulus for software solutions that improve productivity and surgical precision, and provide support for minimally invasive surgical techniques to be demanded, thereby boosting the market’s exposure internationally.

Potential Neurosurgical Technologies for LMICs: Cost Comparison and Market Integration

2022 Cost Ranges of Neurosurgical Imaging Technologies and Their Relation

|

Technology |

Price Range (USD) |

Relation to Neurosurgery Software Market |

|

Fluoroscopy Imaging |

USD 250,000 to USD 500,000 |

Increasingly integrated with software for image processing and real-time surgical guidance |

|

Intraoperative CT |

USD 600,000 to USD 1.2 million |

Hardware-dominant but with advanced software for 3D imaging and navigation |

|

Neuronavigation System |

USD 250,000 to USD 700,000 |

Core market product with continuous software improvements |

|

MRI Scanners |

USD 200,000 to USD 3 million |

Hardware with expanding software applications in image analysis and AI-based diagnostics |

|

AR Navigation System (HoloLens 2 + 4 cameras) |

USD 7,000 to USD 10,000 |

Fully software-dependent AR solutions within the neurosurgery navigation market |

Source: Journal of Surgery, November 2022

Challenges

- Regulatory compliance and approval hurdles limit market entry: Stringent regulations are a concern for vendors of the market, as in other medical software sectors. Besides, the FDA’s regulations help protect users, yet slow down product releases and increase development costs. A large number of resources are needed to comply with new standards, such as cybersecurity and data protection. These constraints reduce the speed at which new software reaches healthcare providers, affecting market growth, usage, and significantly lowering its exposure across different nations.

- High cost of implementation restricts widespread adoption: The high initial cost of neurosurgery software and related hardware limits access, particularly for smaller health centers, which is negatively impacting the market’s growth globally. Advanced surgical technologies continue to be a capital burden for most hospitals, as put forward by the Centers for Medicare and Medicaid Services. Maintenance and training expenses are an added expense. This puts the brakes on wider adoption, especially in underfinanced areas, hindering market growth overall despite increasing clinical need.

Neurosurgery Software Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

4.9% |

|

Base Year Market Size (2025) |

USD 6 billion |

|

Forecast Year Market Size (2035) |

USD 9.2 billion |

|

Regional Scope |

|

Neurosurgery Software Market Segmentation:

End user Segment Analysis

The hospitals subsegment is expected to hold the highest revenue share of 33% due to its capacity to invest significantly in the market. Their software majority of neurosurgical software cases, which involve complex diseases that need to be treated to improve patient care. According to NLM, January 2024, 47.1% of patients had neurological signs and symptoms, including acute-phase headache, either at presentation or admission, showing the increasing clinical strain. This shows the need for software with intraoperative real-time navigation and visualization to reduce surgical risks and optimize productivity.

Deployment Mode Segment Analysis

Cloud deployment mode is the second-highest growing subsegment in the market as it allows safe handling of enormous neurosurgical data and offers distant real-time access to surgical teams. Cloud platforms also enable cooperation among different healthcare institutions while following the regulations of data protection laws, including HIPAA (Health Insurance Portability and Accountability Act). Hospitals and surgical centers are increasingly adopting it because it is more scalable and flexible in supporting more neurosurgical operations, from which patient outcomes improve. Furthermore, cloud systems reduce the need for a larger on-site IT system, thereby reducing healthcare providers’ operational costs.

Product Type Segment Analysis

Surgical planning software leads the product segment in the market by improving preoperative precision and patient safety. In surgical planning software, the use of 3D imaging together with AI-based surgical analytics significantly mitigates operational danger and the length of convalescence. The availability of government grants for the study of neurological disorders has advanced the development of this software and the increase in its use in healthcare institutions with complicated neurosurgical cases. Additionally, the easy-to-use software and its compatibility with existing hospital systems encourage its widespread implementation.

Our in-depth analysis of the global market includes the following segments:

|

Segment |

Sub-segments |

|

Product Type |

|

|

Application |

|

|

End user |

|

|

Deployment Mode |

|

|

Technology |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Neurosurgery Software Market - Regional Analysis

North America Market Insights

The neurosurgery software market in North America is expected to hold the highest growing market share of 36% over the forecast period due to enhanced healthcare infrastructure, high investments in surgical products, and a higher incidence of neurological disorders. As per a study done by NLM in November 2023, analysis of 19,237-day case and elective procedures displayed a significant trend towards day case procedures in the neurosurgery of North America. Spine procedures showed a significant trend towards day cases, accounting for 3,668, and skull base (SB) procedures catered to 2,029 cases, along with 786 functional procedures. This shows the need for sophisticated neurosurgery software specifically designed for outpatient settings that enables improved accuracy and an increased patient pool.

The neurosurgery software market in the U.S. is growing due to earlier adoption of computer-aided surgical platforms and increased demand for minimally invasive neurosurgical interventions. As per a report by NLM in November 2023, the U.S. has an age-standardized incidence rate of neurological disorders that is the highest in the world, at 13,278.7 per 100,000 population. This is driving higher demand for advanced neurosurgery software solutions for treatment planning, diagnosis, and surgical precision. Thus, the U.S. market is also expanding exponentially with cutting-edge software for complex neurosurgical interventions.

The neurosurgery software market in Canada is expanding with government support for neuro health funding and increased application of image-guided and robotic neurosurgery systems. As per a report done by NLM in November 2023, a significant rise in the proportion of neurosurgeons who undergo lumbar discectomy was witnessed, from 87.8% to complete participation among professionals. Such a rising focus on spinal surgery generates the need for advanced neurosurgery software that aims to enhance precision and efficiency in such procedures. This reflects a wider spinal surgery load, driving adoption of image-guided as well as minimally invasive surgery technology. Additionally, medical devices are essential for diagnosing, monitoring, and treating a wide range of health conditions, making their production.

North America 2023 Medical Instruments Market Export and Import Values by Country

|

Country |

Exports (in USD) |

Imports (in USD) |

|

U.S. |

34.8 billion |

37.7 billion |

|

Mexico |

17.6 billion |

4.6 billion |

|

Costa Rica |

5.9 billion |

828 million |

|

Dominican Republic |

2.1 billion |

201 million |

|

Canada |

1.2 billion |

3.7 billion |

Source: OEC August 2025

Asia Pacific Market Insights

The neurosurgery software market in the Asia Pacific is expected to have the highest growth rate in the forecast period due to rising healthcare expenditures, hospital infrastructure expansion, and expanding neurosurgical innovation awareness. Rapid urbanization and expanding access to quality healthcare are driving demand for advanced surgical technologies. Additionally, government initiatives for better neurological treatment and growing investment in medical technology startups are fueling market growth. The increasing incidence of neurological diseases and expanding patient awareness also enable the growing adoption of neurosurgery software across the region.

The neurosurgery software market in China is growing due to the rapid digitalization of the healthcare industry and a growing aging population at high risk for neurological diseases such as stroke and tumors. As per an NLM April 2025 report, in the past 8 years the rising incidence of rare neurological diseases (RND) up to 1,515 per annum has driven the demand for advanced neurosurgical diagnostic and intervention equipment. Notably, ICU stay of juvenile RNDs rose consistently, with an annual percent change (APC) of 28.4%, reflecting the urgent need for accuracy-based surgical software in acute pediatric care.

The neurosurgery software market in India is growing due to increased investment in healthcare, the rise in the number of neurosurgeons, and investment in software solutions in the healthcare sector. The Indian Government's yoga and Ayurveda programmes indicate a shift to developing the healthcare infrastructure, which includes hardware systems for modernised healthcare centers. As per a report published by the Ministry of Health and Family Welfare, in October 2024, government healthcare funding has increased over time. The GDP of Government Health Expenditure increased to 1.8% between 2021 and 2022, from 1.13% during 2014 to 2015. This increasing support from regulations and widening infrastructure provides ample chances for acquiring modern neurosurgery software solutions.

Europe Market Insights

The neurosurgery software market in Europe is growing at a steady rate through the forecast period due to increased demand for sophisticated neurosurgical procedures and uninterrupted funding for neuroscience studies and digital applications. The growth is also supplemented by the strong rule of law in the region and the acceptance of AI-based surgical planning systems. Germany, France, and the UK are among the top countries that are at the forefront of incorporating imaging, navigation, and robotic support into neurosurgical procedures. The growing incidence of neurodegenerative disorders and brain tumors continues to fuel investment in precision-focused software.

The neurosurgery software market in the UK is growing due to the augmented use of AI-supported surgical planning systems and increased NHS programs supporting precision neurosurgery. As per a report by UKCRC 2024, the market in the country is well-endowed, with increased national health research spending, with over £5 billion of public and voluntary health funding in 2022. £1.4 billion was allocated to infrastructure, which supported the adoption of digital solutions and surgical equipment by NHS and private hospitals. Such a vibrant funding ecosystem drives sophisticated neurosurgical software innovation and adoption for planning, navigation, and intraoperative support.

The neurosurgery software market in Germany is expanding due to the strong presence of med-tech firms and the incorporation of cutting-edge imaging and navigation systems in neurosurgical management. High healthcare spending and Germany's well-established hospital infrastructure also contribute to the uptake of innovative neurosurgical technologies. The synergistic interactions between academic institutions and industry stakeholders are driving innovation in intraoperative tools and surgical planning. Additionally, government backing of digital transformation in health is creating a positive climate for software-based neurosurgical innovation.

Key Neurosurgery Software Market Players:

- Medtronic

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Brainlab

- Stryker Corporation

- Siemens Healthineers

- GE Healthcare

- Philips Healthcare

- Intuitive Surgical

- Zimmer Biomet

- Elekta AB

- Varian Medical Systems

- Accuray Incorporated

- Accenture

- Nuvasive

- BrainScope Company

- Compumedics Limited

The market is highly competitive, driven by the world’s largest multinational companies devoted to pioneering surgical navigation, imaging, and planning software. Such firms also establish strategic collaborations with healthcare institutions and research centers to deepen their product lines. Their primary competitors balance their efforts on improving software harmonization with robotic surgery and AI-driven outcome analytics to achieve precise patient results while M&A activities continue to let companies broaden their technology stack and their global presence, guaranteeing a leading position face of a growing demand for precision neurosurgery.

Here is a list of key players operating in the global market:

Recent Developments

- In June 2025, WashU Medicine decided to market Sora Neuroscience’s AI-driven Cirrus Resting State fMRI software, which received FDA clearance. The software is intended to enhance the accuracy of neurosurgery by identifying essential brain regions, and it is hoped that its use is going to improve the results of both tumor and epilepsy surgeries across the country.

- In September 2024, Medtronic unveiled new AiBLE spine surgery systems that advance navigation, robotics, AI, and imaging. In addition, in an effort to improve global spine care results, the company formed a partnership with Siemens Healthineers to increase the availability of advanced imaging for use before and after surgery.

- Report ID: 1503

- Published Date: Sep 05, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Neurosurgery Software Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.