Edge Computing Market Outlook:

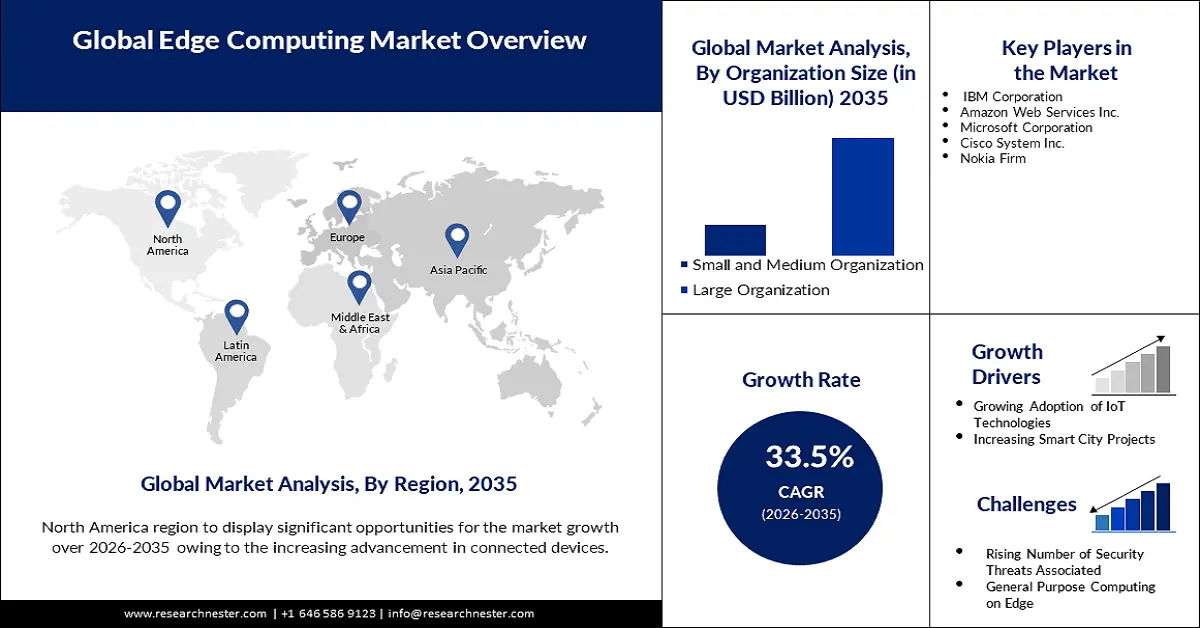

Edge Computing Market size was over USD 30.43 billion in 2025 and is projected to reach USD 547.16 billion by 2035, witnessing around 33.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of edge computing is assessed at USD 39.6 billion.

The increasing rollout of 5G networks globally is a key factor expected to fuel the global market. This can be due to the rising need for high-speed connectivity, ultra-low latency, and real-time data processing across several sectors, including manufacturing, healthcare, automotive and transportation, retail, and energy. Thus, the investments in 5G and edge computing are accelerating, and governments and companies are recognizing their transformative potential. Industry giants are focused on expanding edge computing capabilities. For instance, in February 2024, Digi International Inc. announced the launch of DigiIX40, a 5G edge computing industrial IoT cellular router solution that allows companies to seamlessly connect multiple machines and devices. This is purpose-built for Industry 4.0 use cases like predictive maintenance, asset monitoring, advanced robotics, smart manufacturing, and industry automation.

Another key factor expected to support the growth of the market is the integration of AI in edge computing. Companies are investing in AI-powered edge technologies as AI helps to enhance decision-making ability and improve operational efficiency. In January 2025, ZEDEDA, a company specializing in edge management and orchestration, invested around USD 72 million in 2024 and established its headquarters in Abu Dhabi, UAE, as a part of its global expansion. The expansion is supported by new investments from Prosperity7 and Alpha Wave Incubation to cater to the rising need for advanced edge computing and AI solutions in the Middle East.

Key Edge Computing Market Insights Summary:

Regional Highlights:

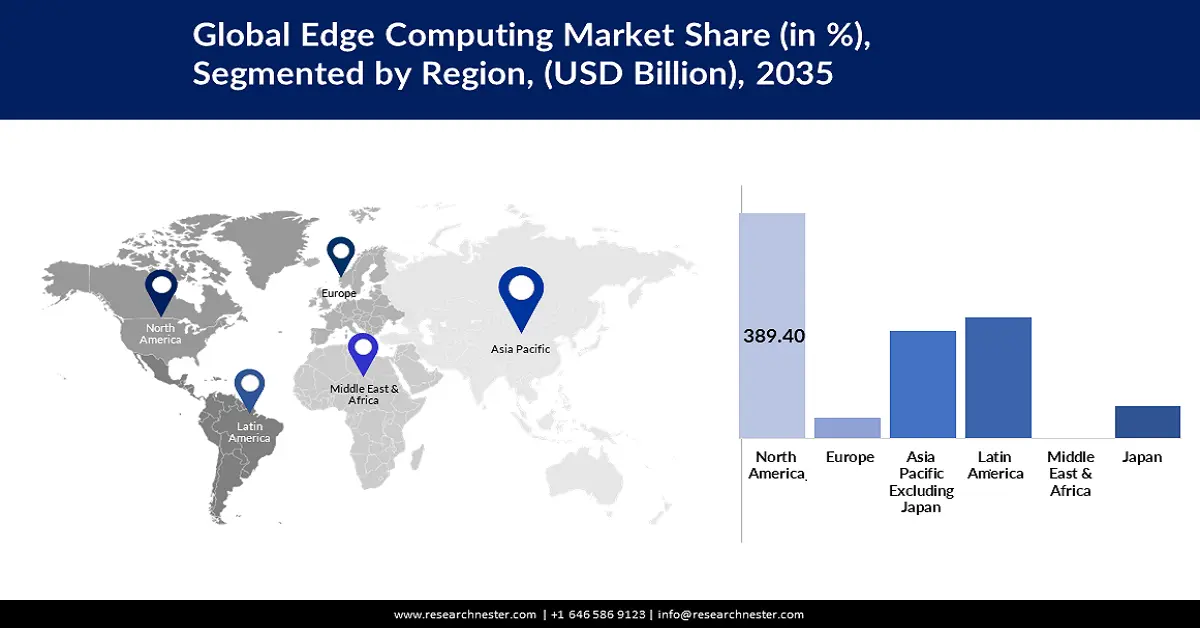

- North America edge computing market will dominate over 43% share by 2035, driven by proliferation of IoT, 5G, and cloud-edge investments.

- Asia Pacific market will exhibit the fastest growth during the forecast timeline, driven by digital transformation and smart city investments.

Segment Insights:

- The large enterprises segment in the edge computing market is anticipated to achieve a 79% share by 2035, propelled by the demand for real-time data processing and secure solutions.

- The hardware segment in the edge computing market is expected to capture a 48% share by 2035, fueled by increasing demand for low-latency, secure, and high-performance edge computing infrastructure.

Key Growth Trends:

- Rising number of smart city projects

- High usage of edge computing in the healthcare sector

Major Challenges:

- High initial investments and security challenges

Key Players: IBM Corporation; Amazon Web Services Inc.; Microsoft Corporation; Cisco System Inc; Nokia Firm; Huawei Cloud Computing Technologies Co., Ltd; Dell Inc.; Hewlett Packard Enterprise Development LP; SixSq SA.

Global Edge Computing Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 30.43 billion

- 2026 Market Size: USD 39.6 billion

- Projected Market Size: USD 547.16 billion by 2035

- Growth Forecasts: 33.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (43% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: China, India, Brazil, Mexico, South Korea

Last updated on : 8 September, 2025

Edge Computing Market Growth Drivers and Challenges:

- Rising number of smart city projects: Rapid expansion of smart city projects to cater to the increasing urbanization across the globe is expected to support market growth in the coming years. According to the United Nations survey, around 55% of the global population is currently living in urban areas and is expected to reach 68% by the end of 2050. This can result in massive deployment of IoT devices such as surveillance cameras, smart meters, and traffic sensors. The demand for edge computing products and services is expected to increase due to the rising need for real-time data processing in these smart city projects. According to a report, over 15 billion connected devices are currently active in urban environments, and the number is expected to rise to 30 billion by 2030.

- High usage of edge computing in the healthcare sector: Edge computing is significantly revolutionizing the healthcare sector by enabling real-time data processing and enhancing patient care and operational efficiency. Some of the key applications of edge computing in healthcare include remote patient monitoring, telemedicine, medical imaging, along with resource management and staff scheduling. In August 2024, Caregility Corporation announced the launch of the first-ever edge-based computer vision AI, iObserver, with fall risk detection capability. The product uses computer vision to analyze information, detect fall risks, and alert caregivers immediately. Moreover, it offers a cost-effective approach and scalable solution catering to the need for advanced solutions in the healthcare fraternity.

Challenges

- High initial investments and security challenges: Deploying edge infrastructure such as edge servers, AI chips, and sensors requires substantial capital investments. However, this can lead to its lower adoption, especially in small and medium-sized enterprises with limited investment cap. In addition, most of the dispersed edge nodes are vulnerable to physical tampering, data breaches, and cyberattacks. This can restrain organizations with sensitive data from adopting these solutions.

Edge Computing Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

33.5% |

|

Base Year Market Size (2025) |

USD 30.43 billion |

|

Forecast Year Market Size (2035) |

USD 547.16 billion |

|

Regional Scope |

|

Edge Computing Market Segmentation:

Component Segment Analysis

The hardware segment is anticipated to surpass 48% by the end of 2035. Edge computing hardware has become increasingly popular in recent years as it can offer a wide range of benefits, including reduced latency, data protection, security, flexibility, and cost savings. To meet workload demands, resource-intensive edge computing applications require high-performance hardware. Therefore, hardware designed for use at the edge is essential. An important part of edge computing is the edge gateway.

Organization Size Segment Analysis

The large enterprises segment is expected to account for 79% share between 2026 and 2035, owing to the rising need for real-time data processing across large organizations and the growing need for advanced edge computing for enhanced data privacy, security, scalability, and flexibility. Large enterprises can greatly benefit from edge computing technology when it comes to cybersecurity. Edge computing gives businesses control over their data by deciding what data should be processed in a central unit and what data should remain in local sources. This improves the security of both personal and business information. Edge computing acts as a private cloud, allowing local data to be seamlessly integrated into a central cloud, resulting in a unified user interface.

Our in-depth analysis of the global edge computing market includes the following segments:

|

Component |

|

|

Application |

|

|

Organization Size |

|

|

Industrial Vertical |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Edge Computing Market Regional Analysis:

North America Market Insights

The edge computing market in North America is anticipated to hold the largest market share of 43% by the end of 2035. With the advancement of connected devices in North America, edge computing will capture a significant market in the region due to the growing need for storing and processing these vast amounts of data. In addition, the proliferation of IoT devices and smart technologies, the deployment of 5G in many parts of the region, and rapid expansion of cloud-edge convergence and big tech investments are expected to fuel market growth during the forecast period.

In the U.S., several organizations are increasingly moving towards distributed computing frameworks and cloud edge. This is encouraging industry giants to develop advanced edge computing solutions. In May 2024, Simply NUC announced the launch of the BMC-enabled extremeEDGE server product line, offering personalized solutions for healthcare, remote deployment, and industrial automation.

APAC Market Insights

The Asia Pacific edge computing market is predicted to be the fastest-growing during the forecast period owing to increasing adoption of edge computing and digital transformation across several sectors and rising demand for mobile and IoT devices. Countries such as China, India, Singapore, and South Korea are heavily investing in smart city projects and urban infrastructure, leading to high demand for advanced edge computing solutions.

In India, the government’s push for Digital India and 100+ smart cities, and rapidly expanding 5G and fiber infrastructure, are expected to support the growth of the edge computing market. Moreover, rising digital payments and fintech ecosystems, increasing number of startups and focus on expanding cloud capabilities to remote and semi-urban locations are likely to fuel market growth going ahead.

Edge Computing Market Players:

- IBM Corporation

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Amazon Web Services Inc.

- Microsoft Corporation

- Cisco System Inc.

- Nokia Firm

- Huawei Cloud Computing Technologies Co., Ltd.

- Dell Inc.

- Hewlett Packard Enterprise Development LP

- SixSq SA

The global edge computing market is highly competitive, comprising key players operating at global and regional levels. Key players in the market are focused on developing new technologies and products catering to the stringent regulatory norms and consumer demand. These key players are adopting several strategies such as mergers and acquisitions, joint ventures, partnerships, and novel product launches to enhance their product base and strengthen their market position. Here are some key players operating in the global market:

Recent Developments

- In May 2024, Tata Communications, a global commtech player, launched a fully automated edge computing platform, Tata Communication CloudLyte, designed to help enterprises make informed decisions. The product is expected to offer a seamless experience with its built-in security features, such as zero-trust architecture and layered defenses.

- In March 2024, Lanner Electronics, a global leader of intelligent edge computing appliances, announced the launch of EAI-I133, a compact Edge AI platform for facilitating AI inferencing in small retail and space settings.

- Report ID: 1945

- Published Date: Sep 08, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Edge Computing Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.