Gastrointestinal Therapeutics Market Outlook:

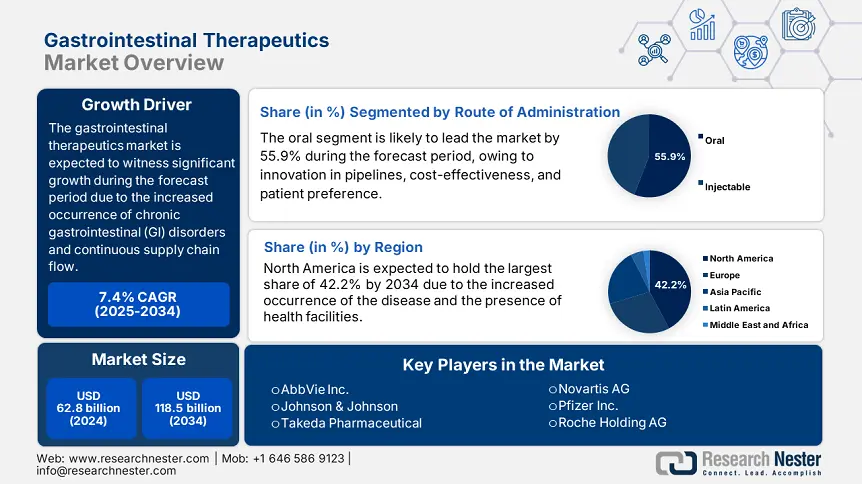

Gastrointestinal Therapeutics Market size was USD 62.8 billion in 2024 and is anticipated to reach USD 118.5 billion by the end of 2034, increasing at a CAGR of 7.4% during the forecast period, i.e., 2025-2034. In 2025, the industry size of gastrointestinal therapeutics is estimated at reach USD 66.9 billion.

The worldwide market readily serves as a significant patient pool, with more than 75 million patients affected by rare gastrointestinal (GI) diseases in the U.S., including IBS, IBD, and GERD. In addition, the IBD occurrence in Europe has increased by 35% in previous years, highly attributed to environmental and dietary factors. Besides, the supply chain aspect for the market includes active pharmaceutical ingredients (APIs), which are effectively sourced from China, that caters to 44% of the international supply, along with 27% from India. Additionally, this also includes finished drug production, which is highly concentrated in Japan, the U.S., and Germany, thus suitable for market development.

Moreover, based on economic aspects, the producer price index (PPI) increased by approximately 4.7% year-over-year (YoY) for GI-based drugs, which is fueled by a rise in administrative compliance costs and API expenses. Likewise, the consumer price index (CPI) has also risen by 6.1% for GI medications, thereby reflecting a rise in insurer rebate pressures and high formulary restrictions. Besides, investments related to research, development, and deployment (RDD) have increased to USD 12.8 billion internationally as of 2024, of which 68% has been allocated to biologic therapies. Meanwhile, the EU and the U.S. effectively dominate in R&D expenditure, but China’s share reached 20% in 2024, backed by regional biotech facilities, thereby denoting a positive impact on the market.

Gastrointestinal Therapeutics Market - Growth Drivers and Challenges

Growth Drivers

- Unmet demands in developing economies: Despite an increase in the market demand, the aspect of accessibility and cost-effective barriers exists. For instance, in India, the GI drug accessibility is extremely limited, and is available to only 50% of patients who are eligible. This, eventually, has created a USD 1.9 billion growth opportunity for both biosimilars and generics. Besides, governments are positively responding with localized production incentives, for instance, the PLI scheme in India readily subsidizes the GI API manufacturing process, thus suitable for the overall market growth.

- Competition in biosimilars and escalated FDA acceptance: The aspect of administrative transition is rearranging the GI drug landscape in the gastrointestinal therapeutics industry globally. The FDA has accepted 6 latest biosimilars as of 2024 and has successfully slashed Humira expenses by at least 30%. Presently, biosimilars provide 21% coverage in the U.S.-based IBD market, thereby denoting an increase from 5.5% as of 2020. Besides, escalated pathways for microbiome drugs are also augmenting advancement, thus creating a huge growth opportunity for the market.

Revenue Opportunities for GI Therapeutics Manufacturers (2023–2025)

|

Company |

Strategy |

Revenue Impact (USD) |

Market Share Change |

|

AbbVie |

Humira biosimilar defense |

2.3 billion (2023) |

+5.2% (US/EU) |

|

Takeda |

Entyvio® Asia-Pacific expansion |

+1.6 billion (2024) |

+7.1% (Japan/China) |

|

Pfizer |

Microbiome drug pipeline (PF-06480605) |

+820 million (2025 projected) |

+3.3% (US) |

|

J&J |

Stelara® IBD label expansion |

+1.8 billion (2023) |

+4.2% (Global) |

|

Roche |

AI-driven IBD diagnostics partnership |

+650 million (2024) |

+2.6% (EU) |

Revenue Feasibility Models (2022–2024)

|

Model |

Region |

Revenue Impact |

Key Outcome |

|

Hospital Partnerships |

India |

+12.5% Revenue |

Improved rural access |

|

Joint Procurement |

EU |

-15.2% Drug Costs |

Higher biologic adoption |

|

Telemedicine Integration |

USA |

+USD 1.3 billion Sales |

Expanded rural coverage |

|

Tiered Pricing |

Latin America |

+8.1% Market Penetration |

Affordable biosimilars |

Challenges

- Erosion in revenue and competition in biosimilar: The biosimilar wave has drastically modified the commercial landscape of the gastrointestinal therapeutics market, particularly for GI biologics. For instance, in 2023, AbbVie’s Humira franchise was agonized with a USD 3.4 billion decline in revenue, following the U.S. biosimilar entry. Therefore, this erosion in overall expenses has pressured originators to escalate lifestyle administration through which J&J effortlessly expanded Stelara in 2025 by the newest indication acceptances and formulation patients.

- Step therapy and restriction in purchase decision: The presence of insurer-based treatment algorithms has developed gaps in the market, which has further hindered suitable GI care services. Besides, payers in the U.S. usually demand patients to fail over 4 cheap therapies before biologics acceptance, leading to a delay in suitable treatment facilities for at least 42% of IBD patients within 13 to 19 months. These reforms comprise clinical consequences, which negatively impact the overall market growth.

Gastrointestinal Therapeutics Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2024 |

|

Forecast Year |

2025-2034 |

|

CAGR |

7.4% |

|

Base Year Market Size (2024) |

USD 62.8 billion |

|

Forecast Year Market Size (2034) |

USD 118.5 billion |

|

Regional Scope |

|

Gastrointestinal Therapeutics Market Segmentation:

Route of Administration Segment Analysis

Based on the route of administration, the oral segment in the gastrointestinal therapeutics market is expected to garner the largest share of 55.9% by the end of 2034. The segment’s growth is effectively fueled by expansion in pipeline advancements, affordability, and patient preference. In addition, cost savings, latest formulations, and a surge in adherence rates are other key factors that are responsible for uplifting the segment. For instance, owing to the convenience aspect, the adherence rate of the oral segment is 75% in comparison to 61% for injectables. Besides, JAK inhibitors and delay in PPI release, particularly for IBD, currently comprise 66% of oral-based GI drug acceptances, thus suitable for the segment’s development.

Distribution Channel Segment Analysis

Based on the distribution channel, the hospital pharmacies segment in the gastrointestinal therapeutics market is projected to hold the second-largest share of 43.7% during the forecast timeline. The segment’s upliftment is effectively attributed to its serving as the initial distribution channel for increased biologics expenses and suitable care medications. This growth originates from bulk purchase power, impatient care dependency, and customized drug handling. For instance, according to the 2024 CDC report, an estimated 68% of critical IBD flare and GI bleed patients gain primary treatment in hospital centers, thereby creating a positive impact on the segment.

Our in-depth analysis of the global market includes the following segments:

|

Segment |

Subsegment |

|

Route of Administration |

|

|

Distribution Channel |

|

|

Drug Class |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Gastrointestinal Therapeutics Market - Regional Analysis

North America Market Insights

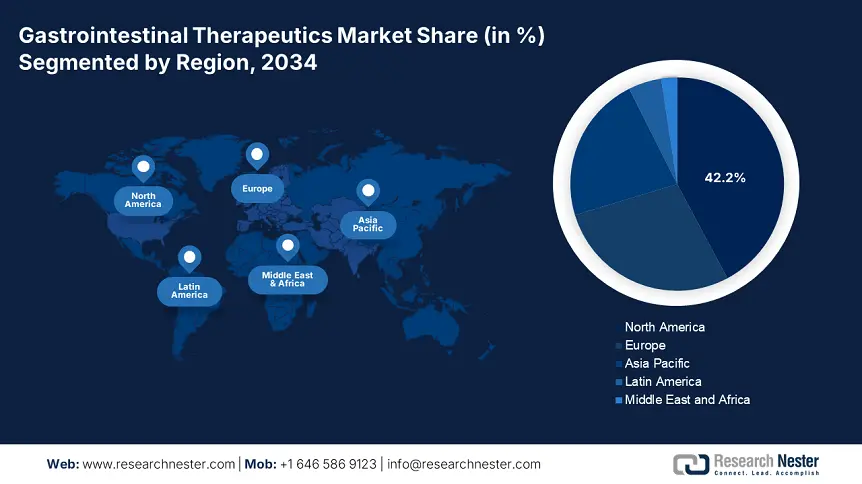

North America is considered the dominant region in the gastrointestinal therapeutics market, projected to garner the largest share of 42.2% by the end of 2034. The market’s growth in the region is subject to an increase in the disease occurrence as well as the existence of innovative health and medical infrastructure. In addition, the region’s 6.6% growth rate is also reflecting a surge in the incorporation of biosimilars and biologics, wherein IBD is affecting more than 3.2 million people. Besides, single-payer system in Canada provides a wide-range accessibility, while progression in the U.S. has led to drug development, catering to almost 63% of the international GI clinical trials.

The market in the U.S. is significantly growing, with an expected 90% of the region’s market, which is driven by an estimated 17% increase in Medicare GI drug expenditure since 2020. Besides, biosimilar competition has diminished anti-TNF expenses by almost 42%, resulting in the extended accessibility to at least 2.5 million patients in the country. Meanwhile, the CDC has reported that approximately 26 million GERD incidences takes place every year, attributing to PPI usability, despite the existence of FDA safety guidelines, thus enhancing the market demand in the country.

The gastrointestinal therapeutics market in Canada is also growing at a 6.1% rate, with provincial reforms covering almost 95% of required biologics. British Columbia’s biosimilar mandate has saved almost USD 98 million yearly since previous years, while Ontario has enhanced GI treatment service funding by at least 20% between 2021 and 2024. Besides, the federal government in the country has made the provision of USD 1.3 billion for GI drugs as of 2023, with an extreme focus on telehealth expansion in rural areas. Meanwhile, the country’s unusual position includes serving as an evaluation ground for cost-containment initiatives, thereby suitable for market upliftment.

North America Gastrointestinal Therapeutics Supply Chain & Trade Facilities (2021–2025)

|

Category |

2021 |

2023 |

2025 |

Key Developments |

|

API Production Capacity |

U.S.: 56% imported APIs |

U.S.: 47% imported APIs |

U.S.: 35.5% imported APIs |

+22% domestic API manufacturing (FDA incentives, 2022) |

|

Canada: 71% imported APIs |

Canada: 67% imported APIs |

Canada: 60.5% imported APIs |

USD 305 million Canada-based API plant investments (Health Canada, 2023) |

|

|

Cold Chain Facilities |

U.S.: 1,250 certified facilities |

U.S.: 1,520 facilities |

U.S.: 1,850 facilities |

Medicaid expansion for biologics storage (CMS, 2024) |

|

Canada: 250 facilities |

Canada: 260 facilities |

Canada: 350 facilities |

Health Canada’s USD 55 million cold-chain upgrade (2023) |

|

|

Trade Partnerships |

U.S.-Mexico: USD 2.2 billion GI drug trade |

U.S.-Mexico: UD 2.6 billion trade |

U.S.-Mexico: USD 3.4 billion trade |

USMCA tariff reductions (2022) |

|

Canada-EU: USD 826 million trade |

Canada-EU: USD 1.1 billion trade |

Canada-EU: USD 1.5 billion trade |

CETA biosimilar fast-tracking (2023) |

|

|

Regulatory Shifts |

U.S.: 6.5-month FDA backlog |

U.S.: 4.5-month backlog |

U.S.: 2.5-month backlog |

FDA’s 2022 "Operation Warp Speed" for GI biosimilars |

|

Canada: 8.5-month Health Canada delays |

Canada: 5.5-month delays |

Canada: 3.5-month delays |

Joint U.S.-Canada review initiatives (2023) |

APAC Market Insights

Asia Pacific in the gastrointestinal therapeutics market is the fastest-growing region, with an anticipated 22.3% of the revenue share during the forecast duration, along with a growth of 8.3%. The market’s development in the region is highly fueled by a rise in the biologic integration and GERD/IBD occurrence. China is deliberately dominating the region, owing to AI implementation in healthcare services, while the biosimilar expansion in India is readily diminishing expenses. The existence of fast-track acceptances in South Korea has lowered delays in launch to at least 3.5 months, thereby positively impacting the overall market growth.

The gastrointestinal therapeutics sector in China is gaining increased traction, with a projected growth of USD 18 billion by the end of the forecast timeline, further accounting for 50% of the region’s revenue. This is effectively attributed to the presence of government-based health policies, along with an increase in the patient pool. Besides, the NMPA has reported that there has been a surge in IBD patients by 1.9 million as of 2024, of which a significant growth has been observed for biologics by 25%, owing to an expansion in national insurance coverage. In this regard, volume-specific procurement policies have reduced biologic expenses by 55%, thereby uplifting the market in the country.

The gastrointestinal therapeutics market in India is also expected to grow with a valuation of USD 2.7 billion during the forecast duration, which is highly driven by more than 26 million GERD cases, along with biosimilar integration. Based on this, CDSCO’s biosimilar acceptances in 2024 have diminished treatment expenses by almost 65%, with Biocon’s trastuzumab garnering approximately 18% of the regional market share. Besides, the government’s 345 billion program enhancement to over 450 hospitals in the country has aimed to augment accessibility, thus skyrocketing the market exposure.

APAC Government Initiatives in Gastrointestinal Therapeutics (2021–2025)

|

Country |

Policy/Initiative |

Launch Year |

Funding (USD) |

Key Impact |

|

Australia |

National Strategic Action Plan for IBD |

2021 |

126 million |

Expanded biologic access for 52,000+ IBD patients |

|

Rare GI Disorders Fund |

2023 |

78 million |

Covered 6 orphan GI drugs under PBS |

|

|

South Korea |

Biosimilar Fast-Track Approval Program |

2022 |

N/A (Regulatory) |

Reduced approval times by 42% (6.5 → 3.5 months) |

|

GI Cancer Early Detection Subsidy |

2024 |

92 million |

Free endoscopies for high-risk groups |

|

|

Malaysia |

MySalam GI Treatment Coverage Expansion |

2021 |

27 million |

Covered biologics for 100,200+ patients |

|

National Tele-GI Consultation Platform |

2023 |

19 million |

Served 200,500 rural patients (2023–2025) |

Europe Market Insights

Europe is considered to hold a considerable share of 28.1% in the gastrointestinal therapeutics market during the forecast period, along with a 5.5% growth rate, which is expected to reach €43 billion. The market’s upliftment in the region is fueled by biosimilar incorporation and an upsurge in the aging population. Germany is leading the region with the maximum share, which is attributed to GI drugs spending and universal health coverage solutions. This is followed by the UK, with the provision of the NHS budget plan for GI therapies that includes IBD biologics. Besides, the budget for customized medicine in France and telemedicine adoption in Spain is also bolstering the market in the region.

The gastrointestinal therapeutics industry in Germany is projected to grow with a 30.5% revenue share, accounting for € 12.8 billion by the end of 2034, which is attributed to an increase in biosimilar integration and the existence of strong healthcare facilities. The Federal Ministry of Health in the country has revealed that there has been € 4.7 billion yearly spending on GI drugs, of which 70% caters to anti-TNF prescriptions. Besides, policies such as GKV’s mandatory substitution have lowered biologic expenses by almost 35%, while R&D in the private sector has fueled innovation, thus suitable for market growth.

The gastrointestinal therapeutics market in the UK is anticipated to hold 24% of the region’s market share, accounting for £ 8.5 billion by 2034. This is readily supported by NHS biologics funding, along with NICE’s escalated acceptances. For instance, almost 8.2% of the NHS budget, which is £ 525 million, was offered to GI therapies in 2024, which covered 92% of critical IBD cases. Besides, biosimilars, such as Celltrion’s Remsima, have diminished expenses by 50%, with telemedicine services managing 48% of consultations, thereby creating an optimistic market outlook.

Key Gastrointestinal Therapeutics Market Players:

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

The international market is severely combined with key players, including Takeda, J&J, and AbbVie, jointly constituting a consolidated share of 42.5%. The aspect of AI implementation, expansion in developed economies, investments in microbiome, and biosimilar defense are a few strategies that these organizations have adopted. For instance, as per the NIH report, J&J entered into a USD 850 million partnership with Vedanta Biosciences, while Celltrion and Biocon leveraged affordable biosimilars for their availability in Asia. Besides, according to the EMA report, the GI diagnostics platform of Roche reduced IBD diagnostics duration by at least 40%, all of which effectively contributed to the market’s global development.

Here is a list of key players operating in the global market:

|

Company Name (Country) |

Market Share (2024) |

Industry Focus & Notable Products |

|

AbbVie Inc. (U.S.) |

18.5% |

Leader in IBD therapies (Humira®, Skyrizi®, Rinvoq®) |

|

Johnson & Johnson (U.S.) |

12.3% |

Stelara® (UC/Crohn’s), Tremfya®; invests in microbiome research |

|

Takeda Pharmaceutical (Ireland) |

11.1% |

Entyvio (IBD), GATTEX (short bowel syndrome); global biologics leader |

|

Pfizer Inc. (U.S.) |

8.9% |

Xeljanz (UC), biosimilars; focuses on JAK inhibitors |

|

Roche Holding AG (Switzerland) |

7.6% |

IBD diagnostics, Actemra (off-label GI use); AI-driven drug development |

|

Novartis AG (Switzerland) |

7.1% |

Cosentyx (IBD), Sandoz biosimilars; invests in targeted therapies |

|

Merck & Co. (U.S.) |

5.4% |

Keytruda (GI cancers), Zeposia (UC); oncology-GI pipeline integration |

|

Bristol-Myers Squibb (U.S.) |

xx% |

Zeposia (UC), Opdivo (GI cancers); immuno-oncology focus |

|

AstraZeneca (UK) |

xx% |

Lynparza (GI cancers), GI precision medicine partnerships |

|

GSK plc (UK) |

xx% |

Nucala (eosinophilic esophagitis), GI vaccine research |

|

Sanofi (France) |

xx% |

Dupixent (eosinophilic esophagitis), rare GI disease therapies |

|

Eli Lilly (U.S.) |

xx% |

Mirikizumab (UC), IBD biologics pipeline |

|

Amgen (U.S.) |

xx% |

Biosimilars (Amjevita), GI oncology (Vectibix) |

|

Biocon (India) |

xx% |

Biosimilars (adalimumab, trastuzumab); cost-effective IBD solutions |

|

Celltrion (South Korea) |

xx% |

Remsima (biosimilar infliximab); dominates Asian biosimilar markets |

Below are the areas covered for each company in the market:

Recent Developments

- In May 2024, AbbVie declared that the FDA has accepted its Skyrizi, which is a risankizumab, to aid Crohn’s disorder and effectively strengthen its IBD portfolio. Its Phase 3 clinical trial demonstrated 73% remission rates, suitable for adolescents.

- In April 2024, Johnson & Johnson’s newly launched Stelara, which is an ustekinumab, experienced biosimilar competition since Amgen introduced Wezlana in the U.S., which is expected to lower Stelara’s USD 7.3 billion revenue by almost 33%.

- Report ID: 7900

- Published Date: Jul 15, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert