Gas Diffusion Layer Market Outlook:

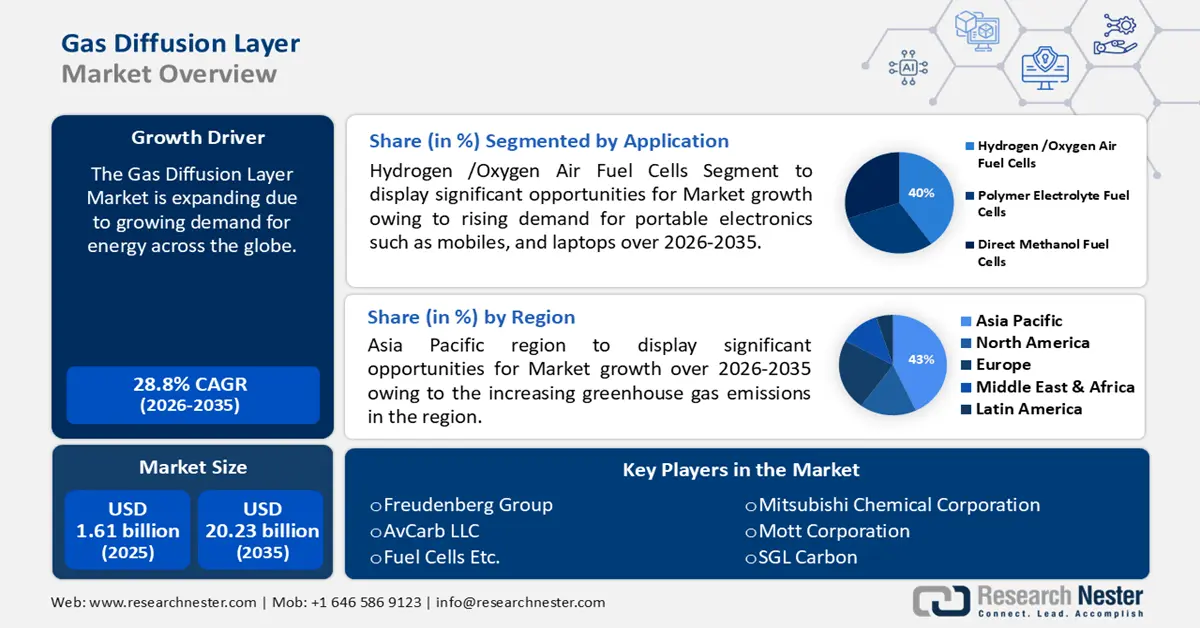

Gas Diffusion Layer Market size was valued at USD 1.61 billion in 2025 and is set to exceed USD 20.23 billion by 2035, registering over 28.8% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of gas diffusion layer is estimated at USD 2.03 billion.

The reason behind the growth is led by the growing demand for energy across the globe, driven mostly by the expanding economies of developing countries as a result of increased industrial activity and advancements in both developed and developing nations.

According to the World Economic Forum, the average annual growth rate of the world's demand for power is predicted to reach 3.4% between this year and 2026.

Key Gas Diffusion Layer Market Insights Summary:

Regional Insights:

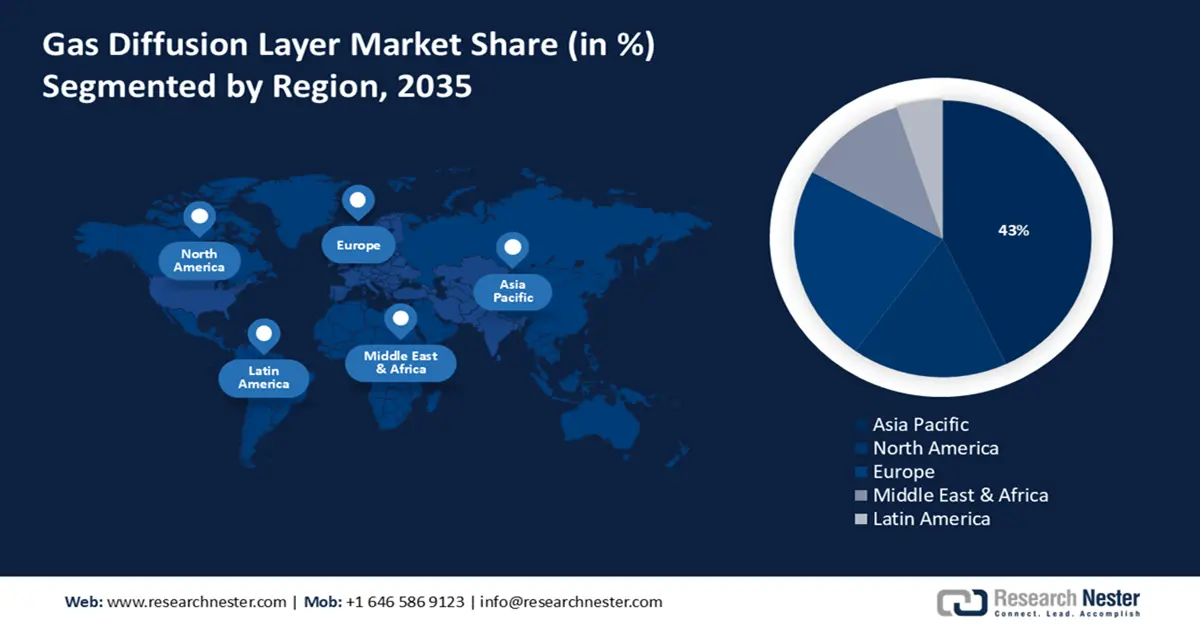

- By 2035, the Asia Pacific region is projected to secure a 43% revenue share in the gas diffusion layer market, supported by escalating greenhouse gas emissions in the region.

- Europe is anticipated to achieve substantial growth through 2026–2035, driven by the region’s amplified emphasis on sustainability initiatives under the European Green Deal.

Segment Insights:

- The hydrogen/oxygen air fuel cells segment is expected to command over 40% share of the gas diffusion layer market by 2035, propelled by surging demand for portable electronics such as mobile phones and laptops.

- The carbon paper segment is set to exhibit a notable CAGR through 2026–2035, underpinned by its dominance owing to high conductivity, corrosion resistance, and superior gas permeability.

Key Growth Trends:

- Increasing sales of electric vehicles

- Recent developments in gas diffusion layer technology

Major Challenges:

- Exorbitant cost associated with gas diffusion layer

- Supply chain disruptions

Key Players: Freudenberg Group, AvCarb LLC, Fuel Cells Etc., Mitsubishi Chemical Corporation, Mott Corporation, SGL Carbon, Technical Fibre Products, GKD Gebr.

Global Gas Diffusion Layer Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.61 billion

- 2026 Market Size: USD 2.03 billion

- Projected Market Size: USD 20.23 billion by 2035

- Growth Forecasts: 28.8%

Key Regional Dynamics:

- Largest Region: Asia Pacific (43% Share by 2035)

- Fastest Growing Region: Europe

- Dominating Countries: United States, China, Germany, Japan, South Korea

- Emerging Countries: India, Brazil, Canada, Australia, Italy

Last updated on : 1 December, 2025

Gas Diffusion Layer Market - Growth Drivers and Challenges

Growth Drivers

-

Increasing sales of electric vehicles - The gas diffusion layer landscape is significantly being driven by the rising demand for fuel-cell electric automobiles, which may become a fundamental component of CO2-free transportation.

For instance, 2023 saw about a 24% YoY increase in global BEV sales. -

Recent developments in gas diffusion layer technology - The first 3D-printable fluoropolymer gas diffusion layer has been produced by researchers at Lawrence Livermore National Laboratory and the University of Toronto, which is said to provide ways to enhance gas diffusion electrode (GDE) for CO2 reduction reactions and offer enhanced CO2 electrochemical reduction performance.

Challenges

-

Exorbitant cost associated with gas diffusion layer - Polyacrylonitrile (PAN) fibers, a synthetic resin made by polymerizing acrylonitrile, are the main ingredient used in the production of the gas diffusion layer leading to higher cost of production.

Although PAN-based carbon fibers are renowned for their exceptional performance and strength, producing the precursor material is costly as it involves energy-intensive processes, including the carbonization process, and the total cost is also increased by the requirement for specialized machinery and regulated surroundings during the production process.

Moreover, high-quality PAN is one of the precursor materials used in the production of carbon fiber, helping to guarantee that the final product satisfies the exacting standards, which contribute considerably to the total cost of the material.

Supply chain disruptions - Natural catastrophes, geopolitical unrest, or other events may cause supply chain disruptions that affect production and the availability and cost of gas diffusion layer solutions, such as shortages of essential materials or components.

Gas Diffusion Layer Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

28.8% |

|

Base Year Market Size (2025) |

USD 1.61 billion |

|

Forecast Year Market Size (2035) |

USD 20.23 billion |

|

Regional Scope |

|

Gas Diffusion Layer Market Segmentation:

Application Segment Analysis

Hydrogen /oxygen air fuel cells segment is predicted to hold gas diffusion layer market share of more than 40% by 2035. The segment growth can be attributed to the rising demand for portable electronics such as mobiles, and laptops. For instance, there will be more than 15 billion mobile devices by 2025, a rise of around 4 billion over 2020 levels.

Hydrogen /oxygen air fuel cells typically known as proton exchange membrane fuel cells are used to power portable electronic equipment, like laptops and cell phones.

Gas diffusion layers, or GDLs, are essential parts of many different kinds of fuel cells, such as proton exchange membrane (PEM) fuel cells, which primarily transport gases and water, and are responsible for distributing reactant gases to the catalyst surface and for carrying current to the collector plates.

Apart from ensuring the mechanical integrity of the membrane electrode assembly, gas diffusion layers carry out a multitude of crucial functions in the PEM fuel cell's operation, including gas distribution, water transportation, and thermal and electrical conduction since a PEM fuel cell requires uniform diffusion of the gas (hydrogen and air/oxygen) being converted to energy.

Additionally, one element that is essential to the functioning of polymer electrolyte membrane fuel cells (PEMFCs) is the gas diffusion layer since it is in charge of delivering the reactants to the catalyst layers, and also acts as a conduit for the movement of gas, water, heat, and electrons.

Besides this, in a direct methanol fuel cell, the gas diffusion layer (GDL) is a crucial part of the membrane electrode assembly (DMFC), which has significant effects on fuel and water management.

Type Segment Analysis

The carbon paper segment in gas diffusion layer market is set to register a notable CAGR shortly. The market for fuel cell gas diffusion layers is dominated by carbon paper due to its superior qualities, which include high conductivity, resistance to corrosion, and high gas permeability, which provides structural support for the electrocatalyst layer along with acting as a current collector.

Gas diffusion layers (GDLs) can be purchased commercially in several formats, including carbon paper, which finds several uses in a fuel cell single cell or stack that is located between the membrane and the graphite plate.

GDLs are made of porous carbon paper that has been coated in a microporous layer to repel water.

Furthermore, the excellent electrical/thermal conductivity and gas permeability of carbon cloth make it the ideal MPS material, which is also widely used for PEMFC and DMFC fuel cell applications.

Our in-depth analysis of the gas diffusion layer market includes the following segments:

|

Type |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Gas Diffusion Layer Market - Regional Analysis

APAC Market Insights

Asia Pacific industry is likely to hold largest revenue share of 43% by 2035, The market growth in the region is also expected on account of the increasing greenhouse gas emissions. For instance, the Asia-Pacific area emitted more than 15 billion tons of carbon dioxide in total in 2022.

Therefore, the government has implemented several policy measures to encourage the use of hydrogen fuel in the region since many nations are investigating hydrogen as an alternative fuel and a bridge to sustainable development to attain net zero emissions. As a result, fuel cells that rely on gas diffusion layers are becoming more important in the region.

China is one of the Asia-Pacific region's fastest-growing gas diffusion layer market for fuel cell technology followed by South Korea because of the extensive fuel cell commercialization.

Japan has long been at the forefront of fuel cell and green hydrogen technology, leading to a significant adoption of gas diffusion layers.

For instance, the Japanese government updated its Basic Hydrogen Strategy in June 2023 which aims to invest about USD 98 billion over the next 15 years on nine essential technologies, such as fuel cells and water electrolysis devices.

European Market Insights

The Europe region will also encounter enormous growth for the gas diffusion layer market during the forecast period and will hold the second position owing to the increasing focus on sustainability in this region. The European Union's growth strategy, known as the European Green Deal (EGD), aims to improve natural capital and achieve climate neutrality by 2050, by eliminating pollution, and ensuring that no one is left behind.

This is anticipated to drive the adoption of fuel cells in the region, leading to a higher demand for gas diffusion layers.

For many years, Germany has been developing fuel cells for use as a mobile power source for automobiles, resulting in a higher demand for gas diffusion layers.

Also, the first hydrogen fuel cell-powered home in Europe was constructed by researchers at the University of Sannio, located in Southern Italy to power both residential and commercial structures.

Gas Diffusion Layer Market Players:

- Caplinq Corporation

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Freudenberg Group

- AvCarb LLC

- Fuel Cells Etc.

- Mitsubishi Chemical Corporation

- Mott Corporation

- SGL Carbon

- Technical Fibre Products

- GKD Gebr

- Kufferath AG.

The gas diffusion layer market consists of many key players who are launching various strategic initiatives to expand their market position in the industry.

Recent Developments

- Freudenberg Group announced to provide fuel cell stacks with gas diffusion layers under contract to expedite the mass production of fuel cell stacks.

In addition, Freudenberg is now adding more lines at its Weinheim headquarters to increase its production capacity, therefore, fuel cell technology will continue to be a vital component of their commercial endeavors in the future. - AvCarb LLC introduced a new series 9 microporous layer (MPL) for our Gas Diffusion Layer (GDL) technology with enhanced MPL composition that reduces production-related penetration, which gives the fuel cell system a consistent surface for ensuing coatings, improves membrane protection, and reduces contact resistance, which lowers high-frequency resistance (HFR).

- Report ID: 6080

- Published Date: Dec 01, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Gas Diffusion Layer Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.