Fuel Card Market Outlook:

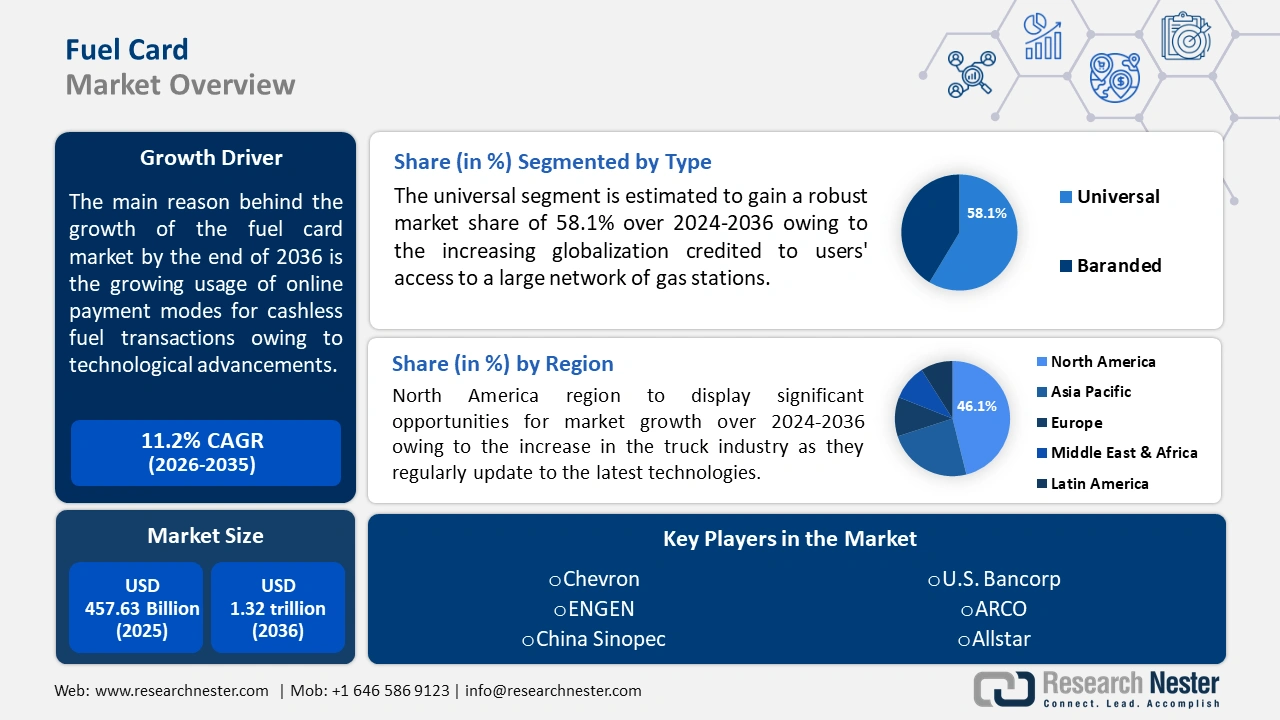

Fuel Card Market size was over USD 457.63 billion in 2025 and is poised to exceed USD 1.32 trillion by 2035, witnessing over 11.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of fuel card is estimated at USD 503.76 billion.

The fuel card market is driven by the growing number of small to medium-sized trucking businesses (SMB) and larger fleet companies. Businesses rely on fuel cards to enable drivers and carriers to manage fuel purchases, minimize fraud, and simplify logistics. A fleet card report provides the fuel consumption and mileage for vehicles, allowing fleet managers to set limits on purchases and discourage card misuse. Furthermore, the growing usage of online payment modes for cashless fuel transactions is fostering fuel card market adoption. A May 2024 World Bank survey, estimated that between 2017 and 2020 the cashless transactions per person boosted from 91 to 135 annually, and is expected to show a significant growth rate of 76% from 2025 to 2030.