Fracture Fixation Products Market Outlook:

Fracture Fixation Products Market size was over USD 11 billion in 2025 and is estimated to reach USD 19.5 billion by the end of 2035, expanding at a CAGR of 6.6% during the forecast timeline, i.e., 2026-2035. In 2026, the industry size of fracture fixation products is assessed at USD 11.7 billion.

The increasing cases of osteoporosis and trauma from falls and accidents are creating a substantial patient pool of bone deformities and damage, which is fueling a notable surge in the market. Further, the continuous expansion of the demography can be displayed by a 2025 article from the International Journal of Basic & Clinical Pharmacology, concluding that the number of people suffering from osteoporosis around the globe surpassed 200 million. It also mentioned that more than 8.9 million fractures occur worldwide due to this ailment. The epidemiology is also extended with rapid aging among populations, where the WHO prediction indicates that the count of individuals aged 60 and older to cross 1.4 billion by 2030 from 1.1 billion in 2023.

The global trade of major components involved in the supply chain of the market primarily contains Class II and III medical devices and specialized medical-grade metals. However, inflation in the cost of these essentials often raises the budget of advanced manufacturing and precision machining, along with assembly, sterilization, packaging, and logistics. This ultimately hinders the strategy of companies to offer comprehensive payers’ pricing for related commodities, translating into a major economic barrier for patients in terms of surgical services and accommodations. In this regard, a 2023 NLM study estimated the cost of osteoporosis and related fractures in the U.S. to increase from USD 22 billion to USD 95 billion by 2040.

Key Fracture Fixation Products Market Insights Summary:

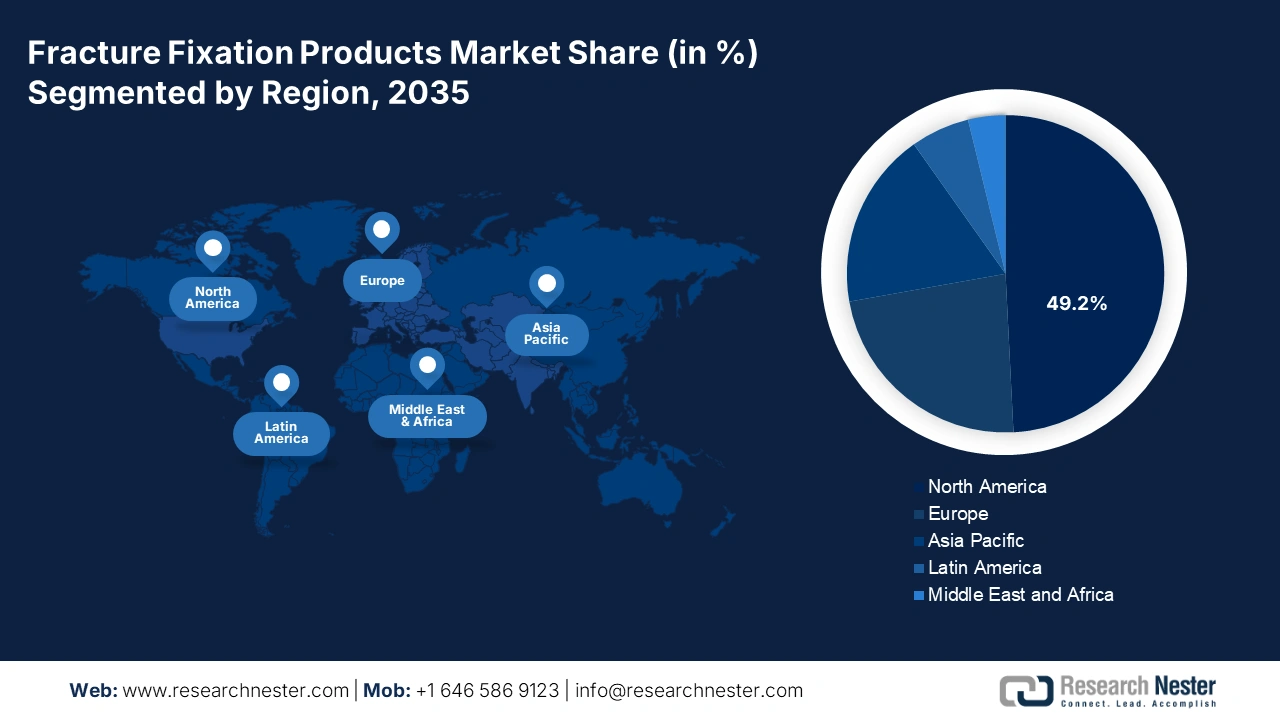

Regional Insights:

- North America is projected to hold a 49.2% share by 2035, reinforced by high healthcare spending and early adoption of advanced surgical technologies.

- Asia Pacific is expected to witness the fastest growth in the market during 2026–2035, driven by rapidly aging populations, rising trauma incidence, and improving healthcare infrastructure.

Segment Insights:

- Internal fixation devices are projected to account for 62.8% share by 2035, owing to superior outcomes in stability, early mobilization, and reduced hospital stays.

- Lower extremity fractures are expected to hold a 48.5% revenue share by 2035, driven by the high prevalence and economic burden of hip, knee, and ankle fractures.

Key Growth Trends:

- Rising road traffic and sports accidents

- Efforts to spread awareness of bone disorders

Major Challenges:

- Hurdles in payer acceptance and widespread adoption

- Procurement processes and tender competitions

Key Players: Johnson & Johnson (DePuy Synthes) Stryker Corporation Zimmer Biomet Holdings, Inc. Smith & Nephew plc Medtronic plc Arthrex, Inc. B. Braun Melsungen AG Össur Wright Medical Group N.V. (part of Stryker) Acumed LLC DJO Global, Inc. NuVasive, Inc. Globus Medical, Inc. Orthofix Medical Inc. Citieffe S.r.l. LimaCorporate S.p.A. aap Implantate AG MicroPort Scientific Corporation Sree Chitra Tirunal Institute coma separated.

Global Fracture Fixation Products Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 11 billion

- 2026 Market Size: USD 11.7 billion

- Projected Market Size: USD 19.5 billion by 2035

- Growth Forecasts: 6.6% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (49.2% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, Japan, France, United Kingdom

- Emerging Countries: China, India, Brazil, South Korea, Mexico

Last updated on : 3 September, 2025

Fracture Fixation Products Market - Growth Drivers and Challenges

Growth Drivers

- Rising road traffic and sports accidents: The increasing occurrence of accidental injuries around the world is a major driver of the patient population in the fracture fixation products market. According to a 2023 report from the WHO, injuries from traffic accidents are the leading cause of mortality for children and young adults, aged between 5 and 29, accounting for an annual 1.1 million deaths. It also revealed that these incidents cause non-fatal injuries among 20-50 million people worldwide. Moreover, rapid urbanization, increased vehicle ownership, and participation in high-impact sports contribute to this demographic expansion.

- Efforts to spread awareness of bone disorders: As the epidemiology and mortality related to the fracture fixation products market increase, more public healthcare authorities are actively raising awareness about orthopedic health and timely interventions. Particularly, government-led campaigns and screening programs are educating people about fracture risks and treatment options, fueling greater demand in this sector. For instance, in 2023, the Bone Health and Osteoporosis Foundation (BHOF) launched a new digital tool, called Your Path to Good Bone Health, to create an informed population that is aware of bone health management and fracture prevention solutions.

- Advances in technology and commodities: Continuous innovation in materials and designs is the key contributor to the future expansion of the fracture fixation products market. Recently developed solutions, such as bioabsorbable implants, titanium alloys, and 3D-printed customized devices, are evolving the pipeline of this sector in terms of enhanced safety, efficacy, and recovery time. This is attracting both surgeons and patients to invest more in this field by improving biocompatibility and reducing surgical complications. Following such advantages, in January 2022, OSSIO gained 510(k) clearance from the FDA for its OSSIOfiber Staple, indicated for use in fixation surgery of arthrodesis, osteotomies, and fractures in the hand or foot.

Trends of Global Trade in the Fracture Fixation Products Market

Export-Import Data for Orthopedic or Fracture Appliances (2023)

|

Country |

Trade Type |

Value (in USD) |

|

U.S. |

Import and Export |

2.6 billion and 2.9 billion |

|

Germany |

Import |

956 million |

|

Netherlands |

Import |

1.0 billion |

|

Switzerland |

Export |

2.0 billion |

|

Mexico |

Export |

2.3 billion |

Source: OEC

Analysis of Trends in the Patient Pool and Associated Expenditure in the Market

Fracture Trends and Cost Savings from Enhanced Osteoporosis Case Finding in the U.S. (2018-2040)

|

Category |

Change / Additional Info |

|

Number of fractures (annual) |

Projected increase of 68% |

|

Direct medical costs (annual) |

Projected increase from USD 48.8 billion to USD 81.5 billion |

|

Total costs, including productivity losses and informal caregiving |

Projected increase from USD 57.0 billion to USD 95.2 billion |

|

Impact of a 20% increase in case finding |

31.3% of women undergo DXA; subset treated |

|

Cost savings with a 20% case finding increase |

USD 41.9 billion reduction in cumulative costs (2018-2040) |

|

Impact of a 50% increase in case finding |

61.3% scanned; 31% treated |

|

Cost savings with a 50% case finding increase |

USD 45.9 billion reduction in cumulative costs (2018-2040) |

|

Savings breakdown |

60% direct medical costs; 40% indirect costs |

|

Preventive services cost share |

<6% of total osteoporosis costs, despite increased diagnosis/treatment costs |

Source: NLM

Challenges

- Hurdles in payer acceptance and widespread adoption: The limitations in cost-effectiveness for premium-priced essentials available in the fracture fixation products market often prohibit insurers from providing financial backing. Thus, securing adequate reimbursement coverage to enable extensive adoption in this sector becomes a separate battle for manufacturers. This is ultimately restricting patient access to advanced solutions, particularly in price-sensitive regions, imposing an unavoidable obstacle in the pathway of globalization for the merchandise.

- Procurement processes and tender competitions: Public health systems mostly use bulk procurement contracts to reinforce medical essentials, which prioritize cost over innovation. As a result, to win such national tenders, manufacturers in the fracture fixation products market are forced to compete aggressively on pricing that often compresses profit margins. These events are further discouraging the introduction of novel but more expensive technologies, while fostering financial barriers for small- and medium-sized clinical service providers.

Fracture Fixation Products Market: Key Insights

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

6.6% |

|

Base Year Market Size (2025) |

USD 11 billion |

|

Forecast Year Market Size (2035) |

USD 19.5 billion |

|

Regional Scope |

|

Fracture Fixation Products Market Segmentation:

Product Segment Analysis

Internal fixation devices, such as plates, screws, and intramedullary nails, are predicted to dominate the fracture fixation products market with a share of 62.8% over the analyzed period. The superior outcomes attained by using these tools in providing stability for complex fractures, enabling early mobilization, and reducing hospital stays are the foundational pillars of the leadership. Moreover, due to being the most used component during a fixation treatment, companies are showing a high interest in bringing more innovative solutions for this segment. Following the same, in August 2024, Stryker introduced a new plating system, Pangea, to the market, which is designed to enhance trauma care for surgeons by enabling greater internal fixation and stabilization in a reliable and user-friendly way.

Application Segment Analysis

Lower extremity fractures, especially of the hip, knee, and ankle, are expected to represent the largest field of application in the fracture fixation products market by the end of 2035, while accounting for 48.5% revenue share. This primarily originates from the high volume of hip fractures in the elderly population, which are often classified as a public health crisis, considering their frequency and cost. Evidencing the same, a study published by the NLM in 2025 unveiled that 30% of all fractures occurring worldwide belong to lower extremity and pelvic fractures (LEPFs). It also highlighted the greater economic burden of hip fractures, which totaled an average of USD 23282.6 per patient recorded by a study conducted in the Netherlands.

Material Segment Analysis

Metallic implants are estimated to capture the highest share of 55.4% in the fracture fixation products market during the discussed timeline. Their wide acceptance and utility in this sector are primarily backed by unmatched capabilities and biocompatibility in stabilizing fractures without causing infection. Besides, the exceptional properties of stainless steel and titanium alloys support bone healing under mechanical stress, making them the gold standard for internal fixation products. Currently, the ongoing advances in production methods are helping curate better performance and safety out of metallic solutions, reinforcing the segment's forefront position in this field.

Our in-depth analysis of the fracture fixation products market includes the following segments:

| Segment | Subsegments |

|

Product |

|

|

Material |

|

|

Application |

|

|

End user |

|

|

Fracture Type |

|

|

Site of Fixation |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Fracture Fixation Products Market - Regional Analysis

North America Market Insights

North America is expected to hold the dominant share of 49.2% in the global fracture fixation products market over the assessed timeframe. High healthcare spending, coupled with being the epitome of early adoption of advanced surgical technologies, is consolidating the region’s proprietorship in this sector. On the other hand, the enlarging high-risk demography from an aging population, lifestyle-related conditions, and accidental injuries is fostering a substantial demand base for this category. Furthermore, the strong presence of leading MedTech innovators, favorable reimbursement frameworks, and continuous investment in R&D create a potential within the region to show remarkable progress in the upcoming years.

According to a report from the International Journal of Basic & Clinical Pharmacology, the number of individuals having osteoporosis in the U.S. crossed 10 million in 2025 alone. It also underscored the presence of an additional 44 million population with low bone mass, who are highly prone to developing this condition, across the country. This demographic trend signifies a consistent increase in demand in the fracture fixation products market, making the U.S. a dominant contributor to the regional revenue generation. Moreover, the presence of globally leading MedTech manufacturers and wide accessibility to specialized orthopedic care empower the nation’s significance in this sector.

Canada is also steadily growing in the fracture fixation products market in support of its publicly funded healthcare system and increasing focus on improving elderly care. Besides, as the country experiences a notable rise in fracture cases, particularly among its aging population, the surge in effective surgical interventions amplifies. Testifying to this epidemiology, the Bone and Joint Canada (BJC) estimated the annual costs to care for patients with hip fractures in Canada to surpass USD 2.4 billion by 2041. Thus, the country is highly focused on in-hospital infrastructure development, availability enhancement of orthopedic specialists, and widening of minimally invasive procedure adoption, contributing to the sector’s expansion.

APAC Market Insights

Asia Pacific is estimated to become the fastest-growing region in the global fracture fixation products market during the analyzed tenure. The region’s pace of progress is primarily propelled by the rapidly aging populations, rising incidence of trauma and osteoporotic fractures, and rapidly improving healthcare infrastructure. As evidence, an NLM study predicted more than 50% of hip fractures to occur in Asia by 2050. Particularly, in developing countries, including China, India, and Japan, the urge for advanced orthopedic treatments is witnessing a notable increase on account of the heightening spending on advanced surgical options. Besides, government-backed subsidies for surgeries performed in public settings are boosting access to adequate fracture care, raising adoption in this sector.

China plays a crucial role in expanding the Asia Pacific fracture fixation products market, which is backed by its massive population, rapid urbanization, and rising rates of road accidents and age-related bone disorders. Additionally, as the country faces a growing burden of osteoporosis and traumatic injuries, the demand for surgical fixation solutions is increasing steadily. Government efforts to expand healthcare coverage and centralize the medical system also make the products available in this sector more accessible.

India is emerging as a growth engine for the APAC fracture fixation products market. The country is augmenting the sector with its large patient population and a rising number of road traffic accidents and bone-related conditions. The rising awareness of orthopedic health, increasing access to healthcare facilities, and expansion of medical insurance are fueling demand for surgical components for fracture treatments. This can be testified by the growing trade of orthopedic appliances in India, which accounted for USD 355 million and USD 956 million in exports and imports, respectively, in 2023, as reported by the OEC.

Opportunities Presented by the Key Landscapes

|

Country |

Form & Characteristics of the Opportunity |

Timeline |

|

Japan |

The launch of the Bone Health Promotion Project by the alliance of Fujitsu and iSurgery |

2023-2025 |

|

China |

5,790,636 radius and/or ulna fractures occurred in 2021; the incidence is expected to rise from 427 to 502 per 100,000 by 2036 |

2021-2036 |

|

India |

4,61,312 road crashes killed 1,68,491 people, with 4,43,366 injured |

2022 |

Source: Company Press Release, Frontiers, and MoRTH

Europe Market Insights

Europe is anticipated to hold the second-largest share in the global fracture fixation products market between 2026 and 2035. The aging population, high prevalence of osteoporosis, and well-developed healthcare systems are the major growth factors behind the region’s consistent propagation in this sector. Evidencing such as a favorable demography, a report published by the International Journal of Basic & Clinical Pharmacology revealed that more than 22 million women and 5.5 million men in Europe were suffering from osteoporosis till 2025. It also mentioned that the region-wide annual expenditure on osteoporosis-related fractures can potentially rise from USD 43.0 billion to USD 89.2 billion by 2050.

The UK is a prominent landscape in the Europe fracture fixation products market, which is backed by a high incidence of fractures among its aging population and a strong public healthcare system. Osteoporosis-related fractures, especially hip and wrist, are becoming a national medical crisis, prompting service providers to accommodate reliable surgical fixation solutions for their enlarging patient populations. The nation’s focus on improving trauma care services, alongside investments in advanced orthopedic technologies, also supports substantial growth in this sector.

Germany is a leading supplier of associated devices for the fracture fixation products market in Europe. The strong presence of MedTech innovators and manufacturers empowers the country’s significance in this landscape. Its large geriatric population also results in a steady rise in osteoporosis-related fractures and trauma cases, hence benefiting the merchandise. Moreover, the hospitals, due to being well-equipped with cutting-edge orthopedic technologies and surgeons, are acting as the major influential factor behind the country’s impressive progress in this category.

Country-wise Export-Import Data for Orthopedic Appliances

(incl. Instruments for Fracture) (2023)

|

Country |

Trade Type |

Value (in USD, Billion) |

|

Germany |

Import |

5.0 |

|

Switzerland |

Export |

7.9 |

|

Netherlands |

Import |

8.9 |

|

Ireland |

Export |

7.6 |

Source: OEC

Key Fracture Fixation Products Market Players:

- Johnson & Johnson (DePuy Synthes)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Stryker Corporation

- Zimmer Biomet Holdings, Inc.

- Smith & Nephew plc

- Medtronic plc

- Arthrex, Inc.

- B. Braun Melsungen AG

- Össur

- Wright Medical Group N.V. (part of Stryker)

- Acumed LLC

- DJO Global, Inc.

- NuVasive, Inc.

- Globus Medical, Inc.

- Orthofix Medical Inc.

- Citieffe S.r.l.

- LimaCorporate S.p.A.

- aap Implantate AG

- MicroPort Scientific Corporation

- Sree Chitra Tirunal Institute

The competitive thresholds of the fracture fixation products market are shaped by the strategic commercial operations and gains from global and regional MedTech pioneers. These players are increasingly focusing on innovation, product quality, and pricing to procure better consumer response and profit margins. The cohort of such global leaders is primarily consolidated by Johnson & Johnson (DePuy Synthes), Stryker, Zimmer Biomet, Smith & Nephew, and Medtronic, who strengthen their position by extending their product portfolios and distribution networks. At the same time, emerging companies and regional manufacturers are gaining traction by offering cost-effective alternatives, especially in price-sensitive markets.

These players are:

Recent Developments

- In October 2024, Johnson & Johnson MedTech launched its next-generation plating system, VOLT Variable Angle Optimized Locking Technology, evolving the company’s fracture management solutions portfolio. The tool is designed to improve stability, enhance performance, and increase efficiency.

- In March 2024, Stryker commercialized its Gamma4 Hip Fracture Nailing System in key markets in Europe after attaining CE certification in September 2023. The newest addition provides surgeons with streamlined procedural workflows while treating hip and femur fractures.

- Report ID: 5233

- Published Date: Sep 03, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Fracture Fixation Products Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.