- An Outline of the Foot Orthotic Insoles Market

- Market Definition

- Market Segmentation

- Product Overview

- Assumptions and Acronyms

- Research Methodology & Approach

- Research Process

- Primary Research

- Manufacturers

- End Users

- Secondary Research

- Market Size Estimation

- Summary of the Report for Key Decision Maker

- Forces of the Market Constituents

- Factors/drivers impacting the growth of the market

- Market trends for better business practices

- Key Market Opportunities for Business Growth

- Major Roadblocks for the Market Growth

- Decarbonization Strategy and carbon Benefits for Market Players

- Global Government Decarbonization Plans/Goals by Each Country under 2015 Agreement Agreed by 200 Countries

- Measures taken by Countries to Reduce Carbon Footprints

- Carbon Credits and Subsidy Plans/Benefits Rolled out by the Government for Market Players

- Effective Ways to Harness Carbon-Credits and Impact on Profit Margins

- Demand Impact on the Companies Opting for Carbon Credits

- Government Regulation

- Technology Transition and Adoption Analysis in Foot Orthotics

- Industry Risk Analysis

- Global Economic Outlook: Challenges for Global Recovery and its Impact on Global Foot Orthotic Insoles Market

- Ukraine-Russia crisis

- Potential US economic slowdown

- Industrial Pricing Benchmarking & Analysis

- Industry Growth Outlook

- Industry Supply Chain Analysis

- Analysis on Ongoing Technological Advancement in Foot Orthotic Insoles Market

- CAD/ CAM

- Scanning and 3D printing technology

- Additive Manufacturing (AM)

- Other

- Analysis on Orthotic Insole Development

- Analysis on the use of Foot Orthotic Insole

- Foot orthoses for people with rheumatoid arthritis

- Foot orthoses for people with diabetes

- Others

- Competitive Positioning: Strategies to differentiate a company from its competitors

- Competitive Model: A Detailed Inside View for Investors

- Market share of major companies profiled, 2023

- Business Profiles of Key Enterprises

- Foot Science International

- Aetrex Inc.

- Superfeet Worldwide, Ltd.

- Algeos Ltd.

- Digital Orthotics Laboratories Australia Pty Ltd

- DARCO Medical India Pvt. Ltd.

- Foot Levelers, Inc.

- Bauerfeind

- Footlogics USA

- PROFOOT INC.

- SIDAS

- Business Profiles of Key Enterprises

- Market share of major companies profiled, 2023

- Global Foot Orthotic Insoles Market Outlook & Projections, Opportunity Assessment, 2023-2036

- Market Overview

- Market Revenue by Value (USD Million), Volume (Thousand Units) and Compound Annual Growth Rate (CAGR)

- Year-on-Year (Y-o-Y) Growth Trend Analysis

- By Material

- Thermoplastics, Market Value (USD Million), Market Volume (Thousand Units), CAGR, 2023-2036F

- Polyethylene Foams, Market Value (USD Million), Market Volume (Thousand Units), CAGR, 2023-2036F

- Leather, Market Value (USD Million), Market Volume (Thousand Units), CAGR, 2023-2036F

- Cork, Market Value (USD Million), Market Volume (Thousand Units), CAGR, 2023-2036F

- Composite Carbon Fibers, Market Value (USD Million), Market Volume (Thousand Units), CAGR, 2023-2036F

- Ethyl-Vinyl Acetates (EVAs), Market Value (USD Million), Market Volume (Thousand Units), CAGR, 2023-2036F

- Others, Market Value (USD Million), Market Volume (Thousand Units), CAGR, 2023-2036F

- By Type

- Pre-fabricated, Market Value (USD Million), Market Volume (Thousand Units), CAGR, 2023-2036F

- Custom Made, Market Value (USD Million), Market Volume (Thousand Units), CAGR, 2023-2036F

- By Age Group

- Adults, Market Value (USD Million), Market Volume (Thousand Units), CAGR, 2023-2036F

- Pediatrics, Market Value (USD Million), Market Volume (Thousand Units), CAGR, 2023-2036F

- By Distribution Channel

- Online, Market Value (USD Million), Market Volume (Thousand Units), CAGR, 2023-2036F

- Offline, Market Value (USD Million), Market Volume (Thousand Units), CAGR, 2023-2036F

- By Application

- Medical, Market Value (USD Million), Market Volume (Thousand Units), CAGR, 2023-2036F

- Personal Comfort, Market Value (USD Million), Market Volume (Thousand Units), CAGR, 2023-2036F

- By Geography

- North America, Market Value (USD Million), Market Volume (Thousand Units), CAGR, 2023-2036F

- Asia Pacific, Market Value (USD Million), Market Volume (Thousand Units), CAGR, 2023-2036F

- Europe, Market Value (USD Million), Market Volume (Thousand Units), CAGR, 2023-2036F

- Middle Est & Africa, Market Value (USD Million), Market Volume (Thousand Units), CAGR, 2023-2036F

- Latin America, Market Value (USD Million), Market Volume (Thousand Units), CAGR, 2023-2036F

- Cross Analysis of Global Foot Orthotic Insoles Market by Material w.r.t. Application (Value and Volume)

- By Material

- North America Foot Orthotic Insoles Market Outlook & Projections, Opportunity Assessment, 2023-2036

- Market Overview

- Analysis on Govt. Guidelines, Trends, and Other Factors in the region & Impact on Y-O-Y Revenue

- Market Revenue by Value (USD Million), Volume (Thousand Units) and Compound Annual Growth Rate (CAGR)

- Market Segmentation Analysis 2023-2036

- By Material

- Thermoplastics, Market Value (USD Million), Market Volume (Thousand Units), CAGR, 2023-2036F

- Polyethylene Foams, Market Value (USD Million), Market Volume (Thousand Units), CAGR, 2023-2036F

- Leather, Market Value (USD Million), Market Volume (Thousand Units), CAGR, 2023-2036F

- Cork, Market Value (USD Million), Market Volume (Thousand Units), CAGR, 2023-2036F

- Composite Carbon Fibers, Market Value (USD Million), Market Volume (Thousand Units), CAGR, 2023-2036F

- Ethyl-Vinyl Acetates (EVAs), Market Value (USD Million), Market Volume (Thousand Units), CAGR, 2023-2036F

- Others, Market Value (USD Million), Market Volume (Thousand Units), CAGR, 2023-2036F

- By Type

- Pre-fabricated, Market Value (USD Million), Market Volume (Thousand Units), CAGR, 2023-2036F

- Custom Made, Market Value (USD Million), Market Volume (Thousand Units), CAGR, 2023-2036F

- By Age Group

- Adults, Market Value (USD Million), Market Volume (Thousand Units), CAGR, 2023-2036F

- Pediatrics, Market Value (USD Million), Market Volume (Thousand Units), CAGR, 2023-2036F

- By Distribution Channel

- Online, Market Value (USD Million), Market Volume (Thousand Units), CAGR, 2023-2036F

- Offline, Market Value (USD Million), Market Volume (Thousand Units), CAGR, 2023-2036F

- By Application

- Medical, Market Value (USD Million), Market Volume (Thousand Units), CAGR, 2023-2036F

- Personal Comfort, Market Value (USD Million), Market Volume (Thousand Units), CAGR, 2023-2036F

- By Country

- US, Market Value (USD Million), Market Volume (Thousand Units), CAGR, 2023-2036F

- Canada, Market Value (USD Million), Market Volume (Thousand Units), CAGR, 2023-2036F

- By Material

- Europe Foot Orthotic Insoles Market Outlook & Projections, Opportunity Assessment, 2023-2036

- Market Overview

- Analysis on Govt. Guidelines, Trends, and Other Factors in the region & Impact on Y-O-Y Revenue

- Market Revenue by Value (USD Million), Volume (Thousand Units) and Compound Annual Growth Rate (CAGR)

- Market Segmentation Analysis 2023-2036

- By Material

- By Type

- By Indication

- By Demography

- By End-User

- By Country

- Germany, Market Value (USD Million), Market Volume (Thousand Units), CAGR, 2023-2036F

- France, Market Value (USD Million), Market Volume (Thousand Units), CAGR, 2023-2036F

- UK, Market Value (USD Million), Market Volume (Thousand Units), CAGR, 2023-2036F

- Italy, Market Value (USD Million), Market Volume (Thousand Units), CAGR, 2023-2036F

- Spain, Market Value (USD Million), Market Volume (Thousand Units), CAGR, 2023-2036F

- Netherlands, Market Value (USD Million), Market Volume (Thousand Units), CAGR, 2023-2036F

- Russia, Market Value (USD Million), Market Volume (Thousand Units), CAGR, 2023-2036F

- Rest of Europe, Market Value (USD Million), Market Volume (Thousand Units), CAGR, 2023-2036F

- Asia Pacific Foot Orthotic Insoles Market Outlook & Projections, Opportunity Assessment, 2023-2036

- Market Overview

- Analysis on Govt. Guidelines, Trends, and Other Factors in the region & Impact on Y-O-Y Revenue

- Market Revenue by Value (USD Million), Volume (Thousand Units) and Compound Annual Growth Rate (CAGR)

- Market Segmentation Analysis 2023-2036

- By Material

- By Type

- By Age Group

- By Distribution Channel

- By Application

- By Country

- China, Market Value (USD Million), Market Volume (Thousand Units), CAGR, 2023-2036F

- Japan Market Value (USD Million), Market Volume (Thousand Units), CAGR, 2023-2036F

- India, Market Value (USD Million), Market Volume (Thousand Units), CAGR, 2023-2036F

- South Korea, Market Value (USD Million), Market Volume (Thousand Units), CAGR, 2023-2036F

- Australia, Market Value (USD Million), Market Volume (Thousand Units), CAGR, 2023-2036F

- Singapore, Market Value (USD Million), Market Volume (Thousand Units), CAGR, 2023-2036F

- Rest of Asia Pacific, 2023-2036F (USD Million)

- Latin America Foot Orthotic Insoles Market Outlook & Projections, Opportunity Assessment, 2023-2036

- Market Overview

- Analysis on Govt. Guidelines, Trends, and Other Factors in the region & Impact on Y-O-Y Revenue

- Market Revenue by Value (USD Million), Volume (Thousand Units) and Compound Annual Growth Rate (CAGR)

- Market Segmentation Analysis 2023-2036

- By Material

- By Type

- By Age Group

- By Distribution Channel

- By Application

- By Country

- Brazil, Market Value (USD Million), Market Volume (Thousand Units), CAGR, 2023-2036F

- Argentina Market Value (USD Million), Market Volume (Thousand Units), CAGR, 2023-2036F

- Mexico, Market Value (USD Million), Market Volume (Thousand Units), CAGR, 2023-2036F

- Rest of Latin America, Market Value (USD Million), Market Volume (Thousand Units), CAGR, 2023-2036F

- Middle East & Africa Foot Orthotic Insoles Market Outlook & Projections, Opportunity Assessment,2023-2036

- Market Overview

- Analysis on Govt. Guidelines, Trends, and Other Factors in the region & Impact on Y-O-Y Revenue

- Market Revenue by Value (USD Million), Volume (Thousand Units) and Compound Annual Growth Rate (CAGR)

- Market Segmentation Analysis 2023-2036

- By Material

- By Type

- By Age Group

- By Distribution Channel

- By Application

- By Country

- GCC, Market Value (USD Million), Market Volume (Thousand Units), CAGR, 2023-2036F

- Israel Market Value (USD Million), Market Volume (Thousand Units), CAGR, 2023-2036F

- South Africa, Market Value (USD Million), Market Volume (Thousand Units), CAGR, 2023-2036F

- Rest of Middle East & Africa, Market Value (USD Million), Market Volume (Thousand Units), CAGR, 2023-2036F

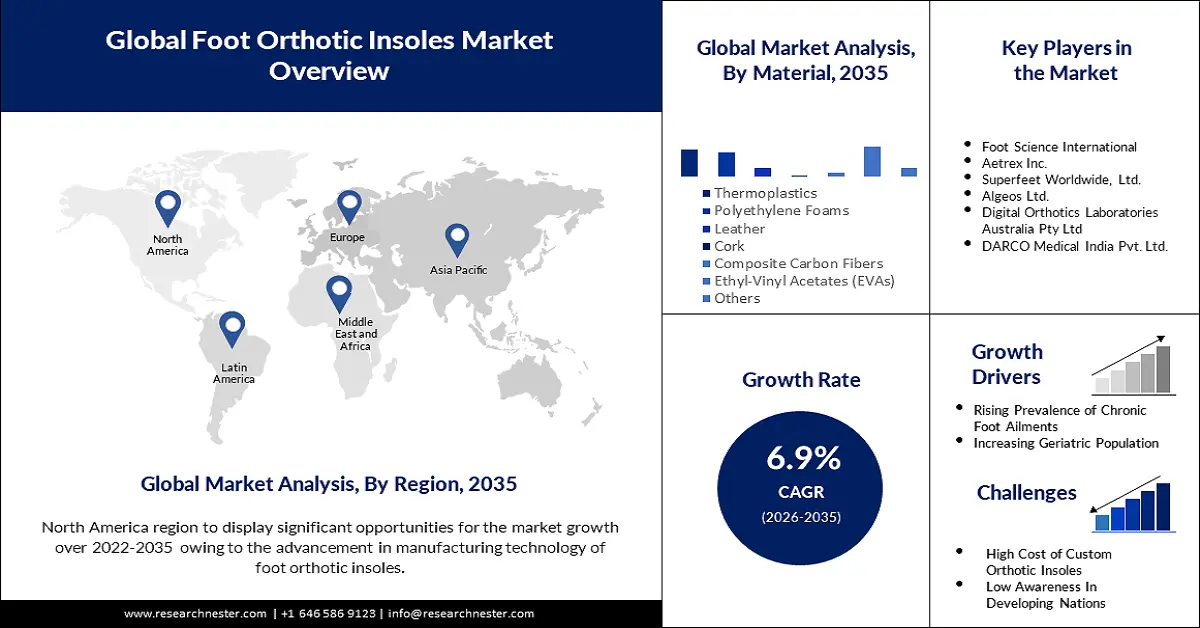

Foot Orthotic Insoles Market Outlook:

Foot Orthotic Insoles Market size was over USD 4.22 Billion in 2025 and is anticipated to cross USD 8.22 Billion by 2035, growing at more than 6.9% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of foot orthotic insoles is assessed at USD 4.48 Billion.

The demand for foot orthotic insoles is rapidly rising due to the increasing prevalence of diabetes and arthritis globally. According to the Institute for Health Metrics and Evaluation (IHME), diabetes is one of the top 10 leading causes of disability and death, and global cases of diabetes are expected to reach 1.3 billion by 2050. A similar analysis by IHME published in August 2023 states that more than 1 billion people will be living with osteoarthritis by 2050. This rising prevalence has encouraged healthcare industry giants to develop foot orthotic insoles with advanced technologies. For instance, in September 2020, Aetrex, a global player in designing and developing comfort shoes, orthotics, and wellness products announced the launch of the thinnest 3D-printed insoles in partnership with EOS.

Besides this, the rising cases of musculoskeletal disorders are expected to boost the overall foot orthotic insoles market growth. As per recent data by WHO, around 1.71 billion people in the world are living with musculoskeletal disorders. The primary reasons for this cause of harsh work environment and performance work. However, the person with musculoskeletal can carry on their chores pain-free by using foot insoles.

Key Foot Orthotic Insoles Market Insights Summary:

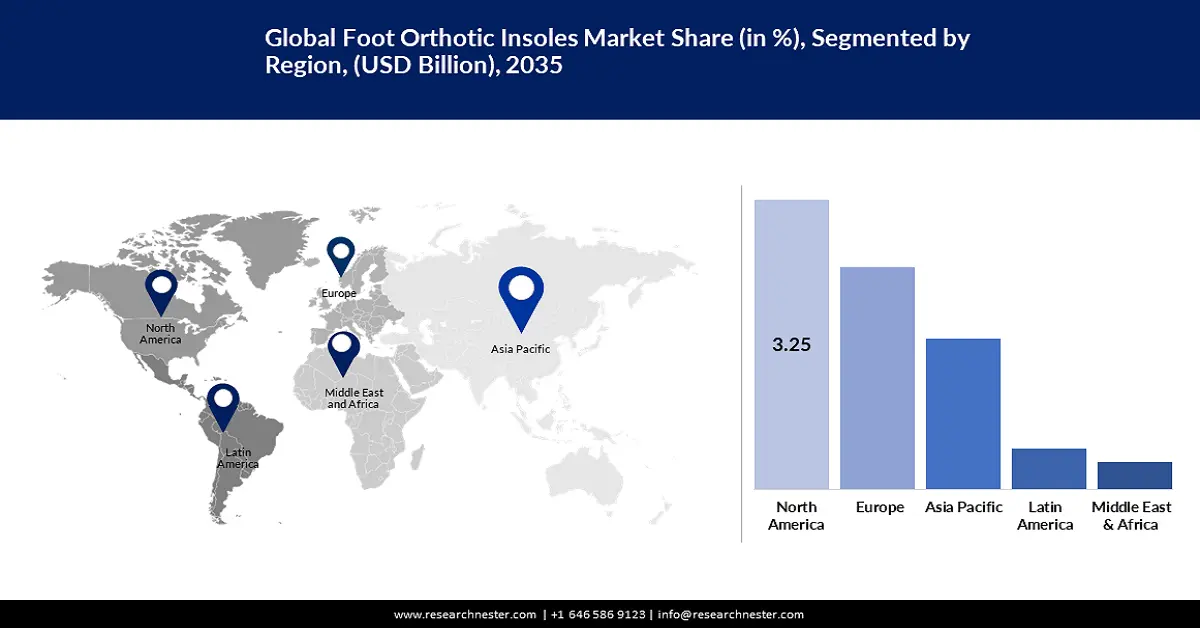

Regional Highlights:

- North America foot orthotic insoles market will hold over 39% share by 2035, fueled by high foot disorder prevalence and e-commerce growth.

- Europe market will register substantial CAGR during 2026-2035, attributed to rising cases of arthritis across the region.

Segment Insights:

- The custom-made type segment in the foot orthotic insoles market is poised for substantial growth during 2026-2035, driven by rising foot disorders, adoption of tailor-made insoles, and advancements in 3D printing.

- The ethyl-vinyl acetates (EVAs) material segment in the foot orthotic insoles market is anticipated to hold the largest share by 2035, driven by the rising prevalence of foot deformities and widespread use of EVAs in insoles manufacturing.

Key Growth Trends:

- Increasing geriatric population

- Rising e-commerce sales and awareness campaigns by healthcare providers

Major Challenges:

- High cost of custom orthotic insoles

- Lack of awareness

Key Players: Foot Science International, Aetrex Inc., Superfeet Worldwide, Ltd., Algeos Ltd., Digital Orthotics Laboratories Australia Pty Ltd, DARCO Medical India Pvt. Ltd., Foot Levelers, Inc., Bauerfeind, Footlogics USA, PROFOOT INC., SIDAS.

Global Foot Orthotic Insoles Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 4.22 Billion

- 2026 Market Size: USD 4.48 Billion

- Projected Market Size: USD 8.22 Billion by 2035

- Growth Forecasts: 6.9% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (39% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, Japan, China, United Kingdom

- Emerging Countries: China, India, Brazil, Mexico, South Korea

Last updated on : 10 September, 2025

Foot Orthotic Insoles Market Growth Drivers and Challenges:

Growth Drivers

- Increasing geriatric population: The rising geriatric population across the globe is a key factor driving the foot orthotic insoles market demand. As per UN reports, in 2020, there were 727 million people worldwide who were 65 or older. By 2050, this figure is expected to rise more than double, reaching over 1.5 billion people. Orthotic insoles offer essential support to the foot by improving foot alignment, reducing pain, and preventing further complications.

- Rising e-commerce sales and awareness campaigns by healthcare providers: The rapid expansion of e-commerce platforms and rising efforts by sales channels to reach untapped markets is predicted to impel the foot orthotic insoles market growth. Different types of foot orthotic insoles are easily available on these online platforms at comparatively cheaper rates.

Challenges

- High cost of custom orthotic insoles: The high cost of custom foot orthotic insoles is a major factor expected to hamper foot orthotic insoles market growth. Several custom orthotics are made to fit a particular foot and treat individual foot ailments. In contrast to over-the-counter insoles, these products are typically more expensive.

- Lack of awareness: Many potential users are unaware of the benefits of orthotic insoles, especially in emerging economies. This can hamper the overall adoption rates going ahead. In addition, lack of distribution networks and limited access to certified podiatrists will affect market expansion.

Foot Orthotic Insoles Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6.9% |

|

Base Year Market Size (2025) |

USD 4.22 Billion |

|

Forecast Year Market Size (2035) |

USD 8.22 Billion |

|

Regional Scope |

|

Foot Orthotic Insoles Market Segmentation:

Material Segment Analysis

The ethyl-vinyl acetates (EVAs) segment is estimated to account for the largest foot orthotic insoles market share during the forecast period owing to the rising prevalence of foot deformities and foot pain and the widespread use of ethyl vinyl acetate in orthotic insoles manufacturing. EVA is expected to remain the most preferred material, maintaining about 20-25% share of the total market due to rapid advancements in insole manufacturing. These products offer excellent arch support and cushioning and are widely available across several platforms.

Type Segment Analysis

The custom-made foot orthotic insoles segment in the foot orthotic insoles market is likely to register 61% revenue share by 2035, led by rising prevalence of foot disorders, high adoption of tailor-made foot insoles for the geriatric population, and rapid advancements in 3D printing and CAD/CAM systems that enable precise customization and faster production. In addition, increasing workplace ergonomics focus and rising preference for generic to customized insoles has encouraged key players to develop novel technology and solutions.

Our in-depth analysis of the global foot orthotic insoles market includes the following segments:

|

Material |

|

|

Type |

|

|

Age Group |

|

|

Distribution Channel |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Foot Orthotic Insoles Market Regional Analysis:

North American Market Insights

North America is expected to lead the global foot orthotic insoles market with a 39% share by 2035, propelled by increasing investments from both public and private players, high prevalence of foot-related disorders, and the presence of well-established healthcare services and infrastructure. Innovations in material, manufacturing processes, and customization options and the rapid expansion of e-commerce platforms have resulted in growing popularity of foot orthotic insoles in this region.

In the U.S., sedentary lifestyles and obesity have resulted in increasing conditions, and according to reports, 0.8% population experience plantar fasciitis and heel spurs. This has resulted in a growing need for comfortable and effective foot orthotic insoles. Moreover, as the U.S. is at the forefront of integrating advanced technologies, several key players are developing orthotic insoles using 3D printing and CAD/CAM technologies to cater to rising consumer demand. These products are also popular among fitness and sports enthusiasts to prevent injuries and enhance their performance.

Canada has a rapidly aging demographic, with older adults seeking orthotic foot insoles for managing mobility issues and conditions like arthritis and diabetes. Moreover, increasing awareness about preventive foot care, and rising investments by key players to expand their product base in the country are set to impel the market revenue in Canada.

Europe Market Insights

Europe region is anticipated to observe substantial growth through 2035. According to WHO, the cases of osteoarthritis have increased by 54% in the last 30 years. Currently in Western Europe, there are nearly 57 million people are suffering from arthritis. This is also expected to fuel the demand for foot orthotic insoles in the coming years. In March 2021, Norfolk Biomechanics Clinic announced the launch of in-house 3D printing manufacturing technology for medical orthotic insoles.

The market in Germany is expected to hold a robust share between 2026 and 2035, attributed to rising aging population and increasing investments in innovative products and manufacturing processes like composite carbon fiber to produce more effective and durable orthotic insoles.

Foot Orthotic Insoles Market Players:

- Foot Science International

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Aetrex Inc.

- Superfeet Worldwide, Ltd.

- Algeos Ltd.

- Digital Orthotics Laboratories Australia Pty Ltd

- DARCO Medical India Pvt. Ltd.

- Foot Levelers, Inc.

- Bauerfeind

- Footlogics USA

- PROFOOT INC.

- SIDAS

The global foot orthotic insoles market is experiencing significant growth driven by the rising prevalence of diabetes and foot disorders and the increasing geriatric population. The market is highly competitive, comprising key players operating at global and regional levels. These key players are focused on developing advanced technologies and products to cater to the rising demand. Here is a list of key players operating in the global market:

Recent Developments

- In April 2022, Ortholit announced the launch of a new electrostatic discharge (ESD) insole technology designed for work and service footwear. This technology is expected to offer mechanically bonded electrostatic discharge protection, enhancing the functionality of orthotic insoles in specific work environments.

- In April 2022, Foot Solutions, Inc., a leading retailer of wellness footwear and tailor-made orthotic insoles acquired Happy Feet Plus, Inc., a Florida-based retailer to enhance its product base.

- Report ID: 4528

- Published Date: Sep 10, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Foot Orthotic Insoles Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.