Product Overview

Fluoroscopy is an imaging technique that involves the generation of the real time images of the internal organs with the help of the X-rays. The fluoroscopy technique enables the physician to view the internal structure and function of the patient on a digital monitor. It is widely used for the imaging of the gastrointestinal tract in order to diagnose ulcers, tumors, inflammation etc. It is also used for various surgeries. Fluoroscopy instruments are used with c-arms which enables the view of the image from different angles. Fluoroscopy is performed for the evaluation of the definite areas of the body including bones, muscles and joints.

Market Size and Forecast

The global fluoroscopy market is anticipated to expand at a significant CAGR during 2018-2027. The rising prevalence of the chronic diseases coupled with growing demand for the minimally invasive surgeries is anticipated to be key factor for the growth of the global fluoroscopy market.The global fluoroscopy market can be segmented on the basis of surgery, end-use and region. On the basis of surgery, it is sub-segmented into biopsy, cardiovascular interventions, orthopedic surgeries and others. The cardiovascular interventions are anticipated to be the largest sub-segment of the surgery segment during the forecast period. The increasing prevalence of the cardiovascular diseases is anticipated to be the major factor for the increasing demand for the cardiovascular interventions surgery sub-segment during the forecast period. On the basis of end-use, it is sub-segmented into diagnostic centers, hospitals and clinics. Hospitals is anticipated to be the leading sub-segment during the forecast period. This is on the account of large pool of patients coupled with availability of the high quality healthcare infrastructure.

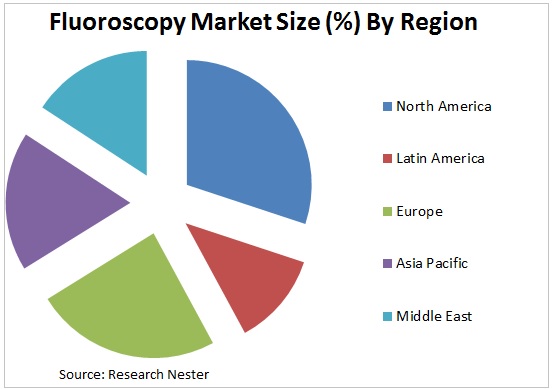

By region, global fluoroscopy market is segmented into North America, Asia-Pacific, Latin America, Europe, Middle East and Africa. North America is anticipated to contribute the largest market share for the global fluoroscopy market during the forecast period. The availability of highly developed healthcare infrastructure in the region coupled with enhanced reimbursement policies is estimated to be the major factor for the region to lead the global fluoroscopy market during the forecast period. Asia-Pacific region is anticipated to be the fastest growing region for the global fluoroscopy market. The rising geriatric population in the Asia Pacific region is increasing the demand for the better diagnosis which in turn is anticipated to boost the market growth of the fluoroscopy during the forecast period.

Market Segmentation

Our in-depth analysis segmented the global fluoroscopy market in the following segments:

By Surgery:

- Biopsy

- Cardiovascular interventions

- Orthopedic surgeries

- Others

By End-Use:

- Diagnostic centers

- Hospitals

- Clinics

By Region

Global fluoroscopy market is further classified on the basis of region as follows:

- North America (U.S. & Canada) Market size, Y-O-Y growth & Opportunity Analysis

- Latin America (Brazil, Mexico, Argentina, Rest of Latin America) Market size, Y-O-Y growth & Opportunity Analysis

- Europe (Germany, UK, France, Italy, Spain, BENELUX, NORDIC, Hungary, Poland, Turkey, Russia, Rest of Europe) Market size, Y-O-Y growth & Opportunity Analysis

- Asia-Pacific (China, India, Japan, South Korea, Indonesia, Malaysia, Australia, New Zealand, Rest of Asia Pacific) Market size, Y-O-Y growth & Opportunity Analysis

- Middle East and Africa (Israel, GCC, North Africa, South Africa, Rest of Middle East and Africa) Market size, Y-O-Y growth & Opportunity Analysis

Growth Drivers and Challenges

The rising demand for the minimally invasive techniques for the treatment of the diseases is anticipated to be the primary growth driver for the global fluoroscopy market. The increasing demand for the cost-efficiency, safety and rapid recovery from chronic disease is anticipated boost the demand for the fluoroscopy. The favorable government policies for proper reimbursement of the diagnosis is driving the global fluoroscopy market. The various other drivers for the global fluoroscopy market are high image quality and dose reduction. The increasing number of hospitals and physician across the globe is anticipated to boost the growth of the global fluoroscopy market during the forecast period. The increasing investment in the research and development by various companies operating in the fluoroscopy market is estimated to further propel the market growth of the fluoroscopy throughout the forecast period. Additionally, the favorable healthcare policies is also expected to fuel the growth of the fluoroscopy market.

However, risk associated with the radiation is anticipated to restrain the growth of the global fluoroscopy market during forecast period.

Top Featured Companies Dominating The Market

- GE Healthcare

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Toshiba Medical Systems Corporation

- Orthoscan Inc.

- Canon U.S.A. Inc.

- Shimadzu Corporation

- Hologic Inc.

- Carestream Health

- Siemens Medical Solutions

- Philips N.V.

- Hitachi Ltd.

- Amico X-ray technologies

- Ziehm Imaging GmbH

- Report ID: 738

- Published Date: Feb 09, 2023

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Fluoroscopy Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert