Fluoro Enzymatic Assays Market Outlook:

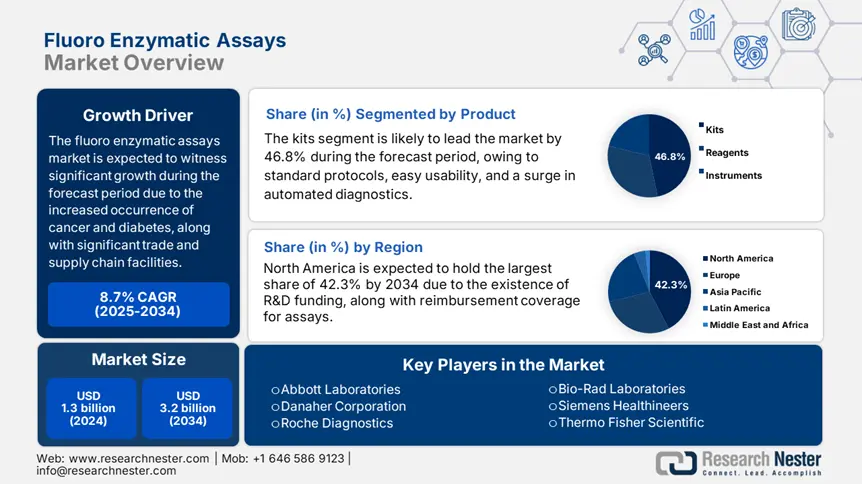

Fluoro Enzymatic Assays Market size was USD 1.3 billion in 2024 and is anticipated to reach USD 3.2 billion by the end of 2034, growing at a CAGR of 8.7% during the forecast period, i.e., 2025-2034. In 2025, the industry size of fluoro enzymatic assays is evaluated at USD 1.6 billion.

The international patient pool in the market effectively demands therapeutic and diagnostic solutions, which is continuously expanding based on an increase in the need for precision medicines and a rise in chronic disorder occurrence. As per a report published by the World Health Organization (WHO) in 2023, an estimated 425 million people across nations are suffering from diabetes, while cancer cases are expected to increase by 57% by the end of 2030. Besides, the supply chain for the market includes medical-grade microplate readers, specialized reagents, and active pharmaceutical ingredients (APIs), which are initially supplied from China, the U.S., and Germany, thereby suitable for uplifting the market demand.

Furthermore, economic-based indicators have revealed that the producer price index (PPI) has increased to 6.9% for diagnostic enzymes, thereby reflecting a surge in energy and material expenses. Likewise, the consumer price index has also boosted by 4.5% for clinical laboratory services, highly attributed to the need for high-sensitivity testing. Besides, private and government investments for conducting research, development, and deployment (RDD) are robust, with the NIH providing a USD 2.7 billion fund for enzymatic assay-based diagnostics as of 2024. Meanwhile, the export for the market has been growing by 9.4% since 2023, deliberately led by Germany and the U.S., thus denoting a positive impact on the market.

Fluoro Enzymatic Assays Market - Growth Drivers and Challenges

Growth Drivers

- High-throughput drug discovery requirement: The pharmaceutical’s R&D, with a focus on enzymatic high-throughput screening (HTS), is effectively rearranging the overall market. In this regard, the NIH made an allocation of USD 2.9 billion as of 2024 for neurology and oncology HTS, which has readily underscored this sudden transition. Besides, automation in platforms such as PerkinElmer’s Echo MS currently processes 100,200 assays per day, which has reduced drug discovery expenses by at least 26%, thereby suitable for uplifting the market across different nations.

- Unattended demand in emerging economies: The existence of cost-effective barriers represents more than USD 1.6 billion opportunity for the fluoro enzymatic assays market to flourish globally. For instance, in India, public laboratories conduct only 17% of the required assays, of which the private industry pricing denotes 5.5 times increase in comparison to equivalents from Western countries. Besides, there has been an emergence of local solutions, including Brazil’s Fiocruz scaling up dengue identification kits by almost 250%, and the launch of BGI from China introduced a USD 16 hepatitis B assay, thus creating an optimistic outlook for the market.

Challenges

- Increased out-of-pocket expenses: The aspect of cost-effectiveness is a huge barrier in the overall fluoro enzymatic assays market, particularly common across Latin America, Africa, and Asia, wherein almost 85% of patients initiate purchase for assays out of their budget. For instance, private sector testing in India usually costs around 4.5 times more than public alternatives, thereby making them expensive for 90% of the overall country’s population, and leaving at least 9 million underserved patients. However, organizations are addressing this issue by localizing pricing and PPP models, thus creating a scope for market growth.

- Susceptibilities in the supply chain dynamics: The global market depends on a fragile supply chain, with an estimated 97% of fluorescent dyes supplied from only two suppliers in China. Besides, during the COVID-19 pandemic, there have been delays in shipments, which led to 6.5-month backlogs, and meanwhile, tensions in the U.S.-China trade arose, thus triggering a 30% surge in expenses, especially for severe reagents. Besides, geopolitical challenges further compounded the issue, and the invasion of Russia over Ukraine gradually interrupted the supply of argon gas, thereby causing a hindrance in the market.

Fluoro Enzymatic Assays Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2024 |

|

Forecast Year |

2025-2034 |

|

CAGR |

8.7% |

|

Base Year Market Size (2024) |

USD 1.3 billion |

|

Forecast Year Market Size (2034) |

USD 3.2 billion |

|

Regional Scope |

|

Fluoro Enzymatic Assays Market Segmentation:

Product Segment Analysis

Based on the product, the kits segment in the fluoro enzymatic assays market is expected to hold the highest share of 46.8% by the end of 2034. The segment’s growth is effectively fueled by an increase in automation for diagnostics, ease of usability, and standardized protocols. According to an article published by the NIH in 2024, there has been an increase in assay kits adoption by almost 28% as of 2022, since they can reduce human error as well as diminish laboratory preparation. Besides, the 2023 FDA guidelines have further mandated kit-driven validation to conduct clinical studies and successfully reinforce the demand.

Application Segment Analysis

Based on the application, the drug discovery segment in the fluoro enzymatic assays market is expected to hold the second-highest share of 40.2% during the forecast timeline. The segment’s development is attributed to the demand for high-throughput screening, along with a surge in R&D investments to ensure pharmaceutical upliftment. For instance, more than 70% of the top 25 pharmaceutical organizations currently utilize fluoro enzymatic assays for identifying targets and diminish discovery duration by at least 45%. Besides, almost 50% of the enzymatic assay requirement originates from cancer biomarkers, with Alzheimer’s research accounting for approximately 22% growth, thereby suitable for the segment’s exposure.

Our in-depth analysis of the global fluoro enzymatic assays market includes the following segments:

|

Segment |

Subsegment |

|

Product |

|

|

Application |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Fluoro Enzymatic Assays Market - Regional Analysis

North America Market Insights

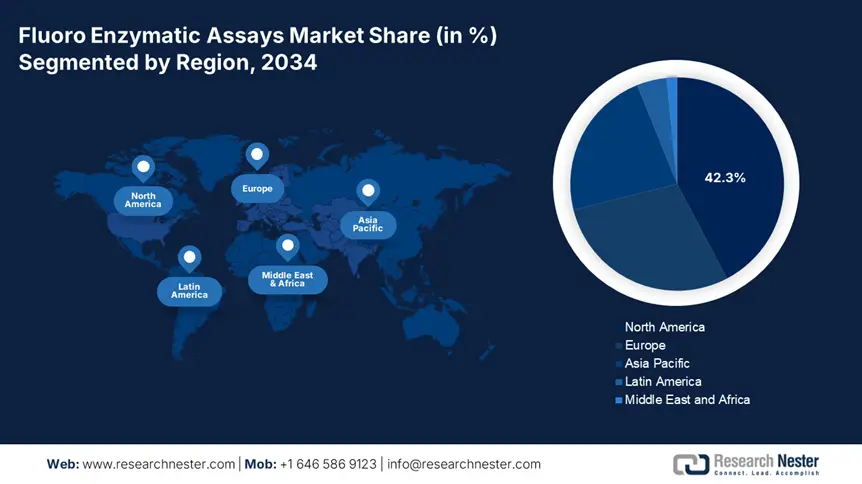

North America in the fluoro enzymatic assays market is dominating and is projected to grab the largest revenue share of 42.3% by the end of 2034. The market’s growth in the region is highly attributed to the NIH’s USD 2.6 billion R&D-based enzymology funding, along with Medicare’s USD 1.4 billion coverage for assays. Besides, high-throughput drug discovery effectively accounts for 47.5% of usability, of which at least 8 out of 12 top pharmaceutical organizations depend on these assays. Meanwhile, Canada is also contributing towards market growth in the region with an increase in spending on precision diagnostics.

The fluoro enzymatic assays market in the U.S. is dominating the region with a worldwide share of 39.5%, which is effectively driven by the USD 2.8 billion NIH grants for enzymology as well as Medicare service facilities. Besides, an estimated 95% of top pharma companies are readily utilizing assays based on the aspect of drug discovery. In addition, the CDC government report has revealed that point-of-care evaluation is also expanding by almost 30% as of 2024. Therefore, all these factors are deliberately driving the market growth in the country.

The fluoro enzymatic assays market in Canada is also growing at a 7.1% rate, which is backed by the USD 325 million federal funding. Besides, there has been a surge of 18.5% in Ontario for assays between 2021 and 2024, which has enhanced accessibility for almost 200,250 patients. Additionally, private and public partnerships, for instance, BioCanRx’s USD 55 million investment, have escalated the oncology assay integration. However, the supply chain dependency on the EU and the U.S. imports, catering to an estimated 85%, is a bottleneck, thus creating a gap in the market expansion.

Trade and Supply Chain Dynamics for the Fluoro Enzymatic Assays Market in North America (U.S. and Canada) from 2021-2025:

|

Category |

2021 |

2023 |

2025 |

|

API Imports (U.S.) |

69% from EU/China |

73% from EU/China |

68% (EU shift due to tariffs) |

|

Local Production (U.S.) |

13 facilities (GMP-certified) |

16 facilities (+25.5%) |

20 facilities (55% growth) |

|

Canada-Mexico Trade |

USD 124 million assay component trade |

USD 185 million (+51.5%) |

USD 225 million (22.5% CAGR) |

|

Cold Chain Logistics |

47% labs with full compliance |

66% (+22pp) |

82% (FDA mandate by 2025) |

|

U.S.-Canada API Trade |

USD 95 million |

USD 117 million (+29%) |

USD 144 million (23% CAGR) |

APAC Market Insights

Asia Pacific in the fluoro enzymatic assays market is considered the fastest-growing region with an expected share of 22.8% during the forecast period. The market’s upliftment in the region is effectively fueled by government-based diagnostic expansion, along with a rise in chronic disease incidences. China is deliberately dominating the region, attributed to its USD 1.4 billion NMPA investment for the production of localized assays. Besides, the market in India is also growing, which is supported by administrative plans, particularly for rural deployment, thereby suitable for increasing market demand in the region.

The fluoro enzymatic assays market in China is dominating the region, with a projected revenue share of 50% by the end of 2034, highly fueled by localized manufacturing as well as robust government investment. Besides, the NMPA has played a vital role with its 14th Five-Year Plan by allocating USD 1.5 billion to regional assay manufacturing, which has diminished import dependency from 65% to 40%. Meanwhile, the high-throughput screening implementation in pharmaceutical R&D has increased by 27% yearly, of which approximately 82% of the localized demand is met by the country’s manufacturers.

The fluoro enzymatic assays market in India is also gaining increased traction with a 13.5% growth rate, and is anticipated to reach almost 18% of the regional share by the end of the forecast timeline. The market’s development in the country is highly driven by Ayushman Bharat’s USD 550 million investment to expand rural diagnostics. Besides, local PPP models have reduced assay expenses by almost 42%, with TransAsia Bio and Abbott unveiling hepatitis B kits at USD 17. Meanwhile, import facilities, automation in laboratories, and ICMR policies are readily bolstering the market in the country.

Government Policies and funding for Fluoro Enzymatic Assays in South Korea, Malaysia, and Australia (2021-2025):

|

Country |

Initiative/Policy |

Funding (USD) |

Launch Year |

Key Impact |

|

South Korea |

KFDA's "Precision Dx 2030" Program |

305 million |

2021 |

22% YoY growth in oncology assay adoption |

|

National Strategic Biotechnology Plan |

157 million |

2023 |

Subsidized 55+ local assay manufacturers |

|

|

Malaysia |

MOH's National Diagnostics Transformation |

122 million |

2022 |

2.5x increase in rural clinic testing capacity |

|

Bioeconomy Corporation Grants for Assay R&D |

54 million |

2024 |

14 new locally developed kits by 2025 |

|

|

Australia |

MTPConnect's Diagnostics Development Fund |

93 million |

2021 |

33% reduction in import dependency |

|

NHMRC Grants for Point-of-Care Assays |

76 million |

2023 |

Deployed in 205+ regional hospitals |

Europe Market Insights

Europe in the fluoro enzymatic assays market is expected to hold a considerable share of 28.8% during the forecast timeline, with a valuation of USD 7.3 billion. This is effectively attributed to precise medicine implementation as well as a rise in the aging population. Germany has been leading with a reasonable share of the region since 2021, and the UK is following closely based on healthcare budget allocation for assays as of 2023. In addition, France, as of 2023, also provided a budget allocation of almost 7.5%, accounting for €920 million, which has increased from 5.7% since 2021, thus suitable for uplifting the overall market.

The fluoro enzymatic assays market in Germany is dominating the market in the region, with a revenue share of 33.5%, accounting for USD 2.3 billion by the end of the forecast duration. The market’s growth in the country is highly fueled by IVDR compliance-based mandates and the presence of strong government and administrative support. Besides, the Federal Ministry of Health made the provision of €4.8 billion in 2024, with a focus on neurodegenerative and oncology disorder testing, thereby denoting a positive impact on the overall market.

The fluoro enzymatic assays market in the UK is significantly growing by garnering 23% of the region’s market, which is USD 1.8 billion, highly attributed to the NHS’s 8.5% budget provision, accounting for £ 1.3 billion for precision diagnostics. Besides, the presence of genomic medicine service in the country has effectively driven 28% of the market’s growth, particularly for cancer assays, which indicates a huge development for the overall market in the country.

Key Fluoro Enzymatic Assays Market Players:

- Thermo Fisher Scientific

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Roche Diagnostics

- Abbott Laboratories

- Danaher Corporation

- Siemens Healthineers

- Bio-Rad Laboratories

- PerkinElmer

- Agilent Technologies

- Merck KGaA

- Becton Dickinson (BD)

- BioMérieux

- QIAGEN

- Luminex Corporation

- Abcam

- Grifols

The global fluoro enzymatic assays market severely comprises a fusion of organizations, including Thermo Fisher, with a revenue share of 21.5%, followed by Roche with 16.8%, and both readily dominating across nations through automation and acquisitions. Besides, key strategies such as PPP models, organizational investment, and AI-based kits are other strategies that are bolstering the market development internationally. For instance, in 2023, the U.S. FDA successfully cleared Thermo Fisher’s AI-driven kits, and as per the 2024 EMA report, Roche generously initiated an investment of USD 1.2 billion to provide multiplex assays, thereby suitable for skyrocketing the market exposure.

Here is a list of key players operating in the global market:

Recent Developments

- In May 2024, Thermo Fisher Scientific unveiled the Phadia 2500 FLEX+, which is an automated fluoroenzymatic immunoassay system, comprising AI-powered analysis to diminish processing duration by almost 40%.

- In March 2024, Roche Diagnostics announced that it received the CE-IVD mark for its newly introduced cobas e 612 analyzer, to integrate FRET technology, particularly for high-sensitivity oncology assays.

- Report ID: 7897

- Published Date: Jul 15, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Fluoro Enzymatic Assays Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert