Fluorinated Solvents Market Outlook:

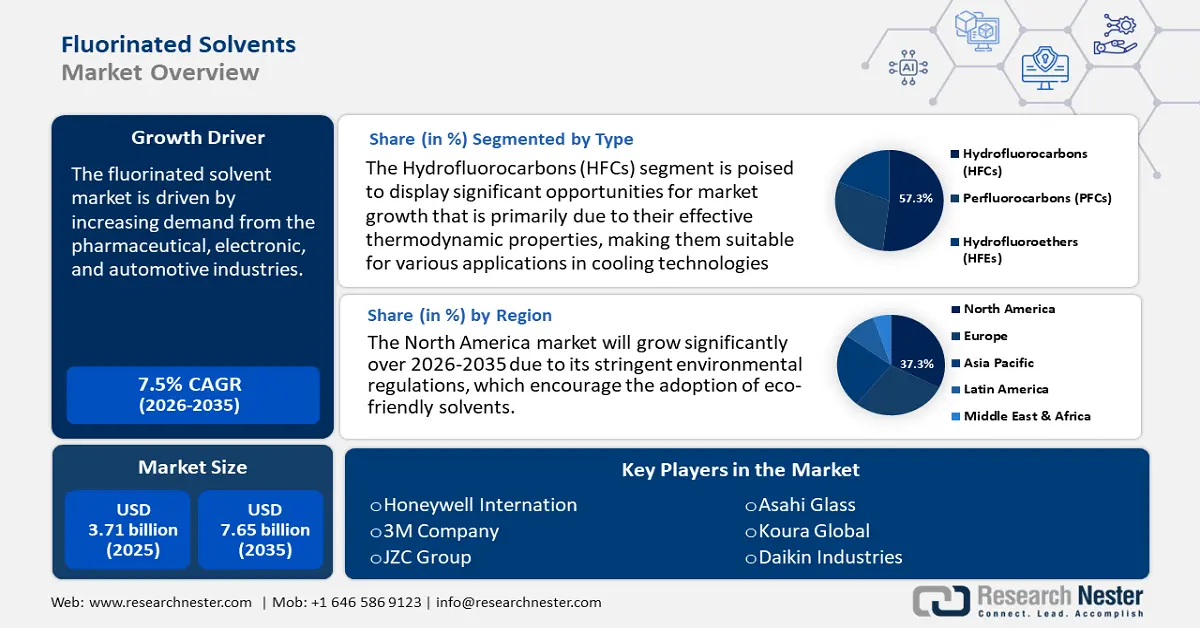

Fluorinated Solvents Market size was over USD 3.71 billion in 2025 and is poised to exceed USD 7.65 billion by 2035, witnessing over 7.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of fluorinated solvents is estimated at USD 3.96 billion.

The fluorinated solvents market is witnessing substantial growth, highly driven by rising needs from the rising pharmaceutical applications, phase-out of traditional solvents, increasing semiconductor industry’s needs, technological enhancements, need for low-GWP alternatives, expanded usage in aerospace & electronics, as well as improved environmental regulations. In the semiconductor sector, fluorinated solvents play a key role in etching and cleaning processes. Octafluoropropane (C3F8) is extensively used in plasma etching to create intricate patterns on wafers.

Similarly, nitrogen trifluoride (NF3) is employed for cleaning chemical vapor deposition (CVD) chambers, effectively removing residual materials and ensuring accuracy and efficiency in microchip manufacturing. For instance, Daikin Industries Ltd. stands front of the fluorinated chemicals, and has presented low-global-warming-potential (GWP) solvent alternatives, demonstrating the industry's commitment to sustainability. Meanwhile, in pharmaceuticals, these solvents are necessary for drug formulation and synthesis, leading to a growing uptake in industry.

Stringent environmental regulations have further accelerated towards green and fluorinated alternatives. The fluorinated solvents market is also experiencing opportunities arising from technological enhancements and expanded application areas, including aerospace and electronics, where fluorinated solvents are valued for their chemical stability and performance. A notable trend in the sector is the development of low-GWP solvents, aligning with global sustainability goals. Companies are investing in endurable production techniques, leveraging renewable feedstock to manufacture fluorinated solvents with minimized environmental impacts. This transition supports eco-compatible manufacturing while satisfying consumer and regulatory demand for eco-friendly solutions. For instance, 3M offers the Novec Engineered Fluid, a line of fluorinated solvents utilized in semiconductor manufacturing for precision cleaning and heat transfer applications. These solvents are designed especially to offer effective cleaning performance while reducing environmental impacts, featuring low GWP and zero ozone depletion potential (ODP). This underscores that industries and manufacturers are actively exploring greener alternatives to reduce their impact on the environment and nurture a sustainable future.

Key Fluorinated Solvents Market Insights Summary:

Regional Highlights:

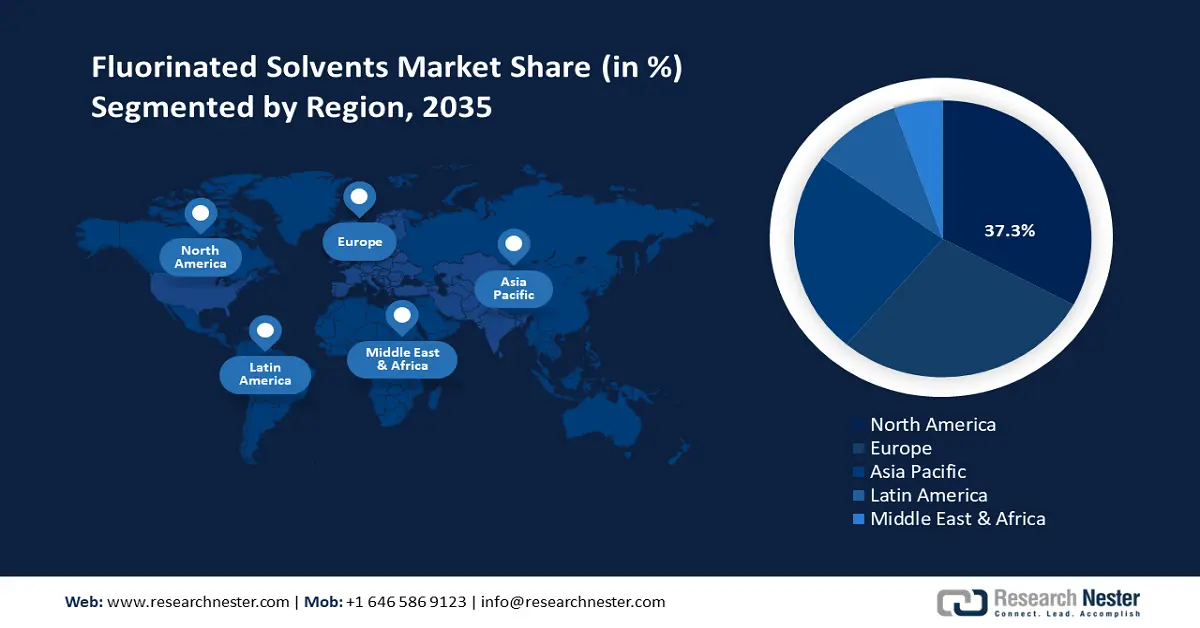

- North America leads the fluorinated solvents market with a 37.3% share, propelled by the U.S. chemical industry's innovation and the demand from cosmetics, electronics, and pharmaceuticals, fostering strong growth through 2035.

Segment Insights:

- The Electronic Cleaning segment is projected to capture a substantial market share by 2035, driven by the escalating demand for electronic devices such as laptops, smartphones, and tablets.

- The HFCs segment is expected to capture over 57.3% share by 2035, fueled by their effective thermodynamic properties for cooling applications.

Key Growth Trends:

- Increasing adoption in aerospace and defense applications

- Rising adoption in semiconductor manufacturing

Major Challenges:

- Safety concerns

- Cost consideration

- Key Players: Dongyue Group, Arkema S. A., 3M Company, JZC Group, Gujarat Fluorochemicals Limited, Asahi Glass, Navin Fluorine International Ltd, Koura Global, Daikin Industries.

Global Fluorinated Solvents Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 3.71 billion

- 2026 Market Size: USD 3.96 billion

- Projected Market Size: USD 7.65 billion by 2035

- Growth Forecasts: 7.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (37.3% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, Germany, France

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 12 August, 2025

Fluorinated Solvents Market Growth Drivers and Challenges:

Growth Drivers

- Increasing adoption in aerospace and defense applications: The aerospace and defense sectors are heavily using fluorinated solvents due to their high-performance characteristics and capability to satisfy the strict requirements of aircraft maintenance, engine cleaning, and precision cleaning of sensitive components. These solvents are broadly utilized for degreasing metal parts to remove contaminants and also ensure the reliability of aerospace systems. Their high thermal stability, material compatibility, and non-flammability make them unique for usage in demanding and intense environments, whereas traditional cleaning agents are not effective or environmentally compliant.

- The increasing need for next-generation aircraft and enhanced defense systems further accelerates the fluorinated solvents market, as manufacturers seek sustainable and efficient cleaning solutions. For instance, Honeywell Solstice performance Fluid (PF) is a fluorinated solvent utilized in aerospace cleaning applications, providing low-GWP, ODP, and superior cleaning efficiency. As industry shifts towards eco-friendly and high-performance alternatives, fluorinated solvents will continue to play a key role in guaranteeing aerospace and defense component reliability and longevity.

- Rising adoption in semiconductor manufacturing: The requirement for fluorinated solvents across electronics, healthcare, and automotive industries is driven by the phase-out of ozone depletion solvents, strict government regulatory frameworks, the need for high-purity cleaning solutions, miniaturization of electronic components, growth in semiconductor development, and advancements in precision cleaning technologies.

The solvents are highly utilized in semiconductor manufacturing for cleaning and etching wafer surfaces, and efficiently removing photoresists, metal residues, and organic contaminants. Their excellent solvency, high chemical stability, and low surface tension make them unique for precision cleaning applications. The demand for fluorinated solvents rises due to the continuous growth in the semiconductor industry. For instance, Solvay offers Solvaclean, a fluorinated solvent designed for precision cleaning in semiconductor manufacturing. Solvaclean is engineered to efficiently eliminate contaminants from delicate electronic components, guaranteeing high performance and reliability in semiconductor devices.

Challenges

- Safety concerns: While fluorinated solvents are broadly utilized for their non-flammability, chemical stability, and cleaning efficiency, some may pose safety risks that influence their usage in particular applications. Concerns include toxicity, where prolonged exposure may lead to health hazards and flammability risk in some formulations, and require strict handling regulations. Regulatory compliance is another hurdle, as many countries impose restrictions on usage and emissions. Moreover, safe disposal and recyclability remain big issues due to their chemical persistence. Industries must invest in safer formulations, enhanced containment systems, and sustainable alternatives to handle these challenges while sustaining efficacy in aerospace, semiconductor, and pharmaceutical applications.

- Cost consideration: Cost is one of the major factors that restricts its widespread adoption, as fluorinated solvents are highly expensive compared to alternatives. Furthermore, strict environmental regulatory frameworks require costly compliance measures, further raising production costs. On the other hand, their complex manufacturing processes, which involve enhanced fluorination technologies and specialized raw materials, have increased their manufacturing expense. The requirement for high-purity formulation in industries such as aerospace and semiconductors contributes to their increased cost. Due to these factors, many industries choose cost-effective alternatives for fluorite solvent, which restricts its usage despite its superior performance, low environmental impact, and stability.

Fluorinated Solvents Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

7.5% |

|

Base Year Market Size (2025) |

USD 3.71 billion |

|

Forecast Year Market Size (2035) |

USD 7.65 billion |

|

Regional Scope |

|

Fluorinated Solvents Market Segmentation:

Type (Hydrofluorocarbons (HFCs), Perfluorocarbons (PFCs), and Hydrofluoroethers (HFEs))

Hydrofluorocarbons (HFCs) segment is anticipated to account for fluorinated solvents market share of more than 57.3% by the end of 2036. This dominance is primarily due to their effective thermodynamic properties, making them suitable for various applications in cooling technologies. Despite their effectiveness, HFCs are highly used due to their high GWP, which satisfies the regulatory measures. Notably, HFC-134a is predominantly used in domestic refrigerators and automobile air conditioning systems, especially in developing countries.

HFC-134a, chemically known as 1,1,1,2-Tetrafluoroethane, is a widely used hydrofluorocarbon refrigerant, particularly prevalent in automotive air conditioning systems. HFCs have been instrumental in replacing ozone-depleting substances like chlorofluorocarbons (CFCs) and hydrochlorofluorocarbons (HCFCs), contributing to environmental protection efforts. HFC-124a efficiently absorbs and releases heat, providing the cooling necessary for vehicle cabins. For instance, Freon 134a is a commercial product specifically designed for such applications, ensuring optimal performance in mobile air conditioning units. Moreover, PFCs are widely utilized in semiconductor manufacturing and metalworking due to their chemical stability and heat resistance. Meanwhile, HFEs are gaining traction as eco-friendly alternatives, offering low toxicity and reduced global warming potential, making them ideal for precision cleaning and electronics applications.

Application (Electronics Cleaning, Precision Cleaning, Semiconductor Manufacturing, Pharmaceutical Manufacturing, and Aerospace Defense)

The electronic cleaning segment is expected to dominate the fluorinated solvents market by holding a substantial share. This leadership is driven by the escalating demand for electronic devices such as laptops, smartphones, and tablets. Fluorinated solvents are highly valued in this sector for their exceptional ability to remove contaminants like flux residues, oils, and grease from delicate electronic components, ensuring optimal performance and longevity. A notable instance is AGC Inc.’s Asahiklin AE-3000 series, which offers environmentally responsible solutions for precision cleaning and defluxing in electronic circuitry. These solvents are compatible with existing vapor degreasing equipment, facilitating seamless integration into current manufacturing processes.

The electronics cleaning segment is fueled by the continuous proliferation of electronic devices and the necessity for high-performance cleaning solutions. As the electronics industry evolves, the demand for effective and eco-friendly fluorinated solvents is anticipated to rise correspondingly. Moreover, the precision cleaning segment is expanding due to the need in aerospace component and medical device manufacturing. Similarly, pharmaceutical manufacturing sees growth from developing countries’ drug demand, while aerospace defense expands with defense investment in emerging markets. Overall, the growth of the fluorinated solvent is attributed to the rising demand in various applications.

Our in-depth analysis of the global fluorinated solvents market includes the following segments:

|

Type

|

|

|

Application

|

|

|

Purity |

|

|

Packaging

|

|

|

End user

|

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Fluorinated Solvents Market Regional Analysis:

North America Market Statistics

North America fluorinated solvents market is anticipated to account for revenue share of around 37.3% by 2036 is primarily driven by the industries of the U.S. and Canada. The U.S. chemical industry plays a pivotal role in developing innovative solvent solutions, especially in specialty applications. The U.S. manufacturers have been active in creating bio-based alternatives, leveraging the country’s strong agricultural sector for raw materials. The fluorinated solvents market benefits from robust demand from the cosmetics and personal care industry, where the U.S. maintains global leadership.

Furthermore, the U.S., a well-established electronics sector that extensively utilizes fluorinated solvents for precision cleaning of components and circuit boards, ensuring optimal performance and longevity. The country’s stringent environmental regulations, enforced by agencies like the Environmental Protection Agency (EPA), have also accelerated the adoption of these solvents as safer alternatives to traditional, hazardous options.

On the other hand, Canada contributes significantly to the fluorinated solvents market through its expanding pharmaceutical and electronic industries. The pharmaceutical sector relies on high-quality solvents for manufacturing active pharmaceutical ingredients (APIs) and drug formulations, adhering to rigorous standards. Similarly, the electronics industry in Canada employs fluorinated solvents for cleaning and maintaining sensitive components, ensuring product reliability. For instance, Environ Tech International, Inc., headquartered in Melrose Park, Illinois, is a leading supplier of stabilized n-propyl bromide and fluorinated solvents for industrial parts cleaning applications. The company has developed innovative products like EnSolv® and the NEXTR generation fluorinated solvent line, designed to replace environmentally hazardous chemicals with safer, high-performance alternatives.

Europe Market Analysis

Europe has rapidly emerged as the fastest-growing fluorinated solvents market, driven by the region’s stringent environmental regulations, such as the European Union’s directives on volatile organic compounds (VOCs) and industrial emissions, which encourage the adoption of eco-friendly solvents. Germany leads the European market, particularly through its robust automotive and aerospace industries that require high-performance solvents for cleaning and surface preparation. The country’s emphasis on sustainable chemical solutions has also spurred innovation in eco-friendly solvent technologies.

On the other hand, the UK’s fluorinated solvents market demonstrates resilience, driven by steady demand from key end-use industries such as paints and coatings, pharmaceuticals, and industrial cleaning. The emphasis on sustainable development in the UK has promoted the use of green solvents, especially within industrial settings. For instance, F2 Chemicals Ltd, based in Preston, UK, specializes in the production of high-purity perfluorinated fluids under the FLUTEC brand. F2 Chemicals offers selective direct fluorination services, utilizing elemental fluorine to produce specialized compounds for pharmaceutical and other high-tech applications.

Key Fluorinated Solvents Market Players:

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Dongyue Group

- Arkema S. A.

- 3M Company

- JZC Group

- Gujarat Fluorochemicals Limited

- Asahi Glass

- Navin Fluorine International Ltd

- Koura Global

- Daikin Industries

- The Chemours Company

- Merck Co., Inc.

- Hualon Group

- Maruyoshi Fine Chemicals Company

- Solvay

Leading companies in the fluorinated solvents market leverage cutting-edge fluorochemical synthesis, enhanced distillation, and eco-friendly formulations to maintain a competitive edge. The company focuses on developing low-global-warming-potential solvents, high-purity fluorinated compounds for semiconductor and aerospace applications. Their continuous investments in research and development drive innovations in precision cleaning, electronic component manufacturing, and pharmaceutical processing. By adopting sustainable production methods, they stand out in front of the fluorinated solvents market.

Honeywell International

Recent Developments

- In June 2022, Solvay SA revealed its intentions to enhance its production capacity for fluorinated solvents in Belgium, with a particular emphasis on augmenting its Tecnoflon fluoroelastomer production capabilities in Changshu, China, and Spinetta Marengo, Italy.

- In January 2022, Arkema SA introduced a novel, more efficient, and eco-friendly approach to the production of fluorinated solvents, intending to minimize its carbon emissions and adhere to sustainability objectives.

- Report ID: 7519

- Published Date: Aug 12, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Fluorinated Solvents Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.