Flexible Epoxy Resins Market Outlook:

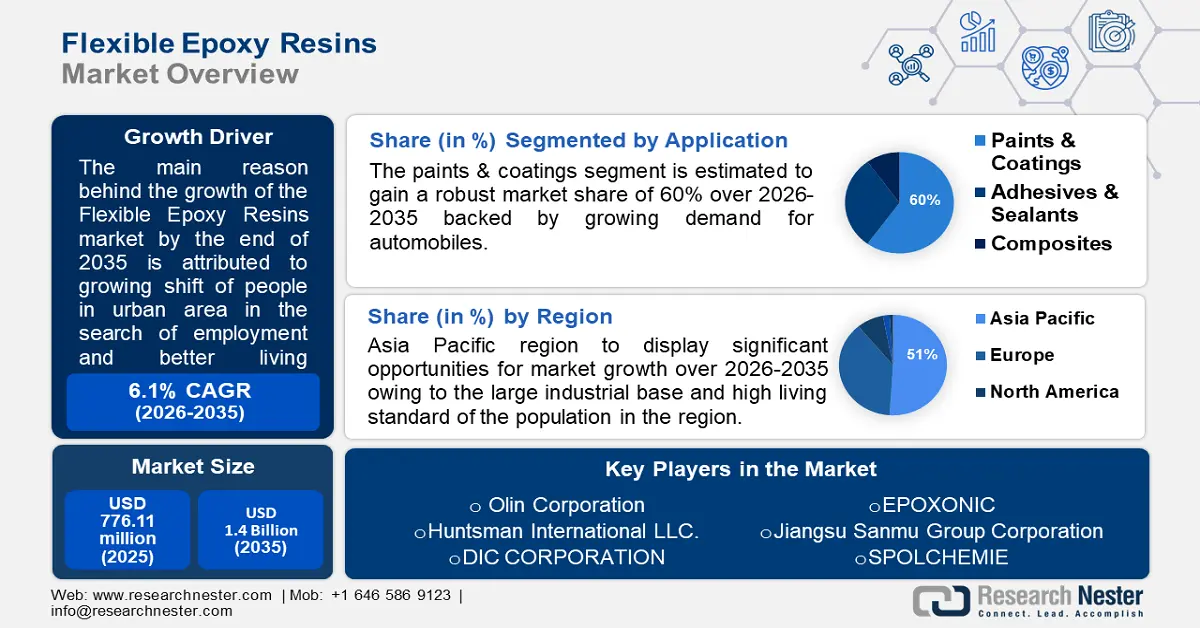

Flexible Epoxy Resins Market size was over USD 776.11 million in 2025 and is projected to reach USD 1.4 billion by 2035, witnessing around 6.1% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of flexible epoxy resins is evaluated at USD 818.72 million.

The growth of the market can be attributed to growing shift of people in urban area in the search of employment and better living conditions. For instance, by 2050, 68% of the world's population, or more than half of all people, would reside in urban regions. Hence, the demand for house is growing which is why the construction activities are carried out on a large scale. Therefore, owing to this factor the market for flexible epoxy resins is estimated to increase. Additionally, other factors which is estimated to boost the growth of the construction activities, further boosting the market growth are growing middle class population in urban and rural area, and rising nuclear family trend.

With the growth in middle class population comes the boost in the disposable income. Hence large number of middle class people are expected to reconstruct their houses or either demand for a new one. In rural area large number of people are estimated to be living in kutcha house whose walls are usually build of mud, stones, and more. However, owing to the growing disposable income, middle class people living in rural area are estimated to re-build their house over the forecast period, hence boosting the market growth for flexible epoxy resins. Additionally, the trend of join family is disintegrating into nuclear family owing to scarcity of living space in big cities, desire for more privacy, and more. Hence, this nuclear family are demanding more houses, which is further estimated to boost the market growth.