Flexible Electrical Conduit Market Outlook:

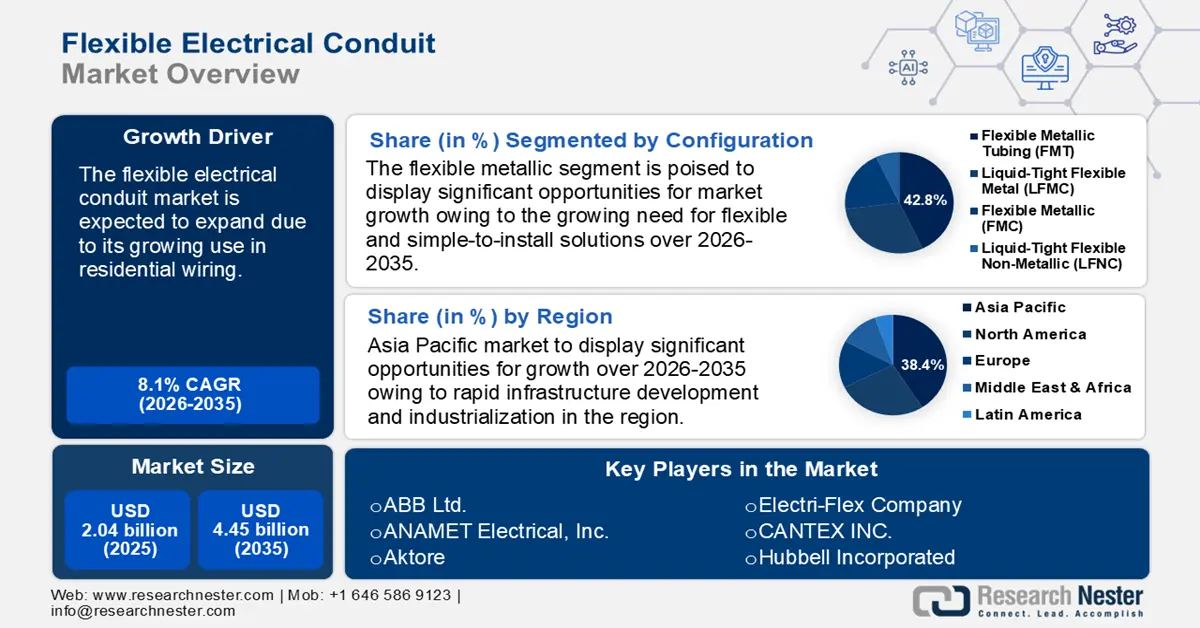

Flexible Electrical Conduit Market size was over USD 2.04 billion in 2025 and is poised to exceed USD 4.45 billion by 2035, growing at over 8.1% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of flexible electrical conduit is estimated at USD 2.19 billion.

The flexible electrical conduit market is expanding primarily due to its growing use in residential electrical installations for routing and protecting electrical wires. It is frequently used in applications like electrical panel wiring, residential wiring, and wiring for HVAC systems, appliances, and lighting fixtures. According to the International Energy Agency (IEA), by 2030, around 600 million heat pumps will be installed worldwide, up from 180 million in 2020. The number of heat pumps installed in individual buildings is expected to increase from 1.5 million per month to about 5 million by 2030. Heat pumps are at least three times more efficient than conventional fossil fuel radiators.

Electrical wire protection against attainable threats is another crucial element. Flexible conduits provide a physical barrier that protects the wires from environmental factors such as heat, moisture, dust, and mechanical harm. This protection is required to guarantee the records core's uninterrupted operation and to avert potential equipment malfunctions or outages.

Key Flexible Electrical Conduit Market Insights Summary:

Regional Highlights:

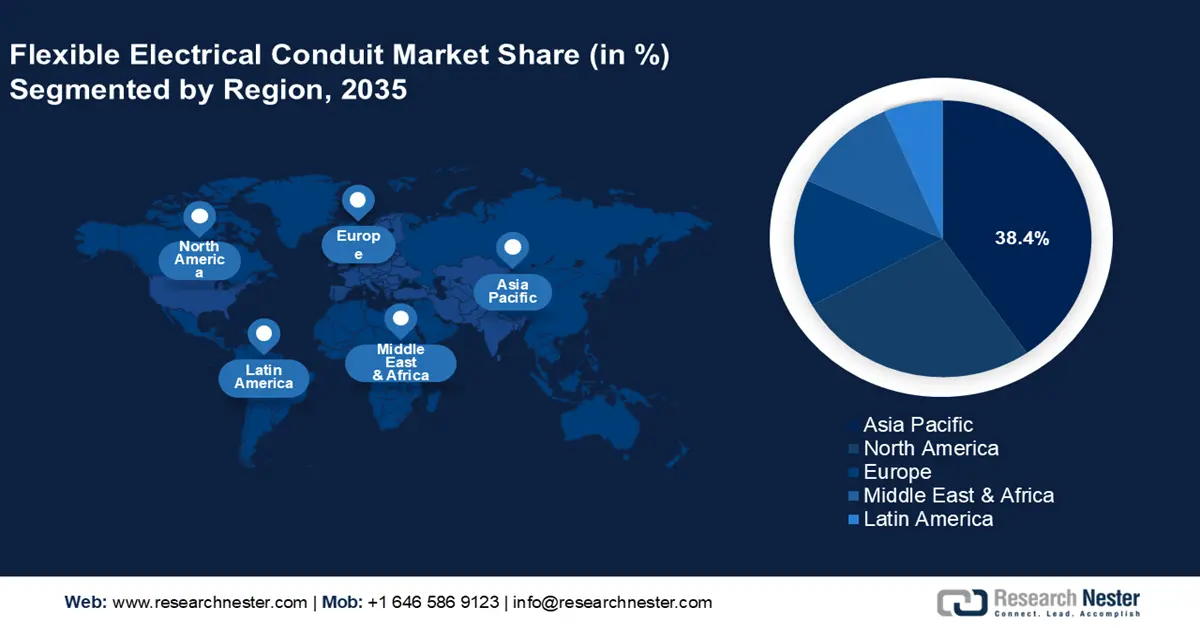

- Asia Pacific leads the flexible electrical conduit market with a 38.4% share, driven by rapid infrastructure development through 2026–2035.

Segment Insights:

- The Energy segment of the Flexible Electrical Conduit Market is poised for substantial growth through 2035, driven by the rising demand for dependable and long-lasting wiring solutions in renewable energy projects and smart grid systems.

- The Flexible Metallic Tubing segment is expected to secure a 42.8% share by 2035, propelled by the growing need for flexible, easy-to-install solutions and adherence to stringent safety standards.

Key Growth Trends:

- Increased use in data centers

- Surging demand in aerospace & defense industries

Major Challenges:

- Bending radius & connector compatibility limitations

- nvironmental exposure

- Key Players: ABB Ltd., ANAMET Electrical, Inc., Aktore, Electri-Flex Company, CANTEX INC., Hubbell Incorporated, HellermannTyton, Kaiphone Technology Co., Ltd., Schneider Electric SE, Wienerberger AG.

Global Flexible Electrical Conduit Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 2.04 billion

- 2026 Market Size: USD 2.19 billion

- Projected Market Size: USD 4.45 billion by 2035

- Growth Forecasts: 8.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (38.4% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, Japan, India, United States, Germany

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 13 August, 2025

Flexible Electrical Conduit Market Growth Drivers and Challenges:

Growth Drivers

- Increased use in data centers: Digital services are increasingly in demand. IEA stated that global internet traffic has increased 25-fold since 2010, while internet users have more than doubled. However, data centers and data transmission networks, which together account for 1–1.5% of the world's electricity consumption, have seen an increase in energy demand that rapid advances in energy efficiency have moderated.

This demands an environmentally friendly and well-equipped electrical distribution infrastructure to handle the intricate network of servers, networking hardware, storage systems, and other essential elements. Flexible electrical conduits offer flexibility in the structure and management of cables. Given the large number of connections in data centers, appropriate cable management is crucial to maintaining a seamless and environmentally responsible environment. Flexible conduits make it possible to route cables neatly and systematically, reducing the possibility of tangling, interference, or accidental disconnections. - Surging demand in aerospace & defense industries: Yearly, new applications for military connectors emerge as military technology advances. They are frequently employed in commercial automotive, industrial, marine, and aerospace applications. Wide temperature variations, extreme vibration, extreme shock, corrosion, fuels, hydraulic fluids, humidity, vacuum, space, dissimilar metal electrolysis, lightning, electromagnetic interference (EMI), radio frequency interference (RFI), electromagnetic pulse (EMP), and many other conditions are among the typical conditions that military connectors must withstand. Flexible conduit connections protect vital electrical systems in the aerospace and defense sectors, where accuracy and safety are crucial.

- Rising smart homes: The flexible electrical conduit market has grown due to the development of smart homes and intelligent construction systems. A 2022 report by the World Economic Forum showed that smart home gadgets are predicted to grow significantly. For instance, more than 130 million households have at least one smart speaker, and in the next five years, this number might increase to as many as 335 million. These conduits provide an effective method to hide and safeguard cables used in smart devices such as audio/video installations, safety systems, and home automation. It gives flexibility for developing technologies by permitting future additions, changes, and easy access to the wiring.

Challenges

- Bending radius & connector compatibility limitations: Connectors and accessories are frequently needed for the appropriate installation of flexible conduits. When incompatible materials or connectors from different manufacturers are utilized, compatibility problems may occur. Additionally, there are bending radius restrictions for each type of conduit that, if exceeded, may cause kinking or damage. Therefore, these factors may impede the flexible electrical conduit market.

- Environmental exposure: Flexible conduits are widely employed in various settings, including extreme outdoor situations and indoor business locations. Extreme temperatures, chemicals, moisture, and UV rays affect how long conduits last and function. To solve this issue, conduits with the right material specifications for the surroundings must be used. Therefore, various environmental settings may hamper the flexible electrical conduit market growth.

Flexible Electrical Conduit Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

8.1% |

|

Base Year Market Size (2025) |

USD 2.04 billion |

|

Forecast Year Market Size (2035) |

USD 4.45 billion |

|

Regional Scope |

|

Flexible Electrical Conduit Market Segmentation:

Configuration (Flexible Metallic (FMC), Liquid-Tight Flexible Metal (LFMC), Flexible Metallic Tubing (FMT), Liquid-Tight Flexible Non-Metallic (LFNC))

Flexible metallic tubing segment is anticipated to capture around 42.8% flexible electrical conduit market share by the end of 2035. The segment’s expansion is influenced by the growing need for flexible and simple-to-install solutions. Customization is also a major trend, with customers looking for unique configurations such as conduits for industrial automation that are highly flexible or fire-resistant. Additionally, the popularity of pre-assembled and modular setups is improving operational efficiency, lowering labor costs, and simplifying installs. Furthermore, the need for setups that adhere to stringent standards is growing due to the emphasis on safety and compliance, driving businesses to invest in cutting-edge designs such as FMT.

Application (Rail Infrastructure, Military Aerospace, Healthcare Facilities, Process Plants, Energy)

The energy segment in flexible electrical conduit market is estimated to garner a substantial share in the forecast period. The segment growth can be attributed to the growing need for dependable and long-lasting wiring solutions. Additionally, the use of flexible conduits for effective wiring solutions is growing due to the growth of renewable energy projects, such as wind and solar installations. According to the International Renewable Energy Agency’s (IRENA) 1.5°C scenario, the proportion of renewable energy in the world's energy mix would rise from 16% in 2020 to 77% by 2050. Furthermore, the need for flexible conduits in energy distribution networks is driven by the development of smart grid systems and the rising adoption of energy-efficient devices. Manufacturers are developing specific conduit solutions for the industry, driving market expansion, and emphasizing safety, compliance, and environmental preservation.

Our in-depth analysis of the global flexible electrical conduit market includes the following segments:

|

Trade Size |

|

|

Configuration |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Flexible Electrical Conduit Market Regional Analysis:

APAC Market Statistics

Asia Pacific in flexible electrical conduit market is anticipated to account for around 38.4% revenue share by 2035. The market is growing due to the trend of rapid infrastructure development and industrialization, especially in China and India, which has raised demand for electrical systems and related infrastructure. Moreover, stricter safety laws and emphasizing eco-friendly products are also spurring innovation. With an emphasis on high-performance and environmentally friendly solutions, manufacturers are broadening their product lines to satisfy local demands.

China's flexible electrical conduit market expansion can be attributed to the rising demand for conduits driven by the increased investments in infrastructure and industrial activities. For instance, the U.S. contributed USD 76 billion to infrastructure projects in five major infrastructure sectors through the Belt and Road Initiative (BRI) between 2013 and 2021, while the People's Republic of China (PRC) contributed USD 679 billion. This growth is further fueled by the country's large population and increasing urbanization, heightening the need for electricity and power generation. Moreover, the recent launches and innovative products introduced by market players have significantly boosted the industry's growth across the nation.

In India the urban population is growing at an unprecedented rate, pressurizing the country's resources, infrastructure, and environment. The idea of smart buildings and cities has gained traction nationwide in response to these issues, consequently accelerating the demand for flexible electrical conduits. The India Brand Equity Foundation reported that 40% of India's population is predicted to live in urban regions by 2030, and they will account for 75% of the country's GDP. Cities that experience a population increase face difficulties in managing their infrastructure and providing services. In India, the Smart Cities Mission seeks to effectively and efficiently address these issues.

North America Market Analysis

North America will hold a significant share of the flexible electrical conduit market in 2035. The region is establishing itself as a major market for electrical conduit pipes, offering important participants in the sector profitable prospects. The market's growth potential is still strong and attractive to manufacturers and investors alike as long as infrastructural development continues to flourish.

In the U.S., flexible electrical conduit market demand is mostly driven by energy generation, which includes fossil fuels, renewable energy, and nuclear energy. For instance, in 2023, utility-scale electricity production plants in the U.S. generated approximately 4,178 billion kilowatt-hours (kWh) (or 4.18 trillion kWh).1 About 60% of this electricity was generated using fossil fuels such as coal, natural gas, petroleum, and other gases. Nuclear energy accounted for roughly 19%, with renewable energy accounting for approximately 21%.

In Canada, utilities are leveraging smart grid technology and data to improve efficiency in electricity supply and storage. This advancement helps them manage costs and peak demand more effectively, while also integrating large-scale renewable energy and power generated by customers into the grid.

Key Flexible Electrical Conduit Market Players:

- ABB Ltd.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- ANAMET Electrical, Inc.

- Aktore

- Electri-Flex Company

- CANTEX INC.

- Hubbell Incorporated

- HellermannTyton

- Kaiphone Technology Co., Ltd.

- Schneider Electric SE

- Wienerberger AG

The leading companies in the flexible electrical conduit market strive to get a competitive edge by launching new products, spending on R&D, and diversifying their product lines. To control the market and increase their footprint in many areas and marketplaces, both regional giants actively engage in mergers and acquisitions.

Recent Developments

- In May 2024, Electri-Flex Company launched Liquatite flexible electrical conduits designed for data center installations. Liquatite offers high-quality Data Center wiring protection solutions that include physical protection for wires and cables, the ability to bend wiring where it is needed, conduit with colored jacketing to identify critical circuitry, UL-listed and CSA-certified varieties, and halogen-free, low fire hazard solution types.

- In March 2024, ABB unveiled FlexLine, a new line of modular protection devices designed to make installation quicker, faster, and more adaptable in residential and small commercial buildings.

- Report ID: 6834

- Published Date: Aug 13, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Flexible Electrical Conduit Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.