Fleet Management Market Outlook:

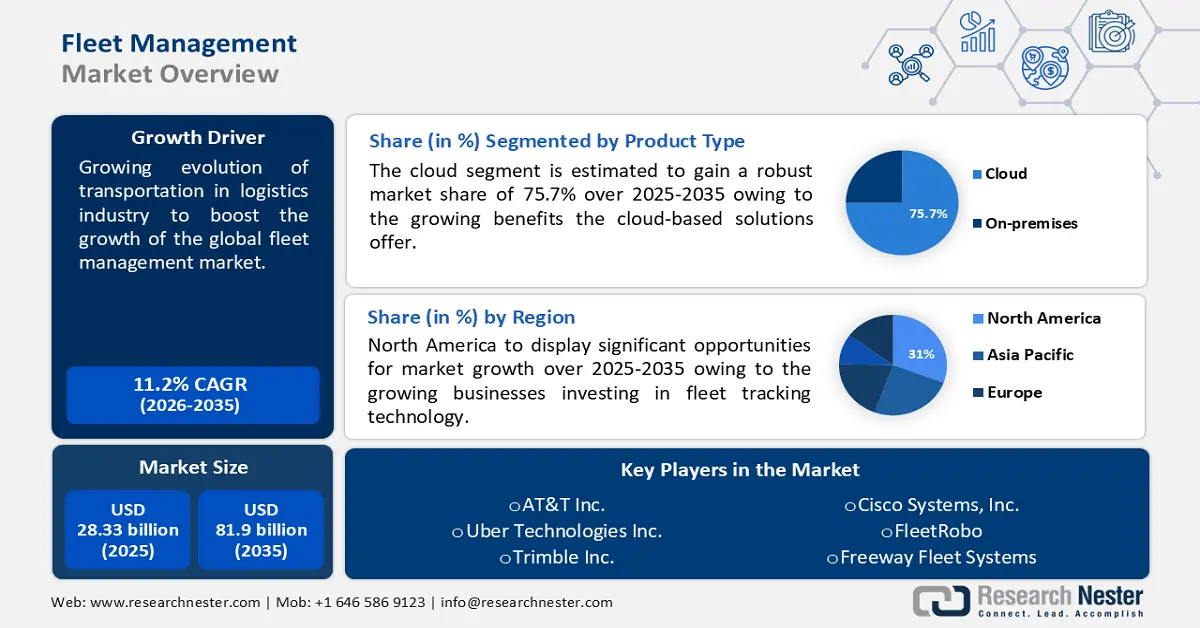

Fleet Management Market size was valued at USD 28.33 billion in 2025 and is likely to cross USD 81.9 billion by 2035, registering more than 11.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of fleet management is estimated at USD 31.19 billion.

The market growth can be attributed primarily to how transportation in logistics is evolving day by day. It was observed that worldwide, the share of the fleet that had incorporated GPS fleet tracking had increased from about 65% in 2019 to over 71% in 2020. Such technology in logistics transportation mainly helps reduce time wastage by monitoring the time spent by drivers in loading bays and work sites.

Further, high reliance on public transportation is poised to create market demand. It was estimated that public transportation was used for over 9 billion trips by Americans in 2019. Public transportation is a lifeline for people traveling in places where the use of private vehicles is inconvenient in terms of time and money spent. It also helps to maintain the health of an economy as companies are able to connect with a large employee base over a large area. Fleet management could improve the efficiency of the public transportation system in a place by using data such as the number of commuters in a route and vehicle location while making the trips profitable for the whole system.

Key Fleet Management Market Insights Summary:

Regional Highlights:

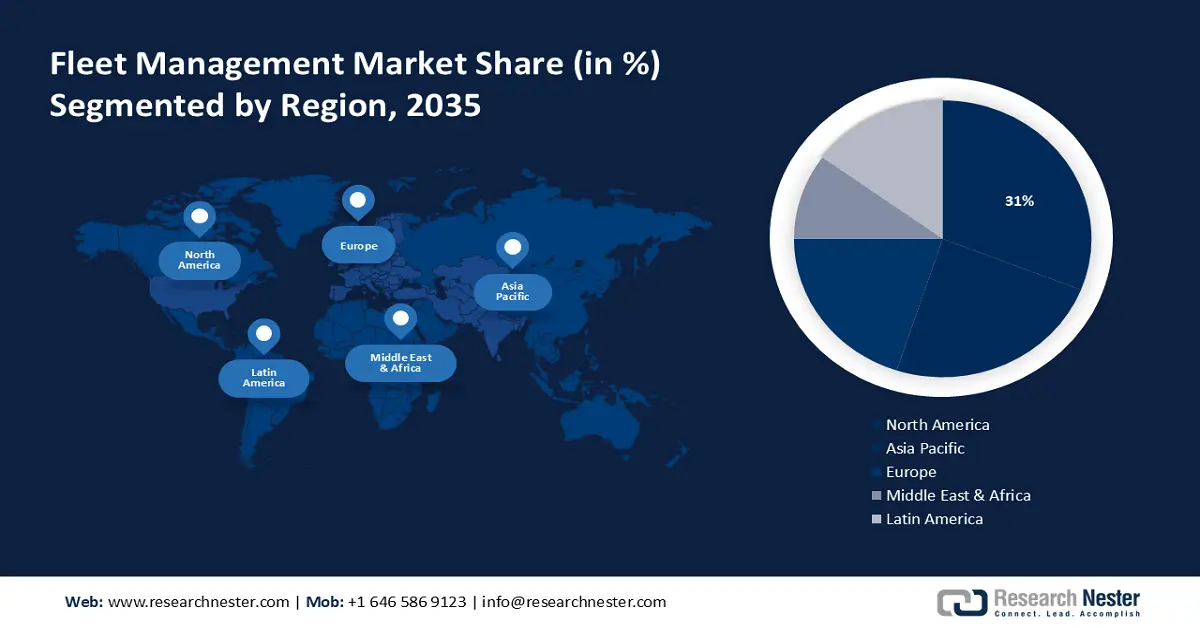

- North America fleet management market is poised to capture 31% share by 2035, driven by timely investments in fleet tracking technology and strong presence of logistics, transportation, and manufacturing industries.

- Asia Pacific market projects substantial growth during the forecast timeline, driven by expanding industries in oil and gas, transportation, and construction sectors, along with the booming e-commerce industry in China.

Segment Insights:

- The transportation segment in the fleet management market is projected to achieve a 40% share by 2035, driven by the increasing use of fleet management solutions in real-time logistics and delivery.

- The cloud segment in the fleet management market is anticipated to achieve significant share by 2035, influenced by cloud-based solutions offering cost-effective, scalable fleet management tools.

Key Growth Trends:

- Immense Significance of Fleet Safety

- Growth of International Trade After the Pandemic

Major Challenges:

- Lack of an Uninterrupted Internet Connection in Some Parts of the World

- Occasional Inaccuracy in Geocoding Features

Key Players: TomTom International BV., Fleetmatics Group PLC. (Verizon), Freeway Fleet Systems, International Business Machines Corporation, AT&T Inc., OLA Australia Pty Ltd., Cisco Systems, Inc., Trimble Inc., Uber Technologies Inc., FleetRobo.

Global Fleet Management Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 28.33 billion

- 2026 Market Size: USD 31.19 billion

- Projected Market Size: USD 81.9 billion by 2035

- Growth Forecasts: 11.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (31% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, United Kingdom, Japan

- Emerging Countries: China, India, Japan, South Korea, Malaysia

Last updated on : 8 September, 2025

Fleet Management Market Growth Drivers and Challenges:

Growth Drivers

-

Immense Significance of Fleet Safety – It was observed that the occupants of more than 51 goods vehicles got killed on the road annually between 2012 and 2021 in Great Britain. The crashes of fleet vehicles have grave consequences when they are at-fault accidents. The consequences of such accidents include high rates for insurance, expenses on overtime while covering for missing drivers, and high medical costs and employee downtime. Fleet management should ensure safe fleet movement to a great extent. Safety management using measures including in-vehicle computer system is a significant part of fleet management solutions. These solutions would also minimize the need for over speeding and abrupt braking, thereby reducing the probability of wear and tear in the vehicles used in transportation. The reduced incidences of wear and tear should also create a situation suitable for the reduction of fleet size and money savings.

-

Rapid Rise in the Use of Wireless Technology by Automotive - Wireless technologies are capable of improving driver performance considerably. They also play an important role in fleet management. On-board devices and sensors connected to different parts of the vehicles help collect actionable and real-time data from these components. Wireless technology goes beyond data collection and helps improve diagnostics and strategies for preventive maintenance. An instance is how 5G is used in fleet management. 5G improves alerts on real-time conditions of the road. The instant alerts on disruptions and traffic help fleet managers re-navigate their fleet and share the information with the whole fleet without delay. It is estimated that the share of cars with an active connection to 5G worldwide should increase from 16% in 2020 to about 95% in 2028.

-

Growth of International Trade After the Pandemic - It was observed that during the first quarter of 2021, the recovery of international trade from the crisis of COVID-19 reached a record high. The year-over-year increase was by 11%, while the quarter-over-quarter recovery increased by 5%. The growth of international trade increases the use of commercial vehicles, and this is expected to lead to market growth.

-

Changing Mobility Needs with Growing Urbanization - It was estimated that about 58% of the world's population resided in urban areas in 2022. The strain on overall mobility worsens with the growth of the population in urban centers. The mobility needs of people continue to evolve, and this is expected to create opportunities for market growth.

Challenges

- Lack of an Uninterrupted Internet Connection in Some Parts of the World - Fleet management requires continuous connectivity to the network and data. However, this becomes a major challenge in underdeveloped and developing countries with a partial or very serious lack of connectivity. It is estimated that about 91% of people in low and middle-income countries lack access to a decent internet connection. The consequences of poor connectivity, such as poor routing and disruptions in the availability of fleet information, could hamper the market growth to a great extent.

- Occasional Inaccuracy in Geocoding Features

- Hindrance to GPS connectivity as a result of atmospheric interferences

Fleet Management Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

11.2% |

|

Base Year Market Size (2025) |

USD 28.33 billion |

|

Forecast Year Market Size (2035) |

USD 81.9 billion |

|

Regional Scope |

|

Fleet Management Market Segmentation:

Industry Segment analysis

The transportation industry is estimated to gain largest share of 40% by 2035. The use of fleet management solutions in transportation and logistics is becoming increasingly inevitable with time. These solutions are mostly used to plan and manage the dispatch schedule, optimize spending, and track the movement of goods and vehicles in real-time for smooth last-minute delivery.

The traditional fleet management system failed to track the movement of items from their starting point to their destination. However, advanced fleet management solutions include metrics such as delivery routes, real-time position tracking, and movement speed to improve the trip and delivery time. Considering all these, the expanding transportation industry is expected to drive the market growth. For instance, the U.S. alone has over 4 million businesses in the transportation & warehousing industry as of 2023.

Deployment Type Segment analysis

The cloud segment is expected to hold a significant market share during the forecast period. The growth of the segment is driven by capabilities of cloud-based solutions for a cost-effective and hassle-free integration. Further, cloud-based deployment has been observed to improve fleet management activities such as GPS tracking, which otherwise suffer in areas with low connectivity. With the incorporation of more such devices in the fleet management system, the demand for cloud deployment should also rise. Further, the initial expense of cloud-based fleet management software is low, and businesses get access to more scalable and flexible solutions.

Our in-depth analysis of the global market includes the following segments:

|

By Component |

|

|

By Fleet Type |

|

|

By Deployment Type |

|

|

By Application |

|

|

By Industry |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Fleet Management Market Regional Analysis:

North American Market Insights

The North American fleet management market, amongst the market in all the other regions, is projected to hold the largest market share of 31% by the end of 2035. The two countries that should help the region garner such a huge market share are the U.S. and Canada. The growth of the market in North America region can be attributed majorly to the gains of fleet management businesses in the region after investing timely in fleet tracking technology. For instance, in the U.S., where about 97% of the fleet had deployed GPS fleet tracking software in 2021, close to 33% of the users reported gaining a good return on investment (ROI) in half a month after implementing the fleet technology. Further, the strong presence of the logistics, transportation, and manufacturing industries, the partnership between fleet management businesses and commercial vehicle enterprises, and strict government regulations to control emissions are thought to contribute towards market growth.

APAC Market Insights

Asia Pacific region is projected to register substantial growth through 2035. East Asia alone is expected to hold 19% of the market revenue by the end of 2035. The market growth in Asia Pacific should be led by China and India. China has expanding industries in the oil and gas, transportation, and construction sectors that would require large-scale adoption of fleet management solutions. Another significant factor that is supposed to contribute to the market growth is the increasing use of commercial vehicles in the booming e-commerce industry in China.

India's growth in the regional market for fleet management should be mainly a result of the presence of thriving e-commerce and construction sectors. In August 2022, the construction sector made up 10% of India's gross domestic product (GDP). Further, the demand for connected vehicles is also on the rise in India. Japan and South Korea are two other important contributors to regional market growth.

Europe Market Insights

Europe region is likely to observe significant growth till 2035. The primary reason for the growth of the fleet management business in Europe is the presence of Germany, which has the leading auto industry in the world. Further, the region has been estimated to produce 19 million trucks, cars, vans, and buses in its automotive and heavy manufacturing industries, and this is expected to lead to market growth.

Fleet Management Market Players:

- TomTom International BV.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Fleetmatics Group PLC. (Verizon)

- Freeway Fleet Systems

- International Business Machines Corporation

- AT&T Inc.

- OLA Australia Pty Ltd.

- Cisco Systems, Inc.

- Trimble Inc.

- Uber Technologies Inc.

- FleetRobo

Recent Developments

-

February 2022: TomTom International BV partnered with Webfleet Solutions, a leading provider of telematics solutions in the world. The partnership resulted in the launch of the TomTom GO Fleet App and WEBFLEET Work App, which exhibit the combined expertise of the two companies. The apps aim to help fleet managers and drivers address the everyday challenges of safety concerns, route compliance, and on-time delivery.

-

January 2021: Freeway Fleet Systems announced its cloud-based fleet management solution being adopted by the London-based bus operator HCT Group. The adoption of the fleet management solution followed HCT's switch from internal servers to a hosted IT platform.

- Report ID: 2424

- Published Date: Sep 08, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Fleet Management Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.